Want to Minimise Trade Credit Risk and Bridge Cash Flow Gaps?

Keep trade credit flowing with Lula's funding solutions.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Trade Credit Financing Offers a Competitive Advantage

Offering trade credit to customers is key to staying competitive, yet 74% of South African small and medium enterprises (SMEs) think that offering trade credit is a problem. Not having the right capital reserves when providing or accepting trade credit puts your business at risk of:

- Extended cash flow gaps because incoming and outgoing payments misalign.

- Damaged business relationships because of delayed payments.

- Hampered business growth due to tied-up capital.

- Limited access to capital, as banks view outstanding trade credit as a liability if you owe a supplier.

All these issues are obstacles that can prevent your business from reaching its full potential. There are alternative financing options that help you bridge liquidity gaps so that you can continue to leverage extended payment terms without sacrificing your financial health or growth.

Read on to find out how trade credit works, how it affects your business and cash flow – plus how Lula’s Cash Flow Facility and Lulapay solutions ease the potential cash flow strain for B2B customers and suppliers.

What is trade credit?

Trade credit is a business-to-business (B2B) agreement in which one business can purchase goods from another while paying at a later date set out in the payment terms.

Trade credit financing of stock purchases helps businesses increase sales, maintain customer relations and win new contracts.

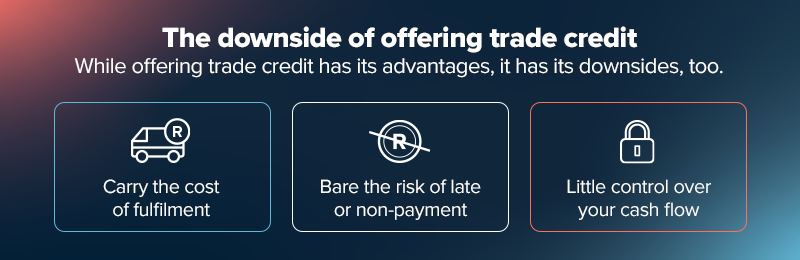

Trade credit in South Africa is usually offered with 30-, 60- or even 90-day payment terms. Yet if your business is the provider, offering or accepting these terms can come with a downside that mean:

• You carry the cost of fulfilment

• You bear the risk of late or non-payment

• You have little control over your cash flow

The good news is that having access to alternative business funding can mitigate the risk of non-payment and stabilise your cash flow, giving you better control over your daily operations.

How can you finance inventory sales?

Here are some options:

Short-term business loans

Businesses can secure external funding from alternative lenders like Fixed-Term Funding from Lula to manage cash flow gaps, whether supplying or offering trade credit.

Invoice financing

Lenders sometimes finance a portion of their accounts payable to unlock cash while waiting for payments.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later services have taken over B2C and are increasingly popular in B2B inventory sales. Lulapay is an example of BNPL for business.

Open lines of credit

Ongoing access to funds helps manage and stabilise cash flow when waiting for delayed payments.

Lula’s Cash Flow Facility*, for example, gives you ongoing access to funds that can be used whenever cash flow gaps appear in your trade credit cycle.

*Note that access to a Cash Flow Facility is subject to a credit assessment.

Trade credit challenges for South African SMEs

Leveraging trade credit can be challenging for businesses on both sides of the deal. Suppliers must shoulder both the cost and the risk of customers’ business credit, while customers risk overextending their finances.

“Offering trade credit can be quite daunting. We often see customers only starting to think about borrowing money when the money’s not coming in,” says McKinnon.

Managing large credit books

The majority of South African SMEs that offer payment terms have over 20 accounts to manage. Not only is risk management hard with such a complex balance sheet, but it can also easily drain limited reserves.

Having multiple accounts payable also complicates financial management for businesses buying inventory from different suppliers.

Payment cycles of 70 days

SMEs that offer trade credit carry the cost and risk of that sale for an average of over two months. That’s almost 20 days longer than corporates wait, but SMEs do not have the resources to cover this cost.

For customers, cash reserves can dry up while suppliers wait for payment. Trade credit interest and fees often rise the longer they delay settling accounts.

“Delayed payments are a cash flow killer and can massively affect your business. Maybe you’ve agreed to 30 or 60 day terms, but in reality, debtor’s days can vary wildly,” says McKinnon.

Market volatility impact

Average debtor’s days fluctuate and are heavily dependent on macroeconomics. Economic uncertainties in South Africa mean even reliable customers can suddenly struggle with due dates.

