We’re in the grip of a long-term national energy crisis, so it’s little wonder more small-to-medium enterprises (SMEs) than ever are looking at solar finance in South Africa.

SMEs are part of a solar installation boom across the country, with imports from China more than doubling in 2023 alone, according to BloombergNEF data.

You may be the owner of one of these businesses, but have found that:

- Solar financing options are thin on the ground in a tight lending market.

- The solar finance in South Africa you do find comes with high interest rates and hidden costs.

- The time and hassle of finding and applying for this finance affect the running of your business.

All are relevant concerns, yet securing business funding for renewable energy solutions is becoming a pressing concern for South African entrepreneurs.

Load-shedding continues to plague SMEs, with Eskom cutting power to companies for a record 280 days in 2023 (up from 65 days the previous year), often for up to 12 hours a day.

Finding solar finance in South Africa to fund the likes of solar panels and water heating isn’t just a way of getting an edge over your competitors, but to survive.

Continue reading to find out who finances solar projects in South Africa, the financing solutions your business should consider, and how they work.

Don’t let a lack of renewable energy funding hold your business back. Explore Lula’s funding options today and learn how to access up to R5 million in just 24 hours.

How does solar financing work?

South Africa’s solar energy sector is set to grow by almost R70 billion by 2028, helped by government incentives and technological advances.

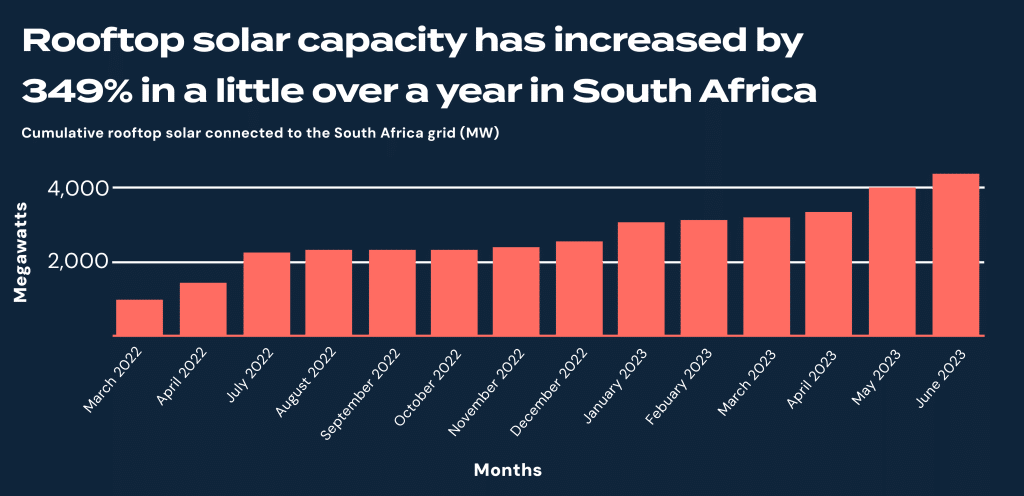

From 2022 to 2023 alone, rooftop solar capacity increased by 349% across the country, according to energy experts Energy Monitor. This boom is largely attributed to homeowners investing in home solar installations, but small businesses also play a big part.

Yet funding this renewable energy boom remains a problem for small businesses.

The upfront cost of a solar energy system (including panels, inverters and installation) ranges from between R150,000 and R350,000 for households and small businesses, to up to R3.5 million for a 100Kw system, which many companies use.

Solar system finance in South Africa is the best way for SME owners to access the benefits of solar PV without a large upfront cost.

Traditionally, it has worked similarly to a car loan, where you borrow the money to cover the system installation and repay it over a set term with fixed monthly payments.

A lack of financing options, however, means that solar finance lenders often impose tough repayment terms and high interest rates as they make the most of the demand for this type of lending.

The effect of this on your business can be problematic, with the cost of borrowing offsetting any gains you make on installing the solar system.

Finding the right solar energy solution, then, is crucial to make your investment worthwhile. So, how can you do this?

The 7 best solutions for solar finance in South Africa

So, what is the best way to finance solar energy in South Africa?

While this type of lending may be tight right now, there are several options for you to look at.

Here’s a balanced look at the best solar finance solutions in South Africa right now.

1. Traditional bank loan

A solar loan from banks and other financial institutions is still available to SMEs, yet these are often hamstrung by tough business loan requirements and a lengthy application process.

However, the major benefit here is that you’ll own the solar system and benefit from any future increase in its value, providing you meet the repayment plan.

If you don’t, the lender has the right to seize the system (or other assets you own) from you.

2. Capital advance

The old-fashioned nature of bank loans in South Africa has led to a wave of alternative lenders who provide solar capital advances on much better terms.

Lula’s Fixed-Term Funding is a great example. As with a bank loan, you get to own your solar installation, as you receive a lump sum to pay for it, but you get much more flexible repayment terms and you don’t need a credit report.

Instead, you can access up to R5 million in just 24 hours and free up valuable time to concentrate on other important business activities.

Applying takes just two minutes via a simple online form, and you can even work out how much you’re eligible for with our business funding calculator.

3. Power purchase or lease agreements

Purchase or lease agreements are ideal for businesses seeking a pay-as-you-go approach.

