Meet Opportunity. Meet Lula.

Get Started

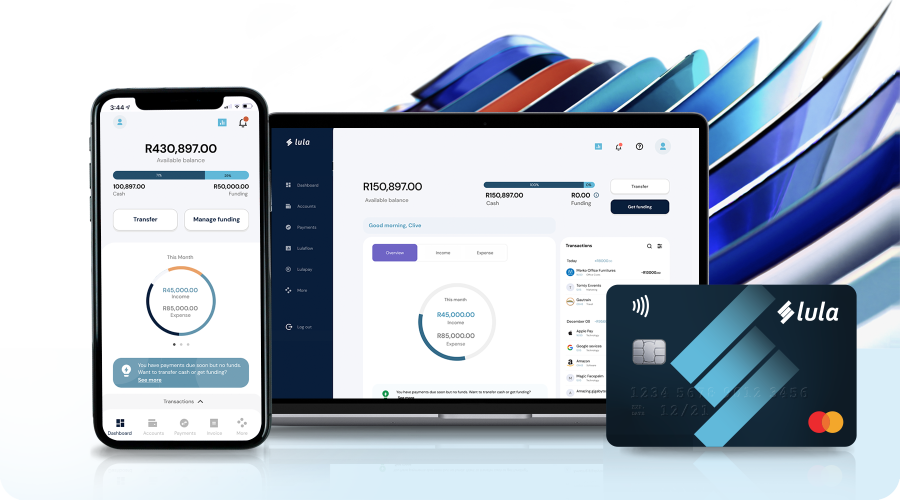

Say hello to SA's first dedicated SME Banking platform.

We'll say it. Big banks don't care about small business. That's why we've made it our business to re-think what SME banking should be. It's banking made by entrepreneurs, for entrepreneurs.

This is how we help SMEs grab every opportunity:

-

Access Funding within 24 hours.

The sooner you start transacting with your Lula bank account, the quicker you can access the business funding you need to boost your cash flow 🙌.

-

AI-driven Cash Flow Manager.

Say goodbye to spreadsheets. Lulaflow is an AI-driven Cash Flow Manager that gives you the data, automation and forecasting to make better business decisions.

-

Speak to Humans. Not Robots.

Tired of telephone "on hold" music and chatbot auto-responses? Our helpful humans are never more than a click or a call away.

Find out more

Experience the future of SME banking today.

Choose a bank account that's right for your business.

Two simple account plans. One promise.

Make cash flow faster, simpler, Lula.

|

|

✔ | ✔ |

|

|

✔ | ✔ |

|

|

✔ | ✔ |

|

|

✔ | ✔ |

|

|

1 | 5 |

|

|

✘ | ✔ |

|

|

✘ | ✔ |

Access to funding made fast, easy, Lula.

Apply for funding, straight from your bank account.

Access Business Funding in 24-hours.

Only pay for what you use, if you use it.

No monthly account or admin fees.

Get paid into your Lula Account instantly.

Opportunity favours the SMART.

Lula bank accounts come standard with smart cash flow tools to help you make better financial decisions.

