Looking for Working Capital Finance?

Get On-Demand Cash Flow in 24 Hours With Lula’s Cash Flow Facility and Fixed-Term Funding.

Get up to R5 million in business funding in 24 hours.

By clicking 'Apply Now' you agree to be contacted.

In an ideal world...

… a small business always has enough working capital to manage its day-to-day expenses, and enough liquidity to scale.

But immediate cash flow isn’t always on hand.

If you’re a small business owner, you may find that short-term financial challenges affect the cash you have available, including:

• Uneven revenue streams due to seasonal sales or a delay in payments

• Business expansion, like taking on new employees or opening a new branch

• High operating expenses, including utilities, rent and insurance.

The financial health of a young business often needs a helping hand. Particularly if its liquidity is all tied up.

Having access to on-demand cash advances allows businesses to take major steps forward while avoiding the dread of negative working capital.

Working capital financing is the solution that can provide this.

Here, we’ll explore how working capital financing works in South Africa, how your business can access it quickly and how Lula’s funding solutions can make a difference.

What is working capital finance?

Business owners know operating expenses can pile up fast.

When a company finds its outflow of cash is greater than its inflow, there’s a tremendous strain on existing financial obligations.

That’s where working capital financing comes in. It provides an injection of cash to address any pressing financing needs, or even to provide a safety net for the future.

What are the benefits of working capital finance?

There are several reasons working capital finance is important.

As a financing option, working capital lending offers both growing and established businesses the opportunity to keep everyday operations afloat during a dip in cash flow.

Securing this finance can also help businesses expand or nurture a part of their business when they don’t have the funds.

While profits matter to the bottom line of business, it’s the cash flow that keeps it afloat.

As Peter Drucker, a leading management consultant, once said: “Entrepreneurs believe that profit is what matters most in a new enterprise. But profit is secondary. Cash flow matters most.¨

This is why working capital finance is essential for the everyday running of SMEs and for forming a competitive advantage.

In short, by using working capital finance, businesses can easily:

• Offset the costs of day-to-day operations

• Cover financing needs without running into overdrafts

• Nurture new expansion initiatives

• Gain financial flexibility and a safety net

• Take advantage of early discounts from suppliers

Another major benefit is speed.

When getting business funding in South Africa, time is of the essence, so it’s helpful that many working capital finance tools get funds into your bank account quicker than traditional bank loans.

SME funding providers like Lula put time on your side. Lula’s unique offering means that, once approved, you can receive funds within 24 hours if you’ve opened a Lula Business banking account, allowing you to act without delay.

