Looking for Inventory Financing?

Access Lula’s Cash Flow Facility to Fulfil High Demand Without Draining Cash Reserves.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Why Inventory Financing?

Nothing can be more frustrating for a business than when you are expecting a significant increase in demand during peak season, but don’t have enough cash flow to purchase the inventory to meet it. You might have just received an unexpected bulk order from a customer but the cash you have on hand falls short. Or your cash flow may even be sufficient – but using all of it to meet this order could put your operations in cash flow trouble.

What’s for certain is that failure to meet any spike in demand can result in:

Losing the revenue that you could have earned from the demand

Missing an opportunity to increase your cash flow

Losing the profit needed to grow your business

Loss of business to a competitor

You can avoid this situation with inventory financing. With this financing, you can secure the cash you need to pay for your inventory so you can fulfil customer orders and earn the revenue, profit and cash flow your business needs to continue growing.

In what follows, we’ll consider what inventory financing is, how it works and how you can access inventory financing in South Africa.

What is inventory financing?

Inventory financing is a system where wholesalers and retailers can get the funding needed to purchase inventories required to fulfil customers’ orders.

In some cases, inventory financing companies (the financial institutions providing inventory financing) will only pay a part of the inventory value. However, there are cases where they will be willing to cover the entire cost.

Manufacturers use inventory financing to purchase raw materials while wholesalers and retailers (whether bricks and mortar or e-commerce) use them to purchase goods that they resell to retailers and customers. In actual practice, wholesalers and retailers are the most common users of inventory financing.

With inventory financing, you don’t need to offer any of your business assets (or personal assets) as collateral since the inventories themselves serve as collateral. Thus, if you fail to repay according to the agreed financing or loan terms, the financial institution can take that stock and sell it.

What are the types of inventory financing?

There are two main types of inventory finance solutions:

- Inventory financing loan: An inventory loan is a form of business term loan – an asset-backed, short-term loan that will be repaid over a period. Here, the inventory financing company provides a certain amount of money to your business for the required inventory purchase, and you make monthly payments to repay the loan amount. Inventory loans are common when the spike in demand is unusual (one-off) rather than seasonal.

- Inventory line of credit: On the other hand, an inventory line of credit (which is a form of business line of credit) is a revolving line of credit where you have access to a given amount of funds that you can use any time you need it. For example, if you have a R1,000,000 inventory line of credit (LOC), you can borrow funds up to that amount to purchase inventories. If you use R200,000, your limit will be reduced to R800,000 and once you repay, your limit will go back to R1,000,000. Inventory LOC is more appropriate for businesses operating in seasonal industries that regularly have demand spikes.

Who needs inventory financing?

If your business falls into any of these categories, then you might need to consider inventory financing:

If you are a business owner operating in an industry where demand spikes up in certain seasons (cold weather, holiday seasons, festive seasons etc.), inventory financing can help you meet the high demand in those busy seasons.

With 47% of South African SMEs struggling with cash flow problems, according to GQ South Africa, it’s possible that your business also deals with the same situation. Instead of turning down orders due to low cash flow, inventory financing can help you meet those orders, thus increasing your revenue and cash flow.

Business owners find it hard to secure business loans from banks due to the absence of collateral and low credit scores. Even when they qualify, the process is often tedious and time-consuming. If you are a small business that doesn’t have access to these traditional loans or seek an alternative to the bureaucracy surrounding them, inventory financing is a more accessible and convenient option.

As long as you are a product-based business (even if you don’t operate in a seasonal business), there is always the possibility of receiving unusually high demand that you can’t handle with your current cash flow. In that case, inventory financing can come in handy.

If you are concerned about having a strong cash flow, then you might prefer inventory financing to exhausting your cash purchasing inventories for an unusually large customer order.

How can you access inventory financing in South Africa?

If 47% of South African SMEs have cash flow problems, then having ready access to inventory finance solutions is an increasingly crucial need. So, how can you access inventory financing in South Africa?

- Inventory loan: You can get the equivalent of an inventory term loan through Lula’s Fixed-Term Funding solution. With it, you can get up to R5,000,000 and repay in 3, 6, 9 or 12 months, depending on what is convenient for your business.With it, you can purchase inventories to meet unusually high demand when cash flow is low or when you need to maintain stable cash flow despite the high demand.

- Inventory LOC: If you operate in a seasonal industry or your business tends to have regular demand surges, Lula’s Cash Flow Facility is more appropriate.With it, you can have regular access to funds up to a certain limit (that will be increased over time) to purchase the inventories you need to fulfil customers’ orders and meet other working capital needs.

How does inventory financing work?

Let’s illustrate how inventory financing works by considering two examples covering the two types of inventory financing.

Suppose you’ve received an order that will require you to purchase inventory worth R500,000. You don’t have the cash and have therefore reached out to a lender for an inventory loan.

The lender has agreed to pay for 80% of the cost with the inventory as collateral (R400,000). You have also agreed to pay over 6 months with interest set at a (hypothetical) 4%. This will require a monthly payment of R67,446 and a total payment of R404,679.

