The world is changing faster than ever before, but you can’t say you didn’t see it coming. In 1965, Intel co-founder Gordon Moore predicted that the number of transistors on an integrated circuit would double every two years with minimal rise in cost. This observation accurately foresaw the long-term trend in how rapidly technology would change.

As a small retail business owner maybe you’ve thought of how you’re going to make this pivot or achieve other growth objectives to keep up with this trend. Small business funding could be the answer to unlock growth.

The rise of e-commerce and shifting consumer behaviour towards online shopping calls for retail business owners to pivot rapidly into the online space.

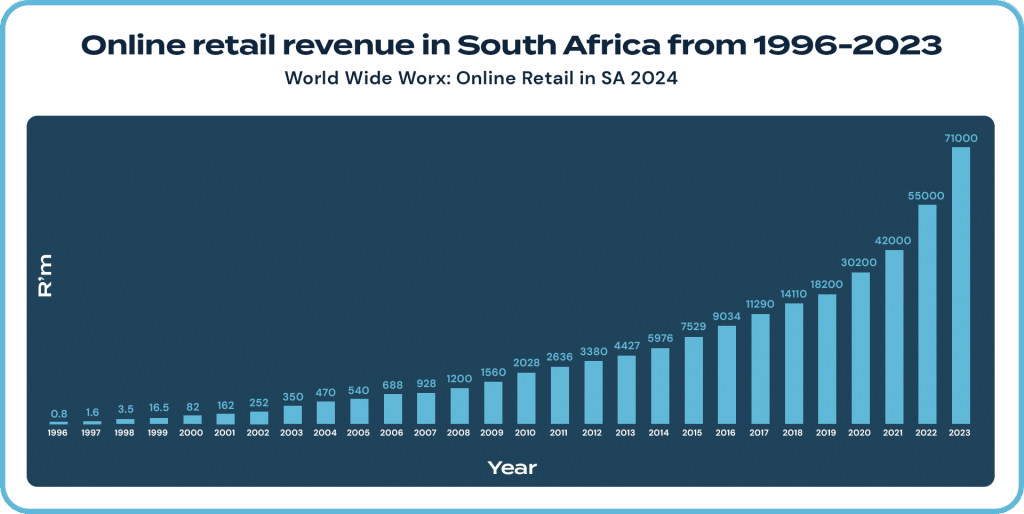

A study by leading technology research company, World Wide Worx, in partnership with Mastercard, Peach Payments, and Ask Africa, has revealed significant growth in South Africa’s online retail sector, reaching R71 billion in e-commerce sales in 2023, exceeding 5% of total retail.

According to the report the total growth for online retail in South Africa in 2023 came to 29%. As a small business owner maybe you’ve thought of how you’re going to make this pivot or achieve other growth objectives. Small business funding could be the answer to unlock growth.

The rapid growth in online retail points to a significant shift in consumer behaviour, with more South Africans opting for the convenience and variety offered through online shopping platforms. Access to small business funding could be the key to taking advantage of new opportunities in the online space.

The Importance of Access to Quick and Easy Retail Business Funding

In June 2024, South Africa’s retail trade grew by 4.1% compared to the same period in the previous year, according to Stats SA. This marked the fourth consecutive month of increases in retail activity, with the growth rate at its strongest since July 2022.

The largest contributors to this increase were general dealers and retailers in textiles, clothing, footwear and leather goods. Additionally, in Q2 2024, the trade industry contributed 0.1 of a percentage point to the GDP increase of 0.4%.

This significant uptrend in retail activity indicates positive momentum that can be leveraged for growth. Access to funding can help small retail businesses capitalise on this growth by investing in inventory, expanding operations, or investing in marketing efforts.

However, small businesses, including those in the retail industry, experience frequent cash flow problems, making it difficult for them to adjust and adapt to changes. This calls for reliable funding support to overcome these hurdles.

Preparing to Adapt to a Rapidly Evolving Retail Landscape

If you’re a retail business owner and you’re looking to launch an e-commerce store or expand your in-store offerings, you know that it involves more than just setting up a website or purchasing more stock. You can consider investing in advertising to market your new products, adjust your current physical store or implement digital marketing.

Another important aspect to consider is security. The web is fraught with phishing scams and anyone can fall victim to fraud attempts.

Securing Adequate Inventory to Meet Market Demands

The core component of a retail business will always be its product, and once all the other elements are in place, having substantial inventory to meet customer demand is a top priority.

In preparation for the festive season, inventory finance can help small businesses stock up to meet customer demand and reduce the risk of stockouts.

Inventory finance can also help businesses avoid operational challenges that would normally arise if available cash was used to purchase inventory in bulk.

This way, retail businesses can focus their efforts on expanding and funding new product lines. But there is so much more to retail finance to be explored. Here, you can discover some of the best retail business funding options available;

The Best Retail Business Funding Options to Consider for Your Retail Store

1. Cash Flow Facility

Lula’s Cash Flow Facility is a funding solution perfect for retail businesses.

It’s designed to give small businesses access to working capital to, among many other uses, purchase inventory to meet customer demand and keep cash flowing. Access the capital you need to invest in marketing or new technology in your business.

This funding option empowers businesses with up to R5 million. Fees are fixed and only repayable on the amount that is used.

2. Buy Now, Pay Later Facility

A ‘Buy Now, Pay Later’ (BNPL) facility is especially beneficial if cash flow is hindered by unpaid invoices.

This type of business funding helps consumers finance their purchases at a retailer’s point-of-sale (POS) checkout. With Lulapay, a Buy Now, Pay Later facility offered by Lula, customers can spread their payments over time, without hindering your business’s cash flow.

3. Purchase Order Funding

If your small retail business operates in a seasonal industry, purchase order funding is a good way to manage fluctuating periods of customer orders, helping you secure revenue and retain customers.

Purchase order funding is an arrangement where a third-party financing company provides the funds you need to pay your suppliers for the goods you need to fulfil your customers’ orders.

A simpler and faster solution to traditional purchase order funding is Lula’s Cash Flow Facility, which can also be used to fill the gaps in your cash flow.

4. Fixed-Term Funding

Another alternative to bank loans is funding in the form of a fixed-term lump sum.

This type of funding can be used to cover immediate costs between expected payments. Lula’s Fixed-Term Funding offers funding as a fixed-term lump sum that can be repaid over an agreed term of either 3, 6, 9, or 12 months with fixed costs that don’t change.

Apply for funding online in a few quick and easy steps and access up to R5 million in business funding within as little as 24 hours. Make cash flow and keep your retail business running and growing smoothly.