The long-term value of working capital

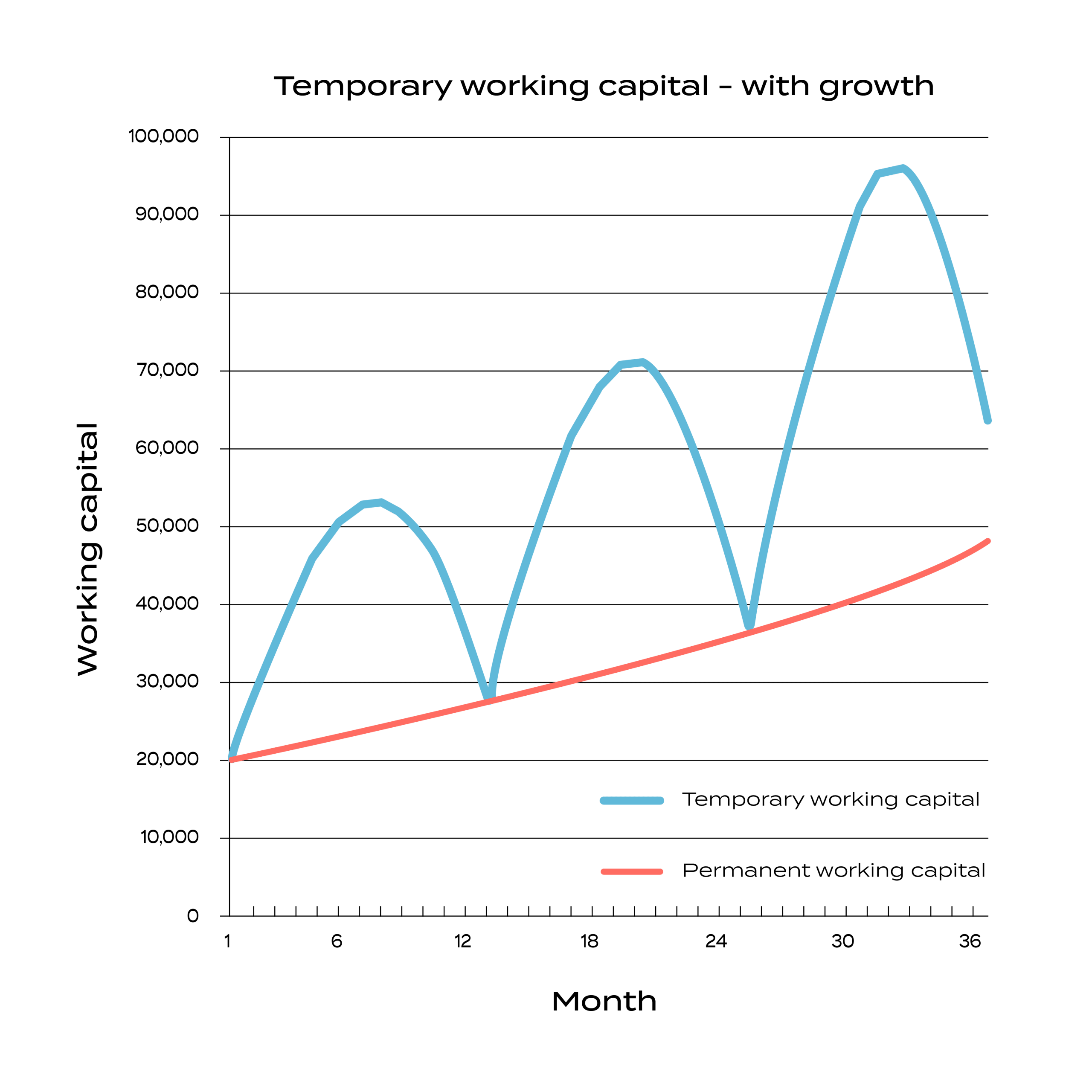

For short-term funding, working capital financing allows SMEs to get a stable footing and work towards steadying their cash flow as their business grows.

Indeed, the need for a source of permanent working capital rises (in line with sales) the longer a business operates, according to data from business strategists Plan Projections.

What are the 6 types of working capital finance?

Working capital finance in South Africa comes in many different forms, but most typically, lenders will work with SMEs in six ways:

A basic working capital loan is provided to cover day-to-day operational costs. The amount is paid as a lump sum, and interest rates and a repayment schedule are fixed.

Such a loan might come in the form of Fixed-Term funding, which usually works quicker than a normal loan.

An overdraft allows a business to take money on top of their business bank account funds up to an agreed limit.

Interest is only paid on what is withdrawn. If a business takes out more than the assigned amount, then overdraft fees apply.

A line of credit works on the same principle as an overdraft except that it’s separate from your bank account. It also tends to have more flexible terms. Businesses can then draw from these funds as they need.

A revolving credit facility is a line of credit that you can repay and reborrow without the hassle of reapplying. This makes it ideal for short-term expenses that need covering.

Much like an advance, this strategy allows businesses to borrow amounts based on what’s due from customers.

With the rise of retail finance these days, providing flexibility for customers to pay in instalments can put a burden on a company’s liquidity.

This form of working capital finance provides businesses with the funds immediately.

Asset-based financing provides funds based on the wealth of assets available. The lender first audits a company’s balance sheet, equipment, inventory and other resources before giving the green light.

Credit can be used for all business-related expenses, and interest rates are typically only applied to the amount withdrawn.

How do you choose the best working capital finance providers?

Business funding, while vital, needs to be handled carefully. Here are certain points to consider when selecting a working finance capital provider in South Africa:

Clearly identify your business needs and goals first so that you know what type of lender to approach.

Compare providers who prioritise flexibility, repayment terms, access to funds and interest rates.

Ensure that their terms meet your business needs and don't add financial strain.

Once established, regularly review the partnership with your lender and the change in cash flow.

What are the different components of working capital?

