You’ve built a solid business. Now, you’re ready to grow.

But, before you can take that next step, there’s one key thing you need to get right: your financials.

Even if you know the business is doing well, proving it on paper can be tricky. This is where knowing how to calculate a profit and loss statement comes in.

Informative and concise, it provides a neat snapshot of your business’s financial performance – but if you find the numbers confusing, you’re not alone.

This guide breaks down the profit and loss (P&L) statement in plain terms. We’ll show you how to calculate it, what it tells you, and how to use it to support funding applications or expansion plans.

Let’s simplify the numbers, so you can focus on growing your business.

Why is a Profit and Loss Statement So Important?

A P&L statement, also called an income statement or statement of operations, is one of the most important financial reports a small business owner can have.

It shows your company’s revenues and total expenses over a specific period, so you can clearly see whether your business is making a profit or running at a loss.

Unlike a balance sheet, which gives a snapshot at a moment in time, the P&L tracks financial performance over a certain accounting period, such as a month, quarter or full fiscal year.

It helps you measure metrics like gross profit, net income and operating costs, and plays a key role in evaluating your pricing, planning for growth and applying for funding.

If you’re expanding your business, including opening a franchise, then a clear, accurate P&L statement tells potential investors or lenders that you understand your numbers and your business’s financial health.

“A P&L statement is not just a reflection of a business’s financial health,” says Melissa Houston, a business finance coach speaking to Forbes. “It helps guide strategic decisions. When parsed and understood, the data disclosed in a P&L can profoundly influence the direction of a company.”

In this sense, it’s more than just a report: it’s proof that you’re ready.

What are the Key Components of a Profit and Loss Statement?

Once you know why you’re completing this task, the next step is to know how to read a profit and loss statement.

This comes down to knowing the important terms. The table below defines those that you are most likely to come across.

Key components of a profit and loss statement

| Component | Definition |

| Total revenue | The total amount of money generated from sales of goods or services (often referred to as the top line) |

| Cost of goods sold (COGS) | Direct costs incurred by the production of goods sold by your business |

| Gross profit | The profit remaining after subtracting COGS from total revenue |

| Operating expenses | Costs incurred in the normal course of business, excluding COGS |

| Operating profit | The profit generated from core business operations, calculated as gross profit minus operating expenses (also known as operating income) |

| Other income | Revenue from non-core business activities |

| Interest expense | The cost incurred by a business for borrowed funds |

| Depreciation | The allocation of the cost of a tangible asset (ie, a business vehicle) over its useful life |

| Amortisation | The allocation of the cost of an intangible asset (ie, patents) over its useful life |

| Income tax | Taxes paid on the company’s taxable income |

| Net profit | The final profit remaining after all expenses and taxes are deducted (often called the bottom line or net income) |

Once you have the meaning of these terms clear, then you’re ready for the next stage: how to work out profit and loss.

How to Calculate a Profit and Loss Statement: A Step-by-Step Guide (with Formulas)

Knowing how to calculate a profit and loss statement can be difficult, get one part of it wrong and you risk creating an inaccurate picture of your business.

That’s why understanding each step is so important. Let’s break down the process:

1. Calculate total revenue (top line)

This is where your P&L statement begins – with all the money your business has brought in.

Total revenue represents all the money earned from your primary business activities, such as sales of goods or services, before any expenses are deducted. It’s referred to as the ‘top line’ because it sits at the very top of your P&L.

Formula:

Total revenue = net sales

Note: ‘Net sales’ refers to your gross sales (the total value of all sales) minus any returns, allowances (like discounts given to customers for damaged goods) and sales discounts.

Example for a profit and loss sample period (ie, a quarter):

If your business sold R550,000 worth of products, but had R10,000 in customer returns and R5,000 in discounts given, your calculation would be:

Total revenue = R550,000 – R10,000 – R5,000 = R535,000

2. Calculate the cost of goods sold (COGS)

Next, we look at the direct costs associated with generating that revenue.

Cost of goods sold (COGS) involves the cost of materials, direct labour and manufacturing overhead directly tied to the creation of your products or services.

Formula:

COGS = beginning inventory + purchases – ending inventory

Note: For service-based businesses, COGS would include direct costs like subcontractor fees or specific supplies used for customer projects.

Example:

Let’s say your business started the quarter with R20,000 in inventory, purchased an additional R150,000 in inventory and ended the quarter with R15,000 in inventory.

