Looking for Renewable Energy Financing Options?

End Your Load-shedding Nightmare for Good with Lula’s Revolving Capital Facility.

Get up to R5 million in business funding in 24 hours.

Apply for a fast, commitment-free quote now.

If you’ve been held back from adopting renewable energy because of high set-up costs...

… renewable energy finance could be the solution you need.

How often has load-shedding disrupted your business operations? You pay large utility bills, but the power supply still doesn’t match the cost, and the expenses of running generators have left their marks on your financial statements.

You may have even considered switching to renewable energy sources like solar energy in the past.

However, though they are cleaner, beneficial to the environment, and cheaper in terms of running costs, you may have been discouraged by the high upfront costs of setting up renewable energy sources. Consequently, you have continued to deal with:

High running costs

Disruption of critical operations due to power outages

Loss of competitiveness as your competitors switch to renewable energy

A larger carbon footprint

What if you could access the funds you need to set up your renewable energy solutions? With renewable energy financing options, you can start enjoying the benefits of renewable energy immediately and pay later.

In this guide, we consider what renewable energy finance is, the different options available to you, and how you can get started.

What is renewable energy finance?

Renewable energy finance is funding that helps businesses to make the switch to renewable energy sources.

It can also be seen as a form of asset finance, since the funds provided are for the procurement and installation of renewable energy assets.

Frustration with low energy production from the coal-dominated South African energy sector and the resulting load-shedding crisis has led many businesses to consider switching to renewable energy sources, especially solar energy (solar photovoltaic installations can be seen across the nation).

