How Many Bank Accounts Should a Business Have?

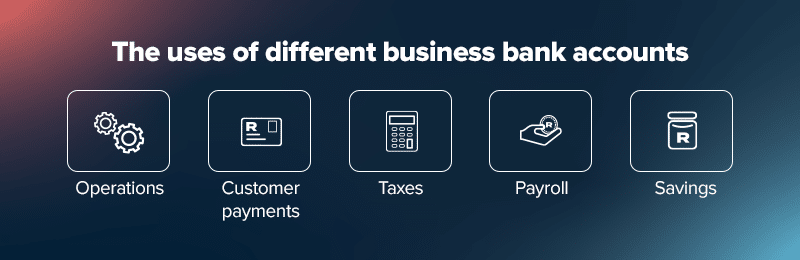

We’ve already established that having just one business account is a good starting point, but how many bank accounts should a business have? Is it too much to have four bank accounts, for example?

Financial experts often recommend that self-employed business owners have a certain number of accounts to optimise their business operations.

However, the truth is that there’s no magic number: the ideal number of accounts depends on your specific business’s financial needs and size.

Smaller businesses might start with just a chequing account, for example, while larger ones often have several different accounts for various purposes.

Here’s a common set-up for a start-up just finding its feet:

• Business chequing account: For everyday business transactions like receiving payments.

• Business savings account: To save for short-term financial goals like equipment purchases.

After a while, established businesses can upgrade their accounts or add extra facilities to help them move through different growth phases. An example would be an upgrade to a comprehensive business account.

An upgrade on a chequing account, these help businesses process a large number of transactions (without incurring high fees) by offering features like unlimited free electronic funds transfers (EFTs), faster access to business funding, dedicated customer support, and integrated cash flow management tools.

In short, the further you progress along your business journey, the more bank accounts you’re likely to have. This can help you upscale your operations and organise your business expenses, not to mention take advantage of perks available to established businesses.