“How to reduce overhead costs in business”. As a small business owner, you’ve probably searched for answers to this problem many times.

Typing those eight words is easy, but putting them into action is complicated.

You may not know, for example, which business expenses you should cut without impacting growth, or you may struggle to find the time to go through every single overhead that your business incurs.

This guide aims to clear up these doubts for you.

We will help you identify the types of overhead costs that you can target for immediate savings. It will save you time and effort by focusing on key areas rather than requiring a detailed review of every expense.

What are Overhead Expenses? A Breakdown for Small Business Owners

So, what is an overhead cost, exactly?

Put simply, these are the indirect costs that you incur to keep your business operations running smoothly.

Think of them as the behind-the-scenes operating costs that are essential but don’t directly make you money.

Unlike fixed overhead costs, these can fluctuate, so it’s worth paying close attention to them.

Here are the most common types of overhead cost examples that you’re likely to come across during your business activity.

- Administrative costs: These include anything crucial to the day-to-day running of your business, like salaries, office equipment, utilities and insurance premiums.

- Property taxes: The tax burden associated with owning or leasing a physical office space.

- Depreciation: The decrease in value of assets over time, like equipment or buildings.

- Utilities: Electricity, water and internet service bills are the most typical examples.

- Insurance: These could be business liability, property and workers’ compensation insurance.

- Rent or mortgage payments: For office space or other property.

- Advertising and marketing: The costs of promoting your business.

- Legal and accounting fees: Costs for professional services that help you stay legally compliant.

- Subscriptions: Fees for software, online tools or memberships that help you run your business.

- Unexpected costs: It’s always a good idea to have a pot of money ready for expenses you don’t see coming, such as a loss of income caused by load-shedding.

Managing these overhead expenses is crucial. By understanding and controlling them, you can improve your cash flow and, ultimately, your bottom line.

The next section will explore how to reduce overhead costs in your business so that you’ll have more funds to put towards growth.

How to Reduce Overhead Costs in Business Save?

Talking about cost reduction sounds impressive, but actually doing it is much harder. Thankfully, there are several strategies you can follow to make this happen:

1. Outsource non-core tasks like accounting and customer service

Sometimes we need to spend money in a new area to save more money elsewhere.

Outsourcing non-core tasks to external service providers is one example.

Let’s say you or your staff normally take on bookkeeping, customer support and marketing in-house: these are all time-consuming tasks that take your attention away from growing your business.

It also comes down to the number of hours you need for a certain task. If you need 20 hours a week for customer service, then it doesn’t make sense to employ full-time employees to do the job.

“Before making a decision, ask yourself if you really have 40 hours of work at one level,” says Jennifer Barnes, CEO of Optima Office, an executive service provider writing for Forbes. “If you need 20 to 30 hours a week at one level, and in one role, it is usually best to outsource that position rather than pay for 40 hours and only get 20 to 30 hours. You want the right person doing exactly what they are good at.”

Often, the cost of specialised freelancers and agencies to which you outsource tasks is lower than internal labour costs, and it also saves time on employee management.

2. Shop smarter

Knowing how to reduce overhead costs isn’t always about not spending money, but how you spend it.

Bulk buying, for example, is a well-known way to get discounts on goods, but such large orders may be outside your budget.

Instead, it could be worth teaming up with other small businesses to buy supplies together. These don’t have to be rivals, but simply a business that buys the same things as you, like raw materials, for example.

There are also comparison websites that can help you find the best prices on everything from office supplies to equipment – whatever suits your business needs.

Finally, don’t be afraid to ask for a discount, especially if you’re a repeat customer. Your supplier will value you going back to them and will likely be open to negotiation if they want to keep your business.

3. Rethink marketing and sales

Want to get more bang for your buck? Take a closer look at your marketing and sales. This is a common area where people lose money on expensive, ineffective ads and poor results analysis.

Here’s a simple checklist to get on the right track.

1. See what’s working

Track your results to figure out which sales method is bringing in customers.

2. Make selling easier

Streamline your sales process so you can close deals faster. This could include a customer relationship management (CRM) platform that helps businesses manage interactions with existing and potential customers.

3. Try new things

Don’t be afraid to experiment with different ways to reach customers, like social media for small businesses, blogging or local influencers. These are all proven ways to increase awareness of a business, and often come cheaper than conventional ads.

Remember, the aim is for quality over quantity of marketing, and taking the time to fine-tune your approach could save you a lot of money.

4. Encourage remote work and push for paperless

Physical office space can be a valuable asset, providing a dedicated workspace for employees, but it also comes with associated costs like rent, utilities and maintenance that can impact your profit margins.

Encouraging remote work (where you can) and switching to paperless processes can help you either look at downsizing your space or go fully digital.

