Need small business funding?

Keep the cash flowing with Lula’s Cash Flow Facility.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Securing small business funding in South Africa is no walk in the park.

You've got a million things on your plate, and getting the money you need to grow shouldn't be another headache. But let's face it:

Traditional banks are slow and have paperwork and approval processes that derail your momentum.

Limited funding options mean you might not get the financial support you need.

Hidden fees and complex terms can make lending a nightmare.

Access to finance is pivotal for entrepreneurs trying to start up, run and grow their start-ups, but there’s still a wide small business funding gap in the South African lending market.

With small business start-up funding in South Africa in such high demand, a surge in alternative lending is happening across the country.

Fast, flexible and secure, it promises to transform the SME lending market. Yet, you may be wondering what these fund sources are and how they compare to traditional lenders like banks.

Continue reading this guide to small business funding in South Africa to find out the answers.

What is small business funding?

Small business funding is any financial support that a small company acquires from a third party.

Business loans, overdrafts, credit lines, angel investors and even crowdfunding all fall into this category and often form the backbone of a business plan over the medium to long term.

Does my business qualify for SME funding?

Qualifying criteria for SME funding vary depending on the lender, but some general benchmarks are common across many providers.

Business registration and legal status

Your business must be officially registered in South Africa with the Companies and Intellectual Property Commission (CIPC).

Trading history

Most lenders require a minimum trading history, often ranging from six months to two years.

Financial performance

You'll likely need to provide financial statements for a short period that show signs of healthy spending and good credit.

Growth potential

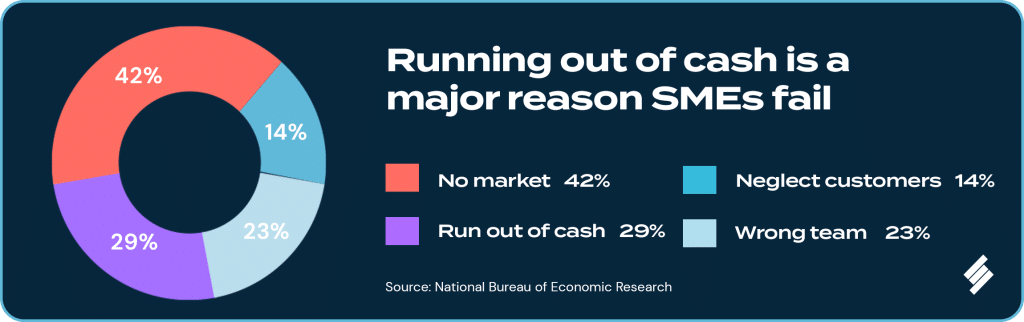

A solid business plan outlining future growth and profitability is often, but not always, required. Tough qualifying criteria for funding is a major reason SMEs fail, as 70-80% of SA small enterprises do, according to recent data from SEDA, South Africa’s Small Enterprise Development Agency.

Do banks provide small business funding in South Africa?

Banks and other traditional lenders are still an important part of the South African lending sector, but their influence is waning.

Tough eligibility criteria have led to a reduction in entrepreneurship lending opening up a small business funding gap in the South African lending market.

While medium-sized businesses enjoy an 85% acceptance rate from financial institutions, it drops to as little as 26% for small and micro enterprises, according to the Aspen Network of Development Entrepreneurs.

The good news is that, while traditional lenders are lagging behind in meeting these demands, an influx of alternative small business funding is coming to the fore right now.

Fast, flexible and free of the constraints of old, they’re changing the way SA business owners secure the capital they need to thrive.

Does the South African government fund small businesses?

The answer to this question is ‘yes’: it is possible to get government funding for a small business start-up in South Africa. In fact, it’s a key source of business support for SMEs, particularly since the pandemic.

The Small Enterprise Finance Agency (SEFA) is the best-known initiative, providing a selection of small business loans and support for the country’s start-ups. It aims to stimulate economic growth via small business development.

Who qualifies for SEFA support? Well, any SME that needs guidance through the difficult early stages of the business cycle, and that can show a strong growth plan.

The National Empowerment Fund (NEF), too, targets businesses, and focuses on providing financial support for minority-owned enterprises and co-operatives.

SEDA, as mentioned above, and Finfind are examples of other initiatives set up to manage small business funding in South Africa, but specialise in non-financial support (like mentoring) and networking respectively.

Are there companies that fund small businesses in South Africa?

Government small business funding in South Africa is important, but financial assistance from companies is also growing.

Investment companies look for promising start-up businesses to put money into with an eye on making a return over several years.

