Cash flow management is a crucial aspect of running a successful business. Proper management of cash flow can help your business remain solvent and meet its financial obligations.

It is important to understand that cash flow management is not just about keeping track of the money that comes in and goes out of the business. It is also about ensuring that the cash is used as effectively and efficiently as possible. Having easy access to small business funding can give you a boost and help you optimise your cash flow, especially during seasonal slumps when sales take a dip.

With easier access to funding comes the responsibility to manage it effectively. By optimising the way you manage your cash flow you are well on your way to achieving better financial health for your business. Here are a few ways to achieve better cash flow management:

Steps to Achieve Better Cash Flow Management

One of the first things that a business owner should do is to create a cash flow forecast. This will help to identify any potential cash flow issues that may arise in the future. It will also help to identify any opportunities for growth and expansion. Creating a cash flow forecast can be challenging, but it is essential for the success of any business.

1. Create a cash flow forecast

To create a cash flow forecast, a business owner must first identify all of the cash inflows and outflows for the business. This includes revenue from sales, investments, and loans, as well as expenses such as salaries, rent and utilities. Once all of the cash inflows and outflows have been identified, you will have a view of projected income and can create a cash flow forecast.

Entrepreneurs believe that profit is what matters most in a new enterprise. But profit is secondary. Cash flow matters most. – Peter Drucker.

This forecast should be updated regularly to reflect changes in the business environment. Another important aspect of cash flow management is to monitor and control expenses.

This can be done by creating a budget and sticking to it. It is also important to review expenses regularly to identify any areas where costs can be cut or reduced.

For example, a business may be able to reduce its utility bills by switching to more energy-efficient equipment. By controlling expenses, you can free up cash to invest in growth opportunities.

2. Use cash flow management tools

In addition, consider implementing cash flow management tools and techniques such as cash flow statements, cash flow analysis, and cash flow ratios.

These tools can help provide a clear picture of your company’s cash flow situation and help identify any areas that need improvement. For example, a cash flow statement can help you identify the timing of cash inflows and outflows, while a cash flow ratio can help to measure the efficiency of cash flow management.

3. Regularly review invoices and payments

Its smart to stay up to date on your accounts receivable and accounts payable. You can do this by regularly reviewing invoices and payments and following up on any late payments. By staying on top of accounts receivable and accounts payable, businesses can ensure that they have enough cash on hand to meet their financial obligations.

Cash Flow Management – The Foundation for Success

Cash flow management is a critical aspect of running a successful business.

By creating a cash flow forecast, monitoring and controlling expenses, implementing cash flow management tools and techniques, and staying up to date on accounts receivable and accounts payable, businesses can ensure that they remain financially stable and successful in the long term.

Effective cash flow management requires careful planning, attention to detail and the ability to adapt to changing circumstances. However, it is an essential skill for any business owner who wants to succeed in today’s competitive business environment.

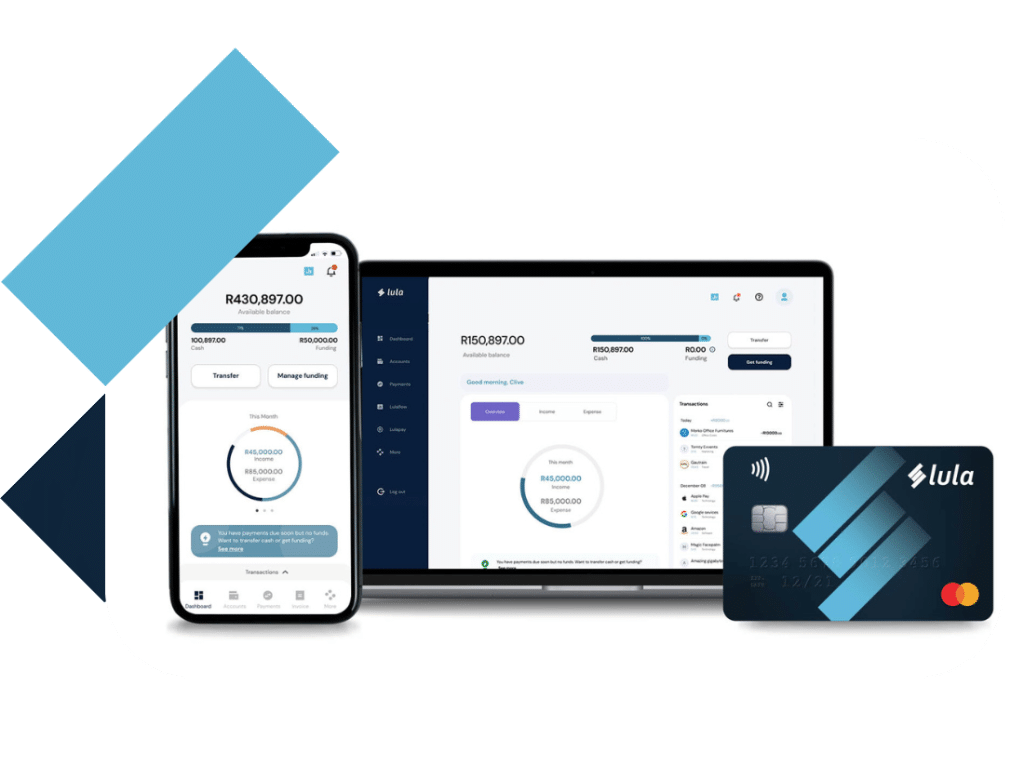

With Lula’s Cash Flow Facility and Fixed-Term Funding, you can access up to R5,000,000 in business funding within as little as 24 hours. This is easy access to capital when you need it.

Apply for business funding today and propel your business into a future of success.