Expanding your business is exciting, but do you have the cash flow to support it?

Growing businesses need to make sure their cash flow management is on point to handle increased activity, yet many struggle to make the leap due to:

- Cash drain from slow payments, with customers taking their time to pay invoices

- Working capital that is tied up in excess stock that isn’t moving, eating into profits and limiting available funds

- Unexpected financial shocks that are disrupting their budget and straining day-to-day cash flow

If your business has hit any of these financial whirlpools, then great cash flow management can help you navigate your way out of them.

Read on for seven tips from the business world that will have you steering your cash flow into clearer waters in no time.

Cash flow management will help you steady the ship, but you need funding to grow. Explore Lula’s alternative funding solutions today and get the capital you need to take your business to new heights.

What is Cash Flow Management?

Effective cash flow management means tracking, analysing and optimising the cash inflows (money coming into your business) and cash outflows (money leaving your business).

Notably, cash flow problems are cited by South African small, medium and micro enterprises (SMEs) as one of their biggest challenges, according to online publication BusinessTech.

Managing the flow of cash within a small business is, therefore, crucial to its wellbeing.

What is a Cash Flow Management Example?

Managing your cash flow is a little like regulating the water in a heating tank. You need to know how much is flowing in, how much is being used, and make sure you don’t run dry when you need it most.

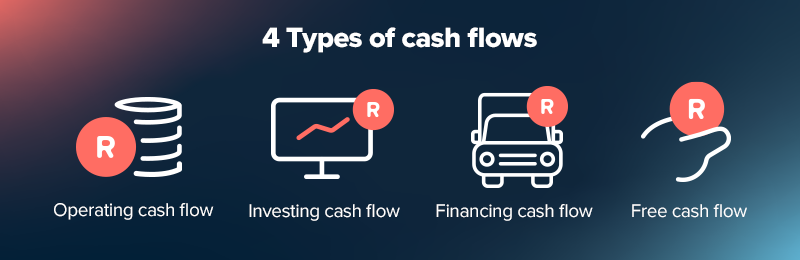

There are four types of cash flows to keep an eye on:

- Operating cash flow: This is the cash generated from your core, day-to-day business operations – sales, services and the expenses directly related to them. A positive cash flow in this regard is a great sign of financial health.

- Investing cash flow: This looks at the cash related to buying or selling long-term assets, like equipment, property or investments.

- Financing cash flow: How is your business funded? Factors like short-term or long-term loans, repayments, issuing or buying back shares, and paying dividends come into play here.

- Free cash flow: This is the cash your business has left after covering its operating expenses and capital expenditures (investments in assets). It’s a key indicator of your business’s ability to fund future growth, repay debt or return value to owners.

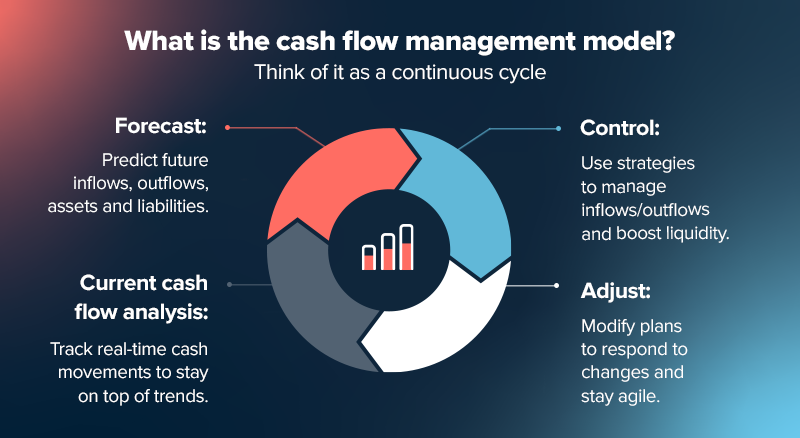

So, what is the cash flow management model? Think of it as a continuous cycle:

- Forecast: Predicting your future cash inflows, cash outflows, and other current assets or liabilities

- Current cash flow analysis: Keeping a close eye on your actual cash movements in real-time

- Control: Implementing strategies to manage your inflows and outflows effectively and improve liquidity

- Adjust: Making changes to your plans based on your monitoring and any unexpected fluctuations.

