Picture this: a golden opportunity lands on your desk. A supplier offers a massive discount on inventory, a key piece of equipment goes on sale, or a chance to expand into a new space opens up.

You need capital to act, but the thought of pledging your business property or personal home as security for a traditional loan feels like too great a risk. This is a common dilemma for South African SMEs, but there is a powerful solution: unsecured business loans.

This modern approach to business funding allows you to leverage your business’s performance and potential, not your assets. Here’s what you need to know about how business loans without collateral can fuel your business growth.

What are Unsecured Business Loans?

An unsecured business loan is a type of funding that does not require you to provide any collateral. Instead of securing the loan against a physical asset like property, equipment or vehicles, lenders assess the financial health and creditworthiness of your business itself to make a lending decision.

This makes unsecured business finance an attractive option for businesses that are asset-light or simply wish to avoid risking their property.

Unsecured vs Secured Loans

While both funding types provide your business with capital, they operate on fundamentally different principles of risk and assessment. The core distinction lies in collateral.

A secured loan, often the standard for traditional bank loans, is tied directly to a valuable asset you own. You must pledge this asset, which means that if you are unable to repay, the lender has the legal right to seize it. This places a higher level of risk directly on you.

Because these assets must be valued, the process is also significantly slower.

An unsecured loan, pioneered by alternative lenders, is not tied to any asset. Your promise to repay is based on your business’s performance. This means your assets remain safe, placing a much lower risk on you. Without the need for lengthy asset valuations, the entire application and approval process is faster, making it an ideal solution for businesses that need to move quickly on opportunities.

How Do Unsecured Business Loans Work?

With an unsecured business loan, the focus shifts from what you own to how your business performs. Modern South African lenders use a data-driven approach. Instead of valuing property, they analyse key performance indicators, often by reviewing your bank statements to gauge your ability to repay.

This typically involves reviewing:

- Business cash flow and monthly turnover: Lenders look for consistent, predictable revenue streams. A healthy monthly turnover shown in your business bank account is a primary indicator that you can handle a repayment plan.

- Trading history: Most lenders require at least one year of trading history. This demonstrates that your business has a stable operational model, has navigated initial start-up hurdles, and understands its market. A consistent history proves resilience and reduces the lender’s risk.

- Creditworthiness: Your business’s track record of paying its suppliers, landlords and other creditors on time is crucial. A strong business credit score signals financial discipline and reliability, making you a more attractive applicant.

- Official company standing: Lenders will want to verify that your business is in good standing with the Companies and Intellectual Property Commission (CIPC). This confirms your business is a legitimate, registered entity.

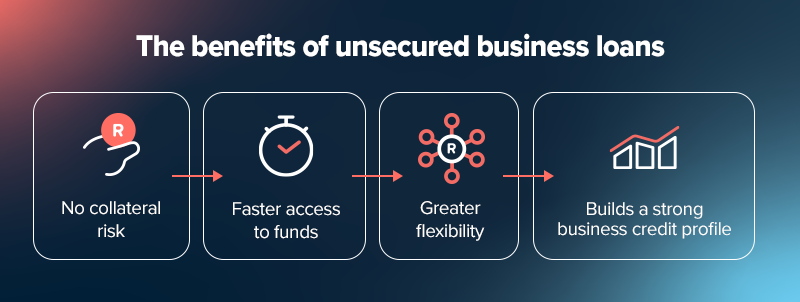

The Benefits of Unsecured Business Loans

Opting for an unsecured loan offers several distinct advantages for agile SMEs:

No collateral risk

This is the most significant benefit. You can pursue growth opportunities with peace of mind, knowing that your business premises, equipment and personal home are not on the line. This de-risks the process of taking on funding for expansion.

Faster access to funds

Because there’s no need for lengthy asset valuations, the application and approval process for unsecured loans is significantly quicker. Digital-first lenders can often process applications online faster than traditional lenders, allowing you to act on opportunities without delay.

Greater flexibility

The funds from an unsecured loan can typically be used for any legitimate business purpose. Whether you need to launch a marketing campaign, bridge a cash flow gap, purchase inventory, or cover unexpected costs, the capital is yours to use where it’s needed most.

Builds a stronger business credit profile

Successfully following a repayment plan on an unsecured loan is an excellent way to build a positive credit history for your company, which can unlock better funding terms in the future.

This is separate from your personal credit score and demonstrates to future lenders and suppliers that your business is a reliable financial partner.

A strong credit profile can provide access to larger funding and more favourable terms down the line.

What to Consider Before Applying for an Unsecured Loan

Before you sign any business loan agreement, it’s vital to do your homework. Because the lender takes on more risk, unsecured loans may have higher fees compared to secured loans.

It’s wise to compare interest rates and fee structures from different providers.

Understand the typical interest rates in the market and clarify exactly how and when you will pay interest, be it monthly or otherwise. Always read the agreement carefully to understand the total cost of credit, including any initiation or service fees, to ensure the loan is affordable for your business.

Who Should Consider Unsecured Business Loans?

Unsecured business finance is particularly well suited for several types of businesses:

- Service-based businesses: Companies that thrive on intellectual property and human capital often lack significant physical assets. Think of a graphic design studio, a legal practice, or an IT consultancy – their value lies in their talent and client list, not a factory of machinery. Unsecured finance is tailor-made for the modern service-based business model.

- Asset-light businesses: Many modern digital, e-commerce and drop-shipping businesses don’t own warehouses or large inventories. Their operations are lean and digital, making unsecured loans the most logical funding choice.

- Businesses needing quick capital: This is crucial for retailers who need to secure seasonal stock months in advance or a construction company that wins a new tender and must mobilise a team and equipment immediately. When speed is a competitive advantage, unsecured loans deliver.

- Established SMEs with strong cash flow: Even if your business owns valuable assets, you may not want to leverage them. If your business has a proven track record of predictable, healthy revenue, you can use that strong performance as your primary asset to secure funding without encumbering your property.

Lula’s Fixed Term Funding: A Modern Approach to Unsecured Funding

At Lula, we’ve designed our Fixed Term Funding to be a premier unsecured funding solution that fuels business growth. Our data-driven approach allows us to move from application to funding in as little as 24 hours, with your funding disbursed directly into your Lula Business Bank Account.

- No collateral required: We assess your business on its performance.

- Fast and simple: Apply online in minutes for up to R5,000,000.

- Transparent costs: We charge a simple, fixed fee instead of interest, so you know the full cost of funding upfront. No surprises.

- Flexible repayments: Your repayment plan is structured to work with your cash flow over six or 12 months.

Grow Your Business While Managing Risk

Unsecured business loans offer a smart, modern and low-risk pathway to obtaining the capital you need to grow. Focusing on your business’s strength and potential, this form of funding helps you to seize opportunities confidently and build a more resilient company.