E-commerce in South Africa is evolving faster than ever.

A South African shopper’s journey from scroll to sale can now happen in seconds. One moment they’re watching a social media video; the next, they’ve placed an order – all without leaving the app.

This instant, frictionless way of buying has redefined what it means to run an e-commerce business in South Africa.

Consumers are now much more confident online, and digital payments have become second nature. The result is an e-commerce sector that’s faster, more social and increasingly shaped by local entrepreneurs.

As 2026 approaches, this transformation shows no sign of slowing down.

These 10 emerging e-commerce trends reveal how South Africans are reshaping digital retail – and what small businesses can do to keep up.

How Big is the E-Commerce Market in South Africa?

South Africa’s e-commerce industry has entered a new era of scale and maturity.

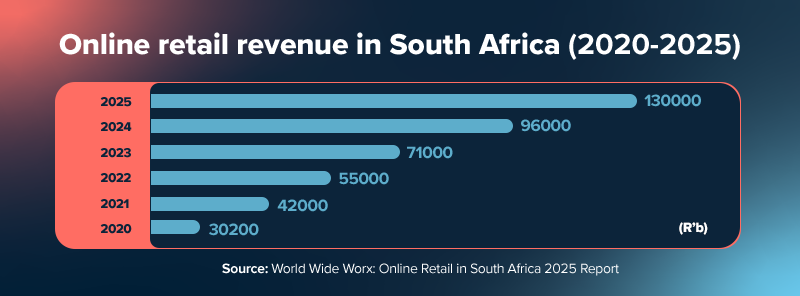

Online retail is expected to surpass R130 billion in turnover by the end of 2025, capturing almost 10% of total retail sales nationwide, according to the Online Retail in South Africa 2025 Report by World Wide Worx, Mastercard and Peach Payments.

Just a year earlier, e-commerce in South Africa grew 35% to reach R96 billion, while physical retail managed less than 3%. Growth in 2025 has accelerated even further, rising at an annualised rate of 38%, driven by mobile shopping, faster deliveries and trusted payment options.

Digital platforms are now central to South Africa’s retail economy, powered by major players like Checkers Sixty60’s R19 billion sales and Woolworths’ 50% online grocery surge.

The momentum isn’t set to stop any time soon, either. Online sales are projected to top R150 billion, cementing e-commerce as the country’s new growth engine.

“(Online retail) momentum is no longer limited to major cities,” says Gabriel Swanepoel, Country Manager for Mastercard South Africa. “It is in smaller towns and among middle-income households as connectivity improves and secure payments open access. This shows how digital inclusion is expanding opportunity well beyond traditional retail hubs.”

10 Trends Shaping E-Commerce in South Africa Right Now

Keeping up to date with business trends in South Africa is important for any entrepreneur, but e-commerce store owners must move faster.

Online retail is developing at breakneck speed, and consumer expectations are higher than ever – from mobile-first shopping and seamless payments to fast delivery and AI-driven experiences.

Here are 10 key trends that every South African e-commerce business should know to grow in 2026 and beyond.

1. Local marketplaces challenge global players

The arrival of global players like Amazon South Africa, alongside fast-growing imports such as Shein and Temu, has turned the e-commerce market into a high-stakes battleground.

Going into 2025, Shein and Temu together captured a combined 3.6% share of South Africa’s retail, clothing, footwear and leather market (CTFL), an all-time high.

But local retailers haven’t backed down. They hold key advantages: faster delivery services, easier returns and, most importantly, stronger trust among South African consumers.

With stricter customs enforcement narrowing cross-border price advantages, the playing field is levelling.

Action for SA e-commerce retailers

Compete where you can win, namely speed, reliability and customer experience. Doubling down on local service is the marketing strategy that will keep domestic marketplaces thriving against global giants.

2. Mobile-first shopping is now a must-have

South African consumers are living on their phones, and e-commerce brands need to meet them there.

According to Meltwater, a sales intelligence advisory, 98.4% of the country’s internet users access the web via mobile devices, spending an average of nine hours and 23 minutes online daily, more than any other nation.

Social media is just as central, with 98.25% of users engaging regularly across platforms, particularly Facebook, which almost two-thirds (65%) cite as their go-to platform.

