Ask the owner of any of South Africa’s 2.6 million small businesses (SMEs) what their main challenges are, and cash flow risk management is sure to be near the top of the list.

Yet, the unique set of challenges that SA’s small enterprises face also makes them some of the most resilient in the world.

Regular disruptions caused by load shedding, or strikes, force owners to think on their feet every day, adapting their cash flow strategies to survive in this demanding environment.

Such high economic volatility also makes managing cash flow risk extremely difficult.

If you’re an SA small business owner, you’ll have seen how your company’s risk planning is obstructed by various hurdles, including:

- Late payments from debtors also affected by economic disruption

- Limited access to funding that will help you prepare for financial challenges

- A lack of tools to help you track and control your cash, eating up valuable time and resources.

The silver lining for a small business in this situation is that there are proven steps you can take to reduce risk that don’t demand huge amounts of time and expense.

But before we get into these, we should first understand what cash flow management is, why it’s so crucial to businesses, and what key risk factors look like.

Don’t let cash flow worries hold back your business’s potential. Open a Lula account today and find out how our all-in-one financial management platform for SMEs can help you better manage your cash flow and access funding fast to fuel business growth.

What is cash flow risk management and why is it important?

The best way of viewing cash flow risk management is to see it as weaving a financial safety net for your business.

Cash flow is important in managing risk because it’s the financial backbone of any enterprise. When flowing smoothly, it steers the business through choppy economic waters and also allows it to seize growth opportunities when they appear.

Successful businesses excel at forecasting what will put cash flow at risk. They can identify these risk factors before they occur and use smart strategies to make sure they land in that safety net.

What are the risk factors of cash flow for SA businesses?

South African businesses must handle unique threats to their cash flow that other enterprises around the world don’t have to, as well as standard market risks present in any business cycle.

As mentioned, economic disruption is a chief threat. Load shedding also leads to production delays and increased operating costs as businesses switch to backup power supplies. Power outages combined with frequent transport strikes mean that businesses must also be prepared for severe supply chain disruptions on any given day.

Global market conditions also dictate financial mechanisms vital to a business’s livelihood, such as fluctuations in commodity prices and currency exchange rates. Both of these factors determine production costs and the expense of importing and exporting goods abroad.

The global credit gap caused by limited access to business funding is another cashflow issue keenly felt by SA businesses.

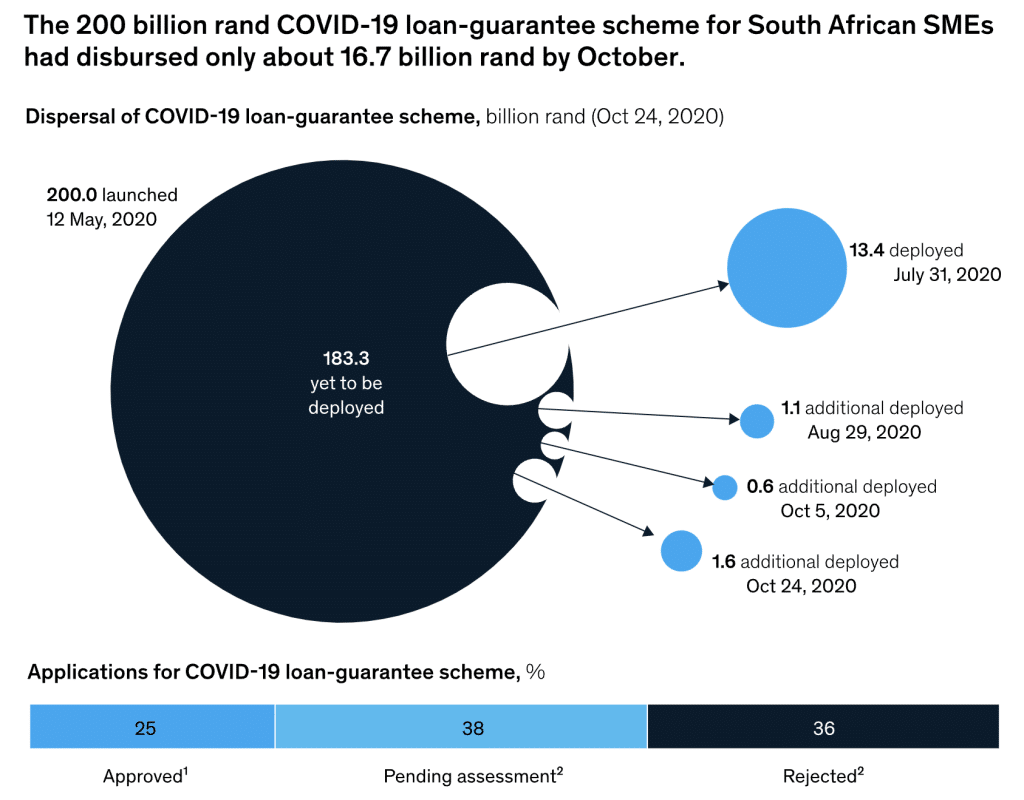

Less than 1% of the country’s SMEs had benefited from the country’s COVID relief fund within five months of lockdown according to McKinsey research, a slow roll-out that threatened the livelihoods of 60% of businesses.