The rise of renewable energy sources

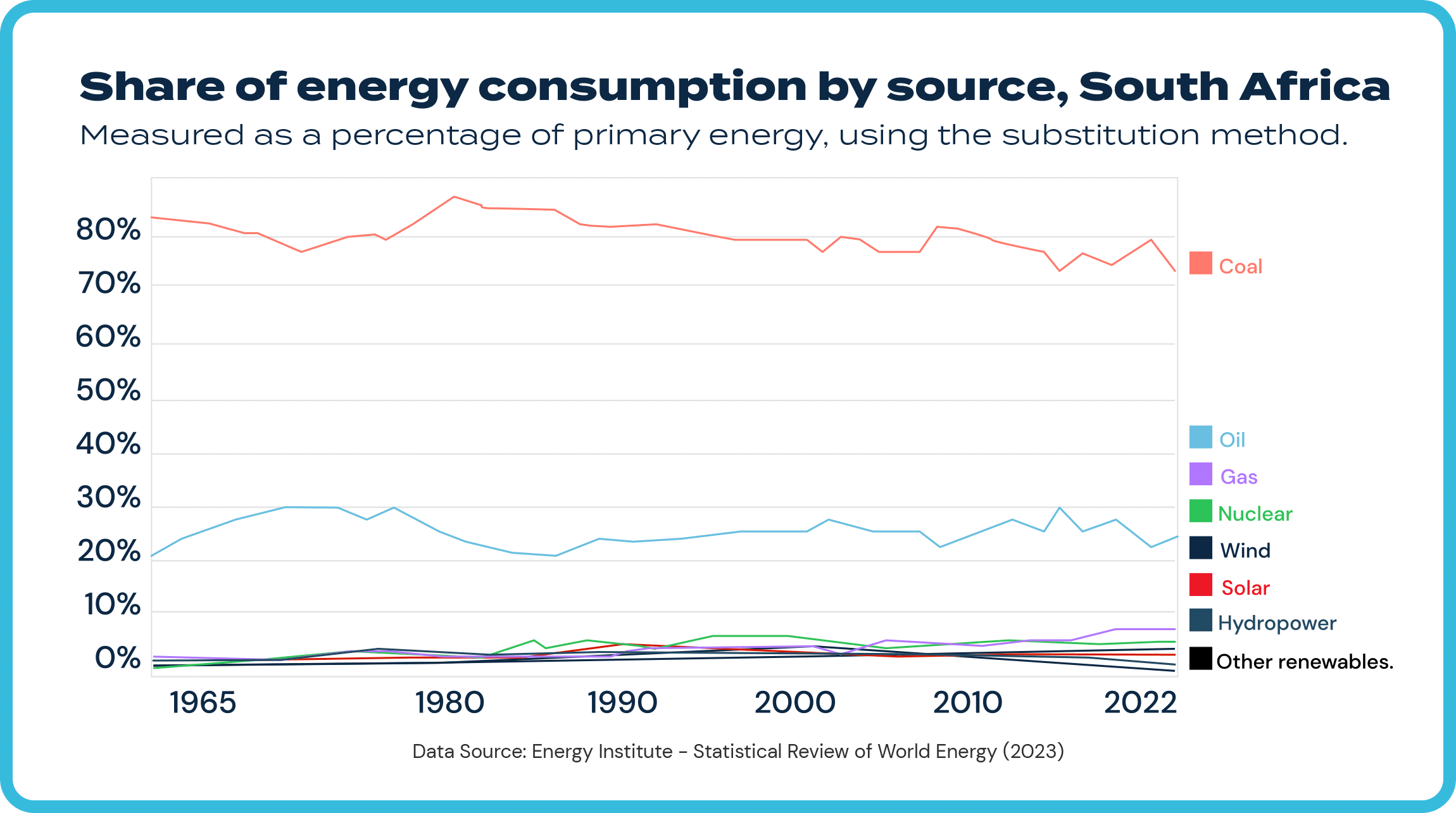

As seen in this chart, while there has been a fall in the usage of coal, energy consumption from renewable energy sources has increased over the years.

However, the high upfront costs of solar installation (for example) mean many businesses cannot afford the transition. A 10kW solar installation can cost upwards of R200,000, according to Huawei. And some businesses will need large-scale power projects that can supply more than 10kW.

Renewable energy finance seeks to provide the financing needed for businesses to take this step so they can start enjoying the benefits of renewable energy without having to pay its costs upfront.

Who needs renewable energy finance?

You probably would benefit from renewable energy finance if any of the below factors apply to you, but you lack the funds to finance a renewable energy project:

Tired of having your operations disrupted by load-shedding

Frustrated with high utility costs that are not providing sufficient benefits to justify their cost

Concerned about reducing your carbon footprint and contributing to environmental preservation

What are the renewable energy finance options in South Africa?

As a South African business in need of renewable energy finance (or solar financing in particular), you can explore the following options:

A power purchase agreement is a renewable energy financing arrangement where a financing company or service provider pays for the installation of the renewable energy system (including equipment like solar panels and charge controllers in the case of solar energy) while you pay them a monthly utility bill based on your usage.

With a PPA, you don’t own the system that has been installed. Instead, the financier of the project is just like a typical utility company supplying electricity, which, in this case, is being produced from renewable energy sources, and you would pay them for the energy used.

If you prefer to own your system, a bank loan is one of the solar finance solutions in South Africa that can provide the funds needed for the set-up.

Like PPAs, you also don’t own the installed system. However, payment for usage of the electricity supplied by the system is fixed per month (rather than varying per kWh used).

This is a form of rental or lease agreement that is common with malls and shopping centres. The financier (service provider) installs rooftop solar and pays the property owner for the usage of the roof while the property owner pays for the energy supplied (can be fixed or variable). The property owner can then share the cost among the occupants of the building.

Large companies that meet the conditions for issuing bonds can decide to generate funds through green bonds. Green bonds are bonds specifically targeted toward initiatives that will contribute positively to the environment, including energy efficiency and renewable energy project developments.

Since the transition to a renewable energy source will improve the environment, you can issue bonds for that purpose.

Bank loans are not the only option if you want a renewable energy project finance (that allows you to take control of your renewable energy system). For example, with Lula’s Capital Advance, you can get funding for your renewable energy project and spread payments over 3, 6, 9 or 12 months, depending on which one is convenient for you.

Lula’s Revolving Capital Facility is another option. With it, you can get continuous (revolving) funding for your working capital needs up to a limit that can be increased over time.

Such a system ensures that you don’t need to find new funding sources every time you need funds. If your energy needs increase after 6 months, you can use the Revolving Capital Facility to access new funds to scale up your renewable energy system.

Pros and cons of renewable energy financing options

What are the advantages and disadvantages of these renewable energy financing options?

Pros

- Pay based on usage: Your utility payment will reflect your usage. If there are times when usage is low, your utility bill will also be low.

- Maintenance and repairs are not your problem: Since you don’t own the installed system, you are not responsible for maintenance and repair. This can help save costs.

Cons

- You will not own the system: In essence, you will always be at the mercy of the company that owns the system. They can decide to increase prices at any time, for example.

- Dependent on the company for maintenance and repairs: You might have to chase down the company for them to do necessary maintenance and repairs.

Pros

- Ownership: Banks can provide the funds needed for you to install and own your system.

- Low interest rates: Banks still provide some of the lowest interest rates on loans.

Cons

- Accessibility: Only 25% of the funding accessed by South African SMEs came from traditional banks, according to a Reserve Bank study in 2020, the latest year with relevant data.

