Being approved for business funding is not the easiest process. Every day thousands of small business loan applications are declined across South Africa.

In an assessment of South Africa’s SME landscape published by In On Africa (IOA) for SME South Africa, out of the 1,157 SME owners surveyed, 33% indicated that they have been refused funding for several reasons.

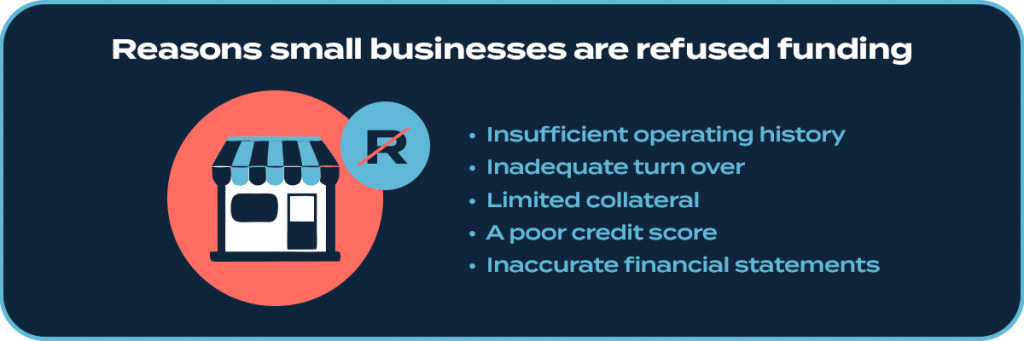

Reasons Small Business Funding Applications are Rejected

- Insufficient operating history

- Inadequate turnover

- Limited collateral

- A poor credit score

- Inaccurate or outdated annual financial statements submitted

Before you apply for small business funding, it’s important to familiarise yourself with the best funding options for your current business needs. Knowing the difference between a traditional business loan and alternative funding options like those offered by Lula can help you make the best decision.

Every funding provider has their own set of criteria that could determine whether you are approved for funding. Traditional funding options like bank loans, overdrafts or credit facilities usually have more stringent requirements and criteria that are difficult to meet.

In the 2018 survey carried out by SME South Africa, 6% of businesses that responded said they received government funding and 9% said they received funding from private sources. Furthermore, 24% cited business incubators as their primary source of funding while 20% cited large financial institutions like banks.

Besides the common traditional business funding options like government funding and traditional bank loans, there are alternative funding options designed for small businesses. Business funding fintech Lula simplifies the application process and offers solutions with flexible terms and less stringent application requirements.

Alternative small business funding options available include:

- Bridging finance

- Purchase order finance

- Inventory finance

- Retail finance

- Manufacturing finance

- Crowdfunding

Your business can also benefit from alternative small business funding products like a Cash Flow Facility and Fixed-Term Funding.

Improve Your Chance of Being Approved for Small Business Funding

Now that you’ve explored different funding options and you want to prepare for the application process, you may be wondering: What’s next?

1. Register your business

First things first. A funding application will not be considered if your business is not formally registered.

You can register your business online in minutes on the Companies and Intellectual Property Commission (CIPC) website. Most funding providers, including Lula, request a company registration certificate or a COR 14.3 Registration Certificate. Having this on hand goes a long way to help ensure your small business is approved for funding.

2. Have your personal documents ready

Most funding providers including Lula need personal identification documents for any application.

If your business has more than one director, you will need to submit ID documents for every director when applying at Lula. This enables us to verify your identity to make sure you are who you claim to be. It is also used to assess creditworthiness. Increase your chances of a smooth funding application assessment by checking that your documents are accurate.

3. Financial statements

Some banks and traditional financial institutions require a basic business plan, cash flow projections, proof of outstanding debtors, up-to-date management accounts, your business’s latest annual financial statements, latest VAT statement, past 3–6 months’ bank statements and a tax clearance certificate.

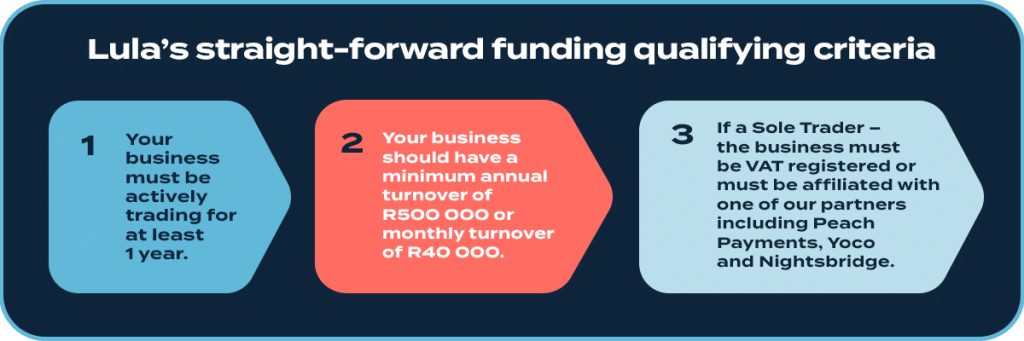

These requirements may vary depending on the amount of funding you need. When applying for Lula business funding, only 3 months of transactional data, in addition to personal and business details, are required.

4. A history of trade

A lender would want to know how long your business has been operating for.

Common minimum periods are six months, one year or even two years. Lula’s minimum requirement is one year.

5. Collateral

In South Africa, collateral can include assets like property, vehicles, equipment, or even financial assets like stocks and bonds. Essentially, collateral helps protect the lender. If a loan isn’t repaid, the lender can take and sell the collateral to recover their money. To get a better understanding of the process, here is an overview of the legal procedure.

Alternative lenders, on the other hand, don’t request collateral. Lula does not request collateral before granting funding.

6. A good credit score

Responsible lenders perform credit checks on applications and conduct searches on court judgements to measure your risk. It’s a good idea to run a credit check on your business with a credit bureau before applying for funding.

Sometimes information on a business credit record can be inaccurate and can be addressed by:

- Cross-checking the information on the business credit report with bank statements to ensure that any inaccuracies are documented clearly.

- Submitting a formal dispute to the credit bureau that issued the report to request that inaccuracies be corrected.

Only inaccurate information can be removed from a business’s credit report; negative information that is accurate will stay on the credit report. TransUnion performs free credit report investigations, in accordance with applicable legislation.

Now that you know the basic requirements to maximise your chance of being approved for business funding, you can prepare for the application process. If you think you’re ready and have everything you need, skip the queues at traditional banks, say goodbye to long approval waits, and apply online for fast, flexible funding with Lula – designed for small businesses just like yours.