What if you are a seasonal business and chose an inventory LOC instead?

The lender will offer a certain credit limit that you can keep using. Suppose your limit is R1,000,000 and you have received an order for which you need R200,000 to purchase inventory. The lender will provide the R200,000 and your credit limit will now be R800,000.

If interest is 5%, for example, you will be required to repay R210,000. Once the payment has been made, your credit limit will be back to R1,000,000.

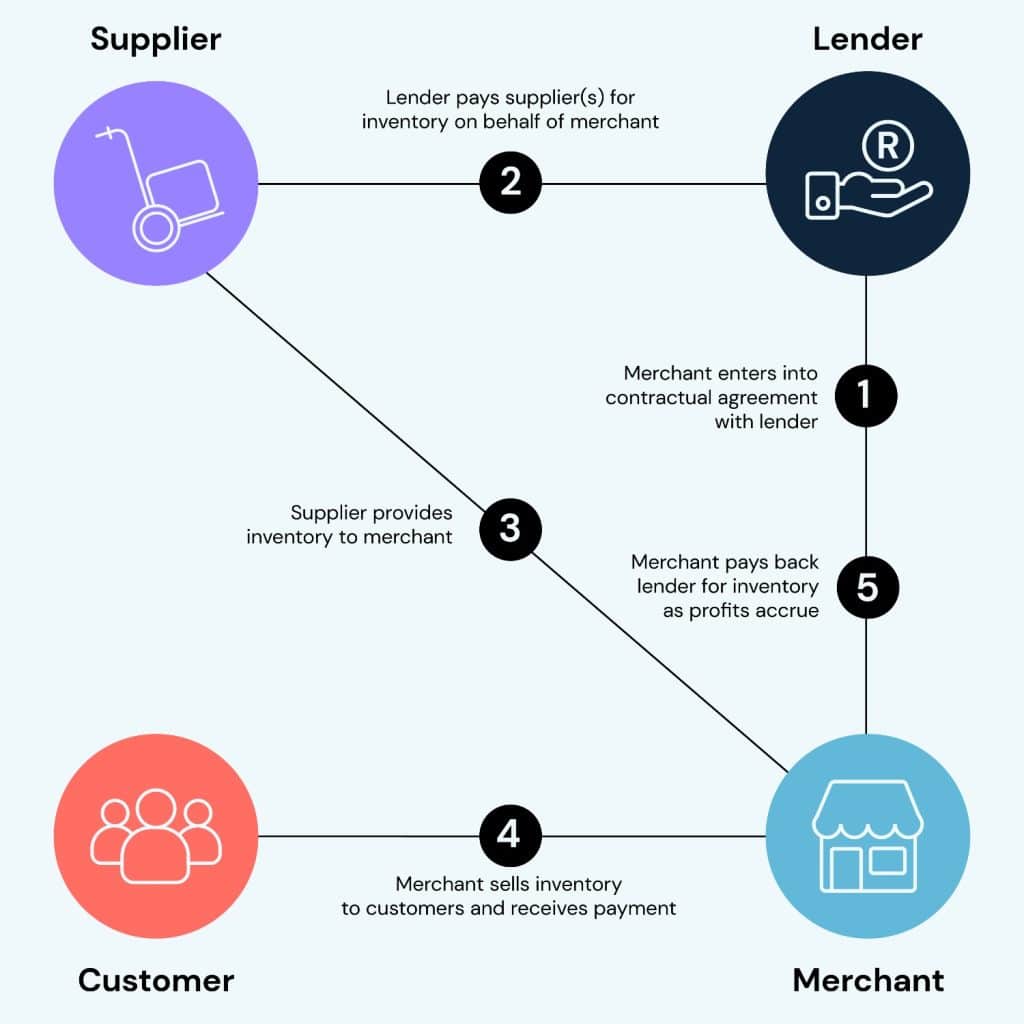

We can summarise the inventory financing process in the following steps:

- Customer sends order: It all begins with the customer sending an order.

- Strike agreement with the inventory financing provider: If you don’t have the cash flow needed to purchase inventories, you reach out to the financing company for an inventory loan or LOC. Some financing companies require a minimum level of inventory turnover ratio and gross profit ratio before they can supply the funds needed. Also, they will evaluate the type of inventory in view (perishability, depreciation rate, resale value, among others) and your inventory management system before deciding to work with you.

- The financing company pays for the inventories: The financing company pays for all or part of the cost of the inventories needed to meet the customer’s order. They can send the money to you or pay the supplier directly.

- The supplier delivers inventories: The supplier delivers the inventories.

- Customer receives deliveries: The inventories supplied will be used to fulfil the customer’s order.

- Customer pays for the delivery: The customer receives an invoice for the order and then pays for the goods delivered.

