Looking for Business Banking in South Africa?

Streamline multicompany management & payments with Lula’s business banking.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Considering a Business Bank Account?

Building a successful SME comes with many challenges, but none might be more important and overlooked than good financial management. That’s why business owners need more than a simple deposit account to stay on top of their company finances. Yet many traditional banking solutions leave South African SMEs facing unnecessary complications, including:

- Tedious payment approvals that take multiple steps and signatures

- Limited control over who can authorise transactions or access accounts

- Fragmented financial oversight when managing multiple companies

- Little support from relationship bankers in improving company finances

Big corporations might get support from dedicated teams to overcome such issues, but smaller businesses need simpler solutions that don’t sacrifice control or visibility.

The latest business banking tools bridge this gap in banking services with smart features specifically designed to meet the business needs of growing South African SMEs.

Let’s look at what advanced business banking is, how it differs from traditional and corporate banking, why SMEs need it and how Lula is more than just another banking solution.

What is Advanced Business Banking?

Business banking refers to commercial banking services designed for companies instead of private individuals. Traditional business banking focuses on:

- Providing bank accounts

- Processing transactions

- Offering access to basic business loans for day-to-day finances

Most traditional banks still offer outdated solutions focused solely on transactions. Instead of improving business efficiency, these banking services tend to only create extra admin work.

Advanced business banking has evolved beyond those limitations. Today’s online banking solutions feature:

• A digital-first approach, replacing branch visits and paperwork with

online tools like digital signatures

• Role-based access systems, allowing multiple team members to interact with accounts

• Customisable approval workflows matching your organisational structure

• Consolidated views across multiple entities or accounts

• Cash flow forecasting based on automated, real-time analysis

• Faster funding application for solutions tailored to your needs

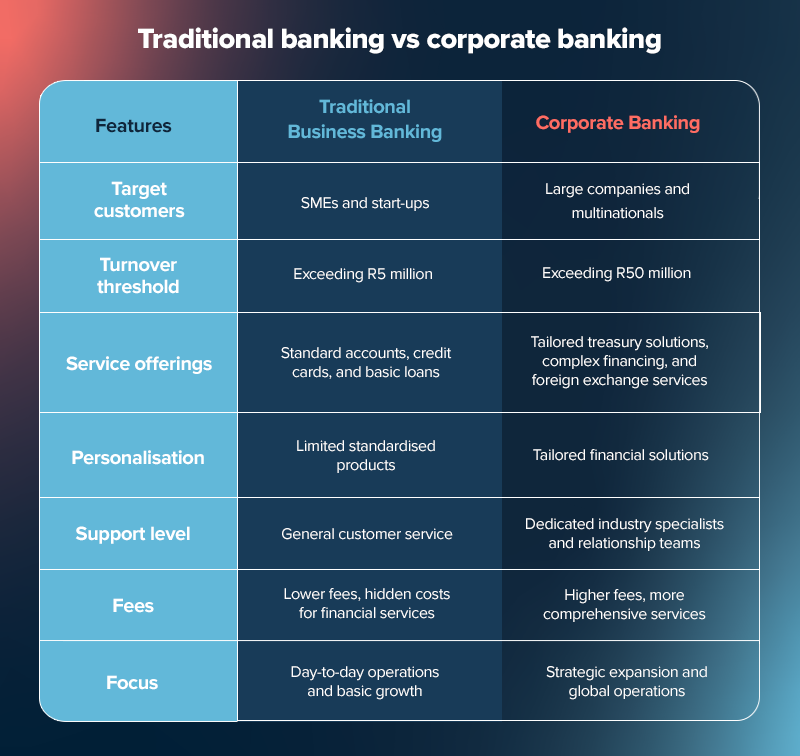

Business Banking vs Corporate Banking

It’s easy to confuse business banking with corporate banking, as both are types of commercial banking offered by authorised financial services. Yet while business banking generally serves small and medium-sized enterprises and start-ups, corporate banking caters to large companies and multinationals. Corporate banking accounts have:

- Annual turnover exceeding R50 million and running into billions

- Individually tailored treasury and cash management solutions

- Dedicated industry specialists and relationship teams

- Complex financing structures, including syndicated loans

- Extensive cross-border trade and forex capabilities

In contrast, most business banking offerings include standard account functionalities, a business credit card, and perhaps an additional investment account, often at a high monthly fee.

