Running a brick-and-mortar store in the retail industry in South Africa can’t be easy as a business owner.

One month, you’re competing for a share of record-breaking Black Friday sales, the next, you’re worrying about the value of the rand dropping or suppliers delivering on time.

No wonder you might often feel like the ground is slipping beneath your feet.

But here’s the good news: the same forces shaking up the market are also creating fresh opportunities.

If you’re one of those retail entrepreneurs, you can do yourself a big favour by knowing where the big trends are heading. This way, you can position your business to grow instead of just reacting to change.

In this guide, we’ll break down eight of the biggest shifts shaping South Africa’s retail market right now – and how you can stay ahead of them.

The Eight Trends Currently Affecting the Retail Industry in South Africa

1. E-commerce and the battle for market share heats up

Online retail is no longer optional; it’s a key battleground.

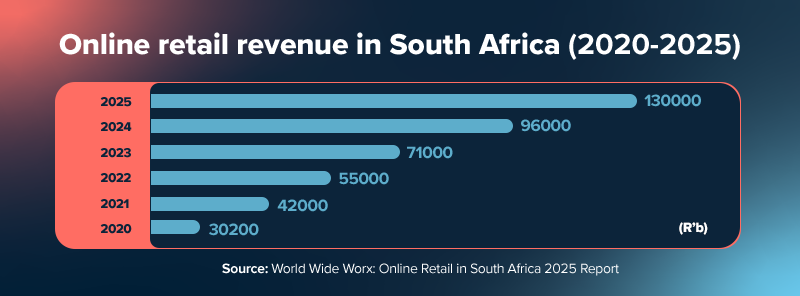

E-commerce sales are set to hit R130 billion for 2025, a 35% increase from the previous year, according to the World Wide Worx/Mastercard Online Retail in South Africa 2025 report. They now, for the first time, account for 10% of total sales.

Offline retail, meanwhile, is still struggling, with growth of only 1.6% in June 2025.

Market leaders like Takealot hold a sizeable share of online shoppers, while new entrants Shein and Temu are aggressively grabbing fashion spend. This means national reach for low-cost sellers, but also tougher competition and pressure on margins.

Action for retail businesses

For small retail businesses, the goal is to focus, instead of competing on size.

Start by selling a small range of proven, high-demand products rather than trying to stock everything. Choose five to 20 of your bestsellers, list them online (on your own site or marketplaces like Takealot) and make sure your prices stay competitive.

Keep track of simple but important numbers, including how much it costs you to get a customer and how much profit you make from each sale. If you’re making money, invest more in what’s working. If not, adjust your prices or product mix.

Selling online gives SMEs a chance to reach customers across South Africa without opening new stores, so focus on building a small but strong online presence that can grow in the long term.

2. The digital transformation to omnichannel continues at pace

The ongoing digital boom means South Africa’s retail industry is moving quickly towards omnichannel shopping, and WhatsApp is increasingly at the front door.

Shoppers are comfortable ordering through chat, with WhatsApp rising in popularity as a commerce channel.

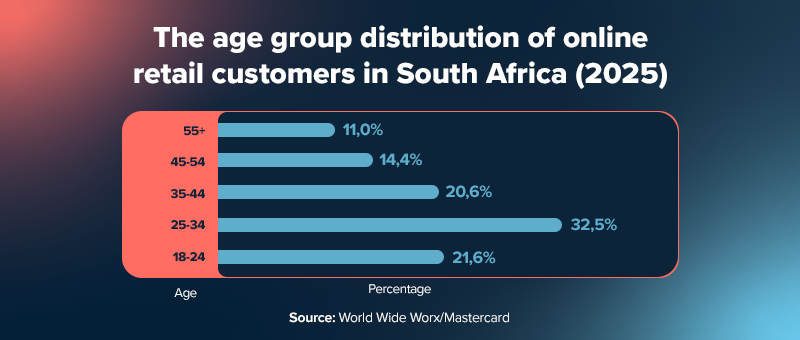

Out of the 1400 respondents surveyed in Mastercard’s recent online retail study, 54.1% of those under 35, shop online.

For many, it’s faster to send a message than to load a cart.

