Looking for Growth Capital?

Lula's Cash Flow Capital Facility gives you flexible access to the funding you need.

Get up to R5 million in business funding in 24 hours.

By clicking 'Get Funded' you agree to be contacted.

Need the fuel for your next phase of expansion?

You've built a solid foundation. You've got the track record. Now, you need the fuel to ignite your next phase of expansion. Yet if you’re one of many entrepreneurs seeking growth capital in South Africa, you’ll probably have come across the following challenges:

- Your business has hit a ceiling. Demand is there, but you lack the funds to increase production or expand your team to meet it.

- You’re struggling with cash flow. Large orders and supply chain gaps stretch your resources, stopping you from investing in the growth you know is possible.

- You're seeing competitors capitalise on market gaps or new technologies, but you can't invest in the equipment or R&D needed to compete.

- You’ve tried applying for growth capital funding before, but have been turned down thanks to strict lender criteria.

Business growth is impossible without the right capital. This makes finding a source of growth capital essential.

Read on to read more about examples of growth capital, why it’s so important, and how alternative funding is helping to solve this critical growing pain for businesses in South Africa.

What is growth capital?

Growth capital is a type of funding that helps businesses that are ready to scale up.

Unlike early-stage funding for start-ups, growth capital funding targets small and medium-sized enterprises (SMEs) that are established in their market and show signs that they are ready to expand.

This is why growth capital is often referred to as expansion capital.

Growth capital providers offer funding to help unlock growth opportunities and take successful businesses to the next stage of their lifecycle.

What is capital growth?

Capital growth refers to the increase in your assets’ value over time, including:

• Property and land

• Investments

• Your business’s worth

While not the same as growth capital, we can see one leading to the other.

Growth capital is about securing funds for expansion, and capital growth is the resulting increase in your business’s value as it develops.

What is a real-life

example of a growth capital investment?

Growth capital can help any business expand and reach the next stage of its development.

To understand how this might work in South Africa, let’s look at a hypothetical example of a Cape Town artisan bakery Khaya Breads.

Khaya Breads’ owners have built a loyal customer base with their unique sourdough loaves and pastries, sold at local markets and a small shop. Demand is soaring, with restaurants and cafes wanting to stock their products.

To meet this, Khaya Breads needs to invest in:

- Larger ovens and more cooking equipment

- New delivery vehicles

- Extra staff

Growth capital would enable Khaya Breads to move from a local favourite to a regional supplier and reach the next stage of its development.

Why is growth capital so important for businesses?

The goal of any business is to grow to its full potential, and growth capital is the driving force behind that.

Financing fuels the core initiatives behind expansion, including:

• Product development

• Equipment purchases

• Hiring staff

• Expansion into new markets

• Strategic mergers or buyouts

Access to this capital grows liquidity, strengthens the management team, and, when done well, drives the sustainable profitability that leads to success.

What happens if a business doesn’t seek growth capital?

Without growth capital, businesses risk stagnation – a potent threat.

A lack of funding means they miss crucial growth opportunities and fall behind competitors who are investing in product development and new functionalities.

This, in turn, impacts their chances of retaining customers and the future revenue that comes with it. This can hurt their chances of attracting future equity investors.

Let’s take the above example of Khaya Breads; without the necessary capital, they remain confined to their local market, unable to expand production or distribution.

Competitors offering similar artisan products but with access to funding could seize the expanding regional demand, leaving Khaya Breads behind, and their potential for becoming a large, established bakery would fade.

What are the different types of growth capital?

Growth capital comes in various forms and often comes down to where the business is at in its lifecycle and what it plans to achieve.

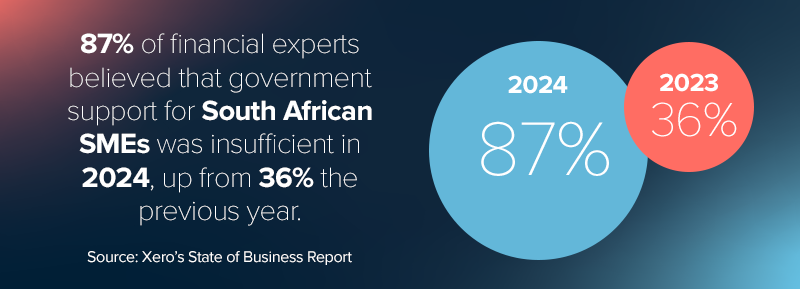

This type of funding mainly comes from private sources, with government lending being more difficult to access than ever. Xero’s State of Business Report puts this into sharp focus by reporting that 87% of financial experts believed that government support for South African SMEs was insufficient in 2024, up from just 36% the previous year.

