Are you a growing business and want to achieve financial stability, but struggle to meet month-end payments just to keep operations running smoothly? Then you need to master cash flow forecasting.

Like the king of cash flow, American businessman and author of Rich Dad Poor Dad, Robert Kiyosaki says: “Making more money will not solve your problem if cash flow management is your problem.”

To see your business thrive, you need to honour month-end payments it’s a sure way to achieve financial stability. This is especially true in industries like manufacturing and construction. In these sectors, businesses often have to invest capital upfront for projects before receiving payments from clients.

In retail, cash flow forecasting is essential and can add great value to your business. Allistair Bunding, owner of sports apparel manufacturer Sports & Corporate, explains just how important cash flow is to keep things moving forward:

“In the manufacturing industry, things take time. We pay staff weekly, and some suppliers need to be paid upfront for fabrics and materials. You don’t want to be telling your staff on a Friday that you can’t pay them.”

Poor cash flow management can lead to missed month-end payments and harm your business by:

- Straining supplier relationships

- Incurring late payment penalties from suppliers

- Disrupting cash flow forecasting

- Tarnishing your business’s reputation

It’s possible to master effective cash flow management and overcome the struggle to cover basic operational costs. Learn how cash flow management and cash flow forecasting can set your business up, not only to survive, but to thrive.

What is Cash Flow Management?

Cash flow management involves tracking the cash inflows and outflows of your business. This gives you a better sense of your financial position. By monitoring expenses and income, you can identify patterns and adjust your spending.

With a clearer view of what to expect, you can plan accordingly. This guide explains effective cash flow management in detail and lists proven strategies to boost your cash flow. If you’re eager to begin your journey to cash flow mastery, you can also download this cash flow kit.

The first step towards achieving effective cash flow management is to create a cash flow forecast. There are plenty of free user-friendly apps and online tools that can help you forecast your cash flow in a flash. A few popular tools for small businesses are Xero, Quickbooks, Invoiced and Lulaflow, the cash flow management tool built into our digital business accounts.

Why is cash flow forecasting important for businesses? And what is cash flow forecasting?

What is Cash Flow Forecasting?

Your cash flow forecast gives you a glimpse into your business’s future, to see how much cash you’ll have, based on past data. By forecasting your cash flow, you can avoid running out of the fuel that runs your business. This means no more sleepless nights, worrying about paying rent or keeping the lights on.

The primary purpose of a cash flow forecast is to help you anticipate and plan for available funds. An accurate forecast can help you prepare for unforeseen expenses. It can also help you anticipate trouble well before it strikes.

Lula co-founder and CEO Trevor Gosling says, “As a business owner, understanding your cash flow gives you clarity about your monthly cash needs and can help identify the sources from which these can be met.”

Key Benefits of Cash Flow Forecasting

There are many benefits of cash flow forecasting. All of them point towards growth, success and the financial health of your business. Cash flow forecasting can help your business:

