Are you frustrated with your current small business bank account? Are you weighing your options or considering a change? Or are you currently using your personal bank account for business? When you have so many options, it can be a challenge to choose the right bank account for your needs.

Having an exclusive small business bank account that meets your business’s unique needs gives you a smooth user experience, and is a powerful enabler, giving you more control over your finances.

Additionally, it allows you to effectively manage and forecast cash flow. Trevor Gosling, CEO and co-founder of Lula, says that having a small business bank account that is exclusively dedicated to your business’s banking legitimises your business in the eyes of customers and suppliers.

He adds, “By managing all business-related income and expenses through a dedicated business account, your bank statement becomes a single source of your business’s income and expenses. It allows for easier cash flow management and can be integrated with cash flow management tools, supplied by your bank, to identify spending patterns and to forecast financial needs.”

The banking sentiment is also shifting, as digital channels become the primary means of transacting.

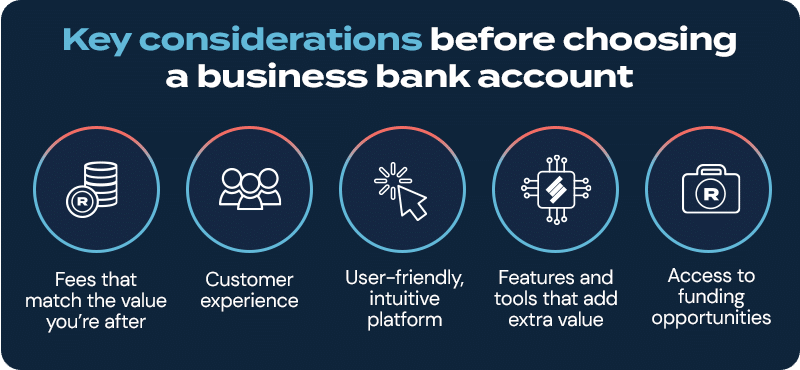

Here are a few key considerations before choosing the best business bank account for your small business:

Key Considerations Before Choosing the Best Small Business Bank Account

When searching for the best small business bank account in South Africa, here’s what to look for:

1. Fees that match the value you’re after

When you’re growing your business, a bank account with affordable fees and low transaction costs could be best suited to you.

On the other hand, if you’re looking for more advanced features to match your business’s operational needs, an account that meets these needs could come at slightly higher fees. Do your research, and compare the value you get from different bank account providers.

“Choosing an account that has a fixed cost allows your business to accurately budget banking costs and not have to worry about large bank charges impacting your monthly cash flow,” says Trevor.

2. User-friendly, intuitive platform

The ability to manage your cash flow on the go is vital. Business is all about speed, and time is money. You don’t want to have to worry about standing in long queues, or struggle to log in to a banking profile just to view your cash flow status or make simple transactions. With Lula’s Free and Unlimited business bank accounts, you can view financial statements, forecast cash flow and manage multiple business accounts from one profile.

3. Access to funding opportunities

When choosing a business account suited to your needs, it’s important to think about the long-term growth goals and support that your business needs. For example, a banking provider that also offers funding may be the right choice for you, as you can build some transactional banking history with the provider, making it easier to share this data as part of a funding application in the future. Lula’s banking solution streamlines the process, providing ease of access to both banking and funding profiles.

4. Customer experience

Another key consideration is the type and level of support you can get from your bank. If you’re banking on the go you want to be able to pick up the phone and get the help you need in seconds, not days. A banking solution that looks after your unique banking needs contributes to your success. Lula prioritises fast, simple and human-first service to meet customers’ expectations.

5. Features and tools that add extra value

Evaluate the range of additional features and value-adding tools designed to support business operations or other business benefits. Besides basic banking services like deposits and withdrawals, some banks offer integrated tools geared towards business growth that can enhance your business banking experience.

With these considerations, you can make a well-informed decision and choose the bank that best supports your business’s needs. Lula’s Multicompany feature gives you a holistic view of multiple business accounts that can help you track your balances and transactions to improve cash flow.

Kick-start your business growth today. With Lula’s Free or Unlimited business bank accounts, you can earn 1.5% interest per year on your balance, get fast, easy access to business funding, and real help from humans to assist you with all your banking needs. Get started now.