Limited access to business funding

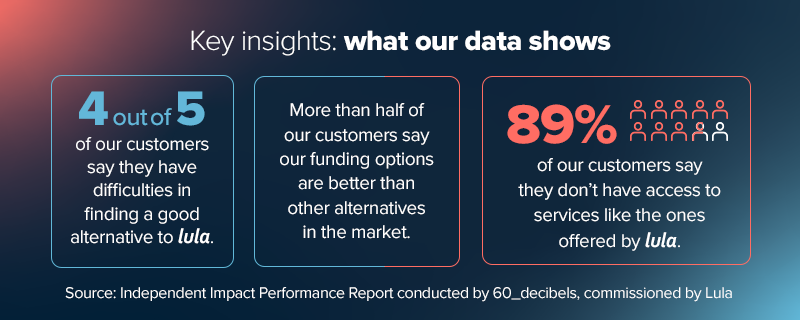

Managing cash flow while leveraging trade credit solutions is hard enough on its own. Without access to commercial finance, it becomes nearly impossible. Business funding in South Africa is notoriously hard to access, with 89% of Lula’s customers reporting not having access to similar financial services to those offered by Lula.

Understanding creditworthiness

Many small businesses lack the tools and know-how to properly assess their own or their customers’ creditworthiness before using trade credit for inventory sales/purchases.

“We see that some of our clients don’t understand their customers’ creditworthiness. But market conditions change. Even great customers can end up not paying you in time,” says McKinnon.

While these challenges can be daunting, not using trade credit is simply not an option for SMEs if they want to stay competitive.

The good news? You don’t have to choose between leveraging competitive terms and maintaining a healthy cash flow. The right business funding solution can help you do both.

Which businesses need financing for trade credit?

Around 50% of inventory sales in South Africa are made on trade credit, and it stimulates business transactions.

However, many companies need financing to make up for potential trade credit shortfalls, and we can break these down into two categories: B2B suppliers and B2B customers.

When B2B suppliers can benefit from financing

If you sell B2B, you need to offer trade credit terms to remain competitive and maintain customer relations. Yet trade credit financing can also strain your cash reserves.

Experience cash flow gaps: If you’re waiting for payments to come in, funding your trade credit financing bridges this gap.

Want to increase sales volume: Offering better payment terms can help win more customers and larger orders, but only if you have the cash flow to support it.

Supply to corporates or government: These clients often demand extended payment terms (up to 90 days) but have reliable payment histories once the waiting period ends.

Act as subcontractors: Main contractors often have to get paid before subcontractors.

You are growing rapidly: Fast-growing businesses often face cash flow constraints as more capital gets tied up in accounts receivable while sales increase.

When B2B customers can benefit from financing

If you’re a B2B customer, buying goods or services on trade credit can free up working capital and improve cash flow. If your business relies on trade credit from its suppliers, you could benefit from alternative types of funding.

Can’t get payment terms: If suppliers can’t provide trade credit, funding inventory purchases can help improve cash flow.

Are waiting for payments: Clients are late on payments, and you need to support cash flow for operations and/or inventory purchases.

Want to expand operations: Funding can help you invest in expansion while maintaining cash flow for regular operations and stock purchases.

How can financing for trade credit help your business?

B2B businesses that want to offer or receive trade credit and don’t have access to funding risk cash flow gaps that cause inefficiencies, leading to higher costs and decreased competitiveness.

However, proper use of business funding transforms the way SMEs can do business and lets them:

Unlock working capital

Employing alternative types of credit frees up cash otherwise locked in unpaid invoices or high interest payments. This allows you to reinvest in your business rather than having capital tied up in accounts receivable or payable.

Maintain business relationships

When you can pay your suppliers on time despite cash flow difficulties, you build stronger business relationships and can potentially negotiate better terms.

Increase your competitive edge

Offer or accept attractive payment terms without straining your cash flow, helping you compete against larger businesses and win bigger contracts.

Fuel business growth

Place or take on larger orders and expand into new markets with the confidence that you can manage the cash flow challenges of extended payment terms.

Improve profitability

Recent research shows a positive relationship between properly managed trade credit and SME profitability, as it helps solve financial constraints and reduces operational costs.

How trade finance helped Manyene Holdings grow

Theresa Ward, Managing Director of Manyene Holdings, shares how funding from Lula helped with her fire and security business: “We can now manage and maintain liquidity without depleting our operational capital.”

