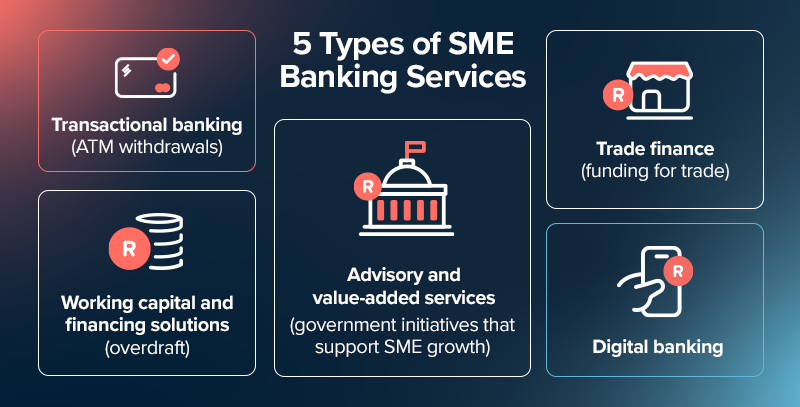

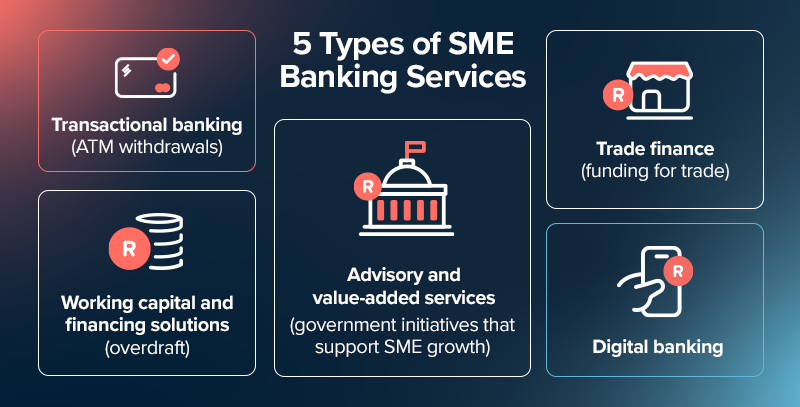

What are the Different Types of SME Banking?

SME banking covers various products and services, all of which should be designed to make your workday easier.

1. Transactional banking (including invoicing)

SME banking includes transactional banking, the nuts and bolts of what makes a business tick, like business-to-business bank transfers, ATM withdrawals and credit and debit cards.

Invoicing features also fall into this category. Many SME banking platforms integrate invoicing tools directly into their service, where you can:

- Create and send invoices directly from the platform

- Track payments in real-time

- Automatically match incoming payments to outstanding invoices

- Set payment reminders for customers

- Reduce late payments and improve cash flow predictability

SME owners rely on these daily services to manage cash flow and keep money moving smoothly across the business’s ecosystem.

2. Working capital and financing solutions

Access to cost-effective funding is key for SMEs.

Cash advances, revolving credit and overdraft facilities all help entrepreneurs cover short-term gaps and fund growth, without long delays or complex onboarding.

However, high turnover requirements and stringent credit demands are among the common reasons why small business funding applications get declined frequently in South Africa, making it a common obstacle to growth.

3. Trade finance

For SMEs involved in import, export or supply chain management, trade finance helps cover upfront costs and reduce payment risks.

Commercial banks and specialised lenders offer products like letters of credit and invoice financing to support global entrepreneurship, but Lula’s SME banking makes funding more accessible for business owners.

4. Advisory and value-added services

The best SME banking services offer business insights, financial planning and access to government initiatives or IFC-supported programmes that promote SME growth.

While not every provider offers a dedicated relationship banker, many of these providers give entrepreneurs data-driven advice to boost profitability. With Lula’s SME banking offering, small business owners receive assistance from a dedicated relationship banker to guide them through each step of the process and make the most of each benefit.

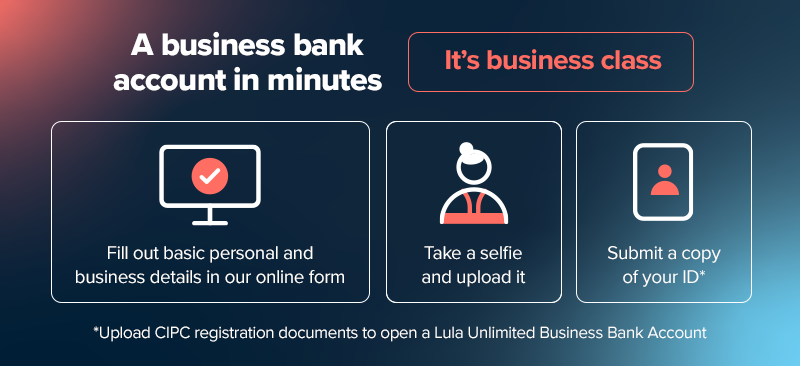

5. Digital banking platforms

Digital platforms act as a smart central hub that brings all of the above types of SME banking together.

The best examples make it easy to open accounts, apply for funding and track finances.

These banking solutions eliminate paperwork and bring fast, flexible banking services to SME owners wherever they are.