In South Africa, many consumers face rising costs, economic uncertainty and inflationary pressures, and are looking at ways to reduce their spending. If you’re an owner of a retail or e-commerce store, fighting to stay competitive, this would have a direct impact on your sales.

In fact, 44% of South Africans would consider switching to a more affordable brand to cut down on spending.

So if you’re looking to learn how to reduce costs in retail businesses without hurting growth, improving your bottom line is not all that matters. Focus on building a strong foundation to position yourself for long-term success.

The good news is that there are some practical ways to reduce costs in your retail business – without compromising on quality or hindering growth.

Costs are part and parcel of running a retail business, but how you manage them makes all the difference. By approaching expenses with an open mind and looking for ways to reduce them without limiting growth, you can cut back while still creating room to expand and remain competitive.

5 Ways to Reduce Costs in Retail Businesses

As a retail business owner, cutting costs has several benefits, including higher profit margins, more competitive pricing, and greater financial resilience.

Essentially, the more cash you have on hand, the better you can decide when – and how – to use it.

In retail, where stock is one of the biggest ongoing expenses, cash is often needed up front to secure inventory – or even unlock better pricing. For many business owners, this creates a tricky balancing act between maintaining stock levels and managing cash flow.

Looking for more strategies to reduce your retail expenses? Here are five ways to do exactly that:

1. Monitor your business’s account processing fees

Processing fees and costs like electronic funds transfer fees (EFTs), monthly credit card interest rates, and separate credit facility fees all add up. Before you know it, you’ve spent more than you budgeted for.

However, with Lula’s Unlimited Business Account, you pay a fixed monthly fee, so you know what your upfront costs are. Also, with Lula Multicompany, you can manage multiple businesses from a single login – making it easier to stay on top of finances across all your companies while keeping full control over every decision.

You also get dedicated support from a business relationship banker.

2. Make customer retention a priority

Growing your customer base through new clients is great. However, it’s often more costly than simply retaining the customers you already have.

According to Harvard Business Review, acquiring new customers can cost five to 25 times more than keeping your existing customers.

But what makes existing customers want to leave? The primary reason cited is poor service, with research suggesting that a staggering 96% of customers will leave a brand after experiencing poor service.

When you streamline operations and free up cash flow, you can allocate resources to things that actually improve customer service, like the following:

- staff training and development;

- loyalty and rewards programmes; and

- in-store experience upgrades.

Keeping customers doesn’t just protect your revenue; it reduces marketing and new customer acquisition spend.

3. Regularly audit operational expenses

Sure, running a retail business comes with expenses, but have you ever audited yours to see where and how you can cut back? Can you pinpoint areas where you are overspending? Without a clear picture of your business finances, you risk wasting money on unnecessary expenses – or underspending on areas that can add more value.

For example, you may be spending money on duplicate software tools or repairs on older equipment that needs replacing, or buying too much inventory. This money may be better reallocated to staff training, improving customer service or buying more inventory.

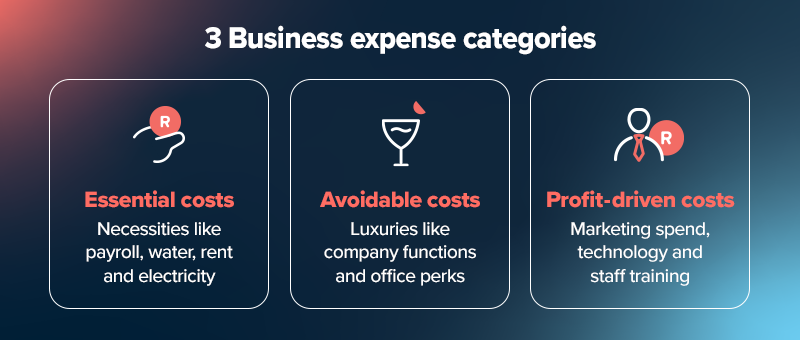

Retail business expenses can be divided into three main categories:

• Essential costs

As a business owner, costs like store space (unless you have an online store), water and electricity, insurance and salaries are unavoidable. While you typically can’t avoid these expenses without changing your business model, there are often ways to reduce them if you look a little closer and explore your options.

• Avoidable costs

These are costs that can usually be reduced – or eliminated altogether. They include things like unnecessary software subscriptions, unused storage space, or luxuries like company events and office perks.

These expenses aren’t necessarily bad, but if you want to cut costs, you’ll need to look over them closely.

• Profit-driven costs

Costs in this category are geared towards growing your business or increasing efficiency. Expenses in these categories should have a return on investment (ROI) – whether that be increased revenue, improved customer satisfaction or greater efficiency.

Common expenses include marketing spend, technology that improves efficiency and staff training.

4. Strategically manage cash flow with inventory finance

If you’re in the retail space, you know that purchasing inventory is one of your biggest expenses. To reduce costs in your business without hurting growth, you need to be smart about stock purchases. Here are a few ways you can do that:

• Secure bulk stock at discount rates

When you have access to enough capital, you can stock up on inventory and usually get better prices with your suppliers. This means improved profit margins and competitive pricing.

• Avoid stockouts and lost sales

In the retail sector, you can’t afford interested buyers walking away because you have no stock. This results in lost sales, unhappy customers, and possibly even customers switching to a competitor brand.

By having access to business funding like Lula’s Cash Flow Facility, you can ensure you’re always well stocked. The facility is a line of capital you can draw down from when you need it, without having to reapply each time (subject to an affordability assessment).

Once you submit your online application and are approved, you can receive business funding within as little as 24 hours. There are also no monthly account or admin fees and you only pay for what you use, when you use it.

• Bridge seasonal cash flow gaps

The retail industry is seasonal, and you need to plan around this. This could mean stocking up for busy months to ensure you’re well stocked when it matters. It also means being smart when planning around the lean months and having access to capital to cover your running costs.

5. Reduce energy and overhead costs

In South Africa, electricity costs are high, and retail businesses cannot afford to be without power. By being smart when it comes to energy efficiency and looking into options like solar power, you can safeguard yourself against disruptions in power.

Although more energy-efficient solutions and back-up power options like solar come with an upfront cost, their long-term savings usually make them worthwhile.

Lastly, evaluate your office space and consider sharing some space or outsourcing operations like payroll, HR or IT support – if it’s feasible.

How to Seize the Right Savings Opportunities Without Throttling Cash Flow

Cost-cutting only goes so far before it starts to slow growth. The challenge isn’t just about cutting back to save money; it’s about how to manage expenses in a way that creates long-term savings.

For many business owners, having access to funding frees up cash flow and makes it possible to seize opportunities like buying stock in bulk at discounted rates, investing in staff training, or bridging seasonal gaps.

Traditional funding methods can be slow and weighed down by red tape. Alternative solutions, on the other hand, offer more flexibility.

With options like Lula’s Cash Flow Facility and Fixed-Term Funding, you can manage costs more strategically – turning funding into a tool for growth. For business funding tailored to SMEs, learn more here.

Cut Costs and Reap the Rewards

Cutting costs in your retail business shouldn’t hinder growth; it should maximise profitability and increase productivity. It’s about taking control of your finances, knowing what you are spending money on, and being smart about your cash flow.

By strategically reducing costs, you can allocate resources to high-impact areas like customer experience, keeping pricing competitive, and staying well stocked.