The slow COVID relief roll-out in South Africa during the pandemic

Source: McKinsey

Many of those who did pull through continue to suffer from a lack of credit options that are vital in keeping business cash flows healthy. SMEs will still receive just 25% of total business loans in 2023, a situation that’s led to the rise of dangerous “too good to be true” quick loan options.

Trevor Gosling, co-founder and CEO of SME banking platform Lula, puts this down to a misguided focus on large businesses.

“Banks provide an impersonal service because they’re not so interested in the smaller, not so profitable accounts”, he says. “They build their business models around and channel their resources toward larger corporate accounts.”

Banks provide an impersonal service because they’re not so interested in the smaller, not-so-profitable accounts. They build their business models around and channel their resources toward larger corporate accounts.

Yet, despite these difficulties, there are certain practices South African business owners can take to safeguard their business’s liquidity risk – both short term and long term.

If you’re one of them, check out the next section for clear and precise information about how you can do this.

4 Best practices to reduce business cash flow risk

In today’s challenging economic climate, fortifying the financial resilience of South African SMEs requires a multi-faceted approach.

Here are four key strategies you can carry out to minimise your business’s financial risk.

1. Build and maintain robust cash reserves

Weathering stormy conditions demands a well-built shelter. In the financial world, a healthy cash reserve acts as this safeguard, protecting you against economic uncertainties, delayed customer payments, and unforeseen expenses.

Even in hard-up times, starting a reserve is possible. Starting small by putting aside a modest amount of revenue consistently will add up over time. Reviewing business expenses regularly, trimming unnecessary costs, and redirecting them toward a reserve is also a vital task.

Many modern banking solutions provide built-in expense management tools that make this process easier, as well as automated saving mechanisms that help build an emergency pot.

On top of that, you’ll also earn from the interest rate on whatever is sitting in your reserves.

2. Update customer payment policies

Late payments are one of the limiting factors to business growth. Over a quarter of South African SMEs are owed tens or even hundreds of thousands of rand, according to a 2022 survey by financial platform Xero. Over half of these are over two months late, while 34% cite a delay of over four months.

Late payments for South African SMEs

Companies can take a huge step toward reducing this cash flow risk by restructuring payment policies. These include setting out well-defined terms for payment, incentives for early settlements, and clear consequences for overdue accounts.

Digital payment platforms are an emerging way of improving payment collection by providing insights into likely problems with payable invoices such as defaults and bad debts. They also offer a wider range of payment methods that improve the chances of the customer paying on time.

3. Effective debt management and supplier negotiations

On the flip side of handling outstanding customer payments is debt management. Every business has some debt, but the most successful ones almost always have a manageable debt-to-equity ratio in place to keep repayments sustainable.

For existing debt, renegotiating supplier terms in the form of more favourable payment terms and extended deadlines is a proven way of bolstering cash flow. There are also often options to convert short-term debt into longer-term arrangements with many lenders.

When taking on new debt, revolving credit facilities are a more flexible option for South African businesses than most traditional finance methods. Quick, easy to use, and often without fixed monthly admin fees, they’re an excellent source of working capital for SMEs looking to grow or handle unexpected costs.

4. Embrace a new wave of cash flow management tools

Artificial intelligence (AI) has been in the news recently, including how it can help small businesses manage their operating cash flow and slash risk.

New cash flow management tools are using AI to pool vast amounts of data and create real-time metrics that provide invaluable insights into your business’s health.

With this information, you’re in a better position to make informed decisions to tackle cash flow challenges and drive growth. Imagine having at your fingertips the ability to:

- Access real-time cash flow statements that paint a vivid picture of where your business is financially

- Peer into a crystal ball and mitigate future cash flow disruptions via accurate forecasting

- Optimise spending by automatically eliminating unnecessary outgoings

- Automate digital invoicing and payment processes without the reams of paperwork that used to come with these tasks

These tools can also give you a huge advantage over your rivals. 70% of businesses still use outdated manual cash management systems (like spreadsheets), according to Forbes research.

Introducing such a digital tool puts you among the exalted few who use the latest technology to minimise the risk of negative cash flow and position your business for sustained growth.

How Lula’s banking and funding can help put your business on track to long-term growth

Reducing cash flow risk is a vital task for any South African business, but B2B banking services tend to be weighted in favour of large enterprises leaving SMEs with impersonal and ill-fitted solutions.

Lula is an all-in-one cash flow risk management platform that is on a mission to level the playing field for small businesses seeking to mitigate cash flow threats.

“Lula isn’t just a banking platform. We’re a financial partner,” says co-founder and CEO Trevor Gosling. “We believe in the power of SMEs as the engine of the South African economy. Our new services are tailored to support these businesses in a way that traditional banking has not.”

Within minutes of signing up to Lula, your business gets access to SME-focused features like Payment Controls, which helps you better handle payments, and as a result, cash outflows in your business.

You can also take proactive steps to protect your liquidity through built-in automated invoicing, payment tracking, and credit risk assessments.

Lula provides you with the funding you need to oil the wheels of your business, which you can access via our Cash Flow Facility. This is your personal link to flexible funding that covers those unforeseen expenses and reduces the risk of cash shortages.

You only pay for what you use, with no monthly fees or paperwork hassles, and you can even apply for an increase when you need more funding.

In a South African economy where access to funding and cash flow risk management are paramount to SMEs, Lula stands ready.

Need to take your business to the next stage? Apply for funding today and take advantage of our platform’s cash flow management features and Cash Flow Facility.