As a business owner, your personal credit score matters, especially if you’re looking to secure funding.

Traditional and alternative lenders who provide access to small business funding consider both your personal and business credit history when assessing whether you are eligible for a business loan.

Fortunately, you can check your personal credit score online at major credit bureaus like TransUnion or Experian. There are ways to improve your credit score if you are thinking about accessing funding for your small business and want to increase your chances of being approved.

Here we break down the relationship between your personal credit score and your business creditworthiness, explain the interplay between the two and why you should pay close attention to both.

What is a Personal Credit Score?

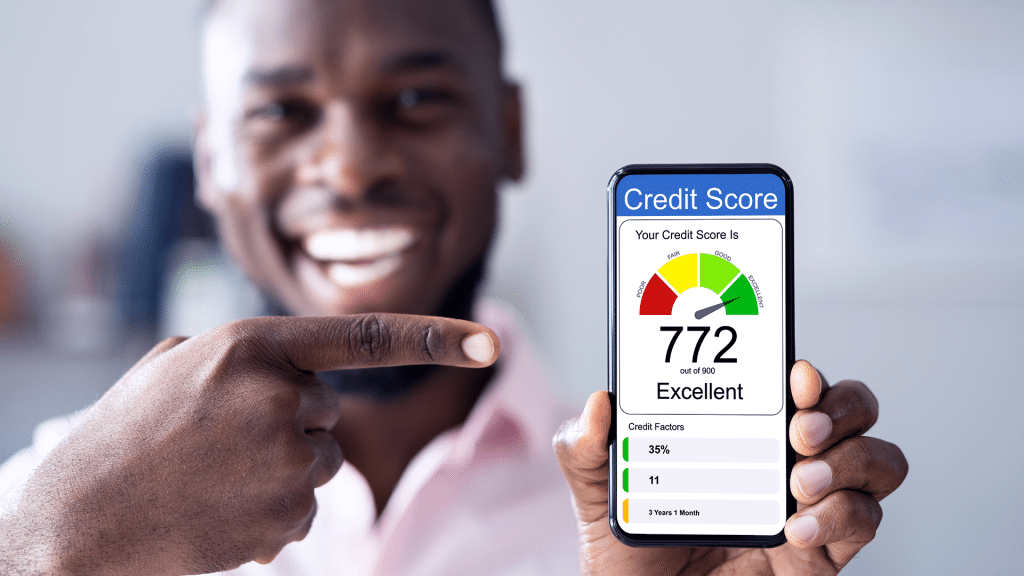

A personal credit score is a three-digit number used to show your creditworthiness. It is based on factors like your financial history, how consistently you pay your bills, the amount of debt you carry and the types of credit you use.

In addition to your business’s credit score, lenders such as banks and alternative funding providers use your personal credit score as a gauge to assess your ability to repay a business loan.

How is Your Personal Credit Score Calculated?

If you’re wondering ‘how to check my credit score’, you can access your free credit report once a year from a credit bureau.

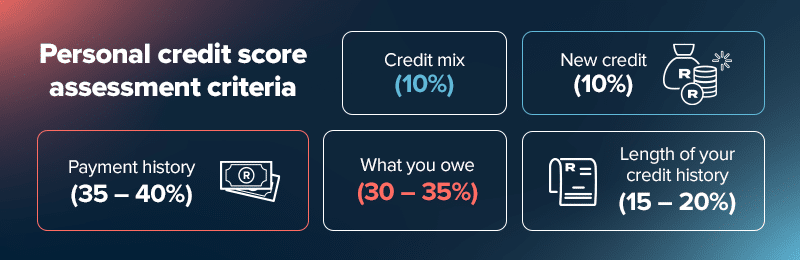

When your credit score is calculated there are a few factors that are considered.

Each lender calculates your score slightly differently based on certain criteria. However, most take the following into account:

- Payment history (35 – 40%): Your track record of paying bills on time and in full for your credit cards, accounts, car and home loans is assessed.

- What you owe (30 – 35%): The total amount of outstanding debt is evaluated. This includes any amount owed on credit cards, loans and home loans. This calculation is usually based on a debt-to-income (DTI) ratio, which is a financial metric used to evaluate your ability to manage monthly debt repayments relative to your income. Owing a large amount that is close to (or more than) your income can impact your credit score negatively.

- Length of your credit history (15 – 20%): This evaluates how long your accounts have been active and how long you’ve been using credit. If you have a longer credit history showing responsible use, this impacts your score positively.

- New credit (10%): FICO’s credit scoring criteria looks at how many new accounts you have by type of account. They may also look at how many of your accounts are new accounts. If you’ve been managing credit for a short time, don’t open a lot of new accounts too quickly. New accounts will lower your average account age, impacting your credit score.

- Credit mix (10%): The types of credit you have are known as your credit mix. This can include credit cards, retail accounts, car loans, capital loans, home loans and lines of credit. Lenders like to see a healthy credit mix that shows you can successfully manage different types of credit.

Why Does Your Personal Credit Score Matter for Business Funding?

Keep your personal score healthy, and ensure all of your business’s directors do the same. This can improve your chances of being approved for business funding.

Most lenders, including banks and alternative lenders, tend to check your personal and business score when evaluating a business loan application. They do this because the way you manage your personal finance often reflects the way you might manage your business finance.

At Lula, we consider both when reviewing a funding application. Many other lenders in South Africa use personal credit scores as a part of their risk assessment process when evaluating loan applications for SMEs.

The Benefits of a Strong Personal Credit Score

A strong personal score shows that you and your business are low-risk borrowers, giving you a better chance of a successful application. Here are a few of the benefits of having a strong credit score:

- Easier access to small business funding.

- Potentially favourable interest rates and terms offered by lenders.

- Greater chances of securing larger amounts of capital, subject to affordability.

- A reputation boost with lenders.

If you’ve checked your credit score with a local credit bureau and have found that it’s low, you can improve it.

How to Improve Your Credit Score

You can improve your score by taking these steps:

- Pay your bills on time, every time.

- Reduce outstanding debt or contact the credit provider to make the necessary arrangements for repayment.

- Be selective when applying for funding.

If you’re serious about improving your score, access your free credit report. Remember that a lower credit score will most likely be a barrier to securing credit on favourable terms.

Regularly checking your credit score can help you strengthen it and improve your chances of being approved for funding. Once you’ve done the work to improve your score or your score is already in the green and you are ready to apply for funding, you can use this handy business loan calculator to calculate your potential funding repayment amount.

Our small business funding options, like our Cash Flow Facility and Fixed-Term Funding, allow you to plan for improved cash flow, and get the support your business needs, with no hidden fees.

We do however look at your business’s real-time performance along with your personal and business credit scores to make our decision. So, while having a good personal credit score is important, we see it as one piece of the puzzle.

At Lula, you can access up to R5 million in small business funding within as little as 24 hours. Explore our flexible funding options and get a capital injection to boost your small business.