For small businesses in South Africa, a strong credit score can be a vital tool for accessing credit and business funding.

As a business owner, you may not realise the impact your business or personal credit score has on your ability to secure funding or negotiate favourable borrowing terms. A credit score is a key indicator of a business’s financial health and lenders use it to assess risk before extending credit to a customer.

Understanding and managing your credit score is crucial for achieving long-term growth and financial stability. While the process might seem daunting at first, taking proactive steps – like paying bills on time, reducing debt and keeping track of your credit report can make a big difference.

By committing to good financial practices, you can build a strong credit score that opens doors to opportunities for your business and promotes growth.

As Garth Rossiter, Chief Risk Officer at Lula, emphasises, “It is vital that SMEs have access to reliable and responsible lenders and are able to make use of credit in a responsible manner in order to scale their enterprises.”

But how does one go about improving their credit score? And what does it all entail? Here we explore what a credit score is and how you can improve your credit score for a positive funding application outcome.

What is a Credit Score?

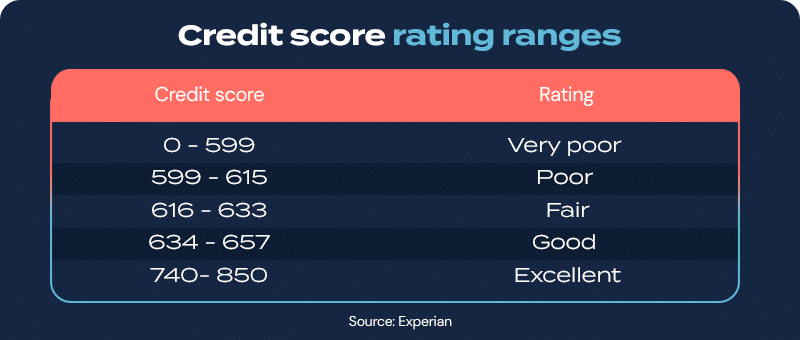

A credit score is a three-digit number used to rate your creditworthiness. The score, which is based on the FICO credit score (a credit scoring model developed by the Fair Isaac Corporation), typically ranges from 300 to 850.

Your credit history is one factor that is considered to determine your credit rating. This includes information like how many lines of credit you have and the repayment history on your accounts.

Rossiter has the following tips for businesses who want to build their credit score: “Keep a clean credit record for your business and for directors personally. The easiest way to do this is ensuring you don’t miss any repayments on any credit you currently have. Keep good financial records and have a solid understanding of your business and the market in which you operate.”

Your credit score can impact your access to funding. While a good credit score doesn’t guarantee that you’ll be approved for funding, it does give lenders an idea of how you manage credit.

How Your Credit Score Impacts Access to Business Funding

Different lenders usually have their own criteria for deciding who to lend to and on what terms. The higher your credit score, the more likely you are to qualify for funding.

As an alternative funder, we consider both the business’s credit score and the personal credit scores of the directors when a business seeks funding.

Both your personal and business credit scores are important to keep in good standing if you think your business will need to apply for funding in the future.

Factors That Affect Your Credit Score

Understanding what factors are considered in calculating your credit score can help you take the necessary steps to improve it.

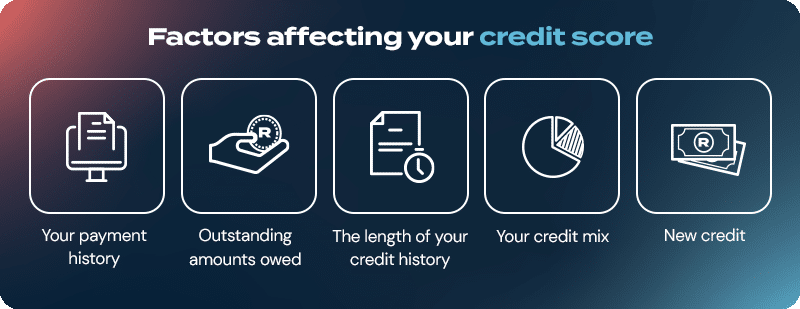

Here are the five factors that affect your credit score:

- Your payment history

- Outstanding amounts owed

- The length of your credit history

- Your credit mix

- New credit

Your payment history

Payment history accounts for about 35% of your credit score.

If you miss a payment by a day or two, it will have a slight impact on your credit score.

However, if you’re so late with a payment that it is handed over to the lender’s collections department, this is cause for concern.

A single payment made 30 days late can hurt your credit score. You won’t always be notified when it happens, and need to check your score regularly to make sure you’re on the right track.

Outstanding amounts owed

How much you owe across your various lines of credit plays an important role in the calculation of your credit score.