Learn more

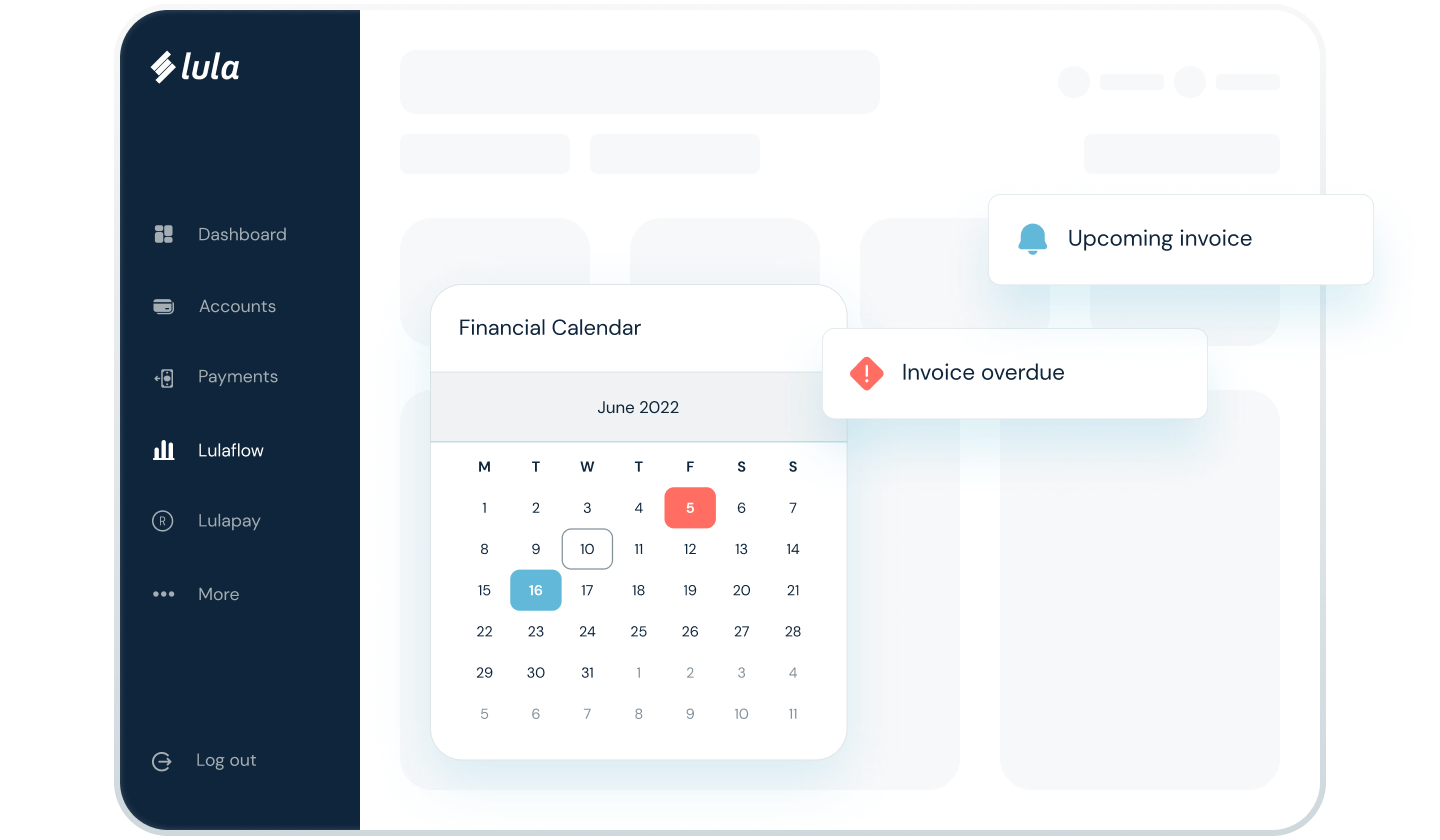

Manage your cash flow like a pro with Lulaflow.

Thirty percent. That's roughly the amount of time you spend doing admin. Imagine if you could spend that doing something else? That's where our powerful AI-driven Cash Flow Manager comes in.

