Looking for a Business Loan in South Africa?

Find Flexible Funding For Your Business.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Does Accessing a Business Loan Feel Like Navigating a Maze?

Accessing the right business loans in South Africa can feel like walking through a maze. You’re ready to fund your company’s growth, but traditional routes seem slow and complex. For South African small to medium-sized enterprises (SMEs), the need for business finance is constant, but the obstacles are real, including:

- Many potential funding paths, but it’s not clear which route leads you to the capital you need

- Lengthy loan application processes that become dead ends thanks to high credit and paperwork requirements

- Rigid repayment terms that add unnecessary pressure when cash flow fluctuates, and can lead to a vicious financial circle

Yet, what if the capital you need to fuel your business was within reach, without the usual headaches?

Read on to find out about the business loans available to you right now, including how to secure the capital your business needs on flexible terms, within as little as 48 hours.

What Type of Businesses

Need a Loan in

South Africa?

Does your business need funding to cover immediate expenses or fuel growth?

You’re not alone. South African business owners in every sector seek loans for these two reasons and many more.

Retailers often need working capital to buy more stock for busy periods, while manufacturers need funding for new equipment.

Large companies, established SMEs, start-ups – all businesses at every growth stage need to access funds.

In short, we shouldn’t view business bank loans or funding as solely an emergency measure, but instead a vital tool that helps businesses thrive.

What are the Types of

Traditional Business

Loans in South Africa?

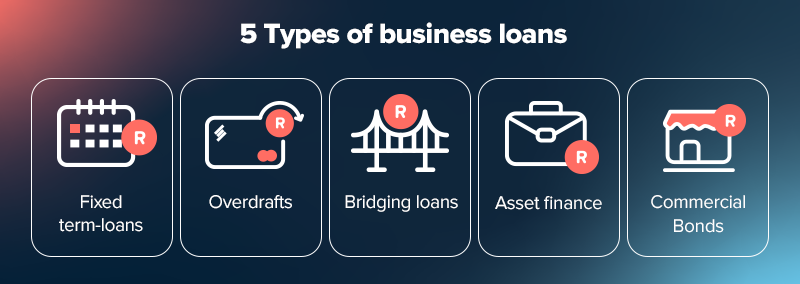

Traditional bank loans are one of the most common types of funding for small businesses and can take various forms.

1. Fixed-term loans

This is a lump sum of capital that you repay over a set period with a fixed interest rate. Businesses often use this for larger investments like equipment purchases or expansion projects.

2. Overdrafts

Overdrafts allow you to withdraw more money than your current bank account balance, up to an approved limit. This way, you get flexible, short-term access to funds for managing cash flow fluctuations or unexpected expenses.

3. Bridging loans

These get their name because they ‘bridge’ the gap until cash becomes available, so they are short-term in nature. They often cover shortfalls in property purchases or those caused by delayed customer payments.

4. Asset finance

This financing enables you to buy assets like vehicles, machinery or equipment. The asset itself often serves as collateral for the loan, spreading the cost over its useful life.

5. Commercial bonds

Commercial bonds are specifically designed for purchasing commercial property, such as office buildings, warehouses or retail spaces. They typically have longer repayment terms.

What are the Pros and Cons of Traditional Business Loans?

If you’ve ever taken out a traditional business loan, you’ll know they come with ups and downs.

- On the plus side: Traditional funding options are trustworthy: they come from some of the nation’s most stable financial institutions that follow stringent financial regulations. Once approved, they provide a powerful boost to your business’s capabilities and may even give you an edge over your competitors.

- There are also some downsides: Repayment terms are often very strict, with high fees and interest rates. Loan requirements, like credit scores and bank statements, are often too high, part of the reason why only a third of South African SMEs report having access to credit.

Even the application process is often complex, eating into valuable time that SME owners could devote elsewhere.

How to Get a Business Loan in South Africa

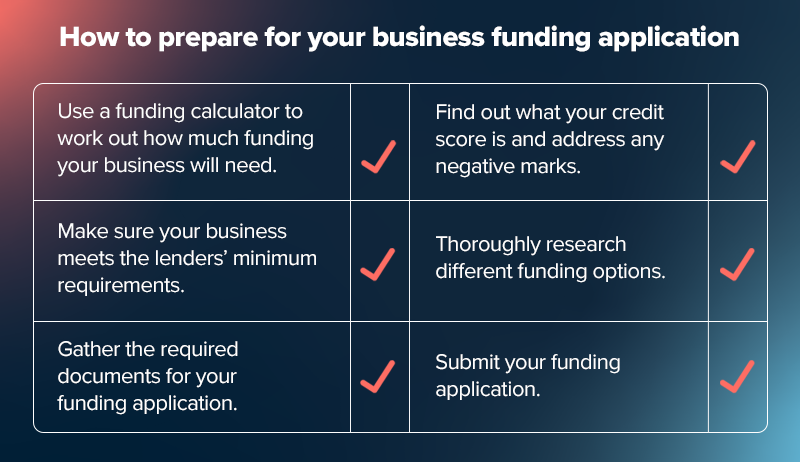

Securing the best business loans in South Africa requires careful preparation that demands time out of your busy schedule.