COGS = R20,000 (beginning inventory) + R150,000 (purchases) – R15,000 (ending inventory) = R155,000

3. Calculate gross profit

Now we can see how much revenue is left after covering the direct costs of producing your goods or services.

Gross profit is a crucial figure that shows how well your business manages its production costs relative to its sales.

Formula:

Gross profit = total revenue – COGS

This figure is also used to calculate your gross profit margin, a key metric that indicates the percentage of revenue remaining after COGS.

Gross profit margin = (gross profit / total revenue) * 100%

Example:

Using our previous figures:

Gross profit = R535,000 (total revenue) – R155,000 (COGS) = R380,000

Your gross profit margin would be: (R380,000 / R535,000) * 100% = 71.03% (approximately).

4. Calculate operating expenses

Every business incurs costs to simply operate, beyond the direct costs of what you sell.

These are operating expenses and they’re critical for running your business and can include a wide range of categories:

- Salaries and wages (for administrative, sales or marketing staff)

- Rent and utilities

- Marketing and advertising costs

- Professional fees (e.g., for accountants, lawyers, business banking fees)

- Office supplies

- Insurance

It’s also important to include non-cash expenses like depreciation and amortisation if applicable to your business.

Example:

Let’s assume your operating expenses for the quarter look like this:

- Salaries and wages: R100,000

- Rent: R15,000

- Utilities: R5,000

- Marketing: R10,000

- Depreciation: R2,000

- Other admin costs: R3,000

Total operating expenses = R100,000 + R15,000 + R5,000 + R10,000 + R2,000 + R3,000 = R135,000

5. Calculate operating profit (operating income)

This figure gives you a clear picture of how profitable your core business operations are before considering financial and tax matters.

Formula:

Operating profit = gross profit – operating expenses

Note: Another relevant metric here is EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation). While not directly on the P&L statement, it’s a popular measure that compares companies by removing the effects of financing and accounting decisions. You would calculate it by adding back depreciation and amortisation to your operating profit.

Example:

Operating profit = R380,000 (gross profit) – R135,000 (operating expenses) = R245,000

6. Add other income and subtract other expenses (incl. interest)

Now, we account for any income or expenses that aren’t part of your regular business operations, but still impact your overall profitability.

- Other income: This might include interest earned on savings, gains from the sale of assets or rental income from property not central to your main operations.

- Other expenses: This covers costs like losses from the sale of assets or, very commonly, interest on loans or financing facilities (like a business loan or revolving capital facility you might have).

Formula:

Taxable profit = operating profit + other income – interest expense – other expenses

Example:

Let’s say your business earned R500 in interest on a savings account, but paid R1,500 in interest expense on a small business loan.

Profit before tax = R245,000 (operating profit) + R500 (other income) – R1,500 (interest expense) = R244,000

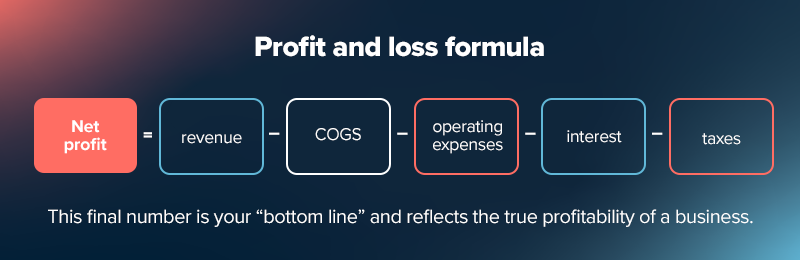

7. Subtract income tax to get net profit

The government gets its share! Income tax is, as we all know, the tax your company pays on its taxable income.

Then, we’ll have the number everyone wants to see – the net profit is the true measure of your business’s financial success for the period.

Formula:

Net profit = profit before tax – income tax

Example:

If your business’s profit before tax was R244,000 and the income tax expense for the period was R60,000:

Net profit = R244,000 (profit before tax) – R60,000 (income tax) = R184,000

8. Calculate net profit margin

Similar to the gross profit margin, a key metric to understand your overall efficiency is the net profit margin:

Net profit margin = (net profit / total revenue) * 100%

Example:

Based on our final calculation:

Net profit = R184,000

And your net profit margin would be: (R184,000 / R535,000) * 100% = 34.40% (approximately).

This R184,000 represents the actual profit your business made during the quarter, which can then be reinvested, used to pay dividends or retained within the business.