Click-and-collect, same-day grocery delivery and buying via social media or WhatsApp are now expected parts of the customer experience, rather than ‘nice extras’.

The challenge is that most WhatsApp sales are still finalised via EFT or offline invoicing, which means inventory, pricing and payment systems aren’t fully connected yet.

That gap is where SMEs can either lose trust – or gain a competitive edge.

Action for retail businesses

Start small and measurable. Add one low-lift digital touchpoint, like WhatsApp ordering with a pick-up counter, and track repeat purchases and average basket size.

If results climb, scale up. If not, pivot. The learnings are as valuable as the sales.

3. Quality is the new battleground

For South African shoppers, quality is becoming more of a non-negotiable.

In every fast-moving consumer goods (FMCG) category, from bread and milk to beauty and personal care, South African consumers are clear: they’ll pay more for trusted, reliable products.

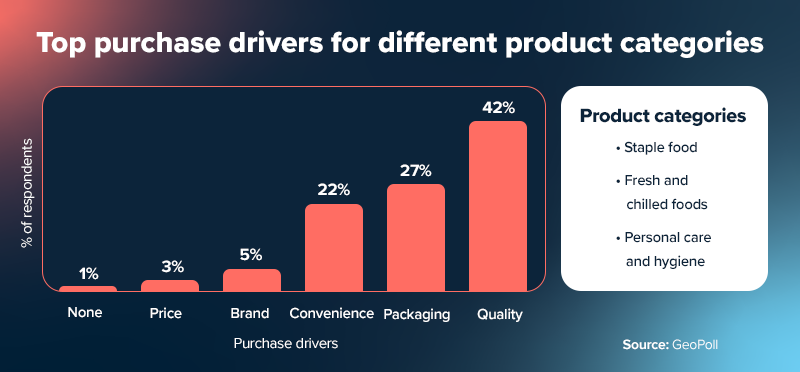

A recent GeoPoll survey shows that 42% of shoppers rank quality as their top purchase driver, far ahead of price (27%) and brand (22%). Even in cost-sensitive categories like staples and dairy, quality comes first.

This shift tells us that urban South Africans are redefining value. The cheapest option no longer wins out; the one that delivers consistent quality does.

That also explains why supermarkets have leaned hard into private labels with premium positioning – thanks to consumer demand.

Action for retail businesses

Don’t try to win on price alone. Invest in sourcing better-quality stock or highlighting product quality in-store and online. Position your business as the shop that customers can trust, and loyalty will follow.

4. Grocery retail dominates, with supermarkets at its core

Grocery retail is the backbone of the retail industry in South Africa – and the numbers show why.

The food retail industry in South Africa makes up nearly half of household spend, according to the Mastercard data, while supermarkets like Shoprite, Pick n Pay and SPAR/Checkers continue to anchor the sector.

These major players do more than sell groceries; they set the pace on pricing, logistics and private labels.

Shoppers are also leaning heavily into convenience. Just look at snack habits from the same report: 78% buy chips, 76% bread and nearly 70% biscuits and chocolate each month.

These grab-and-go items reflect a lifestyle shift: people want fast, practical solutions, whether that’s crisps at lunch or on-demand grocery delivery through Checkers Sixty60, which grew sales by 47% in first half of 2025 and now stands as the nation’s second most popular shopping platform.

Action for retail businesses

For SMEs, the takeaway is clear: if you’re in FMCG, supermarkets are still the growth engine. Get listable on supplier portals and be private-label ready – one listing can multiply your revenue and credibility.

5. Supply chains are improving, but retail businesses must be vigilant

If you run a retail business in South Africa, you already know how fragile supply chains can be.

Port congestion delays imports. The rand’s ups and downs make pricing unpredictable. Rail bottlenecks choke distribution, while cyber criminals are increasingly targeting logistics systems.

Political factors affecting the retail industry in South Africa are also worth thinking about, given that they might flare up unexpectedly.

That said, there are encouraging signs of progress. Retail giants are investing heavily in supply chain upgrades: Shoprite has expanded its Sixty60 fleet and built dark stores; Woolworths is tying its logistics to loyalty programmes; and TFG has integrated Bash across its brands.