- Slow and time-consuming: The bureaucracy involved in accessing bank loans makes them inefficient for those who qualify.

Pros

- Fixed monthly payments: Since your monthly payments are fixed for the term of the lease, the lease provider cannot increase prices as in the case with a PPA.

- Maintenance and repairs are not your problem: Just as with a PPA, the owner of the installed system will be the one worrying about maintenance and repairs.

Cons

- You will not own the system

- You are dependent on the company for maintenance and repairs

Pros

- Ownership: With green bonds, you can raise money to install your renewable energy system.

- Low interest rate: Provided you have a good credit rating, the cost of raising bonds is lower than even bank loans.

Cons

- Accessibility: This option is not available for SMEs who can’t raise money in the capital market.

- Can be expensive: If your company does not have a good credit rating, you might have to pay above-market rates to encourage the purchase of your bonds.

Pros

- Ownership: You will own your system and won’t be subject to the whims of a third party.

- Flexibility: You can repay a capital advance in 3 months or 12. You can even repay earlier than planned without any penalty.

- Accessibility: You don’t need a credit report to access Lula’s Capital Advance.

- Low-interest rate: The accessibility of non-bank financial institutions has often been compensated for by high interest rates. Lula’s Capital Advance is accessible and yet cost-effective.

Cons

- Maintenance and repairs: If you own your renewable energy system, you will be responsible for necessary maintenance and repairs.

Advantages of a Revolving Capital Facility

You will own your system.

You don’t need a credit report to access Lula’s Revolving Capital Facility.

Accessibility is not compensated for by high interest rates. Lula provides competitive rates.

Take care of maintenance and repairs: If you don’t have the cash flow to pay for maintenance and repairs, you can use your revolving capital facility.

Flexibility: Your limit will increase the longer you responsibly manage your funding with Lula.

What are the benefits of switching to renewable energy?

Below are four benefits of switching to renewable energy:

The South African government has developed regulatory incentives and tax credits to encourage clean energy technologies.

For example, upon meeting certain conditions, “Businesses can claim an upfront deduction of 125 per cent of the cost incurred to acquire qualifying assets used in the generation of electricity (including supporting structures) against their taxable income,” according to the National Treasury.

Many other such incentives exist.

Renewable energy sources, especially solar energy, can help reduce utility costs (as reported by Reuters) thus reducing your operational expenses.

South Africa’s dependence on coal is the reason it has one of the highest electricity prices, according to Xolile White, Technical Director, Nestlé East & Southern Africa Region. Thus, a transition to renewable energy (like solar power) can help “reduce the cost of electricity and make it more accessible to businesses and households”.

With the state Eskom is currently in, widespread power cuts in South Africa are unavoidable. Businesses that want to avoid the interruptions caused by power outages need to shift to renewable energy sources.

Take solar energy as an example. “The annual 24-hour global solar radiation average is about 220 W/m2 for South Africa, compared with about 150 W/m2 for parts of the USA, and about 100 W/m2 for Europe and the United Kingdom,” according to the Department of Energy. “This makes South Africa‘s local resource one of the highest in the world.”

With access to the right solar finance in South Africa, you can say goodbye to power outages.

Reduction of carbon footprint and dealing with climate change are not concerns unique to the government; individuals and businesses also have to take initiatives. Switching from fossil fuels to sustainable energy can help you contribute to environmental preservation, a step that also enhances your business’s sustainability.

How can you get renewable energy financing in South Africa?

Does your business need to transition to clean energy but you don’t have the cash to install a solar system that you own and control?

At Lula, we understand the need for you to transition to renewable energy to save costs, improve efficiency, and avoid business interruptions. We also realise that having a system you own and control is important to avoid being subjected to the whims of a third party.

We aim to help you become renewable energy-independent by providing you with the funds needed for financing renewable energy projects.

With our Capital Advance funding, you can get the cash you need, as well as repayment terms designed in a way that is most manageable for your business.

If you need funding that is always there for your working capital needs (including maintenance and repairs of your renewable energy system), Lula’s Revolving Capital Facility is there to help you.

Apply now

How Lula can help you finance a renewable energy project

Are you a South African business that has been established for at least a year and has a minimum of R500,000 in annual turnover? You can apply to Lula for business funding in South Africa (including renewable energy project finance) and we can provide you with:

Quick access to funds

You can complete your application in a few minutes and receive your funds within 24 hours.

Easy access to funds

We don’t request credit reports for business funding nor do we impose the stringent requirements typical of banks. You can link your bank account for a quick real-time evaluation of your business without submitting any paperwork.

Competitive fees

We combine accessibility with competitive fees that won’t burden your business.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.