For any small business in South Africa, cash flow is the lifeblood that keeps the heart of the company beating. It’s the constant movement of money in and out of your business, and understanding its rhythm is the key to moving beyond survival, into sustainable growth.

While many business owners are adept at tracking profits, a cash flow projection is a powerful tool that offers a glimpse into the future. It allows you to anticipate challenges, seize opportunities and make informed decisions with confidence.

This guide will walk you through the process of calculating a cash flow projection in five simple steps, tailored for South African small business owners.

We’ll break it down into manageable steps, helping you take control of your working capital and financial future.

What is a Cash Flow Projection?

A cash flow projection, also known as a cash flow forecast, is a detailed estimate of the amount of money you expect to flow in and out of your business over a specific period.

Unlike a cash flow statement, which looks at past performance, these cash flow forecasts are forward-looking tools. It’s important to remember that cash flow is different from profit or net income, as it tracks the actual money moving in and out of your business, not just accrued revenue.

It’s about anticipating your financial needs, identifying potential shortfalls before they happen, and ensuring you have enough cash on hand to meet your daily obligations.

For a small business, this foresight is invaluable. Poor cash flow management is one of the top reasons businesses fail and a projection is your best defence.

A projection fundamentally answers the question of how much cash you’ll have on hand in the future.

Why are Cash Flow Projections Important for Your Business?

Effective cash flow management is a cornerstone of business success.

As experts from Sage explain, creating cash flow projections and planning for the future using cash flow forecasting is vital for financial security. Here’s why a cash flow projection is so important:

- Avoid cash shortages: By forecasting your cash flow, you can identify potential shortfalls in advance and take steps to mitigate them, such as securing a line of credit or adjusting your spending.

- Informed decision-making: A projection provides the data you need to make strategic decisions about everything from hiring new staff and purchasing equipment to expanding your operations.

- Attract investors and secure funding: A well-prepared cash flow projection demonstrates to potential investors and lenders that you have a firm grasp on your finances and a clear vision for the future, increasing their confidence in your business.

- Plan for growth: By understanding your future cash position, you can identify the best times to invest in growth opportunities, ensuring you have the necessary resources to expand your business.

Preparing to Calculate Cash Flow Projections

Before you can calculate your cash flow projection, you need to lay the foundation.

This involves gathering the right information and organising it in a way that makes the calculation process straightforward. To make this even easier, you can use a dedicated cash flow projection template, like this practical one from SME South Africa or this financial planning template for start-ups from Old Mutual.

Gather financial data and set a time frame

The first step is to decide on the time frame for your projection. For most small businesses in South Africa, a 12-month projection, broken down by month, is a good starting point. You can also create shorter-term projections, such as for a week or a quarter, for short-term planning.

Next, you’ll need to gather the necessary financial documents. These include:

- past income statements;

- balance sheets; and

- bank statements.

Having this historical data is the first step towards creating an accurate forecast of your future income and expenses. For businesses that need to manage multiple accounts or entities, a feature like Lula’s Multicompany feature can be a game-changer.

The feature allows you to view and manage the finances of multiple businesses from a single profile, making it easier to gather the data you need for your cash flow projections.

And with a Lula Business Bank Account, all your transaction data is neatly organised and easily accessible, saving you time and effort.

List cash inflows

Cash inflows are all the sources of cash coming into your business. It’s important to be realistic with your estimates to ensure your projection is as accurate as possible. Your cash inflows can be broken down into two main categories:

Sales revenue

This is the primary source of income for most businesses. To project your sales revenue, you’ll create sales estimates based on historical data while considering any factors that might influence future sales, such as seasonality, market trends and marketing campaigns.

It’s also crucial to consider your customer payment cycles, in other words, when you actually receive the cash, as this can differ significantly from when the sale is made.

Secondary revenue sources

These are other sources of income, such as accounts receivable, that may not be as regular as sales revenue. They can include:

- loans from a bank or other financial institution;

- investments from shareholders;

- sale of assets; and

- grants or tax refunds.

List cash outflows

Cash outflows, or projected expenses, are all the payments your business makes. Just as with your inflows, it’s important to be as comprehensive as possible when listing your outflows. These can include fixed costs, variable costs and quarterly bills, and can be divided into three categories:

Fixed costs

These are regular, predictable expenses, such as rent, salaries and routine accounts payable to suppliers. They include:

- rent;

- salaries;

- insurance premiums; and

- loan repayments.

Variable costs

These are expenses that fluctuate depending on your level of business activity. They can include:

- raw materials;

- commissions;

- shipping costs; and

- marketing and advertising expenses.

One-time or irregular costs

These are expenses that occur irregularly but should still be factored into your projection. Examples include:

- equipment purchases or repairs;

- legal fees; and

- software subscriptions.