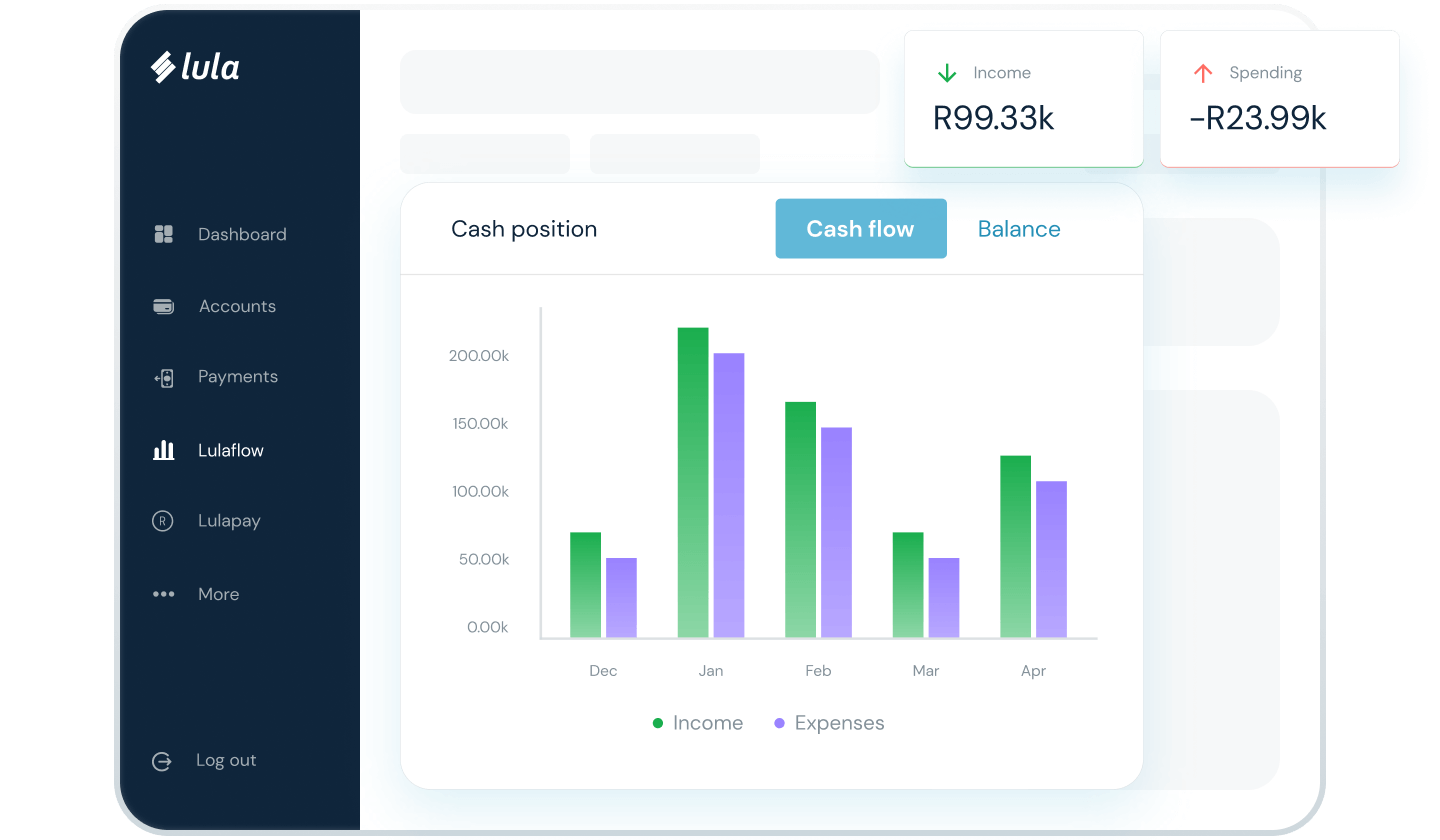

Instantly see which days you have cash coming in or going out. Plus, get monthly reports filled with the financial data you need to better manage your finances. 🎯

