Make Your Business Resilient to Cash Flow Issues with Lula’s Cash Flow Facility.

By clicking 'Apply Now' you agree to be contacted.

It’s a fast-growing short-term financing option that’s helping small-to-medium enterprises (SMEs) cover funding shortfalls. Yet, there may be some areas you’re not sure about, including: How bridging finance works and how it can help your business. How long it takes to receive a bridging cash advance.

Whether your company qualifies for bridging finance. These are all genuine concerns. Knowing how to get small business funding is tough for SA business owners, especially when many lenders ask for an immaculate credit history and set high interest rates.

This is where bridging finance solutions can help get a small company out of a hole: much like a bridge, it can help you quickly cross the turbulent waters of financial uncertainty. Financing solutions offered by Lula, such as our Cash Flow Facility, also act in this way, offering an easy tool to plug up cash flow on demand. Carry on reading to find out everything you need to know about this type of short-term financing.

You may have heard of people talking about short-term funding like a bridge loan, but aren’t sure what is meant by ‘bridging finance’. Put simply, bridging finance, or gap financing, is a quick and flexible way to cover operational costs or repayments for businesses. Probably the quickest type of SME funding around, lasting anything from a month to a year, bridging finance is great for SMEs that need quick working capital to manage cash flow risk.

Bridging finance is useful for anyone who needs a lump sum upfront to fund a purchase or pay unexpected expenses. In business, we might see a buyer in the sale of a commercial property requiring finance. They may find it necessary to take out bridge finance to cover the deposit. Often, there’s also a need for development finance; that is funds to cover the cost of equipment or materials that help the business grow. Bridge finance might also cover something simple such as unexpected agent commission that someone didn’t account for, or pay for everyday expenses like overheads and staff costs.

So what is bridge financing? It can come in several different forms because of the various types of funding that fall into this category.

Bridge financing is most commonly used in business, but it’s also possible to get personal bridging loans to buy a new property or fund property improvements.

Here are some of the most common types of bridge financing in South Africa today.

A longer-term financing option than a bridging short-term loan, these encompass several financial products and arrangements including the following:

Lines of credit: An overdraft-style facility within a certain limit that businesses can access to cover short-term expenses or capitalise on opportunities at any time.

Trade finance facility: Provides financing for international trade transactions, such as importing and exporting goods, through instruments like letters of credit or trade finance loans.

Invoice financing: Enables businesses to access funds by selling their accounts receivable to a financial institution at a discount, providing immediate cash flow while waiting for customer payments.

Used by those buying a new home as much as by businesses, a real estate bridge covers the gap between the purchase of a new property and the sale of an existing one.

These are used by both businesses and new homeowners to smooth the wheels of a purchase while waiting for the sale proceeds of their current property.

Such loans are typically secured on the borrower’s existing property or their new real estate.

Companies use this type of financing to cover urgent capital needs, like when there’s a deficit in start-up, takeover or merger funding, or in large corporate transactions.

Equity bridge financing covers the investment until the business secures permanent financing. Its payment terms might also be structured around the proceeds of share issues like IPOs, but this typically concerns large companies rather than SMEs.

Securing bridge financing is a quicker process than getting a longer-term financing option, but there are still several steps businesses must normally follow to do so. If you’re a business owner looking for bridge financing, here’s a quick guide to how it works.

Once you know how much money you need and for how long, you can start applying. This means completing a paper or digital application form with your personal details, and reason/s you need the money. You’ll also typically be asked to provide your ID. Be careful of lengthy application and approval processes. Tom Stuart, Lula’s CMO, urges SME owners to watch out for traditional lenders that want you to jump through hoops before getting funding. “A big challenge is the time it takes to acquire funding,” says Stuart. “Processes are laborious in some instances when applying through traditional institutions.” However, many alternative online lenders are replacing form-filling with a quick online application that asks for just your name and contact details in return for a commitment-free quote. This helps to slash waiting times for business owners in need of fast funding.

The lending company assesses your status and current situation to determine whether you qualify for the funding you want. They often carry out a credit check to calculate the risk of default, and they might ask you to name a guarantor responsible for repayment should you not be able to do so. Some lenders don’t need all the paperwork that other lenders require. Instead, they’ll draw up a general picture of your business based on recent transactional data.

