If your cash flow is in danger of drying up, getting bridging finance may be quicker than you think.

Bridging finance is an SME’s lifeline. With cash on hand, you can get ahead of the competition. Without it, you could lose… well, your business. But how long does it take to get bridge financing?

Traditional bridging finance provided by banks can easily take one to two weeks to secure. A bank’s bridge financing service might take a few days, including approval and wiring of funds, but there are now providers in SA that can have your approved funds in your bank account and make them available to use in as little as 2 hours!

This is a game changer because fast access to funding is crucial to SMEs’ success and survival, especially in today’s South African business sector.

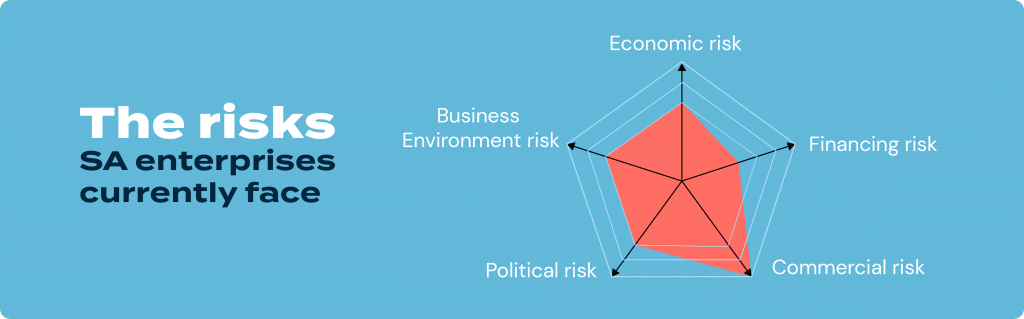

While a modest GDP growth of 1.4% is forecast for a remarkably resilient South African economy this year, SMEs aren’t out of the woods of economic uncertainty yet, according to the yearly Country Risk Atlas from German bank Allianz.

2024 presents several challenges for SMEs when it comes to getting bridging finance in South Africa, including:

- High interest rates make borrowing expensive for SA businesses

- Stringent eligibility criteria are imposed by financial institutions, which limits access to funding for many small businesses.

- Lengthy approval processes and bureaucratic hurdles cause delays in receiving funds for business operations and growth.

To make it worse, the myriad of risks to enterprises described by Allianz and PwC all pose serious threats to SME cash flow in a country where high public debt and political disputes undermine economic stability.

The risks SA enterprises currently face

Source: Allianz

With access to traditional loans slow and tedious, bridging finance is an effective short-term financing solution – but how long does it take to get bridge financing in South Africa?

Read on to find out the answer to this question and more in this article.

Don’t let cash flow worries hold back your business’s potential. Get in touch with Lula today and find out all how you can get flexible bridging finance in just 2 hours.

Bridging finance as an alternative financing option

With the many systemic risks facing SMEs in South Africa, having a readily available credit line is key. However, a lack of access to finance for SMEs remains a challenge in South Africa, with banks being the least likely source of funding for small businesses.

Only 2% of SMEs indicate that they rely on banks for funding, a 2022 analysis from the Organization for Economic Cooperation and Development (OECD) shows.

Instead, SMEs depend on alternative financing options. Small wonder that the South African alternative lending market is estimated at a value of $278.1 million and is set to more than double by 2027, as market research from advisory firm PayNXT360 forecasts.

Of all types of loans on the market, bridge financing is often the most effective short-term loan available to South African SMEs, primarily because it’s both faster and easier to obtain than traditional loans from banks.

Sometimes wrongly called a bridge loan or swing loan, bridge financing is a form of short-term funding specifically targeted to solve temporary liquidity shortfalls with the future promise of income.

What’s the difference between bridge loans and bridge financing exactly?

Bridge loans are typically a lump sum that you borrow until you get permanent financing for a traditional mortgage or pay off debt. They are primarily used for upfront payments in real estate (think of a down payment for residential property, investment property, or refinancing a standard mortgage for a current home).

Bridge financing, on the other hand, is a broader range of products aimed at keeping a business’ cash flow going in the short term. As well as bridging loans, these include credit facilities, lines of credit and other financial instruments. Loan amounts or spending limits depend on expected income and company valuation.