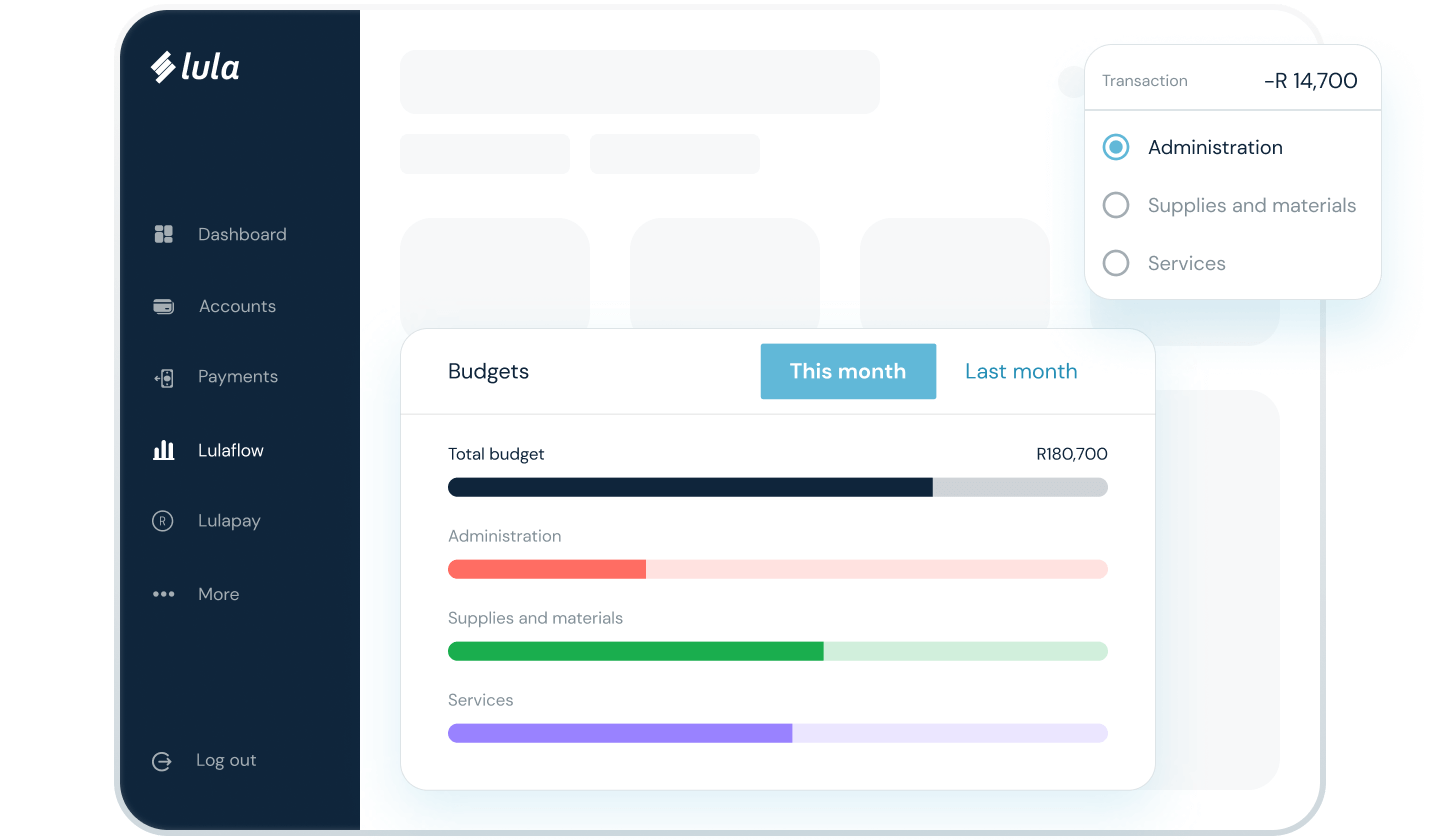

Set budgets and provisions to manage your spend. Categorise your income and expenses to quickly see where you could save. 👌

Link your other bank accounts and accounting software to securely sync your financial data, giving you a real-time view of your cash flow in one place. 🙌

