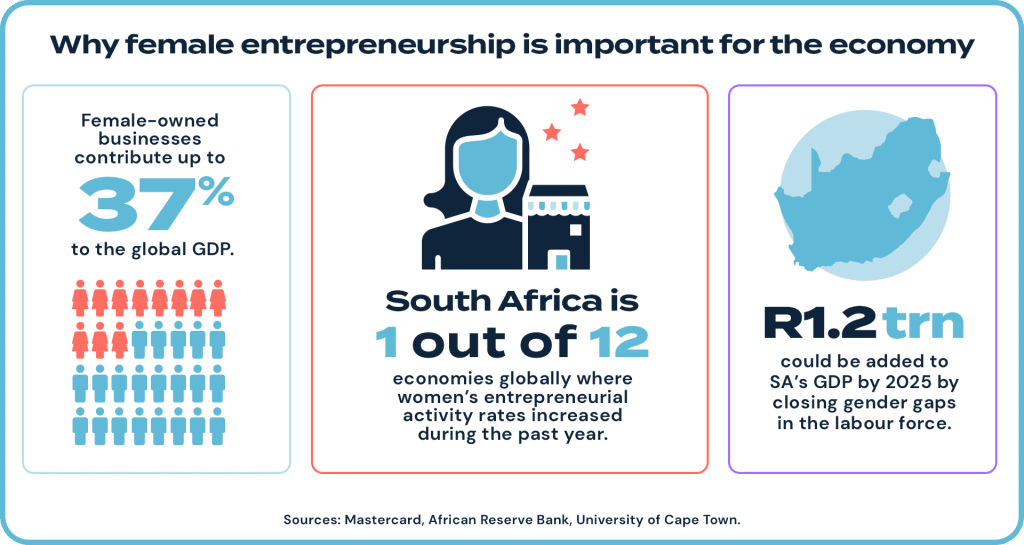

South Africa emerges as a leader on the continent as an enabler of women’s entrepreneurship being one of 12 economies across the globe where women’s entrepreneurial activity rates increased during the past year.

However, only 40% of women in South Africa aged between 15 and 60 are regarded as being economically active and only 21% of the formal SME sector is made up of women-led businesses.

Currently, female-owned businesses contribute to 37% of global GDP and are known for making significant contributions to society. Supporting female entrepreneurs can not only help close the gender gap, but potentially improve global economic development.

Exploring the reason behind these statistics could provide insight into how we can work towards eliminating gender disparity and making business finance more accessible for all.

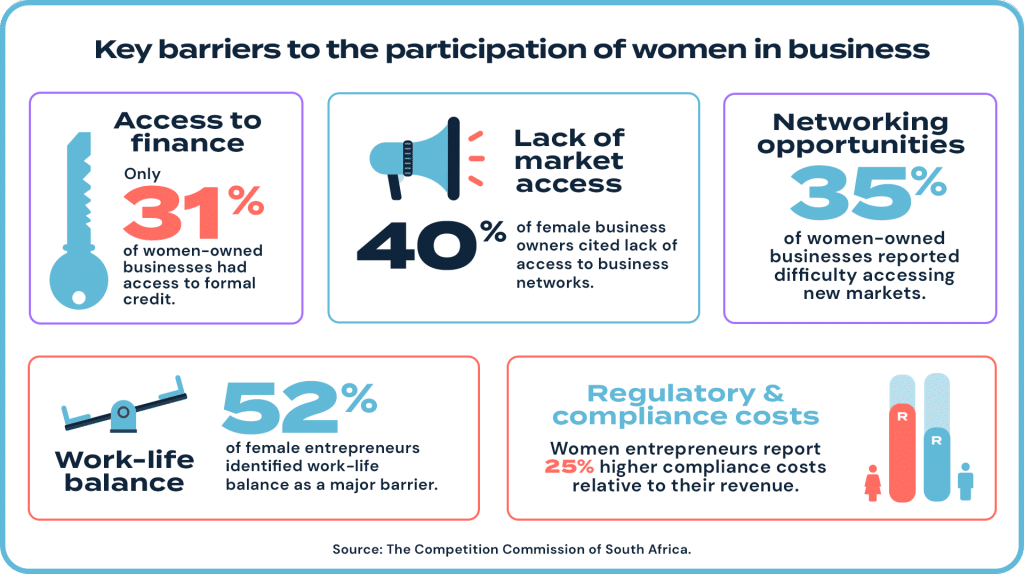

The Women in Business project in 2021 led by the Competition Commission of South Africa identified the key barriers to the participation of women in business:

- Access to finance

- Regulatory and compliance costs

- Networking opportunities

- Work-life balance

- Lack of market access

Female Entrepreneurs Speak about Small Business Funding Challenges

The high interest rates of many financial service providers and the perceived lack of creditworthiness are some of the obstacles preventing women entrepreneurs from accessing business funding.

In South Africa, female-led businesses are 30% less likely to secure loans from financial institutions. Reasons for this include having fewer assets in their name or collateral, making lenders in the formal sector more reluctant to finance them. As a result, the ability for female entrepreneurs to grow their businesses is stifled, leading to fewer women being willing to take the entrepreneurial route.

Alternative funding providers with less stringent requirements and manageable repayment terms like Lula offer a solution that solves the funding challenges female small business owners face.