The challenge for SME owners lies in getting a business banking account that bridges the gap between limited standard business accounts and corporate accounts.

Features to Look for in Advanced Business Banking

Since most SMEs fall between basic business accounts and full corporate banking, it’s important to look for business banking that offers advanced features without corporate-level complexity.

Here are some features to prioritise in modern business online banking:

Mobile-first experience

You want banking functionality where and when the action happens, not at a branch visit. Digital banking lets you handle approvals, check balances and move funds on the go.

Personal support

Personalised financial advice shouldn’t just be accessible to big corporations. Our 60 Decibels Insights Report shows that exceptional customer service is the top priority when choosing a bank account.

Our Unlimited Business Bank Account, for example, comes with a dedicated Business Relationship Banker for instant access to expert support when you need it.

“A business relationship banker can provide personalised support and guidance tailored to your business needs,” says Leigh Smith, Product Marketing Manager at Lula

User access and permissions

Not every employee should have the same access to your company’s banking. Nor should certain banking tasks rely solely on SME owners. Look for banking that lets you control who can view accounts, make payments, or approve transactions based on their role within your organisation.

Payment control mechanisms

Your business banking should include payment solutions that can set spending limits, create approval workflows, and track transaction status. This prevents unauthorised spending while optimising your operations.

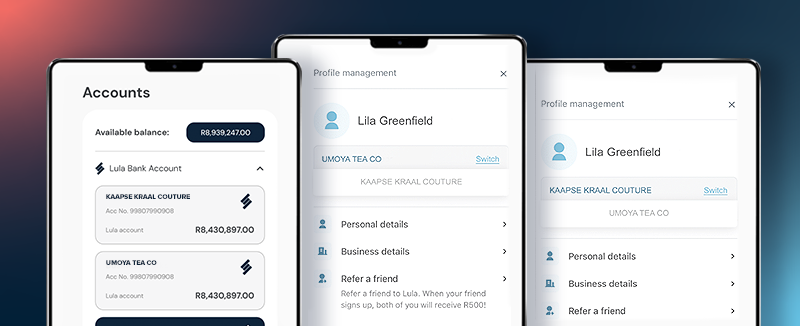

Multi-company management

If you run multiple businesses or branches, being able to manage multiple accounts from one dashboard can provide convenience and ease. You won’t need to constantly log in and out of different accounts.

Transparent fee structure

Understand exactly what you’re paying for without surprises and expensive overdraft fees. The best business banking solutions offer clear pricing aligned with the actual value they provide to your operations.

These features help your business banking account become a tool for improving cash flow rather than just a place to store money.

Why Payment Controls Matter for SMEs

Managing payments can be overwhelming for small businesses. Just one wrong transaction can potentially derail your cash flow for weeks.

The problem with traditional banking is that it offers few safeguards for payment processing. It often only allows for a single account holder with full control, creating an operational bottleneck where:

- Business owners (who are already flooded with work) become the financial bottleneck, delaying payments when unavailable.

- Staff lack the authority to handle even routine transactions.

- Financial control is an all-or-nothing proposition.

Adding payment controls to a business banking account equips SMEs with more transaction authorisation flexibility instead of solely relying on the account holder.

Streamline Business Payments with Lula

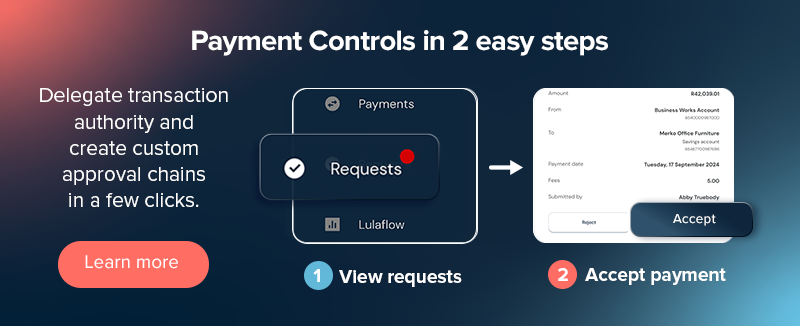

Our Free and Unlimited Business Bank Accounts come with a Payment Controls feature that lets you delegate transaction authority and create custom approval chains.