Once accepted, you’ll receive the agreed amount, and the lender will charge you from the point you receive it. All in all, this process should take days, rather than weeks or months, between applying and accessing the funds. And with alternative lenders (such as with Lula, which allows access to funding within 2 hours from approval), it is much faster.

There are many bridging finance providers out there, but some of them have drawbacks that might be harmful to your business.

A high cost of borrowing is one thing to look out for. Indeed, some financial providers charge interest of up to 5% of the financed amount per month. That’s 60% per year and a potentially substantial business expense.

You may also find that some present you with a complex repayment plan that can include hidden fees. These can be a drain on your business in terms of time and money if you have to keep going through the terms to understand what it is you’re paying.

Finally, some bridge finance providers may insist on low credit limits. This can restrict your ability to grow if you can’t access enough capital to purchase equipment, for example.

A tight lending market doesn’t have to mean expensive lending costs, mind-bending T&Cs and low credit ceilings.

Lula is a South African SME funding provider that has identified a gap in the market for fast, affordable bridging finance.

Our Fixed-Term Funding and Cash Flow Facility offer small business owners quick and easy access to the funding they need to plug gaps in cash flow.

Here’s how we can help you transform your business…

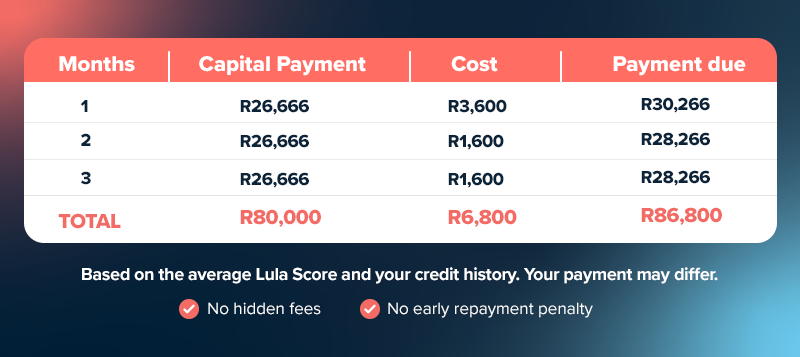

Lula believes small business funding in South Africa should be clear and affordable. That’s why from day one we set out a clear repayment plan, with a simple summary of the fixed costs you’ll pay back. There are no early-repayment penalties and no surprises.

Our terms are brief, simple and ready for you to view at any time.

Lula’s Fixed-Term Funding and Cash Flow Facility are not only fast, but also offer a deep well of financial support that can make a difference to your business’s performance.

Borrow up to R5 million and fuel growth initiatives that can take your business to the next level.

Both Lula’s bridging finance options are great for small businesses like yours, but each one has features that can optimise your performance. Here’s how to choose the right one for you.

Lula’s Fixed-Term Funding

Our Fixed-Term Funding is designed to help you with that big one-off payment you have lined up.

Ideal for: One-time, fixed-cost expenses like equipment purchases, renovations or marketing campaigns.

Repayment: Fixed monthly instalments over a set term of 3, 6, 9 or 12 months.

Advantages:

Lula’s Cash Flow Facility

Ever wanted your own pot of funds to dip into whenever you need it? This is what our Cash Flow Facility is here for.

Ideal for: Ongoing, unpredictable cash flow needs like managing inventory, covering overheads or bridging seasonal gaps.

Repayment: Flexible repayments with only interest charged on what you use.

Advantages:

The time it takes for bridge funding to land in your bank account can vary depending on the lender you use. Yet, this uncertainty doesn’t help you if you’re stuck for cash. Lula’s financing models are built on speed. Our online application for the Cash Flow Facility takes just minutes to fill out, and we’ll get back to you with approval in as little as two hours. Once you accept, you’ll have the money in your bank account within 24 hours, meaning you can swiftly address your business’s financial needs the same day you apply.

Apply in minutes and get funding in hours. No paperwork, no hidden costs, no branch visits.

We use tech to make decisions based on the real-time performance of your business.

Repay as soon as you like and save. No early repayment fees, ever!

We’re experts in what we do and provide the highest level of security.

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.