For business owners, knowing how to calculate working capital is like checking their business’s blood pressure.

Healthy working capital helps to circulate funds around a business in order to perform its day-to-day operations. If this cash flow level is too low, then it may cause ‘business fatigue’ where it doesn’t have enough cash to meet its current demands. If working capital levels are too high then the business isn’t using its short-term assets well enough.

If you run a business, you may not be completely sure how to calculate working capital as you may not know the formula or the items to include in it.

This means you may struggle to make important decisions about your business’s financial health or how to secure the right funding.

In this guide, we’ll cover a foolproof method for calculating working capital. We’ll also explore the net working capital formula and ratio. Finally, we’ll provide you with a relevant example of a business in South Africa to help paint a clear picture of how important working capital is.

Explore more about:

• How to Calculate Working Capital: A Quick Guide

• What is a Working Capital Example?

• What Is the Formula for Calculating the Working Capital Ratio?

• How do I Calculate Working Capital to Determine the Funding I Need?

Working capital is the lifeblood of any business. Explore Lula’s alternative funding solutions today and get the capital you need to keep your business running smoothly.

How to Calculate Working Capital: A Quick Guide

Figuring out how much working capital you have is an essential task that you’ll have to do regularly as part of your business’s financial planning process.

There are several benefits to this. First, knowing that your company’s liquidity is healthy will give you the confidence to invest in growth opportunities. It will also let you prepare for fluctuations in the market and other economic changes.

“Better working capital management serves as a buffer against market volatility and supply chain disruptions,” says Steve Smith, US COO at software company Esker, in a recent Forbes article. “This provides a much-needed cushion in times of uncertainty.”

The good news is that the working capital calculation is very simple. Most businesses follow this simple formula:

Working Capital = Current Assets – Current Liabilities

So, let’s say you have current assets of R300,000 and current liabilities of R100,000. Your company’s working capital would be R200,000.

The tricky part is knowing which expenses go into each section. Does a long-term deposit count as a current asset, for example? How about the remaining balance on a commercial bond?

To make sure you arrive at the right figure, you must first take complete and accurate stock of your company’s current assets and liabilities.

Here are two checklists to help you make sure you don’t miss anything and that you arrive at the right figures.

Current assets

Current assets are the resources your business owns that can easily be converted to cash within a year. We can also refer to them as liquid assets.

They help you to fund your operations and meet short-term obligations and may include:

- Cash and cash equivalents: This includes cash on hand, money in savings and current bank accounts, short-term investments like money market funds and any readily convertible assets like treasury bills.

- Accounts receivable: These are outstanding invoices owed to your business by customers for goods or services already delivered or rendered.

- Inventory: Raw materials, work-in-progress goods, and finished goods ready for sale fall into this category. The value of inventory can vary depending on your inventory management practices and inventory turnover rate.

- Prepaid expenses: Expenses paid in advance, such as insurance premiums, rent or subscriptions. These are for future benefits that have already been paid for.

- Short-term investments: Investments that can be readily converted to cash and expected to mature within a year. Think of certain marketable securities or something similar.

Note: It’s important to distinguish between short-term and long-term investments, such as a long-term deposit or commercial bond, which would not be included in current assets. The key factor is the time horizon – if it’s expected to be converted to cash within a year, it’s a current asset.

Current liabilities

Current liabilities are your company’s short-term financial obligations – the debts and payables that you need to settle within the next year.

These obligations represent a claim on your company’s assets and provide the counterweight to your working capital calculation.

- Accounts payable: Short-term obligations owed to suppliers for goods or services purchased on credit. The payment terms for these impact your amount of working capital as they’re effectively a short-term, interest-free loan. The shorter the terms, the tighter your capital will be.

- Short-term debt: Loans or credit lines with repayment due within a year, including short-term loans from financial institutions.

- Accrued expenses: Expenses incurred but not yet paid, such as salaries, wages and income taxes. If you run a small or medium-sized business, clarifying these costs now will help you prepare for small business tax at the end of the financial year.

- Current portion of long-term debt: The portion of long-term debt due within the next year, plus interest and fees.

- Deferred revenue: Payments received in advance for goods or services that will be delivered or rendered in the future.

As you can see, short-term debt makes up a major share of your company’s current liabilities. Managing debt carefully is a smart way to keep your working capital free to not just cover other costs but also invest in other areas.

If you let it spiral out of control, you risk having negative working capital.

What is a Working Capital Example?

Picture an established furniture manufacturer in Johannesburg. They craft beautiful bespoke pieces, from sleek dining tables to plush sofas.

To keep the production line moving and fulfill customer orders, they require a steady supply of raw materials – wood, fabric, hardware – and the funds to pay their skilled craftspeople, cover rent and manage other operating expenses.

This is where working capital becomes this manufacturer’s financial backbone, allowing them to purchase timber, pay their employees and cover day-to-day costs.

This manufacturer’s working capital is calculated by subtracting their current liabilities (such as outstanding payments to suppliers) from their total current assets, including cash on hand, payments expected from customers (accounts receivable) and the value of their inventory of raw materials and finished goods.

A healthy positive working capital balance indicates that the manufacturer has enough resources to meet their short-term obligations. It keeps production running smoothly and orders flowing.

Yet, if their working capital dips into the negative, this will affect the company’s ability to pay suppliers, meet payroll or fulfil orders. Any or all of these can be enough to halt furniture production.