Here’s a summary of a few of them.

Venture capital firms

For businesses with high-growth potential, venture capital (VC) firms can be a game-changer.

These specialised investment firms offer funds in exchange for a stake (equity) in your company.

Carefully consider this option, as VC funding often comes with several incentives attached, including investor involvement in your strategic decision-making.

Business incubators

Imagine a supportive launchpad for your start-up. Business incubators provide exactly that.

These hubs offer a nurturing environment with mentorship, workspaces and sometimes even seed funding.

Incubators tend to focus on specific industries or stages of development, so it’s best to find one that fits your sector.

What are alternative ways to get small business funding?

There are more ways to obtain business funding now than, say, 15 years ago, thanks to tech advances and internet connectivity. Unlike the typically high-interest rates you’d find with this type of finance, Lula offers bridging finance that’s unsecured, more affordable, and easily accessible.

P2P business loans

Peer-to-peer (P2P) lending has become big in the world of personal finance, but several platforms offer business funding, too. P2P platforms work by connecting borrowers to lenders willing to put up funds online. Costs tend to be lower than traditional loans, as they connect the borrower directly to the funder, so fewer fees are involved.

Crowdfunding

In the digital age, crowdfunding platforms have democratised access to capital. These platforms allow you to present your business idea to a vast online audience, raising funds from anyone who believes in your plan. Crowdfunding is a great option for businesses with strong customer connections and innovative ideas that resonate with the public.

Revolving capital platforms

Managing cash flow is a constant challenge for SMEs. A revolving credit platform seeks to address this by providing round-the-clock access to funding. Unlike traditional finance like fixed-term loans, this type of lending is a lot more like a credit card in that you can keep drawing down funds (and repaying them) without having to reapply. Having a ready-made funds pipeline makes it easier to cover operational expenses, inventory purchases, or simply to cover unexpected costs.

How can I access small business funding quickly in South Africa?

South Africa’s small and medium-sized enterprises (SMEs) shouldn’t have to wait around worrying about whether they can get the funds they need. A new wave of digital finance means the days of lengthy bank applications are disappearing. Digital lending platforms have revolutionised the way SMEs can access funding, offering faster finance options. Here’s how to get funding for a small business in South Africa quickly.

Fast applications

Ditch the paper chase! Reputable digital lenders offer user-friendly online application forms that can be completed in minutes. Just provide the necessary information about your business needs.

Faster processing

Digital lenders use advanced technologies to streamline the application process so that you can get a decision much quicker, often within 24 hours.

Alternative data sources

Don't have a lengthy track record or a perfect credit history? No problem! Many digital lenders consider alternative data points beyond traditional bank statements. This may include your business invoices, Point-of-Sale (POS) data, or even your online business presence.

Transparent terms

Reputable digital lenders provide clear, upfront information about their interest rates, fees and repayment structures.

Get your small business funded with Lula’s Cash Flow Facility

You may be wondering where you can find a digital platform that ticks all the boxes of quick, flexible funding with high approval rates and transparent terms.

Lula is a South African SME funding provider dedicated to providing this exact service.

We specialise in providing fast and convenient working capital to small businesses that help them break growth barriers, not the bank.

Our Cash Flow Facility is a perfect example of flexible small business funding. Once approved, you can borrow and repay the funds time and time again: there’s no need to reapply.

You also don’t need to worry about fluctuating fees and early repayment penalties: our terms clearly spell out the fixed repayment plan you’ll follow.

How to apply for small business funding in South Africa: The Lula Way

Ever ditched an application form halfway through because it took so much time? You’re not alone.

Traditional SME lending requirements are tough and time-consuming.

When applying at a traditional bank, SMEs need to have a strong credit history, evidence of stable cash flow, a viable business plan, collateral (such as property or assets) and sometimes a personal guarantee from the business owner(s).

Lula, in contrast, makes this important first step easy. “We offer access to funds quickly and efficiently, with personalised support throughout the borrowing process.”

-

Go to Lula’s digital application form

Apply in minutes by filling out a few simple details.

-

Get approved

Approval for up to R5 million in funding within just 24 hours.

-

Get a personalised repayment plan

Transparent costs that won’t change, no matter how much you borrow.

Why us?

Easy application.

Apply in minutes and get funding in hours. No paperwork, no hidden costs, no branch visits.

We say ‘yes’ more.

We use tech to make decisions based on the real-time performance of your business.

Pay on your terms.

Repay as soon as you like and save. No early repayment fees, ever!

Trusted by SMEs.

We’re experts in what we do and provide the highest level of security.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.