Here’s how to increase your chances of approval:

1. Assess your funding needs

First, work out how much funding your business needs and what you would use it for (ie, working capital, expansion).

Then determine the most suitable type of funding option (eg, business term loan, overdraft, credit facility).

2. Check your eligibility

Make sure your business meets the lender’s minimum requirements, such as annual turnover and time in operation, then verify its registration number and compliance status.

3. Prepare your financial documents

Gather your business’s paperwork for the required period and organise it in line with the loan’s requirements. This will include bank statements, income tax returns and balance sheets.

A business plan that outlines your business model, financial projections and repayment strategy is also essential.

4. Evaluate your creditworthiness

Find out your business’s credit score and address any negative marks – this will help you demonstrate a history of responsible financial management. Your credit score is important when applying for a business loan and there are ways to improve it.

5. Compare lenders and finance options

Research different lenders, including traditional banks and alternative credit providers, then compare interest rates, repayment terms, loan amount and fees.

You’ll also need to consider the application process and approval speed.

6. Apply for funding

Complete the loan application accurately and thoroughly, and make sure you provide all required documentation as soon as possible.

7. Financial capacity

Many business owners forget to make sure they have the capital to cover loan fees and interest rates for the repayment term – a business loan calculator can help you do this.

Why Alternative Business

Funding is Important for

South African Businesses

If your application for small business funding has been rejected, or you just don’t want the hassle and cost of it, then alternative funding solutions may be the ticket you’re looking for.

Many of these are designed to help South African entrepreneurs, and offer quick access to flexible funding that helps address cash flow and growth issues.

Alternative funding can help you seize opportunities you might otherwise miss due to lengthy bank loan application processes. For some businesses, it can mean the difference between success and failure in a tough South African business climate.

How Does Alternative Business Funding Work?

Alternative finance solutions operate outside the traditional bank and government lending framework.

While they must still follow regulations, alternative lenders often use simple online application processes and technology to speed up access to funds.

They also often consider a broader range of lending criteria, instead of relying solely on credit score and asset finance.

It’s still essential to carefully compare pricing and interest rates before borrowing from an alternative source.

What are the Different Types of Alternative Business Funding in South Africa?

South African businesses have access to a range of alternative funding solutions that can boost a business’s performance. If you’re looking for funding, you may find that one of these options suits your business’s growth ambitions.

- Purchase order funding: This type of funding finances the fulfilment of customer orders, bridging the gap between order and payment.

- Buy now, pay later (BNPL): BNPL allows buyers to pay in installments, boosting sales while the seller receives immediate payment.

- Credit facility: Sometimes called a capital facility, this provides ongoing access to funds up to an approved limit.

- Capital advance: This is a lump sum of capital that’s repaid over a fixed term, often with streamlined approval processes.

Lula’s SME Funding Solutions: A Smarter Way to Fund Your Business

As a busy business owner, you don’t have time to waste on strung-out application forms. You might not have the credit history or financial documents that big banks demand, either.

Even if you do, you run the risk of your application being turned down.

Lula’s funding solutions are designed to connect you to the funding your business needs, quickly and simply, by sticking to three core principles:

Flexibility: Repay as soon as you like with no early repayment penalties or hidden fees.•

Ease of access: Apply in minutes and access funds within as little as 24 hours. No paperwork, no branch visits.••

Customer service: Unlike big banks, we want to help you get funded, which is why you can easily contact us.

Cash Flow Facility

Want funding without the commitment of a long-term loan?

Lula’s Cash Flow Facility lets you draw down funds when you need them. Then, once you’re ready, you can repay the capital, then redraw later on – with no need to reapply (subject to an affordability assessment). You only pay for what you use, when you use it.

Fixed-Term Funding

Need fast yet fixed funding for a specific business goal?

Lula’s Fixed-Term Funding provides a fixed amount upfront, repaid over a set term. Perfect for growth projects, you can access up to R5 million within as little as 24 hours with one transparent fee, so you can plan with confidence.

Lula’s Business Funding Calculator: Get a Clear View of What You’ll Pay

Are you looking for a business loan calculator in South Africa? It can help you estimate monthly repayments more accurately, fees and gauge if you can afford funding or not. We understand the importance of transparent pricing.

That’s why we offer a user-friendly Business Funding Calculator.

Simply input an amount and repayment period to estimate your repayments and make informed financial decisions.

Understanding the full cost upfront is essential for responsible financial planning, and we provide the tools to do so.

How to Access Lula’s Cash Flow Facility in 48 Hours

Accessing the funding your business needs shouldn’t be a lengthy ordeal.

Lula streamlines the process so that you can get started in just 48 hours. All you need is to fill out a simple online application form, have been registered in South Africa for one year of trading, and have annual revenue of at least R500,000.

Find the funding your business needs to thrive and leave the maze behind.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.