Here are the most common types of growth capital funding from private sources that you might come across:

1. Growth equity

When established business owners want to access funding without immediate debt obligations, they often turn to growth equity investors.

You might see this referred to as venture capital or private equity investments.

These investors are typically private equity firms or family offices (investment firms run by high net worth families) that provide funding in exchange for a stake in the company – similar to what you see on the hit TV show Dragons’ Den.

This capital helps the business expand, but the lower ownership stake means less control and lower returns for the founders further down the line.

2. Debt financing

Debt financing for SMEs involves borrowing money from a lender, with the agreement to repay it with interest over a set period.

The obvious positive is that you retain full ownership with this funding, unlike with equity financing.

Yet qualifying for this funding can be tough. Many South African SMEs struggle to obtain debt financing because they don’t meet strict lending standards.

High interest rates and fees can also make it very expensive to borrow in this way and many companies fall into a debt spiral as a result.

3. Mezzanine financing

Mezzanine financing is a halfway house between equity and debt financing and is when a business receives a loan that can be converted into equity if it defaults.

This flexible form of funding immediately reduces cash flow pressure and normally doesn’t have severe non-payment consequences like a normal loan, but it often carries a higher interest rate than traditional debt financing.

4. Alternative SME funding

The lack of funding for South African businesses seeking to expand has left a gap in the market because the appetite for SME financing is still strong.

A new wave of funding solutions has emerged that seek to meet small businesses where they are.

These affordable lending products are free from the expenses and red tape that bog down traditional financing and are designed for today’s fast-paced online world.

Designed to provide rapid access to working capital through flexible facilities, like Lula’s Cash Flow Facility, this alternative funding lets SMEs seize growth opportunities when they arise.

While larger banks may offer tools that stimulate cash flow, Lula stands out as the only SME funder in South Africa to provide a fully digital banking platform specifically tailored to SMEs.

What are the

challenges of accessing

growth capital?

Securing growth capital presents numerous hurdles for SMEs in South Africa. Traditional lenders often impose stringent criteria that demand a high level of future profitability and a lengthy track record of success, which can exclude many businesses with high-growth potential.

Investors also closely scrutinise growth plans and strategies and base their decision-making on whether the applicant is ready for new product launches or new market entries. Businesses often struggle to find the time to show evidence of all of this, and may even need to employ new staff to achieve it.

Finally, finding the right type of investment that aligns with the business’s development stage is tough. A wrong step could prove costly, so making this decision demands hours of research.

Access flexible growth capital with ease. Make cash flow with Lula.

Scaling your business shouldn’t feel like hacking through a financial jungle, where unexpected obstacles stall your momentum.

Waiting for traditional funding often feels like waiting for slow-moving supplies – holding your business back from making progress, or simply surviving.

Lula’s Cash Flow Facility is a fast-growing alternative to strict lending requirements and bank form-filling. We provide businesses with a compass to clear growth with fast and flexible funding that:

- Cuts through the red tape, with an easy online application.

- Provides a commitment-free quote within hours, rather than days.

- Gives access to up to R5 million, within 24 hours of approval.

Once approved, you can draw down funds when you need them so that you can keep your growth strategies on track.

Borrow the money again and again, with no need for reapplying (subject to a credit assessment), and you can repay early, anytime, at no additional cost.

“All our costs are based on the principal amount borrowed so you know exactly what is due, and on what date, when you sign the contract,” says McKinnon.

With Lula, you only pay for what you use with a single all-inclusive fee, so you can forget about spiralling interest rates and hidden fees. You can also tailor your borrowing to fit your trajectory.

“You can plan to service our funding as part of your growth journey. Remember – if you can handle a small advance, the practices and learnings there are scalable to your business as it grows. If you start with R20,000, for example, and use that to grow your business, you might be eligible for R50,000 next time, subject to overall affordability,” says McKinnon.

Make cash flow with our Cash Flow Facility and reach exciting new business territory.

How to qualify for Lula’s funding – our answer to growth capital

Many lenders scare off potential customers with sky-high demands and exorbitant rates, but Lula is different. Our lending model is based on the true potential of your business, not just credit reports and bank statements.

You probably qualify for our SASFA-backed funding if you:

• Are registered in South Africa.

• Have at least one year of trading under your belt.

• Have at least R500,000 annual revenue.

Focus on expansion, not funding delays. Make cash flow with our Cash Flow Facility and reach exciting new business territory.

Trusted by business owners like you.

Keep in touch 🙌

Sign up for tips, insights & inspiring stories to help grow your business.

By signing up, you consent to the processing of your personal information for the purpose of direct marketing by means of electronic communications.