Customers Sunette Botha, founder of Spitbraai Boss, and Paulinah Honyi Teffu, CEO of Digital Solution Foundry, share more about the unique challenges they faced in seeking funding as female entrepreneurs. Three of the main challenges they faced were:

1. Stringent application requirements

2. Volatile market conditions

3. Slow approval processes

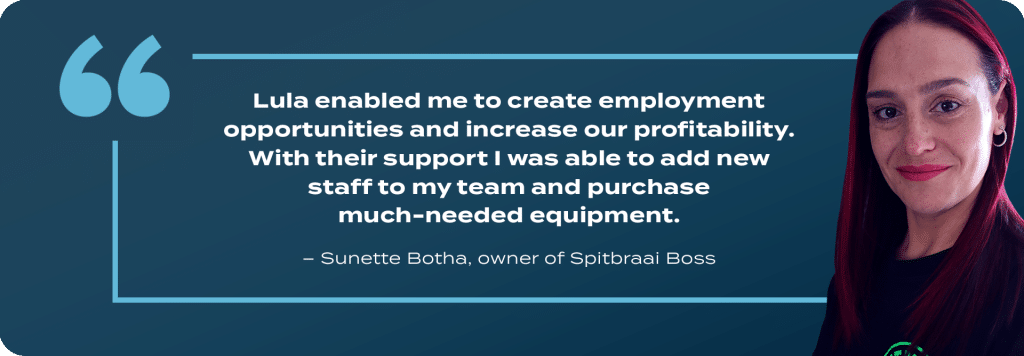

Sunette Botha, founder of Spitbraai Boss

Sunette, owner of Spitbraai Boss, a mobile spitbraai catering company birthed from a passion for food, started with three spitbraais and a small bakkie. Six years later, she’s grown her business to a 14-employee-strong thriving business.

Stringent Approval Requirements

Seeing as Spitbraai Boss was a relatively new business at the time Sunette required funding, she found it especially challenging to secure funding from traditional financial institutions. The banks that she approached required extensive documentation proving the business’s track record.

In addition to being a sole proprietor who started her business just before the restrictions on economic activity were imposed in response to the COVID-19 pandemic, she experienced significant pushback not being able to meet the stringent approval requirements.

The urgency to secure the capital needed for growth prompted her to explore alternative funding options. This is when she discovered Lula.

She highlights her experience with Lula as being one of the best she has ever had with a financial provider, and was able to achieve the business growth she needed to survive the pandemic and grow.

“Applying for funding from Lula was very convenient and easy. It didn’t even take two weeks to get funding. In that year, I was able to purchase three new spitbraais and a mobile bar, and employ new staff. Lula’s support allowed me to create employment opportunities and increase our profitability,” says Sunette.

Paulinah Teffu, CEO of Digital Solution Foundry

Paulinah, CEO of Digital Solution Foundry, celebrates 7 years since its inception in 2017. The company is a software development provider that builds innovative custom software solutions and provides employment opportunities to young talented tech graduates.

Paulinah expresses how securing funding in general has been a challenge, with funders and lending institutions citing that her company did not have a track record of success. She attributes this more to the market volatility caused by COVID-19 and not necessarily the fact that she is a woman.

The Influence of Market Volatility

“I don’t think it was a challenge because I am a woman; the challenge was playing the convincing game, especially with what was happening around us in terms of market volatility due to COVID-19 that made investors much more hesitant.

“At the time, Digital Solution Foundry wasn’t positioned well enough to be able to convince investors to buy into its growth ideas and I believe that now with everything that has transpired, we can go to market and say we are a solid player because we can produce the headcount and capacity. But someone needed to believe in us in order for us to be able to get to where we are now.”

Playing the Convincing Game

“Investors will exhaust every avenue and test whether you can make it or not. Unfortunately, it’s not always possible to provide some of the proof they require until you’ve succeeded, but I couldn’t prove that until I walked the journey. I needed the resource capacity and technology to expand and couldn’t acquire that without capital. Investors would say, ‘Show me your history,’ and I would say, ‘I’m trying to create history – that is why I’m here knocking at your door,’” Paulinah shares.

It was these challenges that propelled Paulinah to seek capital from alternative funding providers. Today, Digital Solution Foundry is a thriving tech SME with big dreams for the future. They are a team of 65 and are growing strong.

Words of Wisdom for Entrepreneurs Exploring Alternative Funding Options

“Seek funding strategically, says Paulinah, “There are alternatives to the mainstream lending providers out there. It’s important to explore them because an opportunity to expand and grow might escape you if you only limit yourself to just five or six providers.”

Alternative Funding Solutions Supporting Female Entrepreneurs

A FinScope survey highlights that women in South Africa have slightly less access to formal financial services compared to men. Various organisations, financial institutions and government initiatives are working towards bridging this gap.

Small business owners or aspiring female entrepreneurs can take advantage of Lula’s Revolving Capital Facility or Capital Advance to access fast, flexible funding options that offer up to R5 million in funding in as quick as 24 hours.

Lula’s alternative funding solution gives you fast, easy access to working capital when you need it and approval requirements are less stringent than those commonly found in traditional financial institutions.

Despite the significant funding challenges facing female entrepreneurs in South Africa limiting their growth potential, there are alternative funding solutions and support in favour of their success. Paulinah and Sunette’s inspiring stories are encouraging and serve as a great source of guidance to women looking for answers.