- Repayment(s) to the financing company: Depending on the nature of the inventory financing, you can repay the funding supplied in monthly instalments (inventory loans) or repay everything plus interest in a lump sum (typical with inventory LOCs)

The pros and cons of inventory financing

The pros and cons of inventory loans

Pros

Accessibility: You don’t need high credit scores to qualify for inventory loans. Even when the lender conducts due diligence, the process is not as stringent as that of traditional banks.

Inventory as collateral: Also, you don’t need to use any other asset on your balance sheet as collateral as the inventories themselves are the collateral. This is good news for SMEs who don’t have the kind of collateral often requested by banks.

Cons

High interest rates: Some online lenders impose high interest rates and fees.

Not available for services: Inventory financing is specially designed for retailers and wholesalers, and not service providers.

Not available for all inventories: Lenders often consider the perishability, resale value, depreciation rate, logistic challenges and the possibility of theft of inventories before deciding whether to provide funding.

In essence, not all product lines may qualify. And even if the inventory qualifies, inventory financing companies may not provide all the cash needed.

Pros and cons of inventory LOCs

Pros

Accessibility: They also don’t typically require credit reports

Inventory as collateral: The inventory purchased is the collateral.

Constant access to cash flow: Businesses in seasonal industries or with regular cash flow problems can have a consistent source of cash flow as long as they keep repaying.

Helps build your credit score: If you consistently repay and keep your credit limit, your credit score will increase and this may open the door to other funding options that require good credit history.

Cons

High interest rates: Some lenders have high interest rates

Not available for services

Not available for all inventories

Mismanagement risk: The fact that you can always access cash up to a credit limit can be a temptation to keep borrowing beyond your ability to repay.

What are the alternatives to inventory financing?

Inventory finance solutions are not the only business financing opportunities that you can use to fulfil customer demand when cash flow is low. Below are some popular alternatives:

- Purchase order funding: With this, the lender pays your supplier directly and the customer also pays directly to the lender. The lender then deducts the amount they paid the supplier and any financing fees before sending you the balance. There is no collateral involved in purchase order funding. Lenders are confident about it because the customer pays them directly.

- Invoice factoring: You can sell your outstanding invoices (on different orders you have fulfilled) to a financing company for cash. The financing company pays the amount on the invoice, minus fees (that is, fees are paid upfront), which is a percentage of the invoice (3%, for example). When the customer is ready to pay, the money goes directly to the financing company.

- Invoice finance: Instead of selling outstanding invoices, you use them as a sort of collateral to get new funds to fulfil customer orders. Unlike invoice factoring, the customer pays directly to you. Once you receive the funds, you repay the financing company with fees.

- Business credit cards: You can also get a credit card from any of the traditional banks. They are often more accessible than traditional bank loans.

- Merchant cash advance: This is a type of business funding that is available for businesses that receive lots of money from credit card transactions. The cash advance is repaid as a fixed percentage of future credit card receipts.

How can inventory financing help your business?

“Entrepreneurs believe that profit is what matters most in a new enterprise,” Peter Drucker, a management expert, once said. “But profit is secondary. Cash flow matters most.” But this is not unique to new businesses. “Never take your eyes off the cash flow because it’s the lifeblood of business,” said Sir Richard Branson, a British business magnate.

Without the required cash flow, you cannot fulfil new demand and it is only by fulfilling new demand that you can increase cash flow, revenue and profit, among others.

Therefore, by providing you with the necessary cash flow to fulfil the demand you would have cancelled, inventory financing can help you:

- Increase revenue: Inventory financing helps increase your sales and revenue, which is crucial to the growth of your business.

- Retain customers: Data analysed by Xirify, an online marketplace, found that “90% of consumers are unlikely to order from a business where there was a cancellation, edit or wrong items delivered in the first 3 orders.” Furthermore, 40% of loyal customers will bounce when order cancellation exceeds 3%. Therefore, by preventing order cancellation, inventory financing helps you retain customers.

- Improve cash flow: Increasing your revenue is a no-cost way to improve cash flow. By helping you earn revenue that you would have lost, inventory financing can help you solve your cash flow problems.

- Increase profit: If your revenue exceeds business expenses, then selling more will help you make more profit. Since profit is the engine of growth, inventory financing can help set you up on the path of business growth. Have your business’s cash flow challenges led you to pass over customer orders, leading you to forfeit revenue, profit and customers?

At Lula, we aim to help you avoid future occurrences by providing you with the cash you need to fulfil customer orders through our Fixed-Term Funding and Cash Flow Facility solutions.

Get the funding you need for inventory

You can get access to our business funding solutions in South Africa as long as you are:

A South African business

Have been established for at least a year

Have a minimum of R500,000 in annual turnover

Whatever business funding solution you choose...

We guarantee

- Quick access to funds: Completing our application process will only take a few minutes and we make funds available within 24 hours.

- Easy access to funds: We don’t request your credit score (or credit report) or any other paperwork. You can link your bank account for a quick real-time evaluation of your business.

- Competitive fees: Our fees are competitive. They are also fixed and transparent.

- Your data is safe with us. Your bank shares just your latest read-only transaction data with us: we don’t save or store your username or password and you can unlink your account at any time.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.