Why is Cash Flow Management Important?

There are several reasons cash flow management is important.

When done well, it creates a looking glass into your business’s short-term future: you’ll see where your money is coming from, where it’s going, and when those movements are happening. This will let you make more informed decisions about what you invest in and spend money on.

If you find that there are cash flow issues ahead, you can nip them in the bud before they develop into full-blown issues that may rock the boat, or even capsize it.

If you find that you’re in a strong financial position, then your business can gain confidence knowing that it has the financial stability to thrive.

The Common Pitfalls of Managing Your Cash Flow (and How to Avoid Them)

Like with everything related to your business, you likely approach your cash management with the best intentions, but it’s easy to stumble into problem areas.

Here are some of the most common mistakes businesses make with their cash flow, and how to steer clear of them. You can tick these off on our checklist as you go along:

1. Overreliance on personal funds

It’s easy to simply turn to your own money when you hit cash shortages, but this just blurs the lines between your personal and business finances and isn’t sustainable.

If you get to this point, focus on building healthy cash flow within the business instead of exploring appropriate financing solutions to get you through this hiccup.

2. Poor or no forecasting

Failing to look ahead is like sailing without a map. Without cash flow forecasting, you’re flying blind and won’t see potential storms brewing.

3. Ignoring late payments

Letting late payments slide might be tempting, especially if you like to maintain a customer-friendly image, but this is a surefire way to let money leak out of your business.

Knowing how to follow up on overdue accounts receivable in a firm but friendly manner is non-negotiable.

Managing your company’s cash flow effectively requires consistent effort and attention to detail. These pitfalls can derail your progress, but following sensible cash flow management techniques will help you avoid them.

7 Pro Tips to Improve Cash Flow Management – A Checklist

Ready to take control of your cash flow and build a more resilient business? Here’s a seven-point checklist that any SME in South Africa can follow.

1. Build and maintain cash reserves

Why it matters

Cash reserves are your business’s emergency fund that helps you absorb unexpected financial challenges like emergency repairs or even a temporary dip in sales.

Often, businesses leave themselves without this financial cushion, which leads to them crashing into debt.

What to do

Aim to have enough cash on hand to cover at least one to three months of your essential operating expenses.

Start small by setting aside a fixed percentage of each sale into a dedicated business bank account, then gradually increase this percentage as your cash flow improves and your business becomes more stable.

Tools or processes to consider

Regularly review your expenses and identify non-essential spending that can be redirected to your cash reserves. If you don’t have enough, then fast-access funding, like a revolving line of credit, is a possible temporary solution.

2. Find a great cash flow forecasting tool

Why it matters

Cash flow forecasting is like having a weather forecast for your business finances. It helps you spot shortfalls (negative cash flow) or swells in the amount of cash you have available so you can plan more accurately.

What to do

Use tools like spreadsheets or financial accounting software like Sage to create your own cash flow statement by documenting cash inflows and outflows and using their statistical features.

Tools or processes to consider

Regularly update your cash flow projections based on actual income and expenditures. For project-based businesses, understanding how to calculate cash flow in project management, like tracking income and expenses specific to each project timeline, is essential.

3. Invoice promptly and automate billing

Why it matters

In South Africa’s business environment, late payments can be a major headache that could turn catastrophic.

“For suppliers, a missed or delayed payment can mean difficulty in restocking inventory, covering operational expenses and payroll, or servicing debts,” says Cedric Bru, Chief Executive Officer of Taulia, an SAP company, writing for Forbes. “In extreme cases, and especially for small businesses, these can make it difficult for the supplier to keep operating.”

As such, it’s important to make it clear to customers that you’re running a business, not a charity.

Having clear customer payment policies and a system for managing cash flow from accounts receivable helps prevent bad debt and ensures timely payments.

The sooner you invoice, the sooner you get paid. You’ll improve your cash position and reduce the amount of working capital tied up.

What to do

The aim here is to streamline incoming business payments to reduce the possibility of delayed income. Here are three steps to take:

- Send out invoices immediately after delivering goods or services.

