What are the Benefits of a Revolving Loan Facility?

A revolving loan facility stands out from many business lending models because of several unique benefits it can offer to customers.

1. Flexible funding

As a borrower, you get to gain control over your available funds. You can draw exactly what you need, when you need it, and repay at your own pace, allowing the funds to replenish for future use. This is excellent if you have to deal with unpredictable cash flow, like many businesses do.

2. Cost-effective use

You only pay for the loan amount you actually draw from the line of credit, not the entire available credit limit.

Borrowers find that this is a much more cost-efficient short-term solution compared to other loan facility options, which come with a fixed fee and are subject to interest rates.

3. Ready access to capital

Once established, accessing funds is swift. There’s usually no need for repeated applications every time you need capital, so you don’t need to wait around for funds to take advantage of business opportunities or deal with unexpected expenses.

4. Improved cash flow management

Having a financial safety net allows you to bridge gaps between invoices or manage seasonal fluctuations without disrupting cash flow. You can also plan better if you know that you have cash on hand when you need it.

“Small businesses that need to frequently fund short-term cash flow issues benefit greatly from this type of facility,” says Chantelle Honiball, Credit Manager at Lula. “Many must pay upfront for stock but offer customers 30- to 60-day payment terms, creating a cash flow mismatch. A facility bridges this gap – they can draw funds to cover inventory, then repay once customer payments come in, and repeat as needed.”

5. Funding for expansion

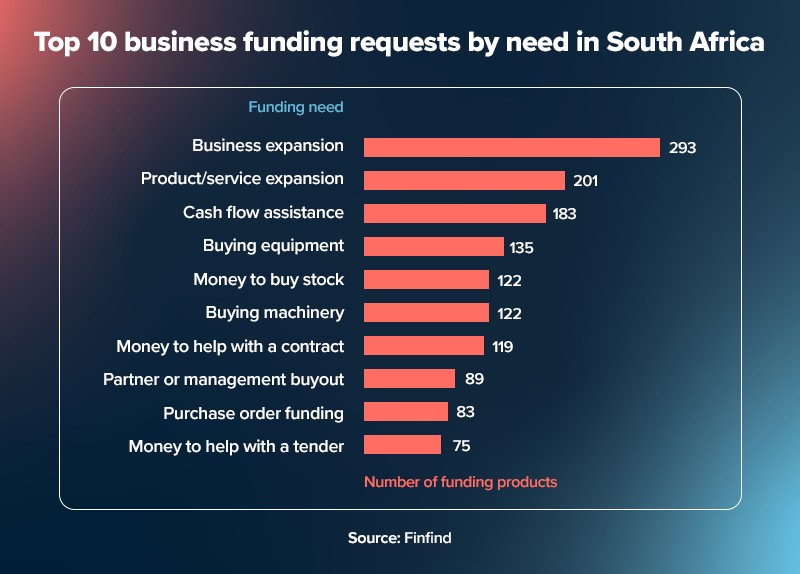

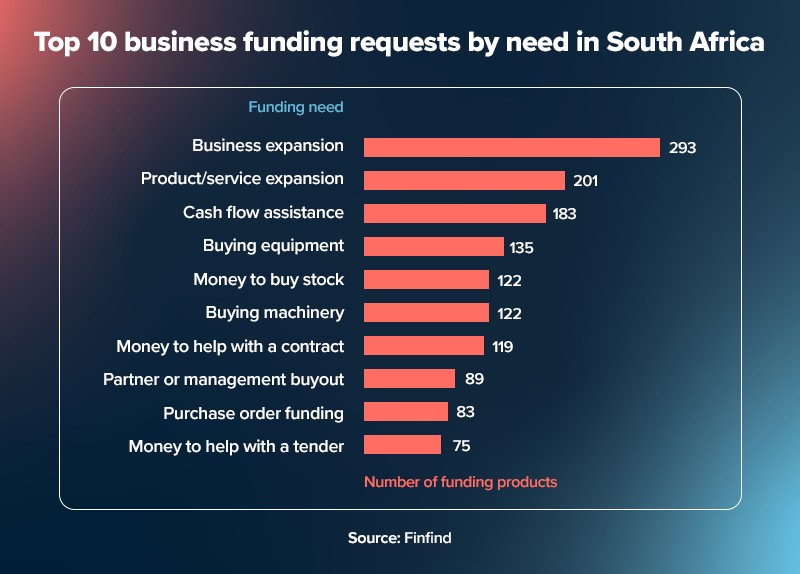

One of the biggest benefits of a revolving loan is how well it supports business expansion – the top funding need among South African SMEs, according to Finfind.

Unlike traditional term loans, a revolving loan gives businesses the flexibility to borrow, repay, and borrow again – without having to reapply each time.

This makes it ideal for growing companies that need to seize new opportunities as they arise – whether that’s opening a second location, expanding operations, or scaling a service offering.