How to Calculate Cash Flow Projections

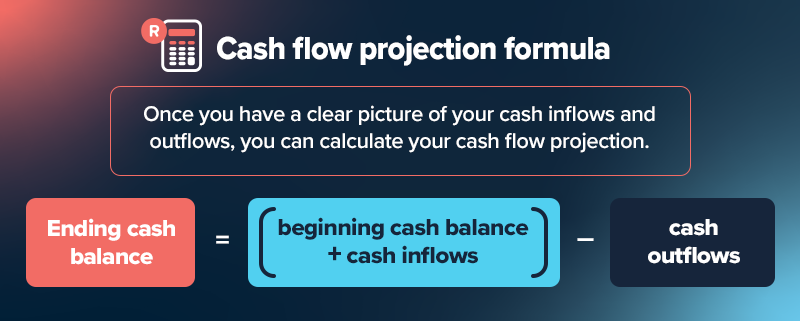

Once you have a clear picture of your cash inflows and outflows, you can calculate your cash flow projection. The formula is simple:

Ending cash balance = (beginning cash balance + cash inflows) – cash outflows

Let’s break this down with a practical example. Imagine you run a small bakery in Johannesburg called Soweto Sweets. Your beginning cash balance for the month of October is R50,000.

Step 1: Project your cash inflows for October

Expected cash inflows:

- Sales revenue: Based on past performance and a planned marketing promotion, you project sales of R100,000.

- Catering gig: You have a confirmed catering gig that will bring in an additional R20,000.

Total cash inflows = R120,000

Step 2: Project your cash outflows for October

Fixed costs:

- Rent: R15,000

- Salaries: R30,000

- Insurance: R2,000

- Loan repayment: R5,000

Variable costs:

- Raw materials: R25,000

- Marketing: R5,000

Total cash outflows = R82,000

Step 3: Calculate your net cash flow for October

Net cash flow = total cash inflows – total cash outflows

(i.e. Net cash flow = R120,000 – R82,000 = R38,000)

Step 4: Calculate your ending cash balance for October

Ending cash balance = beginning cash balance + net cash flow

(i.e. Ending cash balance = R50,000 + R38,000 = R88,000)

So, at the end of October, Soweto Sweets can expect to have a cash balance of R88,000. This ending balance then becomes the beginning balance for your November projection. For an even clearer view, you can plot your monthly projections on a cash flow projection chart to visualise trends over time.

How to Turn Projections into an Actionable Strategy

A cash flow projection is more than just a set of numbers; it’s a dynamic tool for strategic planning. The key is to regularly compare your forecast against your actual performance.

This allows you to refine your future projections and make smarter decisions. For more insights on this, Business Partners offers a simple guide to cash flow for small businesses.

To get the most out of your cash flow projection, consider creating different scenarios:

- Best-case scenario: This is your optimistic projection, where sales are high and expenses are low.

- Worst-case scenario: This is your pessimistic projection, where sales are low and expenses are high. This helps you prepare for potential downturns.

- Most-likely scenario: This is your most realistic projection, based on your historical data and current market conditions.

By creating these different scenarios, you can prepare for a range of outcomes and develop contingency plans for each.

Streamline Your Cash Flow Projection with Lula’s Business Banking Solutions

Managing your business’s finances can be complex, but the right tools can make all the difference.

Lula’s Free and Unlimited Business Bank Accounts are designed to simplify your financial management, making it easier to create accurate and effective cash flow projections.

With a Lula Business Bank Account, you get:

Real-time transaction tracking: See all your inflows and outflows as they happen, giving you an up-to-the-minute view of your cash position.

Easy-to-read statements: Download clear and concise statements that make it easy to gather the data you need for your projections.

Streamline payments: Set rules for your business spending to better manage your outflows with Payment Controls.

Should your projections show a potential cash shortfall, Lula offers a streamlined process to apply for business funding, ensuring you have the capital you need to keep your business running smoothly.

Opening a Lula Business Bank Account is quick and easy. Here’s how:

- Visit the Lula website: Go to our homepage and click on ‘Open an Account’.

- Complete the online application: Fill in your business details and upload the required documents.

- Get verified: The Lula team will review your application and verify your details.

- Start banking: Once your account is approved, you can start using it right away to manage your business finances.

A cash flow projection is an indispensable tool for any small business owner.

It provides the clarity and foresight you need to grow your business with confidence, make informed decisions and build a thriving business. By taking the time to understand and project your cash flow, you’re not just managing your finances; you’re investing in the future success of your business.

Ready to take control of your business’s financial future? Open a Free or Unlimited Lula Business Bank Account today. Experience business-class banking and discover a smarter way to manage your cash flow.