The same applies for how you use credit, or the percentage of your available credit that you’re using. It’s best to use less than 30% of your available credit at any given time.

The length of your credit history

The longer your credit history, the higher your credit score is likely to be if your available credit was managed responsibly. However, this is not always the case.

Your credit history takes into account how long you’ve had your longest standing line of credit, your newest credit account and the average of all your accounts combined.

This way lenders know how long you’ve been responsibly managing your available credit.

If you’re thinking about closing credit accounts that you’ve kept up to date, it’s best to keep them open.

Your credit mix

Having a good mix of credit like a credit card, a student loan, vehicle finance, store accounts and a home loan can boost your score. It shows lenders you can handle different types of credit and are actively making timely repayments.

New credit

Lenders assess how financially stable you are. Opening several new lines of credit in a short period can reflect negatively on your score.

It could be interpreted that you are relying too much on credit and could be struggling financially, or overextended. Each time you open a new line of credit, you’ll trigger a hard inquiry, which can lower your score. A hard inquiry is when a lender requests to review your credit report as a part of the credit application process.

There are various factors that are considered when generating a credit score. It can fluctuate frequently and it’s important to check it regularly. Also, there could be errors on your report, which can unnecessarily harm your score.

With more knowledge about the factors that directly impact your credit score and what it entails, you can confidently apply these five steps to improve it:

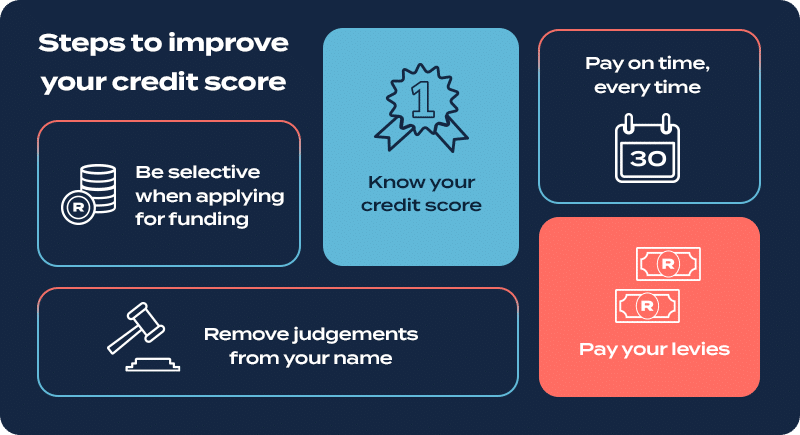

5 Steps You Can Take to Improve Your Credit Score Rating

1. Know your credit score

The first step to improving your credit score is to check what it is. You can request your credit report from a credit bureau. The four main credit bureaus in South Africa are: Experian, TransUnion, Compuscan and Equifax. According to legislation, every South African is entitled to obtain one free credit report every year from a credit bureau.

2. Pay on time, every time

If any of your accounts are in arrears, settle them as soon as possible. If you aren’t able to pay them all at once, you can contact your credit provider and make an arrangement to repay an amount that works for your budget.

3. Pay your levies

Outstanding property levies are one of the reasons judgements appear on a credit report.

Body corporates and Homeowners Associations (HOAs) are swift to send letters of judgement against your name if you fail to pay your levies. Making sure you pay your levies on time can help you avoid incurring any judgements against your name.

4. Remove judgements from your name

If you do have judgements on your name, you can take steps to recover.

Contact the creditor who listed you as having a judgement and settle any outstanding amount you owe. Once you’ve paid up the outstanding amount, you can approach a court for rescission of the judgement either by consent of the attorney that issued the judgement or by approaching a court to notify them that the outstanding amount was paid up in full.

5. Be selective when you apply for funding

When you’re applying for funding it’s important not to apply at several different institutions all at once.

Submitting several applications for funding with different credit providers during a short period of time can reflect badly on your credit report. Every application with a registered credit provider is logged at the credit bureau.

Carefully considering the type of credit your business needs, and the provider that can best suit your funding needs is crucial before submitting your application.

It’s best to get it right the first time than to submit an application only to be declined. Most traditional lenders like banks have a lengthy business loan application process, which can be time-consuming.

At Lula, we offer an alternative solution that fast-tracks the process. As responsible lenders we carefully assess your credit profile to determine whether you are eligible for funding, and can advise that being prepared for the process improves your chances of being approved.

Access to funding can transform your business and unlock new opportunities for growth, innovation and investment which extends to the lives of those employed and served by SMEs.

Once you’ve taken the steps to improve your credit score, you’ll be in a better position to be approved for funding. When you’re ready, start the easy online application process.