- Offer small early payment discounts to incentivise quicker payments.

- Clearly state your payment terms on all invoices.

Tools or processes to consider

Many invoicing tools now use automation to help this along, including sending out reminders for overdue invoices. Buy Now, Pay Later facilities like Lulapay even manage this burden for you, paying you instantly for invoices while offering the buyer up to six months to repay Lula, giving your cash flow a quick boost.

4. Negotiate better supplier terms

Why it matters

Just like you want to get paid quickly, extending your payment terms with suppliers (without damaging relationships) can help you improve your cash position.

What to do

Talk with suppliers, especially those you’ve worked with for a while and have a good relationship with, and try to extend payment deadlines by 30 or 60 days for accounts payable. A history of timely payments will mean you have built the goodwill that could help you achieve this.

Tools or processes to consider

A simple process to follow is to maintain open communication with your supplier, clearly explain your business needs, and explore offering larger or longer-term contracts in exchange for more favourable terms.

5. Control and cut unnecessary expenses

Why it matters

Every rand saved goes directly to your bottom line and improves your profitability and cash flow management. Once you eliminate unnecessary expenses from your operations, you’ll find that you quickly free up a sizeable amount of money.

What to do

Conduct regular audits of all your operating expenses. Look closely at areas like utilities (explore energy-saving measures), vehicle costs (optimise routes, consider fuel-efficient options), subscriptions (cancel unused software), and even stationery supplies.

Tools or processes to consider

Drawing up a strict budgeting process and regularly reviewing actual spending against this budget will let you build a cost-efficient culture within your organisation. Train your team to use it so that it becomes second nature and turns your business into a lean and efficient machine.

6. Optimise your inventory management

Why it matters

Holding onto too much inventory ties up working capital that you could put to better use, like investing in growth initiatives.

Worse, letting working capital pressure like this build up can hinder your business’s ability to meet its short-term commitments later on.

Efficient inventory management allows you to have what you need to meet demand without overstocking.

What to do

A just-in-time (JIT) inventory system allows you to order stock closer to when you need it. Use demand planning techniques based on past sales data to predict future needs and avoid overstocking slow-moving items.

Tools or processes to consider

Real-time inventory tracking software is an investment worth looking at. This lets you review your inventory levels regularly and consider sales or discounts for slow-moving stock.

7. Use SME funding and scenario planning

Why it matters

Sometimes, even with the best cash flow management, you might need a temporary boost to your working capital to seize an opportunity or navigate a tight spot.

Even when you don’t, it’s sensible business practice to have that source of finance available, just in case.

What to do

Many SMEs in South Africa are turning to flexible funding options that give them access to a reserve of cash should they need it. Lula’s Cash Flow Facility is a leading example that lets you draw down cash when exciting new opportunities arise that your current cash on hand can’t cover immediately.

You only pay interest on the funds you actually use, and as you repay, that credit becomes available again without the need to reapply. This means you get a continuous source of funds, which helps you handle cash flow management more effectively.

Tools or processes to consider

Develop scenario planning models to understand how different events (i.e. a large new contract or a potential economic downturn) could impact your future cash flow and work out how much capital you’d need to weather the storm.

Similarly, you can also look into how to calculate working capital to grow your business.

Both will help you prepare contingency plans for future funding.

Turn Cash Flow Management into Your Growth Engine with Lula

As a business owner, you’re not just looking to stay afloat; you’re aiming for serious growth.

At Lula, we want to power these ambitions. That’s why we’ve built funding solutions that slot right into your cash flow management strategy.

Looking to invest in new equipment to streamline your operations and boost your capacity? Our fast-access capital can help you do this.

Our Cash Flow Facility isn’t just a line of credit; it’s flexible funding that comes with a single transparent fee. You only pay for what you use and when you use it.

Applying for Lula’s Fixed-Term Funding is a seamless and fully digital process.

With access to flexible funding when you need it and a deep understanding of your cash flow, you’re not just managing your money – you’re using it to power your next growth phase.

Let Lula be the fuel in your engine.

Ready to unlock your next growth phase? Explore Lula’s funding options today and get the capital you need to take your business to new heights.