Growing a business is no easy feat. As a small business owner, you may have encountered some cash flow slumps and needed a cash injection at some point.

If your business has its mind set on growth, access to small business funding can be a real game changer. Besides traditional loans, alternative funders are providing quick solutions that make it easier to access working capital when you need it most.

Maybe you’ve submitted your application with Lula in the past but were declined for small business funding and found the process challenging. You can always try again. We’ve created this guide to aid you through the process. Read on to learn:

- Five most common reasons we decline small business funding applications.

- Three key steps you can take to improve your chances of being approved the next time you apply.

5 Most Common Reasons Small Business Funding Applications get Declined

Financial services providers (FSPs) don’t all have the same requirements for funding applications.

Knowing the most common reasons a particular funding provider declines applications can give you an advantage when submitting your application and help you prepare adequately.

At Lula, our unique criteria must be met before funding can be approved.

To bring you useful insights to help prepare you for your small business funding application process we sat down with Garth Rossiter, Chief Risk Offer at Lula, to discover the most common reasons small businesses’ funding applications are being declined.

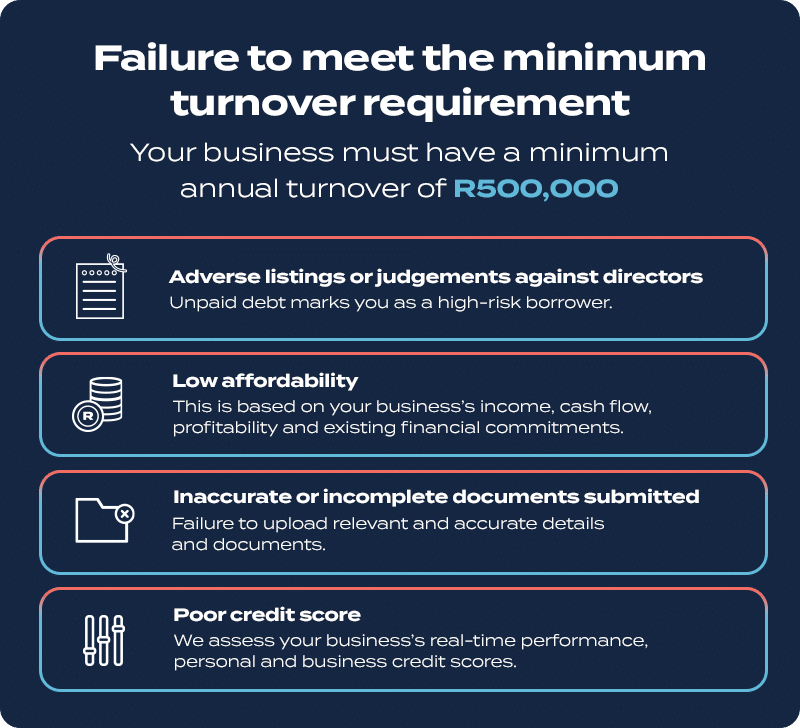

1. Failure to meet the minimum turnover requirement

The standard requirement when applying for our Capital Advance or Revolving Capital Facility is that your business must be in operation for at least one full trading year, and have a minimum annual turnover of R500,000 (this equates to around R40,000 monthly).

Businesses failing to meet this minimum annual turnover may not be approved for funding. You can contact our team to find out more about the specific requirements that apply to your business.

It’s worth noting that our minimum turnover requirement differs for businesses that transact with our partners and those that don’t.

2. Adverse listings or judgments against directors

Another reason funding applications are often declined is if any of the business’s directors have personal records of judgements against them. In this case, your funding application is likely to be declined. Unpaid debts have a negative impact on your credit score, and mark you as a high-risk borrower who may struggle to repay.

Rossiter explains: “Judgements and adverse listings on the business or directors are red flags. We take responsible lending seriously. This means we have to ensure that every business we fund is able to repay.”

3. Lack of affordability

Our affordability assessment reviews factors like your income, cash flow, existing financial commitments, debt-to-income ratio and operating expenses to confirm that your business generates enough cash flow to meet repayment terms.

Our goal is to offer funding to support your business’s growth, not put your business under unnecessary pressure.

4. Inaccurate or incomplete documents submitted

As a part of our online funding process we need to see your personal and business details. Failure to upload the required and accurate documentation – particularly bank statements, will lead to your application being delayed or possibly declined down the line.

Critical information to enable us to process an application and give you a decision as quickly as possible include; personal details like your name, surname, email address, business details, and financial information, including your latest three months’ transactional business bank statements. Having a clear view of your financial records helps us assess whether you’re able to manage repayments.

5. A poor credit score

A poor credit score is one of the key reasons we decline funding applications. We consider the personal credit scores of business directors as a crucial part of the small business funding application process.

A poor business credit score can result from late or missed payments, excessive debt and financial instability. Inconsistent cash flow and high levels of debt relative to income can strain your business’s ability to meet obligations.

Other factors like bankruptcy or poor financial management also add to a poor credit score. When we evaluate your eligibility for small business funding, we look at your business’s real-time performance along with your personal and business credit as factors in our overall credit evaluation.

3 Easy Steps You Can Take to Improve Your Chances of Being Approved for Small Business Funding

Although you may have been declined for funding in the past, after assessing the reasons you might have been declined, you can resubmit an application and try again. Here are three steps you can take to improve your chances of being approved:

1. Work on improving your credit score

Use tools from reputable South African credit bureaus like Experian or TransUnion to perform a personal credit score check. You may be asking, what is a good credit score? The higher your score is, the better. A favourable credit score is above 614, while an excellent credit score is between 767 and 999.

You can improve your credit score by repaying any lines of credit in arrears. If you can’t settle the full amount, contact your credit provider to arrange a payment plan.

You can also get in touch with a local credit bureau and send them the proof of clearance provided by your credit provider, to clear your record. If you don’t know how to improve your credit score, these tips can help you get started.

Rossiter recommends focusing on improving your credit score to increase your chances of being approved for small business funding.

“Keep a clean credit record for your business and for directors personally. The easiest way to do this is to make sure you don’t miss any repayments on any credit you currently have. Keeping good and clear financial records is also advisable.”

2. Be selective about where you apply for funding

It’s never good to make decisions on an impulse, especially when you’re applying for business funding. The obvious solution may be to turn to traditional funding providers like banks or other funding institutions and apply at several simultaneously.

Multiple credit applications in a short timeframe can negatively impact your credit score because each application results in a hard inquiry, signaling potential financial risk to lenders.

Be selective and financially savvy when choosing a provider whose goals align with your own. Some factors to consider are: transparent fees, fair and clear terms, the repayment period and schedule.

3. Keep your personal and business details accurate and up to date

Applications that have inaccurate or incomplete details or documentation will most likely be delayed or declined. To avoid this you can make sure you have all of the necessary documents and details on hand before submitting your application.

Before you start the process, make sure you meet the minimum requirements or contact our support team to help guide you through the process. Funding providers value organised financial records like bank statements that clearly reflect your financial position as a business. One way to make this process easier is to open a Lula Business Bank Account.

Our business bank account streamlines the business banking and small business funding application process, making it easier to apply for business funding and manage your business banking accounts from one profile.

Another way to ensure you submit accurate bank statements is to link your bank account through our service provider Yodlee. This gives us access to your bank or accounting transaction information in a read-only format, making it easier for us to assess.

If you’ve started the small business funding application process, or have previously submitted an application and it’s been declined, don’t lose hope. After following the steps in this guide you can increase the chances of a funding application approval and help your business grow. Start the easy online application process and see if you qualify.