The construction industry is no stranger to change, but the pace of innovation is accelerating faster than ever.

Forget the old image of dusty blueprints and heavy machinery – the construction site of 2025 is a hub of the latest technology, with automation and smart devices leading the way.

The message is very simple for construction companies in South Africa: they must be on top of the latest construction equipment trends to stay competitive.

Read on to find out what these are and how your business can adapt in a busy 2025.

The best construction equipment is costly, so having the right financing is important. Explore Lula’s alternative funding solutions today and find out how you can get business funding to seize opportunities and grow.

The 6 Construction Equipment Trends to Look Out For in 2025

As in recent years, construction equipment trends in 2025 are rooted in technological and environmental topics.

Here’s a rundown of what they mean for South African companies and how they can adjust to them in the coming months.

1. The market is set to continue growing at a rate of just over 4%

The heavy construction equipment market in South Africa is in the middle of a steady rise covering a forecast period of growth until the end of the decade.

Arizton, a market research and consulting firm, estimates this to be a 4.15% compound annual growth rate (CAGR) until 2029, which will see the market size reach a value of $573.7 million (R10.8 trillion), a 33% increase from 2022.

The rise has been fuelled by a series of investment announcements from the government in public infrastructure projects and alternative energy, the latter of which is expected to provide over a quarter of the country’s energy supply by 2030.

What this means for South African construction businesses

This steady market growth presents a significant opportunity for South African construction businesses.

Those that invest in modern, efficient equipment are likely to make themselves more profitable and competitive, improving productivity and safety in the process. These are the ones that stand to win the lucrative government contracts driving this growth.

2. A boost in demand for excavation and earth-moving equipment

The investment drive in public infrastructure will include giant construction projects like the multi-billion-rand Lanseria Smart Mega City, set to be developed around the region’s international airport with an estimated completion year of 2041.

A major consequence of this urbanisation will be a growing demand for earthmoving equipment for the building of roads, transport links and large facilities. Excavators, and loaders, among other types of equipment, will be essential in preparing and developing the land for these.

What this means for SA construction businesses

Investing in modern, efficient earth-moving equipment and embracing technological advancements like telematics and automation will be big players this year. Prices are likely to rise, so businesses can save money by investing now.

3. A focus on prevention rather than cure in health and safety

Advancements in safety technology are a welcome boon for a construction industry that ranks in the top four high-risk sectors in the country, according to recent government figures.

An average of 1.5 to 2 fatalities occur every week and Department of Employment and Labour Deputy Minister Mr Jomo Sibiya has called for a concerted effort from everyone in the sector.

“To emerge victorious against the scourge of health and safety, everyone must play their role,” Sibiya said in a recent keynote address. “We can’t throw our hands in the air, nor can we bury our heads in the sand, we have to roll our sleeves and fight relentlessly against the demon of non-compliance in the construction sector.”

So what does this mean for SA construction companies? In short, compliance will grow in importance, which means a more intense focus on prevention.

Expect to see smart technologies play a bigger role, as we are already seeing in the US.

“In response (to a recent rise in fatalities), construction companies are integrating wearable technologies, remote monitoring via drones, and predictive analytics to anticipate and mitigate hazards,” says Angelica Krystle Donati, President and CEO of the Donati Immobiliare Group. “These tools go beyond compliance – they encourage a culture of prevention. By collecting data on site conditions, worker fatigue and equipment performance, stakeholders can prevent accidents before they happen.”

What this means for South African construction businesses

South African construction companies, which saw their workers claim R500 million in compensation payments in 2024, will need to embrace new safety technologies and prioritise worker training to get ahead of a potential government health and safety clampdown.

Not doing so risks heavy fines and/or legal action, not to mention the clear and present danger to their workforce.

4. A surge in the use of automated mining equipment is expected

Autonomous construction equipment already plays a huge role in the sector.

Self-driving bulldozers and excavators controlled by sophisticated GPS systems are already making their mark, while drones that survey construction sites with pinpoint accuracy are increasing in popularity.

These are set to play a big role in another of the key market trends of this year involving a rise in mining operations. Arizton highlights the growing inflow of investment from developed economies like China, North America, Germany and Japan in fuelling the hike in excavation activities across the country.

What this means for SA construction businesses

Investing in automated equipment that promotes safer and more sustainable mining, including on-site robotics, is a smart move.

External monitoring equipment can also benefit from automated tools, such as building information modelling (BIM) that allow supervisors to monitor development remotely.

