Festive season preparation for South African SMEs can be a real challenge if you’re not prepared. Consumer behaviour tends to peak during the festive season, which directly translates to higher profit margins.

While this presents an excellent opportunity for growth and expansion, it can also pose challenges when managing cash flow, especially for small businesses like yours in the retail, hospitality, tourism and beauty industries.

The best way to leverage all the activity is to be prepared. Even with specials and promotions from other businesses creating tough competition, you can give your business an edge with early preparation and careful planning. Below, we share tips to help your business get the most out of the festive season peak.

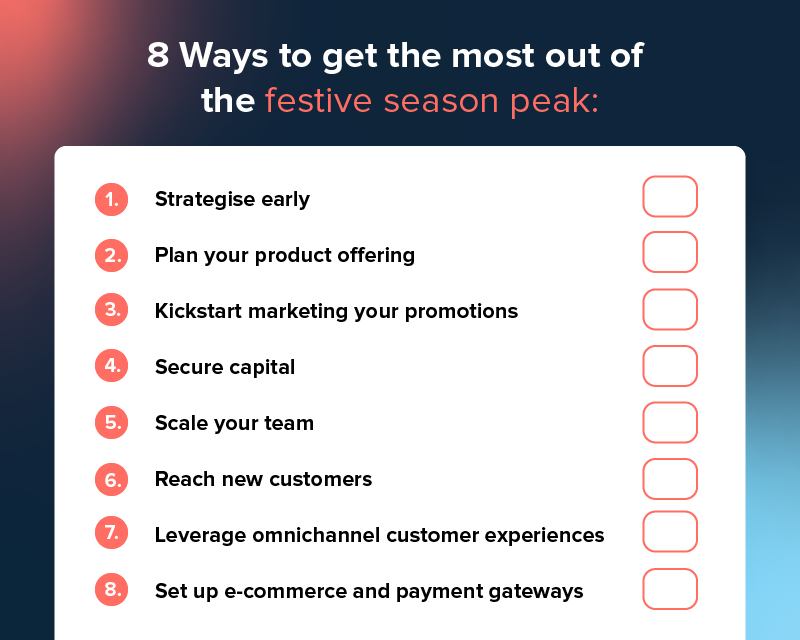

8 Festive Season Preparation Tips for South African SMEs

1. Strategise early

The festive season is filled with public holidays and is a time when many families and individuals go on holiday.

The opportunity for high sales volumes begins as early as Black Friday, and to add to this, many retailers start running their Christmas promotions from late October into early November.

It’s vital that you factor these and other seasonal schedules into your plan so that you aren’t caught off guard.

The earlier you do the planning, the more time you have to develop specific actions and align your resources to ensure you take full advantage of the opportunities that will inevitably arise.

2. Plan your product offering

Just because it is a busy shopping time of the year doesn’t mean all your products or services will be a hit.

Thoroughly research your audience’s needs, challenges, price points and current seasonal trends to understand the products to prioritise. Don’t forget to use your accumulated learnings from previous peak seasons to help in planning your product range.

3. Kickstart marketing your promotions

Once you’ve established your action plan and decided on the products or services you’ll focus on, you can start your marketing and promotional activities.

Create enticing offers that are not necessarily discounts, but rather value-adds for your customers that will help to position your business top of mind for the future. During the festive season, consumer attention is contested by many businesses, so you want to ensure that you stay ahead of the competition.

Choose a mix of marketing channels that align with your audience and reach out to them in the best way possible.

Consider which of the following works best and get creative:

• social media;

• email;

• search engine marketing tactics (SEM), as well as

• traditional offline advertising, e.g. radio/television, newspapers and direct mail.

4. Secure capital

During the festive season, you may need to have more funds readily available to hire more staff or set up promotions and holiday displays.

Catering to the anticipated demand to meet customer needs also means having enough stock and materials for production.

Collecting these resources can be challenging with stock delays and limitations, but can also be financially crippling, especially for small and medium-sized businesses trying to make ends meet.

Financial preparation lays the groundwork for a sales boost today and presents the opportunity to chase your dreams into 2026 with your arsenal in hand.

You can either hobble through to year-end wishing you had prepared your business for the highs and lows it presents, or you can set the wheels in motion for a productive season and quiet, relaxing time when it’s all over.

If you are finding yourself on that ‘last-minute.com’ branch, one way to win is to have fast access to business funding to solve your cash flow problems.

If you don’t have enough cash flow to support your growth plan and give the season your best shot, speak to a trusted lender about securing a line of credit or short-term small business funding.

Lula, for instance, offers access to a capital boost with quick turnaround times, flexible repayment terms and zero collateral required.

Apply now to secure a boost for the upcoming peak season.

5. Scale your team

As the year-end approaches, demand will increase, eventually leading to a heavier workload. Based on this, you’ll need to hire more people to meet the demand, which can be pretty costly in terms of both time and money.

However, the idea that many hands make light work is a philosophy that rings true, even in finances.

Business funding gives you access to capital that can help ease the pressure of recruiting and training staff to meet the surge in demand.

6. Reach new customers

At this time of year, the competition is through the roof, and if you are in retail, why spend on stock if you can’t tell your customers about it?

If you choose to apply for funding in retail, you should ultimately add a marketing amount to your pot and maybe even a professional marketing service to get you places fast.

7. Leverage omnichannel customer experiences

With the above factors in mind, an integrated approach that offers a seamless shopping experience for consumers, whether they are shopping from a desktop, mobile device or in a physical store, puts you at an advantage.

For example, customers might buy online and want to collect in-store later that same day rather than wait two to three days for home delivery.

Ideally, you want a solution that can cater to all of these customer journeys.

Lula offers access to small business funding solutions that give your business a cash flow boost for the times that you need additional funds without delay. We offer unsecured business funding that is easily accessible within as little as 24 hours.

We also offer the option to settle early without worrying about penalty fees. Learn more to optimise your channels with the help of funding.

8. Set up e-commerce and payment gateways

For the 2025 festive rush, a seamless digital experience is non-negotiable. E-commerce platforms need to be mobile-responsive and undergo stress testing to handle the expected surge in traffic, especially during the Black Friday/Cyber Monday (1 December) period.

Businesses should update their payment gateways to offer a diverse and seamless checkout experience, including popular methods like instant EFT, QR payments and buy now, pay later (BNPL) options.

The festive season can also pose risks for small businesses like cyber fraud. But with enough planning and preparation, you can make it a profitable period for your business.

Furthermore, you can harness social commerce by enabling direct purchases via platforms like WhatsApp or Instagram. This ensures your gateway has scalable infrastructure and robust fraud prevention (like 3D Secure) to maximise conversion rates and maintain customer trust during peak trading.

A proactive approach enables you to cover crucial upfront costs like bulk inventory purchasing (often at better supplier rates), seasonal staff hires and executing major marketing campaigns before the holiday rush.

Stop Waiting and Start Growing: Unlock Capital for Your Small Business

Traditional loans can be slow, so businesses are increasingly turning to alternative, flexible solutions like a cash advance or short-term unsecured business funding.

These options provide quick access to working capital and feature repayment terms that adjust to daily sales volumes, preventing a cash flow crunch during the post-holiday slump in January.

Don’t let a temporary cash flow crunch hold your business back during the festive season. A

ccess up to R5 million in business funding for your small business within as little as 24 hours. The online application process is fully digital and you can fill in your business details in minutes to see if you qualify.

If you want an estimate of what your repayment term would be, you can do a quick calculation with our business funding calculator.