Effective working capital management is crucial for any manufacturing business because it enables them to keep up operational efficiency, invest in new designs and equipment, and adapt to the demands of the market.

What is the Formula for Calculating the Working Capital Ratio?

Knowing how much working capital you have is useful, but it doesn’t tell the whole story.

The furniture supplier above may have a large amount of money tied up in slow-moving sofas and tables, for example, and struggle to meet immediate payment obligations if they can’t sell them.

To get a complete picture of your business’s financial health, you need to understand how your working capital compares to your short-term obligations.

This is where the working capital ratio comes in.

Also known as the current ratio, this is a key metric used to assess your company’s short-term liquidity.

The formula for calculating the working capital ratio is also straightforward:

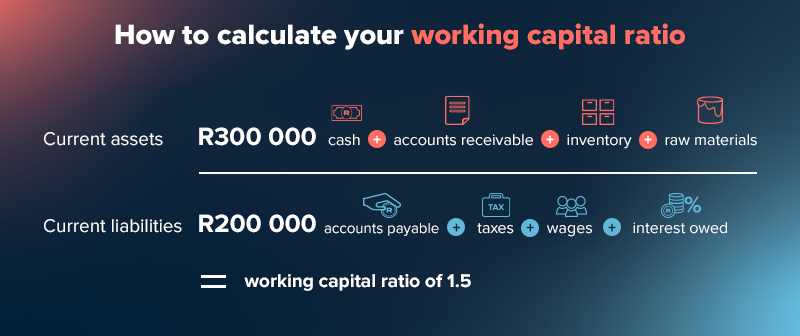

Working Capital Ratio = Current Assets / Current Liabilities

A ratio greater than 1 shows that you have more than enough current assets to cover current or short-term liabilities, and suggests a healthy financial position and enough liquidity to cover your short-term obligations.

A ratio below 1 suggests that you may struggle to meet your short-term obligations, potentially leading to cash flow problems and financial difficulties.

To use the example in our first working capital calculation, we can do the following:

Working capital ratio = R300,000/R200,000 = 1.5

The optimal ratio is generally thought to be between 1.5 and 2. However, stray too far above this and you may find your assets are not being used efficiently.

A very high ratio could indicate excessive inventory, idle cash, or underused assets.

How do I Calculate Working Capital to Determine the Funding I Need?

Your working capital calculation (Current Assets – Current Liabilities) is a snapshot of your company’s short-term financial health. The working capital ratio (Current Assets ÷ Current Liabilities) helps you understand how efficiently you’re using your resources to cover short-term obligations.

However, while both metrics are useful, they don’t tell you the full story –especially when it comes to determining how much funding your business actually needs.

To dig deeper, you need to consider how your net working capital (NWC) impacts your liquidity and capacity to grow. This measure helps you assess whether your business can meet short-term obligations without relying too heavily on external financing.

Net working capital is typically calculated as:

NWC = Current assets – Current liabilities

However, in some cases, it’s helpful to adjust this formula to get a clearer view of your operational working capital – especially when a large portion of your current liabilities consists of short-term debt (like a loan or line of credit). In this case, the formula might look like this:

Adjusted NWC = Current assets – (Current liabilities – Short-term debt)

By subtracting short-term debt from your liabilities, you isolate the capital that’s genuinely supporting day-to-day operations – rather than being temporarily propped up by borrowing.

Example:

Let’s revisit the example business we used earlier, but now their current liabilities have grown to R280,000.

This means:

Working Capital = R300,000 – R280,000 = R20,000

Of the current liabilities, only R40,000 is short-term debt. Now, let’s apply the adjusted net working capital formula:

Adjusted NWC = R300,000 – (R280,000 – R40,000) = R300,000 – R240,000 = R60,000

Although the adjusted net working capital of R60,000 might seem healthier, the fact remains that the basic working capital is only R20,000. This thin cushion leaves the business vulnerable to even minor disruptions or unexpected expenses.

This business would likely benefit from extra working capital finance, especially seeing as its short-term debt is relatively low. Either that or they need to figure out how to reduce overhead costs that drag working capital down.

Increasing liquidity with more stable or longer-term funding could provide a necessary buffer to keep operations running smoothly and support growth.

For a quick view of these important formulas, we’ve created this working capital cheat sheet for you to access whenever you need it.

Get Working Capital Funding the Right Way with Lula

Working capital is, by definition, liquid finance that helps you quickly cover business expenses, but if you’ve ever applied for working capital finance, then you’ve probably felt that the process is anything but quick and accessible.

Lula wants to change that. We’re a flexible financing platform that believes business funding in South Africa should be within reach of every SME.

We provide quick access to business funding on condition that you meet our criteria. You should have one year’s transactional history, a healthy credit score, and a minimum turnover of R500,000 per annum.

We believe working capital finance should be liquid, so we don’t bog down the process with mountains of financial statements, and we aim to pay out funding within as little as 24 hours of approval.

Our approach is designed to help you grow, giving you the capital you need to seize opportunities in our country’s competitive market.

If you want to elevate your cash flow to foster growth, partner with a team that’s truly committed to your success.

Don’t let a lack of working capital hold your business back. Find out how Lula’s alternative funding solutions can give you the capital boost you need to stay competitive.