Looking for a Business Bank Account?

Access more than banking with Lula's business class banking and funding solutions.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Considering a Business Bank Account?

A good business bank account can help manage your company's finances and provide tools for growth. Traditional banking services fall short for South African small and medium-sized enterprises (SMEs) in several ways:

- Long sign-up processes that require paperwork and branch visits

- High account fees that cut into already tight profit margins

- Outdated banking apps with limited features to help manage cash flow

- A tedious, slow process for access to funding to support and grow your business

These are critical issues that seriously limit the functionality of your business bank account. Luckily, there are smart banking solutions available for businesses that offer low account fees and powerful digital banking tools.

Let’s look at what business bank accounts are, why business owners need them, what to look for in a business account, and how Lula is more than just another online banking platform.

What is a Business

Bank Account?

A business bank account is a dedicated financial account provided by a bank or financial services provider for managing your company’s transactions.

A business account comes with a current account and debit card, and might also include investment accounts and a credit card. With your account you can:

• Pay suppliers and employees

• Receive payments from customers

• Track income and expenses for tax purposes

• Build your company’s credit profile

Many banks offer additional financial services through your account, like business loans or forex transactions. While added features can be great, there are some functionalities that you can’t overlook as a small business owner.

What to Look For in a Business Account

When choosing a business bank account in South Africa, prioritise these essential features:

- Low or no monthly fees: Look for accounts with minimal monthly charges to reduce overhead costs.

- Transaction limits and fees: Understand the costs associated with different transaction types and volumes (cash deposits, ATM withdrawals etc).

- Online and mobile banking: Make sure that the account offers user-friendly digital banking tools for managing finances on the go.

- Easier access to funding: Access to credit facilities or revolving capital can be crucial for growth and managing cash flow gaps.

- Dedicated account support: Responsive, knowledgeable support can make a big difference, especially for SMEs.

Do You Need

a Personal Business

Bank Account Manager?

Our research shows that exceptional customer service is the top priority for business owners when choosing a bank account. That’s why our Unlimited Business Bank Account comes with a dedicated business relationship banker – giving you direct access to expert support whenever you need it.

Why Separate Business and Personal Accounts?

Keeping your business and personal finances separate is important for several reasons:

- Legal compliance: For certain business structures separate accounts are legally required

- Tax simplification: A business current account simplifies tracking business expenses and preparing tax returns

- Liability protection: Separating personal from business finances maintains a company’s limited liability status and protects personal assets

- Easier bookkeeping: Having all your income and expenses in one place simplifies calculating annual turnover and monitoring liquidity

- Business credit building: A separate account is often the first step in establishing your company’s credit profile

Having at least one dedicated business account is a must, but you could probably do with more.

How Many Bank Accounts Should I Have For

My Business?

While a single business account can suffice for small businesses, many successful entrepreneurs have multiple accounts, which allows them to optimise financial management and cash flow.

Here’s how operating multiple accounts might look:

- Main operating account: Your primary account for day-to-day transactions and payments

- Savings or reserve account: For setting aside funds for taxes, emergencies or future investments

- Expense account: For managing regular business expenses with defined budgets

- Project-specific accounts: For keeping separate funds for major initiatives

Using these accounts in sync through user-friendly online banking can bring better organisation and financial clarity to your company. “If you’re an existing banking customer, it just takes a few seconds to open an additional account with Lula. All you have to do is add the account type and give the account a name,” says Thomas McKinnon, Chief Growth Officer at Lula.

You may have been banking with your current bank for several years. To make a change now may feel like a lot of work for you and your customers. If you don’t make the change, you could miss out on the benefit of having access to certain features that help you optimise your business’s cash flow more easily.

“We can take a gradual approach to the transition, allowing you to maintain and even strengthen your relationship with your current bank,” says Smith.

What Do You Need to Open a Business Bank Account in South Africa?

To open a business bank account in South Africa, business owners usually need the following to get started:

- Business registration documents: Your company registration certificate from the Companies and Intellectual Property Commission (CIPC), along with any relevant constitutional documents

- Identification: Valid ID documents or passports of all directors/owners

- Proof of address: A proof of address (bank statement, rental contract or utility bill) for all directors/owners that is less than three months old

- Tax documentation: A tax clearance certificate and income tax registration number

- Company resolutions: Authorising the opening of the business account

- Financial statements: Some banks require you to show proof of trading history in the form of financial statements showing at least three to six months of transaction history

- Business plan: You may also be required to present a business plan for the bank to assess your company and risk profile

- Initial deposit: Traditional banks often require an initial minimum deposit to activate the account

Opening a bank account usually takes two to four weeks once you’ve visited a bank branch and filled out the necessary documents.

Lula offers an easy online application process with minimal documentation requirements and no branch visits, making banking more accessible for South African SMEs.