Ward explains how trade credit financing has helped her company through projects with long supply chains: “Because we are subcontractors, we usually don’t get paid on time on bigger projects. We might negotiate for 30 days, but because the main contractor has to get paid first, we normally get paid later.”

That’s where flexible funding solutions like Lula’s Cash Flow Facility come in. “We’ve drawn down funds from Lula several times to cover operational costs and boost cash flow,” says Ward.

Through Lula’s Cash Flow Facility, Manyene Holdings has managed to grow while maintaining a healthy cash flow. “Giving that trade credit to our clients has increased our sales. We’re just R2 million shy of being a large enterprise, so that’s quite an achievement for us. Without Lula, I don’t know where we’d be.”

How much does trade credit financing cost?

The cost of funding trade finance depends on your credit history, B2B turnover and the risk associated, traditional financial institutions and credit providers in South Africa. Traditional financial institutions typically charge interest rates of 3 to 6% for business loans with 30-day terms. Costs can also increase for longer payment periods.

For instance, invoice financing fees typically range from about 0.1% to 0.3% of the amount borrowed per day, which can turn into thousands of rands over time.

Many bank loans also include hidden fees for documentation, early repayments, administration and extensions.

Are there any alternatives to trade credit?

Purchasing goods on trade credit doesn’t have to be your customer’s only financing option.

Alternative types of financing can help you enjoy the benefits of extended payment terms while eliminating the risks.

Lula’s Fixed-Term Funding

Your cash reserves should cover your outstanding payments or credit book, but an unexpected expense can tip the balance. If you have a single order on the horizon that requires you to fund a temporary cash flow gap, Lula’s Fixed-Term Funding can help.

• Our Fixed-Term Funding is simple and transparent.

• Once approved, receive funding within as little as 24 hours.

• Repay over an agreed term of 3, 6, 9 or 12 months.

Lula’s Cash Flow Facility

Want to minimise the cash flow gap your business experiences with variable debtor’s days when offering trade credit? Or purchase inventory without opening a credit book with your supplier?

Our Cash Flow Facility gives you an open line of funding that you can rely on whenever payments are late, or your credit book outgrows your cash flow.

Once your application is approved, you can:

• Easily access up to R5,000,000 in funds without having to reapply.

• Only pay for what you use, making a Cash Flow Facility a cost-effective source of funding.

• Enjoy fixed costs that won’t change throughout your agreement.

Lulapay: A low-risk B2B Buy Now, Pay Later solution

Instead of offering trade credit and waiting over 70 days for payment, Lulapay enables you to fulfil orders while still giving your customers flexible payment terms.

Here’s how it works:

- Submit your customers’ invoices to Lulapay.

- Lula assesses and offers your customers a Lulapay facility.

- Your customers accept the payment terms they’re comfortable with.

- You receive payment immediately, while your customers get up to 6 months to pay.

B2B and B2C benefits of a BNPL partnership for your business:

- Eliminate the risk of non-payment or late payment.

- Receive 100% of invoice value upfront within as little as 24 hours.

- No more chasing unpaid invoices or managing a credit book.

- Zero cost to you as the supplier – no fees, no charges.

For your customers:

- Flexible payment terms of up to 6 months.

- No early payment penalties.

- Simple online application process.

- Ability to preserve their own cash flow.

“Lulapay saves you the risk and cost of having to chase collections,” says McKinnon.

How to qualify and apply for business funding with Lula

Lula’s Fixed-Term Funding and Cash Flow Facility are straightforward – no complex application process, letters of credit or other difficult business loan requirements.

To qualify, new customers need to show:

- They’re a registered South African business or sole proprietor.

- They have a minimum of 12 months’ trading history.

- They have a minimum annual turnover of R500,000.

- Three months of bank transactions.

Here’s how to apply in 3 simple steps:

- Apply online: No paperwork required – apply online in minutes.

- Get a quote: We’ll give you a fast, commitment-free quote in hours.

- Get funded: Once you accept your quote, receive your funds within as little as 24 hours.

Once approved, access funding up to an agreed limit whenever you need, giving you peace of mind when customers purchase goods on credit.

Apply online in minutes and access up to R5 million in funding within hours.

*Your data is safe with us. Your bank shares just your latest read-only transaction data with us: we don’t save or store your username or password, and you can unlink your account at any time.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.