Here, the credit provider installs the system for you and you pay them a monthly electricity bill. This means you don’t own the system, so you have no control over future price increases and are reliant on the service provider for repairs and system uptime.

The difference between a purchase and lease agreement is that leases tend to include a fixed monthly cost, while the former depends on your usage.

4. Green bonds

A financing option for larger companies with access to the capital markets, green bonds allow you to own a solar system at a lower interest rate – and lower carbon footprint.

This option has the bonus of helping companies reach energy efficiency targets while saving money on electricity costs and interest payments.

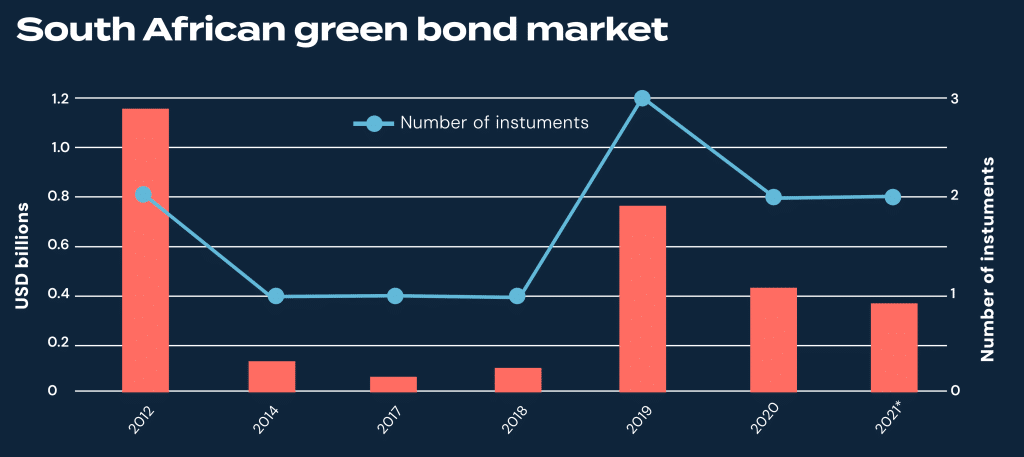

Green bonds often require an excellent credit rating, however, putting them out of the reach of many businesses. This explains why take-up has been patchy in recent years, with the 2021 figure around half that of two years prior, according to data from sustainability experts the Climate Bond Initiative (CBI).

The ups and downs of the South African green bond market

5. Fixed roof rental

This option, often used by malls and shopping centres, involves a service provider installing rooftop solar panels.

The property owner receives a fixed or variable fee for the use of their rooftop, while the service provider sells the generated electricity to the building’s occupants.

This allows property owners to benefit from a solar power supply without upfront costs, but requires sharing some of the financial gains.

6. Asset finance

Similar to a car loan, asset finance allows businesses to spread the cost of a solar energy system over a set term with fixed monthly payments.

This option offers ownership of the system and can be a good alternative to bank loans, especially for SMEs that may struggle with traditional loan approval processes.

7. Cash Flow Facility

Revolving capital is growing in popularity thanks to its ease of access and flexibility.

Businesses apply for funding and then receive access to a line of credit that they can use any time they wish. Then, once they pay it back, they can use the credit again and again, without needing to reapply.

Lula specialises in this type of funding. Our Cash Flow Facility is available within 24 hours to qualifying SA businesses and you don’t need to go through tedious checks or provide a credit report to apply.

Instead, you fill out a few simple details online and get an answer within a couple of hours.

Our facility allows you to scale up your solar system over time to meet your growing energy needs, and even use the credit for unexpected maintenance costs.

The responsibility for maintenance remains with you, but the revolving nature of the facility means you get to increase your borrowing power immediately and boost your business.

What’s the best way to finance solar energy in South Africa? Find out with Lula

From installing solar panels to adding energy-efficient appliances, renewable energy for your business seems like a great idea until you ask yourself, “How can I finance solar power?”

Solar finance in South Africa may not be as abundant as in other countries, but Lula’s flexible funding is designed to provide your business with the capital you need to become 100% powered by renewable energy.

Co-founder and CEO Trevor Gosling summed it up in a recent interview with Venture Burn. “Lula grants access to capital within a mere 24-hour timeframe, sans the requirement of collateral, and offers supple repayment terms.”

Our range of financing options, including the Fixed-Term Funding and Cash Flow Facility mentioned above, all share the same features that make lending simple:

- Fast application: Our two-minute form does away with extensive business checks or collateral. We do everything online and even offer a real-time evaluation based on your linked bank account.

- Easy access: Once accepted, you can use your funds within 24 hours and even borrow them repeatedly (without reapplying) with our Revolving Capital Facility.

- One transparent fee: You hate hidden charges and so do we, which is why you’ll pay just the one monthly account fee which you’ll know all about before you start with us.

- Borrow up to R5 million: You’ll get access to a deep well of funding, giving you the resources to scale your business.

Lula believes in funding green businesses, which is why our solar financing products are so accessible and competitive.

Take control of your energy future today. Get a free quote in just two minutes and see how easy it is to switch to solar with Lula.

Ready to get funding for your solar energy solution? Apply today and access up to R5 million in 24 hours with our fast-track application process.