5. The IoT is changing the face of construction equipment

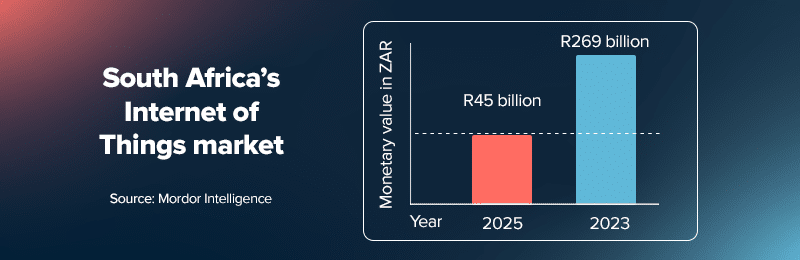

Internet of Things (IoT) technology is now part of everyday use in South Africa. Market research firm Mordor Intelligence calculates the market to be worth $7.79 billion (R143 billion) in 2025, set to almost double to R267 billion in 2030.

The national construction equipment industry has been a key beneficiary of this trend in recent years, with IoT devices digitally connecting construction sites and allowing supervisors to monitor equipment performance, site conditions, and worker safety in real time.

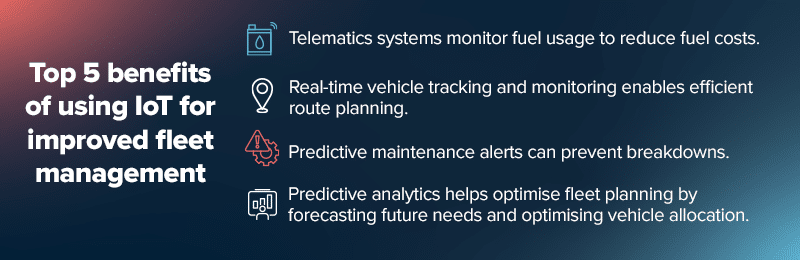

IoT shows just how powerful modern-day connectivity can be through cutting-edge fleet management. Here, every vehicle feeds real-time data into a central hub powered by artificial intelligence.

An example of this might be a team of Komatsu bulldozers carving out a new highway. Supervisors would be able to pinpoint the exact location of each one and its fuel consumption to the exact second via connected devices. They would then receive alerts the instant a critical component in an excavator or dump truck nears failure, allowing them to get ahead and prevent costly downtime.

What this means for SA construction businesses

South Africa’s ambitious infrastructure development plans have increased the need for construction companies that can complete projects with maximum operational efficiency.

While costly, an IoT system helps firms optimise their construction activities and compete for the best private and public contracts.

6. Sustainability continues to dominate

National spending in South Africa on sustainable construction technology has been increasing since 2021, after being found to have the 12th highest greenhouse gas emissions in the world, behind only major polluters like India. The government pledged to lower carbon emissions by 28% by 2030.

2025 will see the latest phase of this drive with a focus on energy-efficient practices across the construction sector. Several mining companies have started using green energy sources, such as solar power and green hydrogen, in the extraction process.

An electrification drive is also gathering steam. Electric construction machinery comes with lower emissions, lower costs and less noise – all obvious benefits for businesses – and is helping the country draw a line under the energy shortages crisis as part of a new power plan recently announced by the government.

The rise in demand for electric vehicles, too, means that minerals like cobalt, nickel, copper, manganese and lithium are very much in vogue. This means that specialist equipment to help source these minerals is very popular.

What this means for SA construction businesses

South African construction companies can jump on this green construction equipment trend by investing in energy-efficient machinery and exploring renewable energy sources like solar power for construction sites. Optimising construction processes to minimise waste and emissions is also a smart route to explore.

Financial institutions and alternative business funders are open to providing easy access to funding. Speaking with them can further accelerate this transition.

A rise in alternative equipment financing options

Technological advancements are helping reshape the construction industry, but the cost of buying and installing them is still expensive.

The high costs associated with purchasing, installing and maintaining cutting-edge equipment, coupled with ongoing operating costs, can strain budgets and limit access to innovation, especially for smaller companies.

What’s more, when they apply for funding they often find that their application gets turned down for reasons ranging from not meeting minimum turnover requirements, to a poor credit score.

This gap in the lending market means that new lenders that specialise in construction finance have emerged. These make it extremely quick to apply, and come with lower lending restrictions than banks and other traditional lenders.

What this means for SA construction businesses

Making use of alternative sources of financing is a good way to not only shore up operating costs, but can also act as a growth mechanism.

Businesses that use funding to expand operations are more likely to succeed than those that batten down the hatches and cut outgoings to the bare minimum.

Funding options like our Revolving Capital Facility, our answer to construction finance, are designed to help businesses access the equipment and capital they need without the usual red tape. Quick and flexible, we allow South African businesses to invest in growth and take on larger projects, rather than just protect themselves against debt.

Don’t let a lack of funding hold your construction business back. Apply for business funding today and get access to up to R5 million within as little as 24 hours.