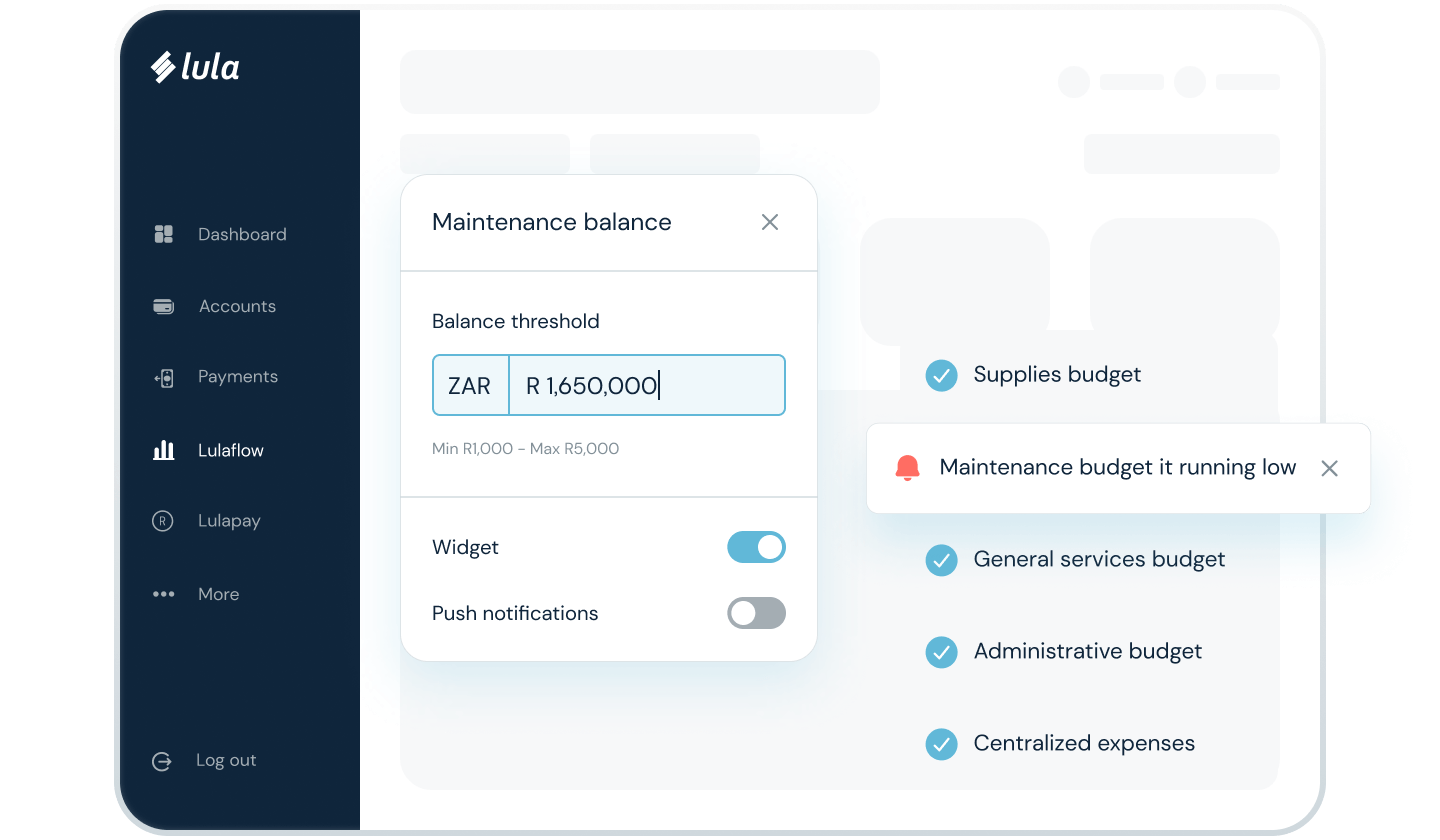

Get smart alerts for payments due or for when your cash flow is forecast to run low, so you can stay one step ahead. 😎