Simply select a primary user and secondary users with access to functions that can create and submit payments. The primary user can then approve or reject a payment.

The Payment Controls feature lets you:

- Streamline collaborative payment workflows

- Lighten your administrative load as staff load payments

- Delegate responsibility to an administrator or bookkeeper

- Keep track of all transactions easily

With the Payment Controls feature in our business banking accounts, SMEs unlock enterprise-level financial governance scaled for their business needs.

“Lula Business Banking is designed specifically for SMEs, making it the only bank account fully dedicated to addressing the unique challenges small business owners face,” says Leigh Smith, Product Marketing Manager at Lula

Managing Multiple Companies?

Lula’s Business

Banking Solution

Running multiple businesses or branches becomes an administrative nightmare when banks make you manually switch between company accounts to process and track transactions. It not only wastes time but increases the risk of errors in your financial management.

Simplify multi-company banking with Lula

Our Multicompany feature solves bookkeeping headaches by bringing all your businesses under one unified dashboard.

Often only found in corporate banking solutions that charge high monthly fees, Lula makes multi-company management accessible to SMEs and extremely simple. Adding an account takes just a few steps.

“If you’re an existing banking customer, it just takes a few seconds to open an additional bank account with Lula. All you have to do is add the account type and give the account a name,” says Thomas McKinnon, Chief Growth Officer at Lula

With the Lula Multicompany feature, you can:

- View the banking profile of all of your companies in one session

- Process intercompany transactions

- Prepare financial statements and tax reports with ease

Having an integrated view of your business helps track balances and transactions to improve cash flow and easily identify which business units are doing well and which aren’t.

The Multicompany feature is available in both our Free and Unlimited Lula business banking accounts.

Can Advanced Business Banking Improve Access to Funding?

If you face occasional cash flow hiccups, the best business bank account for your SME is the one that provides easier access to funding.

Accessing business funding in South Africa can be an uphill battle, with just 33% of SMEs able to access business loans from traditional financial services providers.

Tellingly, according to independent research conducted on Lula customers, 89% of Lula’s customers report not having access to similar financial services to those offered by Lula.

Want to minimise cash flow gaps in your business or capitalise on a business opportunity without dipping into your liquidity?

Our business bank account makes it easier to apply for funding that moves at the speed of your business.

Lula’s Cash Flow Facility

Our Cash Flow Facility* is an open line of capital that you can repeatedly draw down from whenever you need it. It’s a smart funding solution that gives you quick access to capital, as opposed to having to wait weeks on end when applying for a traditional business loan.

Once your application is approved, you can:

- Easily access your approved funds without having to reapply* (*subject to an affordability assessment)

- Only pay for what you use, making a Capital Facility a cost-effective source of funding

- Enjoy fixed costs that won’t change throughout your agreement

Lula’s Fixed-Term Funding

Need a lump sum to overcome operational challenges or exploit a market opportunity? Lula’s Fixed-Term Funding can help.

- It’s a fixed-term lump sum with simple and transparent terms

- Once approved, receive funding within as little as 24 hours

- Repay over an agreed term of 3, 6, 9 or 12 months

*Note that access to a Cash Flow Facility or Fixed-Term Funding is subject to a credit assessment.

How to Set Up Business Bankingwith Lula

Setting up business banking shouldn’t require multiple branch visits and weeks of waiting. Lula’s online application process takes just minutes to complete. “Opening a Lula Business Bank Account is quick and hassle-free. As long as you have the required documents, you can set up your account in minutes,” says Leigh Smith.

Here’s what you’ll need:

Basic documentation

- Your ID document (South African ID or valid foreign passport)

- Recent proof of address (less than 3 months old)

- Business registration documents from CIPC

- Three months of bank transactions

Follow these 4 simple steps:

- Navigate to the ‘Free Business Bank Account’ page

- Fill in your personal details and click ‘Get Started’. Scan your ID and upload a copy.

- Take a selfie and submit it, along with your proof of address and business documents**

- Complete our brief business profile questions

Once approved, you get full access to our business banking platform, including advanced features like Payment Controls and Multicompany.

**Your data is safe with us. Your bank shares just your latest read-only transaction data with us: we don’t save or store your username or password, and you can unlink your account at any time.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.