As a small or medium-sized enterprise (SME) in South Africa it’s vital to have the right equipment. Whether it’s manufacturing machinery, office equipment, delivery vehicles, IT hardware, or medical equipment, you need to stay competitive and drive growth.

While there are equipment finance options out there that can help you make the purchase, you’ve probably asked this question: Should I purchase equipment or lease equipment instead?

“New equipment drives revenue and business growth,” says Thomas McKinnon, Chief Growth Officer at Lula.

However, acquiring equipment can strain finances and disrupt business operations, especially for businesses with limited capital. Your business faces a critical decision: Should you purchase equipment outright, lease it, or finance it through alternative funding solutions?

Each option impacts cash flow, tax obligations and long-term strategy differently. In South Africa’s improving economic climate, with reduced power cuts and growing business confidence, investing in equipment is increasingly viable.

Here we take a closer look at the pros and cons of leasing versus purchasing equipment, and explore South African tax incentives.

Why Equipment Matters for SMEs

Equipment is the backbone of many industries. In manufacturing, modern machinery boosts production efficiency; in retail, advanced point-of-sale systems enhance customer experiences; in construction, reliable equipment ensures project timelines are met.

For example, a catering business might need new assets in the form of new ovens to handle larger orders, while a tech firm may require upgraded servers to support growing data needs. Without the right equipment, your business risks inefficiencies, lost sales, or the inability to scale.

Although the high cost of equipment can be daunting, financing solutions allow you to acquire essential assets without depleting your business’s working capital, which is crucial for daily operations like payroll and inventory. “It’s crucial to plan for equipment replacements strategically to prevent costly downtime,” says McKinnon.

What is Equipment Finance?

Equipment finance refers to funding solutions that enable businesses to acquire essential equipment without depleting cash reserves. It’s a lifeline for SMEs that need business finance to upgrade or replace assets to maintain operations or seize growth opportunities.

There are different types of equipment finance available. It’s important to consider factors like repayment terms, ease of accessibility and other advantages like personal support that a lender can provide besides funding.

Types of Equipment Finance

• Equipment loans: These are traditional loans where businesses borrow funds to purchase equipment, often using the equipment as collateral. Terms typically range from two to five years.

• Equipment leases: Here, businesses pay to use equipment for a set lease period, with options to purchase, return or renew at the end. Leases are ideal for those seeking flexibility.

• Hire to purchase: This is an instalment plan where businesses pay a specified amount over a certain period and gain ownership over the equipment once payments are complete.

• A Revolving Capital Facility: Lula offers a flexible line of credit up to R5 million with no early repayment penalties. Once approved you can receive funding within as little as 24 hours.

When it comes to asset finance, each type suits different needs, from ownership-focused small businesses to those prioritising cash flow management.

Purchasing vs Leasing Equipment

Your choice between purchasing and leasing equipment depends on factors like budget, operational needs, interest rates and your business’s tax strategy.

Below, we compare the two options based on various factors, including their tax implications in South Africa and how they meet business needs.

Purchasing Equipment

Purchasing means owning the equipment outright, ideal for assets with a longer time of use, like delivery trucks or industrial printers.

Pros

• Ownership: Your business has unrestricted use of the equipment and potential resale value.

• Tax benefits: South African businesses can claim wear and tear under section 11(e) of the Income Tax Act, depreciating assets over their useful life (e.g., three years for computers, four years for vehicles).

• Equity building: Ownership adds asset value to your balance sheet.

Cons

• High upfront cost: Large initial payments can strain cash flow, especially for SMEs.

• Depreciation risk: Equipment may lose value or become obsolete, with the business bearing the cost.

• Maintenance responsibility: All repair and maintenance costs fall to the owner.

Leasing Equipment

Leasing allows your business to use equipment without owning it, offering flexibility and lower upfront costs.

Pros

• Lower upfront costs: Minimal or no deposit preserves working capital.

• Flexibility: Leases often allow upgrades to newer equipment at the end of the term, keeping your business competitive.

• Tax deductions: Lease payments are fully deductible in the year paid under section 11(a) of the Income Tax Act, providing immediate tax relief.

Cons

• No ownership: Unless you exercise a purchase option, your business doesn’t build equity.

• Higher long-term costs: Leasing can be more expensive over time compared to purchasing, since there will be ongoing monthly payments.

• Restrictions: Leases may include usage limits or early termination penalties.

South African Tax Incentives

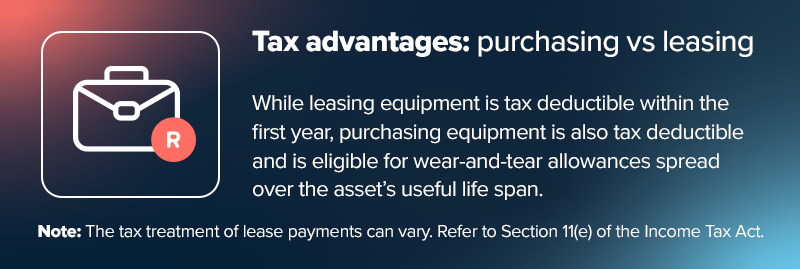

Understanding tax implications is key to making an informed decision:

• Purchasing: Wear-and-tear allowances are spread over the asset’s useful life (e.g., three to 10 years)

• Leasing: Lease payments are fully tax deductible in the year paid, offering immediate tax relief

For example, purchasing a R500,000 machine with a five-year write-off period allows for a R100,000 annual deduction. Leasing the same machine at R10,000 monthly yields R120,000 in deductions yearly, offering faster relief but no asset ownership.

