Are you struggling to keep your cash flow in check? Well, you’re not alone. As fellow entrepreneurs, we understand the challenges of managing your finances and keeping the money flowing in and out of your business.

After all, poor cash flow management is one of the main reasons many small businesses struggle or even fail.

Did you know that five out of seven small businesses that start in South Africa do not make it past the first year?

We’ve gathered some tips and strategies to help you master your small business’s finances. Through this practical guide, you’ll gain a deeper understanding of cash flow management and how to leverage digital tools in the process.

It is important to pay close attention to cash coming in and going out of a business. If your business’s finances are mismanaged they can become a serious struggle to cover costs like wages, inventory and rent. Exploring different ways to improve your cash flow management can be beneficial for your business ensuring you don’t become another statistic.

Are you ready to take control of your finances?

Understanding Cash Flow

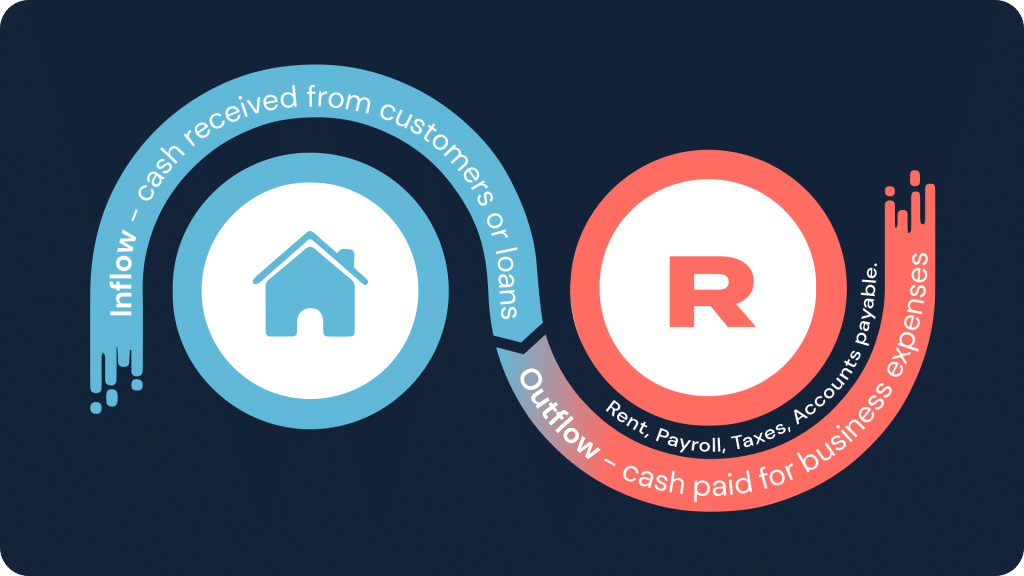

Cash flow is the lifeblood of any business. It includes both inflows (money coming into the business) and outflows (money going out). Projecting this process can help SMEs anticipate financial needs and plan for growth.

Sales bring in the cash, but bills, salaries and equipment or stock purchases for your shop make it flow out.

Effectively managing this ebb and flow is vital. Spotting where each cent goes will give you more control of how your finances are being used and whether they are being managed effectively. For a more in-depth look at cash flow management, your business can benefit from our comprehensive cash flow management kit.

Cash Flow Projection

Understanding the importance of forecasting and how to create accurate projections is crucial for small businesses. By gaining insight into future cash forecasts, your business can make informed decisions and prepare for any potential financial challenges.

The Impact of Currency Fluctuations on Cash Flow

Predicting cash inflows can become difficult when the value of our currency fluctuates. When our currency strengthens, the cost of importing goods goes up. When our currency weakens, the cost of goods decreases.

Keeping an eye out on the exchange rate and staying abreast of current political affairs can greatly improve your ability to make accurate projections.

Regulatory Environment

Government regulations and labour costs in South Africa have an impact on the growth of SMEs. In South Africa, regulatory policies aim to ease cash flow constraints for small businesses through timely payments and invoice factoring.

Cash Flow Management Strategies

To keep a healthy cash flow, following efficient invoicing and receivables practices is essential. It can speed up payment processing and reduce outstanding payments, ensuring the timely collection of dues, and improving overall cash flow for your business.

Identifying and controlling expenses enables you to allocate resources wisely, thereby boosting your financial stability and contributing significantly towards the success of your small business.

Effective strategies include efficient invoicing and receivables practices, expense management, and budgeting for variable and fixed costs.

Digital Cash Flow Management Tools

Digital cash flow management tools can ensure the smooth operation of your business. With a variety of digital solutions and popular cash flow management apps offered by Absa and FNB, businesses can choose the right tool to streamline their cash flow.