Before committing to any working capital support, it's crucial to understand what resources and liabilities you have. This will give you a good indication of your company's current assets and help with financial planning. Here's what you need to consider:

Assets

- Cash or liquid assets that are readily available.

- Accounts receivable from customers.

- Any inventory or goods that are waiting to be sold.

- Other assets, such as prepaid expenses or investments that may pay off in the near future.

Liabilities

- Operational expenses, like rent, wages, or utilities.

- Outstanding payments that are owed to suppliers or creditors.

- Short-term debts or term loans.

- Leases, taxes or accrued liabilities.

With these checks and balances in mind, you have a better view of your company’s short-term needs.

To understand this deeper, using a net working capital formula can give you the complete picture.

How do I work out net working capital?

So, what is net working capital in finance?

In short, it refers to a company’s current assets, minus its liabilities, and is a key indicator of its short-term financial health.

Before applying for business funding in South Africa, you should calculate your net working capital. Why? Because lenders will calculate this, too.

The information provides a clear indication of where your company stands and what it needs to move forward.

The net working capital finance formula weighs your assets and liabilities against one another.

Positive vs negative net working capital

A positive net working capital value demonstrates that a company has the funds to maintain its current operations and could potentially invest in future endeavours.

A negative result shows that there may be struggles with your short-term financial obligations. Here’s how it’s calculated:

Net working capital = current assets − current liabilities

For example, say you tally up your current assets, and they are as follows:

• Cash R10,000

• Accounts receivable: R1000

• Inventory: R20,000

Your assets would add up to = R10,000 + R1000 + R20,000 = R31,000

Then you count your liabilities:

• Operational expenses: R25,000

• Outstanding payments: R15,000

Your liabilities = R25,000 + R15,000 = R40,000

By using the formula, you can see that there is an operational deficit:

Current assets (R31,000) – current liabilities (R40,000) = -R9,000

In this case, you’ll need working capital finance to cover this amount.

How do companies raise working capital finance funds?

Applying for business funding in South Africa can be handled entirely online these days, unlike in the past with its mountains of paperwork.

Providers often ask for basic information about your business, including transaction data, to better understand your current liquidity.

Shortly after, you’ll receive a quote and, should you accept the terms, the necessary funds could be in your account in under a day!

Some service providers include a business funding calculator, allowing you to better understand interest rates and repayment timelines.

Ready to start your application for fast, easy funding with Lula?

Get funded

What are the requirements for working capital finance in South Africa?

Working capital requirements

When it comes to finding out if you're eligible for working capital support, minimum requirements will always vary from lender to lender. In South Africa, lenders will most likely want to know your business’s:

- Credit score

- Financial status

- Legal status

- Income taxes

- Assets and collaterals

- Business registration

- Time in operation

All these factors will determine your eligibility to receive financial support.

How to access working capital in 24 hours with Lula

Working capital finance can be cumbersome to secure in South Africa due to a restricted lending market and mountains of bureaucracy, not to mention the long list of requirements outlined above.

However, Lula excels in providing fast and secure working capital finance to small businesses without the tough criteria. This way, you can focus on maximising opportunity and gaining profits.

With a simple online application process, you don’t even have to leave the office.

You can choose from two working capital finance methods designed for small businesses.

Here's how they work:

Lula's Revolving Capital Facility

- Withdraw, repay and redraw funds without reapplying.

- Cover day-to-day business expenses.

- Benefit from financial flexibility, allowing you to pay only for what you use.

- Enjoy total financial control, with repayments on your own schedule.

- Instant access to funds.

Lula’s Fixed-Term Funding

- Bridge finance for business owners looking to explore new opportunities.

- Alleviate the strain of short-term expenses.

- Receive a quote in minutes.

- Repay as soon as you like, without penalties.

- Get funded fast.

With Lula, you skip the painfully long wait with banks. Because when business calls, it doesn’t wait.

Get capital right away in 24 hours or less. With Lula’s Cash Flow Facility and Fixed-Term Funding, businesses no longer have to miss out on those one-in-a-million opportunities due to financial restrictions or worry the next time payroll’s due.

Lula empowers entrepreneurs by providing working capital that helps businesses grow.

Apply today to start supporting your business’s cash flow!

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.