Specific incentives, like accelerated depreciation (50%/30%/20% over three years) for renewable energy equipment, may also apply.

Note: Consult a tax professional to get the most out of tax incentives.

Options for Financing Equipment in South Africa

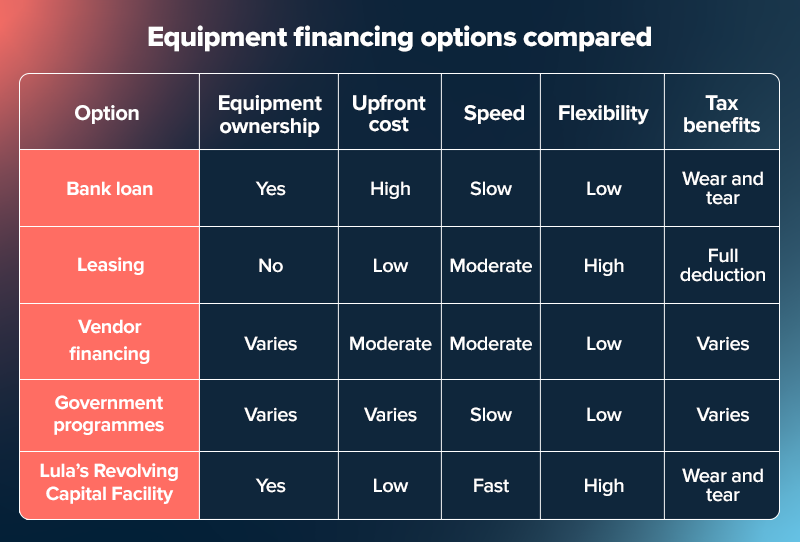

South African SMEs have multiple financing options, each with distinct features:

• Traditional bank loans: Offer high funding limits but require collateral and lengthy approval processes, which can delay projects.

• Equipment leasing companies: A rental company may provide flexible lease terms but may involve higher long-term costs and restrictions.

• Vendor financing: Some suppliers offer direct financing, though options may be limited to their products.

• Lula’s alternative funding solutions: Lula’s Revolving Capital Facility and Capital Advance stand out for their speed, flexibility and accessibility.

Read our guide on how to finance heavy equipment in South Africa.

Lula’s Revolving Capital Facility

Lula’s Revolving Capital Facility is a line of capital that gives you access to up to R5 million that you can draw upon whenever you need to. The application process is paperless, and can be completed online within minutes.

Advantages of accessing financing with alternative funding provider, Lula:

• Up to R5 million: Funds for various equipment needs

• 24-hour funding: Approvals and disbursements within as little as a day

• No collateral: Unsecured, using real-time banking data for credit assessments

• Transparent fees: There are no hidden fees and no early repayment penalties

“With Lula’s financing, businesses can access funds quickly and flexibly, allowing them to seize opportunities without delay,” says McKinnon.

Choosing the Right Financing Option

Evaluate your business’s needs before choosing the best equipment finance option:

• Cash flow: If preserving cash is key, leasing or accessing funding through Lula’s Revolving Capital Facility minimises upfront costs.

• Equipment lifespan: For rapidly depreciating equipment (e.g., IT hardware), leasing supports upgrades. Long-life assets (e.g., vehicles) suit purchasing rather than leasing.

• Tax strategy: Leasing offers tax incentives within the first year; Purchasing equipment spreads benefits over time.

• Flexibility: Need frequent upgrades? Leasing or accessing funding through Lula’s Capital Facility offers adaptability.

• Total cost: Calculate long-term costs, including maintenance and insurance, to compare options.

For example, a tech SME needing servers might lease to stay current with the latest technology, while a logistics firm may purchase trucks for long-term use. Lula’s facility suits both, offering flexibility and speed.

Common Equipment Financing Mistakes to Avoid

Avoid these pitfalls when financing equipment:

• Not comparing options: Failing to explore rates and terms can increase costs.

• Overlooking total costs: Include maintenance, insurance and operational expenses in calculations.

• Ignoring contract terms: Read the operating lease or loan agreements to avoid hidden fees or penalties.

• Neglecting credit impact: Financing affects credit scores and future borrowing capacity.

Being proactive ensures cost efficiency aligns with your goals.

To maximise the return on your equipment investment, consider these tips:

- Preventative maintenance: Implement a schedule for regular maintenance to keep your equipment in optimal condition, preventing breakdowns and extending its lifespan.

- Technology integration: Use technology like Internet of Things (IoT) sensors and software to monitor equipment performance, predict maintenance needs, and enhance overall efficiency.

- Training and safety: Ensure that your staff is thoroughly trained on how to operate the equipment safely and correctly. This will minimise the risk of accidents and damage.

- Energy efficiency: Adopt strategies to improve equipment energy efficiency, which can lead to lower operating costs and a reduced environmental impact.

- Upgrade strategies: Plan for future equipment upgrades or replacements to maintain productivity and stay competitive in the market.

Your Final Decision: To Purchase or to Lease?

As a South African SME, the decision to lease or finance equipment is an important one. Purchasing equipment offers ownership and long-term tax benefits but requires substantial capital.

Leasing provides flexibility and immediate tax relief but may cost more over time. Lula’s Revolving Capital Facility combines speed, flexibility and transparency, ideal for established SMEs looking to grow.

When considering your options, evaluate your cash flow, equipment needs and tax strategy before deciding. Consulting financial or tax advisers ensures the best choice.

With Lula, your business can access up to R5 million in funding within 24 hours, empowering you to acquire equipment and drive success. Explore Lula’s funding solutions or visit our SME Hub for more insights.