“Opening a Lula Business Bank Account is quick and hassle-free. As long as you have the required documents, you can set up your account in minutes,” says Smith.

How Lula’s Business Account Helps You Manage Cash Flow

Effective financial management is crucial for the success of any business, especially for SMEs – which face unique challenges in South Africa’s dynamic economic landscape. Our data shows that SME turnover dropped by more than 50% in 2024.

“Lula Business Banking is designed specifically for SMEs, making it the only bank account fully dedicated to addressing the unique challenges business owners face,” says Smith.

A business banking solution that combines banking, cash flow management, and financial insights helps streamline your operations, reduce costs and increase profitability.

With our business bank accounts you gain access to our features; Multicompany and Payment Controls. You can also more easily access business funding. These features allow you to manage finances effectively, get a clear view of cash flow and secure funding – all from one banking profile.

Delegate Transaction Authority with

Payment Controls

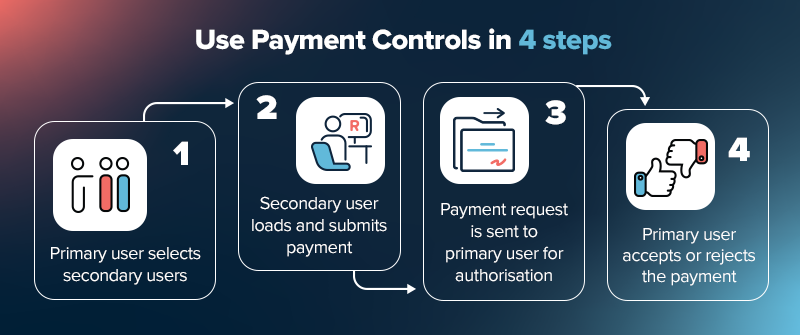

With our Payment Controls feature, you can now give multiple users control over financial transactions through a smart, easy payment approval process from your business bank account profile.

In a few easy steps, you can select a primary user and secondary users. Secondary users will have access to functions like creating and submitting payments. Once the payment is submitted, the primary user can either authorise or reject the payment.

This can be very useful if you’re the primary user and have multiple transactions to make to different accounts, but don’t have the time to load all of the payments, or you’d like to delegate the responsibility to an administrator or bookkeeper.

Secondary users can access the primary user’s account, load payment details and submit them for approval from anywhere, streamlining the payment process and lightening the administrative load.

Cash Flow Facility:

A Cost-Effective Funding Option

Traditional credit providers can be tight-fisted, with just 33% of SMEs able to access business loans. Alternatives like overdrafts come with high interest rates and account fees.

Businesses with a Lula business bank account can more easily apply for funding. When accessing a traditional loan, you may find that by the time you’ve received it, it’s already too late.

Access Lula’s Cash Flow Facility for:

• Up to R5,000,000 in funding

• Fixed and transparent costs that won’t change

• Flexible repayment and no early repayment fees

Once your application is approved, your Cash Flow Facility is accessible when you need it and without having to reapply (subject to an affordability assessment), with no additional admin or account fees.

“You only pay for the capital you use, making it a great way to manage cash flow, boost your return on income – if you manage your cash flow effectively,” says McKinnon.

How Much Does a Business Account Cost?

Before opening a business bank account, consider the account fees involved. Traditional accounts can involve many hidden fees apart from the standard monthly fees, like:

• Withdrawal fees

• Deposit fees

• Debit orders

• Cross-border payments

• EFT fees

Let’s compare the fees of two traditional banks (Standard Bank and African Bank business account) with Lula’s two business accounts:

While traditional banks offer lower monthly fees for basic accounts, they come with higher transaction costs and limited features. Lula offers two business account options, with different monthly pricing.

Lula’s Free Business Account

Our free account is a pay-as-you-transact business account that helps you work smarter, not harder. It features:

• 1.5% annual interest on your balance

• Free physical card and virtual cards, with unlimited free swipes

• Fast and responsive support from real humans who care

• Faster, easier access to business funding

• Manage multiple business accounts with Multicompany

• Delegate and have more control over your cash outflows with Payment Controls

Lula’s Unlimited Business Account

Our Unlimited Business Account has a single flat fee that doesn’t change. No hidden fees, no additional charges:

• Unlimited free EFTs

• Dedicated Business Relationship Banker to help you with finances and funding

• Easier and faster access to business funding

“Our customers asked us for a single flat fee to know what they’re paying per month. With other more traditional options it can fluctuate massively,” says McKinnon.

How Can I

Open a Business

Bank Account with Lula?

Whether you’re a sole proprietor or own a private company, it’s quick and easy to open a Lula Business Bank Account. You can open a business bank account online at any time. No branch visits. No queues.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.