- Anticipate cash shortages

- Get funding more easily

- Identify customer issues

- Identify supplier issues

- Predict seasonality

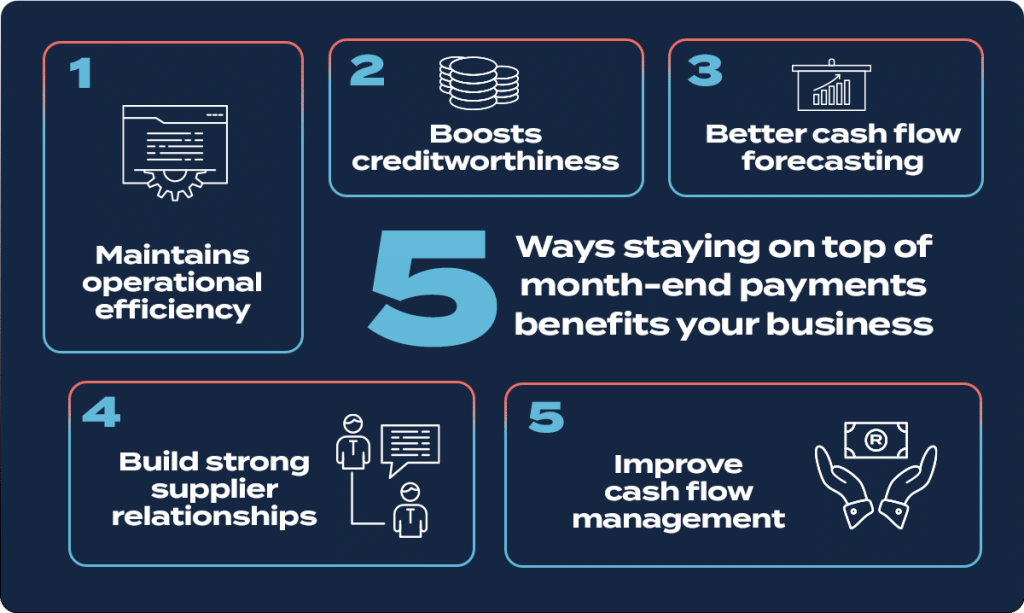

Here are a few practical tips you can apply to never miss a month-end payment again:

Tips to Help You Honour Month-End Payments

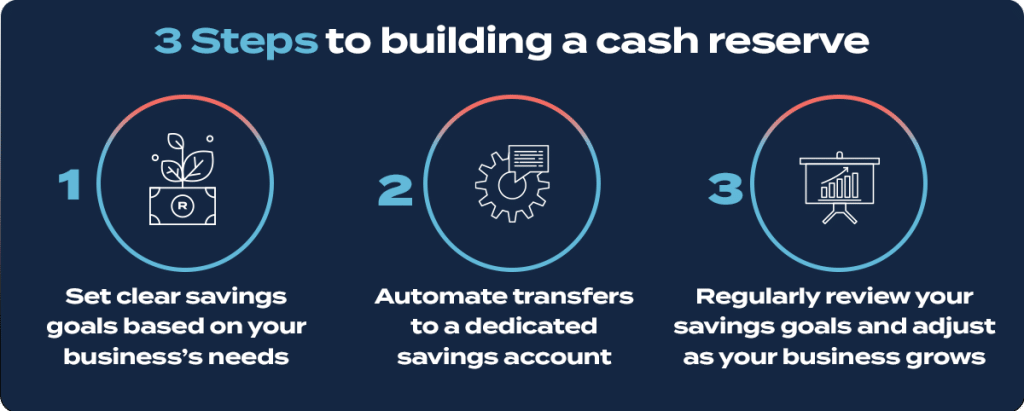

Build a cash reserve for flexibility

One of the simplest ways to improve financial flexibility is to build a strong cash reserve. A cash reserve acts as a safety net, allowing you to cover unexpected expenses without disrupting your operations. To build a strong cash reserve you can:

Set savings goals: Establish clear savings goals based on your business’s needs and potential risks to get a good indication of what you’re able to put away, without negatively impacting other aspects of your business.

Automate savings: Set up automatic transfers to a dedicated savings account to ensure you make consistent contributions.

Conduct regular reviews: Make a habit of periodically reviewing your savings goals as your business grows and evolves, to ensure that your cash reserves are adjusted accordingly.

Negotiate favourable payment terms with suppliers

Negotiating favourable payment terms with suppliers is one way to ensure that month-end payments are always honoured. You can do this by requesting an extended payment deadline. This will give your business the flexibility to align cash inflows from customers with cash outflows, reducing the risk of a shortage.

Access alternative funding to ease cash flow

For many small or medium businesses, funding is a crucial component of a healthy cash flow management cycle. It provides a business with the immediate capital to cover everyday expenses, pay suppliers and handle other financial obligations like payroll and utility bills. With quick access to funding, you can take advantage of growth opportunities, like new projects or expansions, which can improve future cash flow.

Alternative funding options like Lula’s Cash Flow Facility and Fixed-Term Funding give you quick, easy access to up to R5 million in funding when you need it. See it as extra cushioning to ease your cash flow needs through periods where cash flow runs low.

Say hello to stress-free cash flow management, eliminate the month-end payment stress and start exploring Lula’s alternative funding solutions to see your business thrive.