Popular Digital Cash Flow Management Tools

Digital cash flow management tools offer real-time financial information and streamline payment processes, helping to manage past, current and future cash flow. Here are a few helpful tools to get you started:

- Accounting software: QuickBooks, Xero and FreshBooks are all digital accounting tools providing automation for financial transactions, aiding efficient cash flow management.

- A cash flow management tool: Lulaflow is a powerful digital cash flow management tool within Lula’s banking platform providing tailored insights on your business income, expenditure, and cashflow forecasts. The tool allows you to sync all your accounts, giving you a 360° view of your entire cash flow.

Exploring Alternative Funding Options

Exploring various funding options to help manage your cash flow effectively can have a marked effect on your business. It is common for SMEs and entrepreneurs to opt for loans from banks, but it’s crucial to consider alternative funding options.

Loans and business funding tailored for small businesses can be a smart way to fuel business growth while ensuring financial stability when managed responsibly.

Alternative Financing for SMEs

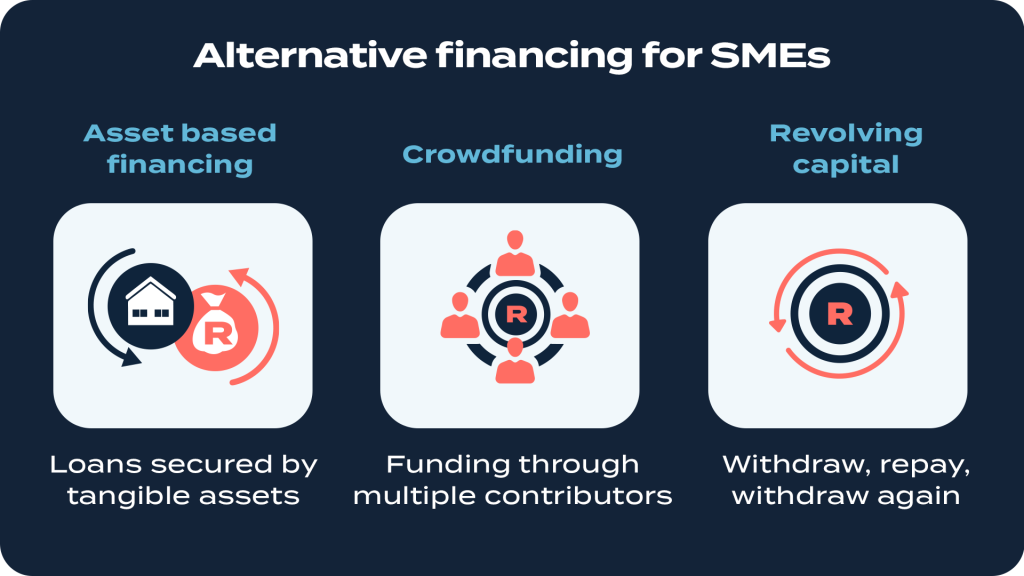

Unlike traditional bank loans, alternative financing methods can provide immediate access to much-needed funding to help you navigate the ebbs and flows of the cash flow cycle. They can also support operational expenses and investment in growth. A few options to consider are:

- Asset-based financing: This type of financing is beneficial for small businesses seeking improved liquidity and support for expansion.

- Crowdfunding: This is a viable financing option for start-ups with effective cash flow management needs.

- Revolving Capital: Common forms of revolving lines of credit include credit, credit cards and certain types of business loans. Lula offers a Revolving Capital Facility which offers a flexible line of funding in case of unexpected expenses or opportunities you can’t afford to miss. A Revolving Capital Facility allows you to withdraw capital whenever you need it without having to reapply (subject to an ongoing credit and affordability assessment). Similar to a revolving line of credit, it is often used for managing cash flow fluctuations, funding inventory purchases, covering unexpected expenses, or taking advantage of investment opportunities.

Managing Debt Effectively

Another crucial aspect that can contribute towards the success or failure of your business is debt management. It is vital to know how to manage debt effectively when considering alternative funding solutions.

Through the strategic and careful handling of debt, you can enhance your business’s financial stability.

Renegotiating payment terms with creditors is another way to boost cash flow. Implementing consistent and sustainable approaches for raising funding is crucial in managing debt efficiently, and aligns with the goal of ensuring steady cash flow management for your business.

Ensuring the effective and efficient management of cash flow is crucial to maintaining a successful business and ensuring its long-term sustainability.

Embracing key strategies, principles and exploring a cash flow management tool like Lulaflow developed with your business in mind can empower you to master your finances.