The original article written by Buhle Goslar, Lula’s Board Chair, is featured in Forbes Africa

In Africa, fintech solutions create opportunities for consumers and businesses, from lowering transaction barriers and costs to unlocking finance for credit-invisible segments.

The sector’s relevance in boosting economic productivity has been proven through pandemics, political upheaval and digital tax uncertainties.

However, there is headroom for growth: fintech accounts for just 5-6% of Africa’s financial services market. McKinsey analysts suggest that if current demographic and digitisation trends continue, fintech revenues could rise to $47 billion by 2028, up from $10 billion in 2023.

But we should not count these billions before they are banked.

These are uncertain times; we should focus on lessons learned over the past decade and consider how fintech can win in an increasingly polarised, transactional world where social impact alone cannot ensure survival.

What Have We Learnt?

1. Distribution is king

Winning in Africa is intrinsically linked to scaling distribution at the lowest cost, as established giants like MTN MoMo and M-Pesa did, followed by newer players such as Wave Money and Moniepoint.

Many consumers and small businesses lack access to fintech products due to poor internet access, fragmented digital footprints, logistical hurdles, or regulations that do not reflect local realities. Marketing alone cannot fix these growth barriers; distribution is key.

Fintechs succeed by adapting their models to close access gaps, embracing market creation, building beyond core products (e.g., agent networks), and reducing compliance friction and costs.

2. The cash is in solving pressing problems

Thankfully, we are past the era when each fledgling fintech had to fit the mould of “the X” – you know, [insert trendy US fintech name] – for Africa.

A small African middle class, burdened with many responsibilities and low switching costs, makes identifying a genuinely large serviceable market challenging. Products that help consumers generate or save money have been the most successful; context-responsive solutions consistently outperform.

Fintech-adjacent companies like d.light and Sun King sell essential assets such as off-grid solar appliances with embedded digital finance and enjoy a stickiness advantage by solving pressing problems. Similarly, B2B fintech-as-a-service and digital lending to Micro, Small and Medium sized Enterprises (MSMEs), where products drive revenue growth, have proven to scale faster – a boon for fintech infrastructure players and SME-focused neobanks.

3. Affordability and profitability

Pricing is often a tightrope for fintech companies. With limited resources, many African customers ignore gimmicks and focus on the full price of a product and opportunity costs.

Fintechs have learnt they can’t just ‘buy’ customers hoping for future profits; growth must be profitable now, primarily due to a challenging funding environment.

The juggling of product affordability and company profitability has led to right-sizing organisational cost structures, recognising that Silicon Valley’s operating models don’t fit Africa’s austere budgets. Many companies have reduced international hiring, favour local staffing and are exploring local cloud hosting and productivity tools to cut high currency costs.

4. Capital diversity is urgent

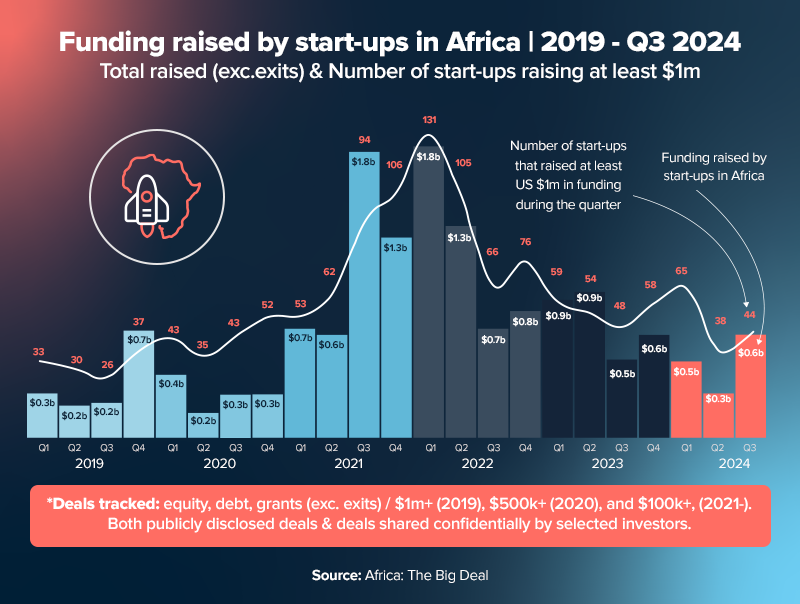

From the giddy peak funding period of 2021–2022 to the recent funding drought, African fintech has been on a roller coaster. We must accept that ‘capital follows the path of least resistance’ and move as an ecosystem to remove or counter existing frictions.

Take currency volatility. A fintech funded and reporting in USD but earning in a depreciating local currency will face tough investor conversations. Potential solutions include: local currency funds to fix currency risk at the funding source or hybrid debt/equity structures to optimise capital mix deal by deal.

Additionally, some African nations now seek to promote local ownership of critical financial infrastructure, which successful fintechs tend to become, a severe friction point for companies operating in an underdeveloped capital markets environment.

To diversify funding while increasing local ownership, we could look to more IPOs (challenging with Africa’s 30+ exchanges being fragmented and relatively illiquid) or, more realistically, greater involvement from African pension and sovereign wealth funds. Figuring this out is urgent, as the saying goes, ‘He who feeds you controls you’. Capital sources shape strategy, for better or worse.

5. Infrastructure matters

It is increasingly clear that core infrastructure (physical, virtual, and regulatory) turbocharges fintech success. Farmers may get digital loans, but they also need roads and ports to access markets. The ‘leap-frogging’ narrative as a cure-all is fading as foundational investments take priority.

Fintech products are woven into ordinary economic activity, so reliable electricity, internet, logistics, and enabling policies (e.g., data governance, tax incentives, or free trade) are critical for scaling across Africa’s 1.5 billion-person market.

While regulatory inertia historically hindered growth, there are positive signals from central banks in places like Ghana and South Africa that look set to accelerate market entry (e.g., National Bank of Rwanda and Bank of Ghana fintech license passporting talks) and innovation (e.g., crypto assets/stablecoin).

Other promising future developments include Mission 300’s energy investments, African Development Bank (AfDB), World Bank and Cassava Technologies’ partnership with NVIDIA to build Africa’s first AI factory and data centres. African fintech has delivered real social and economic gains while maturing through hard-won lessons. With $47 billion in play, we must play to win.