Profit and loss statement example

| Category | Amount (Rand) |

| Revenue | |

| Total sales | 550,000 |

| Less: Returns & discounts | (15,000) |

| Net Sales (Total Revenue) | 535,000 |

| Less: Cost of Goods Sold (COGS) | |

| Beginning inventory | 20,000 |

| Purchases | 150,000 |

| Less: Ending inventory | (15,000) |

| Total COGS | 155,000 |

| Gross Profit | 380,000 |

| (Gross Profit Margin: 71.03%) | |

| Less: Operating Expenses | |

| Salaries & wages | 100,000 |

| Rent | 15,000 |

| Utilities | 5,000 |

| Marketing | 10,000 |

| Depreciation | 2,000 |

| Other admin costs | 3,000 |

| Total Operating Expenses | 135,000 |

| Operating Profit | 245,000 |

| Other Income/Expenses | |

| Other income | 500 |

| Interest expense | (1,500) |

| Net Other Income/Expenses | (1,000) |

| Profit Before Tax | 244,000 |

| Income Tax Expense | (60,000) |

| Net Profit | 184,000 |

| (Net Profit Margin: 34.40%) |

How Often is the Profit and Loss Statement Prepared?

A profit and loss (P&L) statement can be prepared for several periods of time, including monthly, quarterly or annually.

Many business owners review it monthly to stay on top of the key metrics we’ve mentioned, like net profit margin and operating expenses. It helps you track performance over a set reporting period and spot trends before they impact your cash flow.

If you’re applying for business funding in South Africa or updating your business plan, lenders may ask for the most recent P&L alongside your cash flow statement and other financial statements for informational purposes.

Regularly reviewing your P&L keeps you informed and ensures your numbers match what’s in your bank account.

How to Create a Profit and Loss Statement in Excel

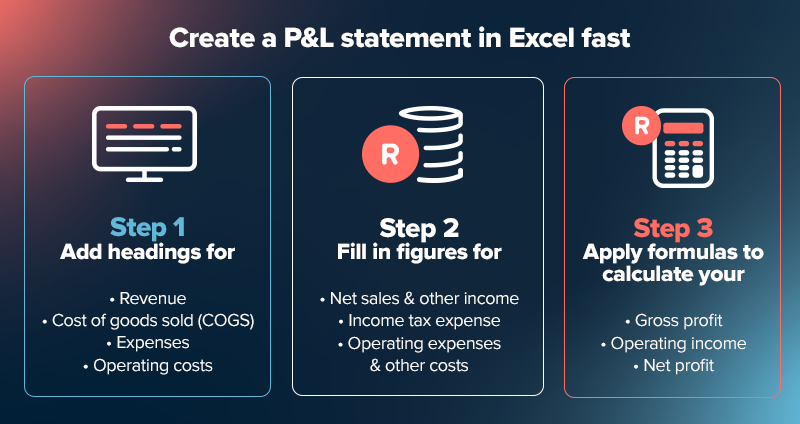

It is possible to create a profit and loss statement in Excel, although it isn’t the most efficient method.

Here are a few quick steps to create the P&L statement:

1. Start by setting up your spreadsheet with clear headings for revenue, cost of goods sold (COGS) and operating costs over a chosen period of time (e.g., monthly, quarterly or annually).

2. Input your net sales and other income, then list all your operating costs and other expenses.

3. Use simple profit-and-loss formulas to calculate gross profit, operating income and, finally, your net profit. Remember to choose between the cash method and the accrual method for accurate bookkeeping.

This step-by-step process helps you assess your profitability and financial health for better business planning and pricing decisions. You can even use a pre-built template to streamline the process.

How to Calculate a Profit and Loss Statement With Automated Digital Tools

Bookkeeping has come a long way. Manual spreadsheets and paperwork are being replaced by smarter, faster digital tools – and it’s making life a lot easier for business owners.

With the use of automated digital banking tools, instead of sorting through receipts or manually inputting figures, you’ve got an up-to-date snapshot of your business finances at your fingertips.

This gives you accurate, organised data you can easily pull into your P&L calculations. Less guesswork, fewer errors and faster reporting – so you can spend more time focusing on what really matters: running and growing your business.

A P&L statement is just one tool you’ll need to help your business grow; accessible funding is another.

Ready to experience business-class banking? Open a Free or Unlimited business bank account with Lula online in minutes.