You’ve spent years studying or practising how to build a successful business, and now you’re ready to take the next step.

Working out how to buy a franchise in South Africa may seem like the perfect way to expand, but where do you begin?

After all, many entrepreneurs in your position find themselves feeling:

- Uncertain of which franchise is the right fit for their goals and expertise.

- Fearful of the financial risk involved with upfront costs and franchise fees to deal with.

- Unsure how the franchise-buying process works, including the paperwork and legal agreements they must complete.

Knowing how to overcome these barriers is fundamental to making franchise opportunities work, but this is something easily within reach for South African business owners.

Read on for information on how to buy a franchise in South Africa with a step-by-step blueprint, as well as which industries are ripe for expansion.

Is Franchising a Good Investment in South Africa?

Franchising is attractive to many existing business owners because it’s a chance to acquire an established business model with a proven track record.

South Africa, in particular, has a thriving franchise industry, with business opportunities abundant across various sectors. New franchises are supported with resources and guidance by national bodies like the Franchise Association of South Africa (FASA).

“Franchising has emerged as a powerful engine of growth and economic development worldwide, and South Africa is no exception,” says Eric Parker, consultant and partner at consultancy firm Franchising Plus.

“In a country grappling with high unemployment rates, economic inequality, and the need for sustained entrepreneurial activity, franchising offers a viable and sustainable business model.”

Such conditions have made it possible for the industry to increase by 36% between 2019 and 2023, reaching a valuation of almost a trillion rand, and contributing 15% to the South African GDP.

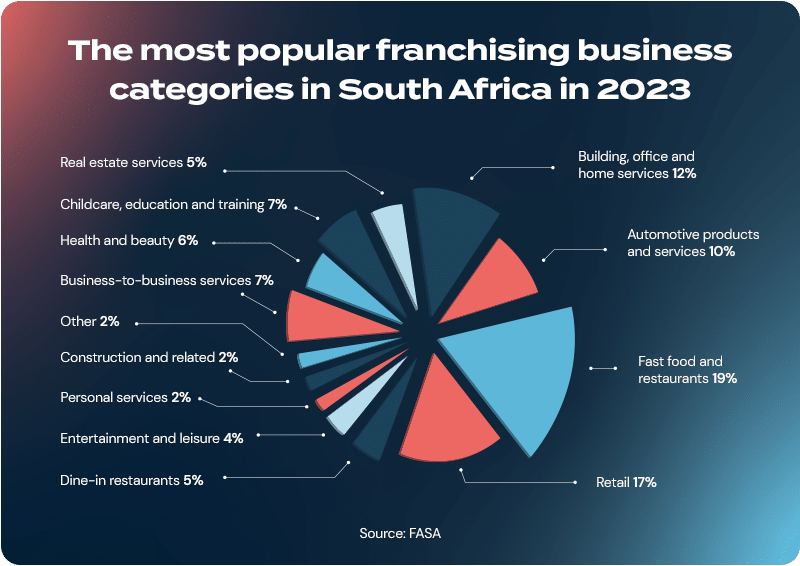

The sectors that profit most from this boom are fast food (making up 19% of the country’s franchises), retail (17%), automotives (10%), and childcare (7%), according to recent research from FASA.

So, what are the driving forces behind this industry success? Here you will discover the benefits of starting a South African franchise.

The pros of franchising

We mentioned how franchising lets you hook onto an established brand, and this comes with several immediate benefits, including brand recognition and customer trust.

This reduces the marketing costs needed to win over new customers and reduces the risk of failure associated with starting a business from scratch.

Franchisors, i.e. the companies or brand owners behind the franchise, offer proven systems, operations, and marketing strategies because they naturally want you to succeed. They typically also share certain costs, such as advertising and marketing, among franchisees, adding to savings.

However, perhaps the biggest boon for new franchise operations is the potential for high returns. Successful franchises can generate significant profits, especially in growing markets, and become a successful long-term revenue stream for growing businesses.

The cons of franchising

Analysing the downsides of a venture is a key part of making your own business work, and franchising isn’t free from them.

High initial costs, including franchise fees and set-up costs, can be substantial, for example. Starting with smaller brands (or those that fall outside the global category of the likes of McDonald’s) typically requires a joining fee and set-up costs well over R500,000.

Throw in ongoing fees such as royalties, typically a percentage of the monthly turnover, and marketing fees and the figure climbs further. Zebro’s Chicken, for instance, charges a 4% royalty fee, while Dream Nails requires a 6% marketing fee.

Franchisees must also follow the franchisor‘s rules and regulations, which means you have less control over the business operations and strategic direction compared to owning an independent business.

Finally, of course, there’s the possibility of failure. Even with a strong brand, franchise businesses can still crash and burn due to various factors, including poor management, economic downturns, or a lack of funding.

6 Steps to Buying a Franchise in South Africa

Franchises in South Africa come in various forms, but there’s a general blueprint you can follow when acquiring one.

Here are six steps that will help you work out how to buy a franchise in South Africa.

1. Research and select the right franchise

Many entrepreneurs make the mistake of chasing flashy opportunities, but searching for a franchise that matches your interests and skills is the first smart move you can make.

Let’s say you’re drawn to the food industry or you have experience working in the culinary industry.