You may find that you save money in other ways than spending less on utility costs and materials. Remote work can increase employee productivity by letting them work in environments better suited to their taste.

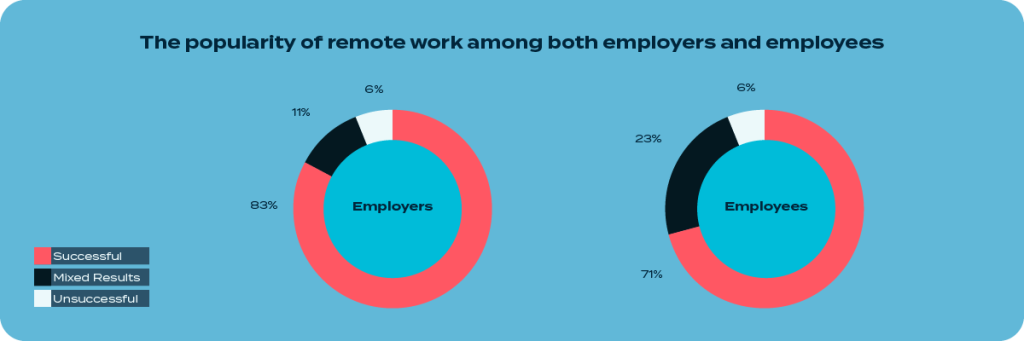

83% of employers and 71% of employees backed this statement up in a PwC Remote Work Survey that asked them if working away from the office had been a success during the pandemic.

Pushing for a paperless office, too, means you save on printing, storage and filing costs, while investing in energy-efficient equipment like LED bulbs also helps reduce utility bills.

5. Keep an eye on your stock levels

Buying in bulk isn’t always a bargain.

While it can seem like a great way to save money, too much stock can lead to higher storage costs and the risk of items passing their sell-by date.

Plus, tying up your cash in inventory can limit how much you can invest in other areas of your business.

To save money without taking unnecessary risks:

- Keep your stock levels low: Only buy in bulk when you’re sure you’ll sell everything.

- Take advantage of discounts: If you see a great deal, but you’re not sure you need it right away, consider if it’s worth storing.

- Be mindful of your cash flow risk management: Make sure you have enough cash on hand to cover your operating expenses, including storage costs.

Following these tips will help you to avoid overspending and free up funds for other ventures.

6. Embrace automation and other technology

Time is a precious resource, especially for small businesses, but just think about how much time you and your team waste on manual, repetitive tasks.

By using cloud-based applications, you can automate these jobs and free up time for more important work.

Here are some examples:

- Draft your social media posts with generative AI (like ChatGPT) and use tools like Buffer or Hootsuite to schedule them at the best times.

- Use generative AI to draft your website copy (although you’ll need to heavily edit it so that it carries your brand’s voice) and review supplier and service provider contracts.

- Manage documents and signatures electronically using platforms like DocuSign.

- Simplify your stock count with software like Quickbooks or Xero.

Remember, you don’t have to pay for every app out there. Review your subscriptions annually and cancel any you’re not using.

7. Review your business financing

Taking some time to look over your business’s funding facilities can help you make smarter decisions and find ways to save money.

Some lenders, for example, charge high monthly account fees and interest rates that make borrowing counter-productive.

They might also make it difficult for you to see where these business overhead costs are coming from with clunky apps and unclear terms and conditions.

The first step is to go through your credit facilities carefully and record every outgoing. If you find that you’re spending too much on borrowing funds, then it’s time to look for another provider.

Lula may be the alternative you’re looking for.

Securing business funding has never been this easy. Lula gives you access to alternative funding solutions within as little as 24 hours and offers excellent customer support to guide you through the application process.

Unlike traditional bank loan applications that can take weeks to be approved, Lula fast-tracks the process through innovative assessment technology, and has less stringent requirements. You can apply online in minutes. It’s fast, easy, Lula to get business funding. Here’s what you’ll get:

- Fast and easy access to funding: Get the capital you need quickly and easily without having to deal with the hassle of securing traditional bank loans.

- Flexible and transparent repayment terms: Choose a repayment plan that works best for your business, including options for early repayment without penalties.

- Fixed fees: Never worry about fluctuating repayment fees.

- Digital application process: The application process is paperless and simple. You can apply online in minutes.

- Dedicated support: Get personalised assistance from real people throughout the business funding application process.

- Easy-to-use dashboard: Get a clear picture of your finances, 24/7.

Knowing how to reduce overhead costs in your business can be tricky, but with Lula’s simple tools, helpful support and flexible funding options, you put yourself on the road to a stronger financial future.

Don’t let high overhead costs and a lack of funding hold you back. See if you qualify for Lula’s business funding today and make cash flow. Apply now.