This means mobile first is now a business imperative. Websites, apps and marketing campaigns must be fully optimised for small screens, including fast load times and touch-friendly navigation.

Social commerce, influencer campaigns and in-app promotions are where customers discover, compare and buy.

Action for SA e-commerce retailers

Prioritise mobile optimisation and embed social media, particularly Facebook, into the customer journey. Being mobile-ready is now a big part of staying competitive in a hyper-connected market.

3. Free delivery tops the charts in online shopping drivers

Everyone loves saving a bit of money, and South African consumers are no different.

Discount mechanisms are the most effective way of getting buyers to convert, according to Meltwater’s report.

Over two-thirds of users cite free delivery as the main reason for making a purchase, outpacing factors like next-day delivery or a smooth checkout experience.

Loyalty programmes and coupons or discounts also strongly influence buying behaviour.

Major retailers are responding. Platforms like Checkers Sixty60 are setting the standard for on-demand delivery, while others are innovating fulfilment models to reach both urban and rural customers.

Last-mile logistics remain challenging, but these hurdles are driving creative solutions in tracking, scheduling and delivery networks.

Action for SA e-commerce retailers

Offer free or low-cost delivery and integrate loyalty incentives. These factors now outweigh convenience and can directly boost conversions. In the battle for customer loyalty, speed alone isn’t enough.

4. Convenience drives home delivery preferences

South African consumers expect flexibility when it comes to online shopping.

DHL’s 2025 E-Commerce Trends report shows that 86% of shoppers prefer home delivery, while 26% like the option to change their delivery day, showing how convenience heavily influences their purchasing decisions.

This demand for convenience is shaping e-commerce platforms across the country. Retailers are integrating multiple payment methods, from credit cards and EFT to payment gateways like PayPal, while optimising platforms like Shopify or custom online stores for smooth, user-friendly checkout.

Efficient logistics and supply chains, combined with reliable delivery options, are now essential to staying competitive in the South African market.

Action for SA e-commerce retailers

Build flexibility into your delivery model. Offer multiple payment options, allow customers to reschedule deliveries and ensure your online store is seamless across devices. Convenience is no longer optional; it’s a core driver of loyalty and growth.

5. AI becomes the new storefront assistant

Artificial intelligence is changing how e-commerce works and South Africa’s online retail market is next in line.

The global AI shopping assistant market is set to skyrocket from around $5 billion (R86.30 billion) to over $37 billion (R638.63 billion) over the next decade.

Shoppers now want retailers to offer AI-powered features, such as virtual try-ons, AI shopping assistants and voice-enabled product searches.

In South Africa, major players like Shein and Temu are showing what’s possible when AI and data converge. Shein uses big data analytics to track user activity in real time, allowing its design team to launch up to 10,000 new styles daily, according to a non-profit company committed to localising manufacturing in South Africa, The Localisation Support Fund NPC (LSF).

Temu, meanwhile, aggregates vast user and third-party data to refine product recommendations and power hyper-targeted marketing.

Action for SA e-commerce retailers

Tap into AI plugins available on platforms like Shopify or WooCommerce to offer smarter recommendations, automate chat support and refine product targeting.

Doing this will let you improve engagement without heavy tech costs.

6. South African consumers are among the world’s most environmentally concerned

South African shoppers are increasingly factoring sustainability into their online purchases. DHL’s report shows that 83% of consumers consider eco-friendly practices when choosing where to shop, ranking South Africa among the world’s most environmentally conscious e-commerce markets.

Demand is rising for local, sustainable brands, including ethical sourcing and environmentally responsible packaging.

Delivery carbon offsetting and recyclable materials are becoming common expectations rather than extras. South Africa also ranks as one of the top countries globally for buying pre-owned or refurbished purchases, according to the DHL report.

Action for SA e-commerce retailers

Learning how to build a sustainable business takes time, but you can make the steps that you’ve already taken visible. Highlight eco-friendly packaging, carbon-neutral delivery and ethical sourcing in your marketing, if you can.

Clear communication of these initiatives can strengthen trust, appeal to eco-conscious consumers and set your online store apart in a competitive digital retail ecosystem.

7. Credit cards are still king, but BNPL payments are on the rise

South African consumers are demanding more flexible and secure ways to pay online.

According to a study conducted by World Wide Worx, EFTs, debit cards and credit cards are the most popular.