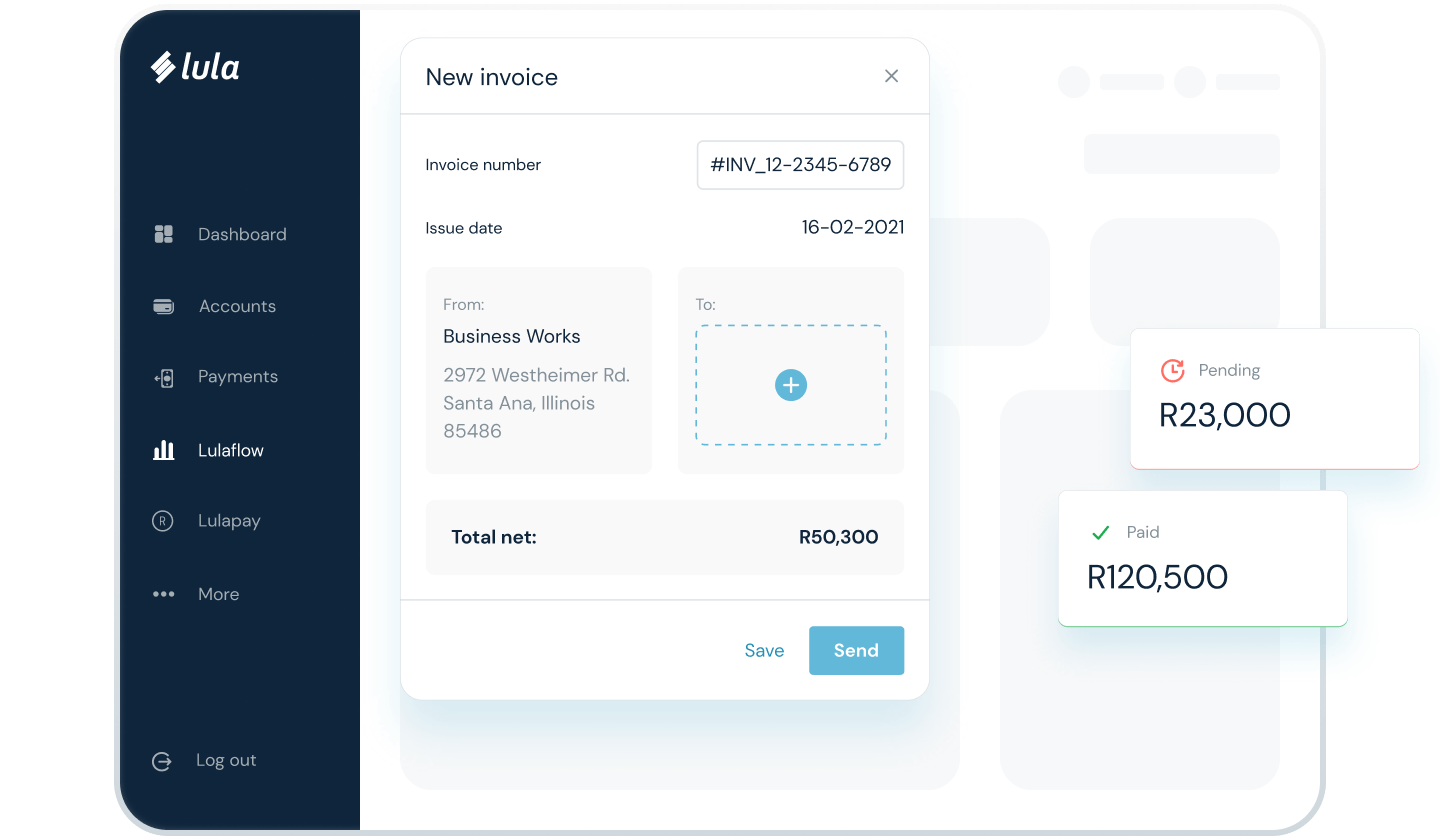

Send and manage your invoices with ease. 🤙

Your Lula bank card comes with unlimited free swipes. Always.

-

It’s free.

Order your free bank card and enjoy unlimited free swipes plus free delivery to your door.

-

It’s instant.

Instantly create virtual cards and start transacting.

-

It’s easy.

Freeze or unfreeze your cards with a click.

Trusted by business owners like you.

FAQs

No, we’re not a bank. We’re Lula. We build innovative fintech products to help SMEs succeed. We’ve partnered with Access Bank, our sponsor bank, to bring you a business banking account.

We know it takes a lot of trust when it comes to your hard-earned cash. If you’re ever unsure about anything, open a chat and let’s talk, human to human.

Our website uses the highest level of encryption. Our business accounts are powered by Access Bank and we comply with all relevant banking regulations.

We’re also PCI compliant and manage your bank card data following strict data security standards.

Creating a Lula business account is completely digital. Here’s what you’ll need:

- To verify your identity: Your ID book, a valid permit or visa for foreign national passport holders.

- To verify your address: Your lease agreement or any statement not older than 3 months.

- To verify your business registration:

If you’re a sole prop, make sure you have your UTR (unique tax ref) doc.

For companies registered Prior to the New Companies Act, we need your CM1 + CM22.

If you registered after New Companies Act, please submit:

COR 14.1 + one of the following: COR14.3, COR17.3, COR18.3, COR20.3.

Lastly, if you’re operating as a close corporation, please submit your CK1 and CK2.

Yes. A valid permit or visa for foreign national passport holders, but you need to have a local address and proof of it to verify your account.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.