How long does it take to get bridge financing in South Africa?

In the past, it typically took traditional banks and lenders two weeks or more to approve bridge financing, but some fintech providers are now able to give the go-ahead in a matter of hours.

Bridging finance offers much faster access to funds and more flexible loan terms than a traditional loan would. In that sense, it’s fintech’s response to the time-sensitive needs of today’s SMEs.

Tom Stuart, Chief Marketing Officer at SME banking platform Lula, notes that “Time is money, and business owners are often stretched between running their business, managing teams, and ensuring that they have the finances on hand to respond to market needs.”

How Long Does It Take to Get “…Business owners are often stretched between running their business, managing teams, and ensuring that they have the finances on hand to respond to market needs.”

— Tom Stuart, Chief Marketing Officer at Lula

So, how quickly can you get bridge financing in South Africa today?

After discovering that access to working capital is the biggest stumbling block for SA small business owners, Lula committed itself to providing the fastest and most efficient means for SMEs to access funding.

For the fastest access to funding, SMEs can open an unlimited Lula business account. This allows for lightspeed deposits of an agreed amount. “Once your application is approved, you will receive the funds in your Lula bank account within two hours”, says Tom Stuart.

Built on an easy online application process and flexible business funding criteria, Lula can offer unsecured and affordable bridging finance in South Africa in the time it takes to watch a movie.

And interestingly, Lula’s terms have no penalty fees for early repayments.

All this makes Lula’s bridging finance incredibly useful to address sudden or unexpected cash flow gaps and allows SMEs to invest in growth opportunities. It’s ideal for meeting day-to-day operational costs such as materials or inventory purchases, salaries, or rent.

CMO Stuart sees many possibilities for SMEs with Lula funding. “For SMEs in transport and vehicle sectors, it means that when a fuel price hike is announced, having the financial agility to refuel your fleet on the same day can result in massive savings.”

How to get bridge financing fast

Normal bridge funding can take days to acquire, depending on the application process. Banks and other traditional lenders, such as FNB, ABSA, Nedbank and Standard Bank, require borrowers to provide extensive paperwork, including financial statements and proof of collateral, for a bridge loan application, stalling the funding approval.

At Lula, the application process is quick and easy, with no paperwork or collateral required. As a business owner, you simply provide basic personal and business details online, as well as your most recent 3 months transaction history. Your application is then assessed within minutes rather than days, and upon approval, you’ll receive a commitment-free quote.

With the application and approval out of the way, how long does it take to receive your bridge financing?

Once you accept your quote, you can then expect to receive your approved funds in your Lula bank account within two hours. Lula’s bridging finance is faster than any other provider in the country.

What is the typical period of bridge finance?

It’s not just the short timeframe in which SMEs can obtain bridge financing that makes Lula’s funding so compelling – it’s also the repayment terms.

Business owners can choose a repayment period of three, six, nine, or 12 months. Because there are no early re-repayment penalties, SMEs can reduce the costs of Lula funding by repaying early if they can do so, making it an ideal short-term financial tool.

Conclusion: Access bridge financing in just 2 hours after approval with Lula

The financial balancing act between what’s coming in and what’s going out is like walking a tightrope – especially in these tough times.

Bridging finance offers a fast and flexible financing solution for South African SMEs struggling with cash flow gaps. It’s a form of business finance used to cover immediate costs in the waiting time between receiving an expected cash flow boost.

But how long does it take to get bridge financing compared to traditional lenders, who can take over a week or more?

Forget a 24-hour bridging loan. Fintechs like Lula provide approved funds for bridge financing in as little as two hours.

With no collateral required and no early repayment fees, Lula’s online bridge financing can give you breathing room to focus on growing your business. And because bridge financing is typically repaid over a short period, it won’t weigh you down with long-term debt.

As economic uncertainty continues in 2024, SMEs can use flexible alternative lending as a competitive advantage to get ahead of the competition in a difficult financial climate.

Time is money. Apply for bridge financing today and get access to funding within hours. Lula offers up to R5 million in unsecured funding.