Other methods of payment like instant EFTs and Payshap are gaining traction as trusted alternatives, while buy now, pay later (BNPL) solutions and mobile wallets are becoming more popular among younger, mid-income shoppers.

This diversity reflects a maturing e-commerce ecosystem where convenience, trust and accessibility are key.

According to Mastercard’s 2025 data, most retailers are satisfied with current gateways, yet many plan to add options like mobile wallets, Instant EFT and QR payments to enhance convenience.

Action for SA e-commerce retailers

Multiple payment gateways, from traditional cards to Instant EFT and BNPL, are the best way to open your customer base. Payment flexibility is a conversion driver that meets shoppers where they are.

8. Want to build trust? Respond to customer reviews

In South Africa’s e-commerce ecosystem, trust is everything – and it’s built through conversation, not just conversion.

According to the DHL research, 43% of the 12,000 South Africans shoppers surveyed say a retailer’s response to customer reviews is the single biggest factor driving their trust in a brand. Shoppers want to see that businesses listen, engage and resolve issues transparently.

Social proof has also become a powerful buying trigger: 74% of consumers say customer reviews on social media influence their purchase decisions. But the stakes are high – 83% won’t buy from a brand they don’t trust.

Action for SA e-commerce retailers

Don’t leave reviews unattended. Respond quickly, thank customers for feedback (good or bad) and show accountability in public threads. Every reply is a chance to demonstrate reliability, and that’s what keeps South African shoppers coming back.

9. Complicated checkout is the biggest reason for cart abandonment

In a fast-moving e-commerce market, even a few extra clicks can cost a sale.

Mastercard’s 2025 data reveals that 37.3% of South African shoppers abandon their carts because the checkout process is too long or complicated.

High shipping fees and declined credit cards are other leading causes, followed by unsatisfactory returns policies and a lack of payment methods.

The message is clear: convenience converts. South African consumers expect a smooth and trustworthy checkout experience, one that mirrors the speed and simplicity of their favourite mobile apps.

Action for SA e-commerce retailers

Streamline your checkout. Reduce the number of steps, enable guest checkout and clearly display shipping costs upfront. A seamless, transparent process can be the difference between a sale and an abandoned cart.

10. Consumer security is more important than ever

Rising digital payment volumes and an increase in delivery-related crime mean consumers are more cautious than ever.

At the same time, the rollout of new global standards like PCI DSS v4.x is pushing online retailers to strengthen data protection far beyond the checkout page.

South African shoppers want to feel safe from purchase to parcel. Payment failures, high shipping costs and delivery insecurity continue to shape buying behaviour.

The onus lies on e-commerce retailers to provide visible security measures and transparent communication to allay those fears.

Action for SA e-commerce retailers

Invest in trusted payment gateways, clear refund policies and secure delivery partnerships such as pick-up lockers. Building visible reliability at every stage of the transaction is the surest way to turn cautious browsers into loyal customers.

How Much do E-Commerce Websites Make in South Africa?

E-commerce earnings in South Africa vary widely, but the upside is significant for those who scale effectively.

According to South African business accelerators V8 Media, online stores making around R500,000 per month sit in the top 10% of local earners, while those earning R1 million or more monthly rank among the top 2%.

Profit margins tend to range between 10% and 30%, depending on factors like logistics, niche and marketing efficiency.

With e-commerce turnover expected to surpass R130 billion by the end of 2025, the potential for a consistent revenue growth rate is there.

For small and mid-sized retailers, this is the moment to double down: South Africa’s digital economy is expanding fast, and early adopters are already reaping the rewards.

Scaling South Africa’s Next Wave of

E-Commerce Growth

E-commerce in South Africa is booming. As digital payments become seamless and consumer trust grows, the space is increasingly dominated by brands that can personalise experiences, deliver reliably and innovate sustainably.

For small businesses, that means the opportunity gap is still wide open. The infrastructure and consumer base are there – what’s often missing are the small business funding options for your retail store to scale.

As e-commerce expands, so do opportunities, but growth takes capital. Lula helps South African SMEs fund their next step, fast.

Unlock your online store’s potential. Stop losing sales to capacity gaps. Get access to small business funding for e-commerce from Lula and fuel your growth without the bank hassle.