These moves show that while risks remain, the sector is actively building a more resilient backbone.

Action for retail businesses

Start with visibility: document your most critical suppliers and map where bottlenecks might occur. Diversify where possible – even one local back-up supplier can mean the difference between empty shelves and steady trade.

It’s also a good idea to push suppliers for weekly delivery updates, and consider modest buffer stock for top sellers. Pair that with adequate insurance cover, and you’ll turn unpredictable shocks into manageable bumps instead of business-ending blows.

6. Interest rates, the rand and consumer confidence paint a mixed picture

Macro conditions affect every business. Uncertain interest rates and a volatile rand squeeze consumer budgets and make inventory and expansion more expensive.

Recent Stats SA data show a mixed picture: the economy grew 0.8% in Q2 2025, driven by manufacturing, mining and trade, but construction and transport lagged. Household spending shifted towards essentials, retail trade sales rose 5.6% and employment in the formal sectors fell slightly.

Understanding these retail industry trends can help small business owners stress-test their plans and safeguard growth, even in uncertain times.

Action for retail businesses

A practical approach is to create a three-scenario forecast: base, downside and upside, covering sales, costs and funding needs.

Then, keep a three-to-six-month buffer for working capital. Knowing how to cut costs in a retail business without hurting growth is helpful here, but you’ll also need to identify where to reinvest – whether in stock, tech or marketing – to keep sales momentum steady even when margins tighten.

If you’re seeking growth capital, link your funding requests to these scenarios. Lenders and investors want to see your downside plan just as much as your upside potential. This approach makes your business both more resilient and fundable.

7. Green is the new growth

Sustainability is now a buying filter for many urban consumers.

South Africa’s Bureau of Market Research recently reported a major push towards green products, with shoppers increasingly expecting recyclable packaging, traceability and local sourcing, and rewarding brands that can prove it.

Digitally agile, value-driven retailers who embrace sustainability, data analytics and omnichannel strategies are best positioned to capture consumer loyalty and differentiate their brand.

Action for retail businesses

For retail SMEs, knowing how to build a sustainable business is about starting small but thinking long term. Choose one credible, verifiable practice (like recyclable packaging or local sourcing), communicate it clearly and back it up with data.

Over time, these small, consistent actions build trust and turn sustainability into a real competitive edge.

8. Collaboration over competition

Partnerships are one of the fastest ways for small businesses to scale.

Big chains, marketplaces and regional hubs in cities like Durban and Johannesburg are actively looking to collaborate with SMEs on product ranges, in-store concessions and last-mile distribution.

Franchising is another proven route – it combines a recognised brand, tested systems and local operator know-how, giving small businesses a head start. 88% of franchise systems in South Africa are local brands, according to SME South Africa.

Action for small retail businesses

For SMEs, the first step is simple: creating a one-page partnership proposition outlining key products, margin expectations, logistics requirements and a 12-month sales forecast. Pitch it to three potential partners, such as a buying team, a marketplace category manager or a local distributor.

Even one successful pilot validates your model and demonstrates potential for funded scale. Partnering with a reliable business funder also makes growth less risky and gives your business the capital to expand alongside your ecosystem.

Track changing consumer behaviour and shopping habits closely, use Statistics South Africa to inform your forecasts, and focus on the retail market segments where consumer spending and retail sales are rising.

SMEs can use partnerships to drive sales growth, strengthen their presence in the South African retail sector and build resilience in a dynamic economy.

Recap: Powering Retail Growth in a Changing Market

South Africa’s retail market is tough – margins are tight, consumers are cautious and the rand keeps everyone guessing. But the upside is clear: the businesses that adapt fastest are the ones that grow.

Strong retail SMEs plan for uncertainty and form smart partnerships that expand their reach. Growth comes from acting on the data, testing new ideas and staying financially ready to move when opportunities appear.

That’s why having the right funding partner matters. The right small business funding options for your retail store can give you the capital and confidence to act fast – to restock, launch or expand when the timing’s right.

With steady backing, you’re then not just surviving shifts in the market, but using them to your advantage.