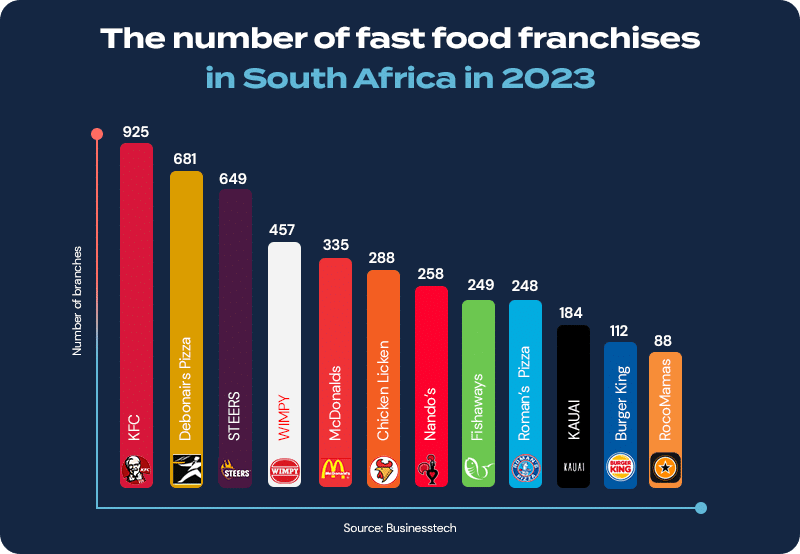

Here, affordable franchises in South Africa’s growing food markets would be the sensible option, yet even fast food brands like McDonald’s and KFC make sense if the market conditions align with your budget and skills.

Hundreds of franchisees have already worked out how to buy several mainstream fast food franchises in South Africa, as the chart below shows.

Franchise directories are great resources for this and will help you assess factors like industry growth and brand reputation.

Conducting due diligence, including looking at financial projections and customer demand will also help you choose the right franchise.

2. Assess your financial readiness

Once you have your franchise in mind, looking at the finances involved is the next important step in working out how to buy a franchise in South Africa.

First, determine the upfront costs, including joining fees and set-up expenses. Many franchises require 40 – 50% of the total investment in unencumbered funds.

Ongoing royalties and marketing fees are another factor. Food franchises often have a percentage-based royalty model. The high cost of starting up means many people explore franchise financing options, such as term loans, inventory finance, or working capital finance via banks or specialised lenders.

3. Engage with the franchisor

Reaching out to the franchisor to understand their business model and expectations is crucial.

This conversation should include a review of their disclosure document for insights into fees, operational requirements, and the support that they will provide.

Once clear, the franchise agreement should reflect these terms and the intellectual property and obligations involved in that.

4. Validate the opportunity

If the franchise opportunity looks like it’s going to materialise, then doing your homework will stand you in good stead for when it all starts.

Speak to current and former franchisees to gain real-world insights into the franchise’s profitability and support system.

They will be able to advise you on potential locations. Economic hubs like Gauteng may appear to be obvious spots, but up-and-coming areas with cheaper rent may make more sense.

Evaluating how the brand stands out among other franchise brands in its market will also help you create a competitive business strategy at this point.

5. Complete legal and financial preparations

Preparing the required documents is a tedious but necessary stage of buying a franchise.

You’ll need personal financial statements, a business plan, and proof of deposit origin to secure a lease for your business location and finalise agreements with the franchisor.

Compliance with the Consumer Protection Act is another must, and seeking legal expertise to help you with this is essential.

6. Launch and operate your franchise

With most of the hard start-up work done, you can start looking at how you’re going to set up operations following the franchisor‘s proven systems, including marketing strategies and workflows.

You’ll need to work out how to organise the training and support provided by the franchisor to get your employees off to a good start, then continuously monitor performance metrics to keep performance levels at their highest.

The early days of a franchise are the most important, as they set the foundation for long-term success. During this period, you’ll build relationships with your first customers and establish operational consistency.

Addressing any teething problems promptly will help solidify your reputation and create momentum for sustained growth.

Find the Right Franchise Finance With Lula’s Flexible Funding

As the owner of any small business knows, keeping cash flow running smoothly is a key challenge.

Knowing how to reduce overhead costs is one way of dealing with this, but many people overlook how important securing the right funding is.

This is especially true for new franchises. The high start-up costs of setting up such a venture are often a huge obstacle in the early stages of a venture, and can threaten to destroy it before it even gets off the ground.

Lula’s flexible funding solutions give small businesses quick access to up to R5 million in capital, which can be used to expand your business through investment in a franchise. We cut through the red tape of traditional lending with a digital application process, fast-tracking the approval time so that you can take advantage of opportunities as they arise.

Tap into our Revolving Capital Facility, for example, and open up a ready supply of funding, paying only a fixed fee on the amount you borrow. Once you repay the amount, you can withdraw it later on, without the need for reapplying, subject to an affordability assessment.

The Capital Advance, meanwhile, is a fixed-term funding option that provides upfront capital to help franchisees cover initial start-up costs, implement new technologies, or manage expansion.

With Lula’s transparent and affordable funding, you can focus on growing your franchise at your own pace – without worrying about cash flow strains. Start the online application process to see if you qualify.