If you’re a small business owner and you haven’t already registered your business, now might be the right time. Once you register your business, you will get a CoR 14.3 certificate from the Companies and Intellectual Property Commission (CIPC). This business certificate legitimises your business and can set your business up for growth.

As an entrepreneur in South Africa, registering your business is the first step to unlocking growth. It’s more than just a legal formality. A business registration document gives you credibility and protection under the law.

You’ll also need a CoR 14.3 certificate if you’re going to open a dedicated business bank account. Although our Free Business Bank Account does not require a business registration certificate, our Unlimited Business Bank Account does.

Registering your business legitimises your business in the eyes of customers, suppliers and potential investors. It enhances your reputation and is a strong foundation on which to build a solid, trustworthy brand.

Registering your business can set your business up to become tax compliant. This helps you avoid penalties, interest and legal issues with SARS, as it formally sets up your business to pay the correct taxes and follow all regulatory requirements.

It also gives you legal protection. This means that if your business faces a lawsuit or financial claim, only the company’s assets would be at risk, not your personal belongings.

Why Your Business Needs a CoR 14.3 Certificate

In South Africa a CoR 14.3 document, or a business registration certificate, is issued by the CIPC once your business has been successfully incorporated.

It serves as proof that your company is legally registered and is recognised as a separate legal entity under South African law.

When you open a business bank account or want to apply for funding for your business it shows financial institutions who the directors of the company are and indicates that all the details match up with the application.

Here are the three key reasons your business needs a registration certificate:

- To be recognised as a legal entity in the eyes of your customers and financial institutions.

- To open a business bank account, or qualify for business funding.

- To benefit from tax benefits and incentives.

At Lula, you only need a business registration certificate if you decide to upgrade from a Free Business Bank Account to an Unlimited Business Bank Account. To open a free business bank account all you need to submit are your basic personal details, proof of residence, a selfie and a picture of your ID.

Once you’re ready you can start the CIPC business registration process to get your CoR 14.3.

How to Get Your CoR 14.3 Certificate from CIPC

1. Visit the CIPC BizPortal

BizPortal is a CIPC platform offering business registration and related services. It is through this portal that you can fill in the form to register your business. If you are not already registered as a CIPC customer you will have to register on the portal with your ID.

2. Access Your CoR 14.3 Certificate

Once you’ve registered you can log in and start the process.

- Once you arrive at the Bizportal home page, select “SERVICES” at the top of the page.

- Under the ‘SERVICES’ page, select ‘COMPANY REGISTRATION’ from the options on the page.

- On the ‘COMPANY REGISTRATION’ page, select ‘REGISTRATION CERTIFICATES’.

- Scroll down to the company details section and select ‘SEND’.

- Your certificate will be sent to the email you registered with, within 10 to 15 minutes.

Once you’ve completed the business registration process and have received your cor 14.3 certificate you can now more easily open a business bank account with us, or access business funding when you need it.

Having your cor 14.3 certificate means that your company is now recognised by South African law as a separate legal entity, with its own rights, responsibilities, and the ability to enter into contracts, own property and incur debts independently of its shareholders or directors.

The next step is to open a dedicated business bank account to ensure your business’s finances are managed effectively.

Why Open a Dedicated Business Bank Account?

If your business is structured as a sole proprietorship or (Pty) Ltd, keeping finances separate is important for showing a distinction between you and your business. You can risk losing limited liability protection if you mix your personal and business finances.

Here are a few other reasons it’s better to separate personal banking from business banking:

- You can easily present a clear record of business transactions for tax reporting.

- It helps you build a transactional history for the business, which is assessed by lenders when you apply for business funding.

- With everything in one place, accounting becomes easier for your bookkeeper or accountant.

- You can easily categorise expenses, making it easier to budget and track financial performance.

- It gives you easier access to lines of credit that are tied to a dedicated account.

- If you have investors, partners or stakeholders, it gives them a clear picture of how your business’s finances are being managed.

- You get added benefits like access to cash flow management tools or reduced banking fees.

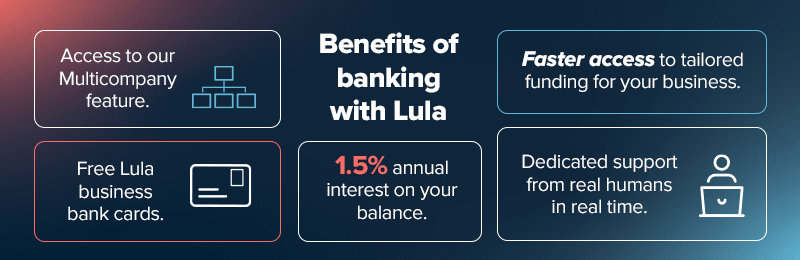

Benefits of Banking with Lula

Our Business Bank Accounts make it easy to stay on top of your business finances. What’s even better is that once you’ve opened a Free Business Bank Account or have upgraded to an Unlimited Business Bank Account, you start earning 1.5% annual interest on your balance. Other benefits of the Unlimited Business Bank Account include:

- Access to our Multicompany feature that allows you to manage multiple business accounts from one profile.

- Dedicated support from real humans in real time.

- Unlimited free EFTs.

- Free Lula business bank cards delivered to your doorstep.

You also get access to Lulaflow, a powerful cash flow management tool that gives you personalised insights into your business income and expenses. The tool allows you to effortlessly forecast your cash flow.

If you’re an established and growing business and want to take your business to the next level but need access to capital to grow, our business bank accounts makes it easier to apply for funding.

Make the smart choice for your business. Open a Free Business Bank Account.