As an established business owner, you already understand the importance of a dedicated business bank account. But in a rapidly evolving digital world, is your current account still working as hard as you do?

The popularity of modern digital banking is surging, and for good reason. Alternative providers now offer advanced features designed to streamline financial management for savvy small businesses.

Choosing the right business bank account is no longer just about transactional convenience; it’s a strategic move to improve your financial management. The right digital tools can unlock new levels of efficiency, offering integrated invoicing, real-time cash flow insights and seamless software integration.

Modern banking has shifted online, making the process of opening business accounts faster and more efficient than ever.

We provide the essential details you need, covering the types of accounts available, the documents you’ll have to submit, and a step-by-step walkthrough to help you apply and get started.

The Benefits of a Modern Business Account

For an established and growing business, a dedicated business bank account is more than a place to hold money; it’s a strategic asset that enhances your operations and positions your business for future growth. Upgrading to a modern, digital-first account offers tangible benefits that go far beyond basic transaction processing:

- Professionalism and credibility: A modern account elevates your professional image.

- Clear financial tracking: Digital business accounts offer real-time cash flow visibility and other automated functionalities, depending on the provider. Some also allow for the seamless integration with accounting software, providing you with the up-to-the-minute data needed for agile, strategic decision-making.

- Improved creditworthiness and access to funding: A dedicated account with clean, easily accessible data builds a strong financial story. When you apply for funding, a clear transaction history can make the application process faster and strengthen your case, unlocking access to the capital needed for your next phase of growth.

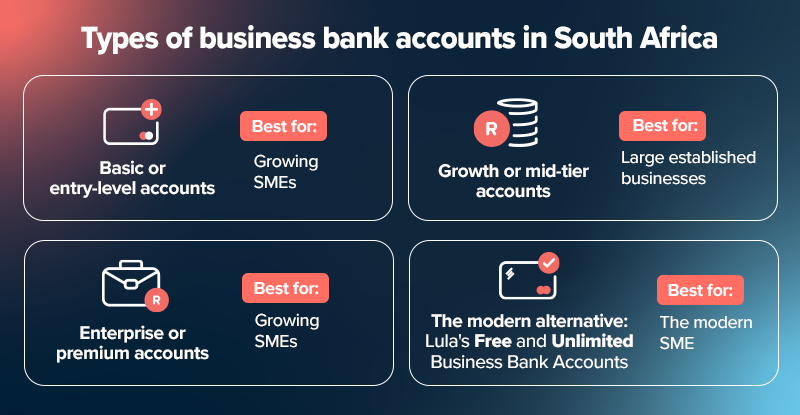

Types of Business Bank Accounts in South Africa and Who They are Best For

Choosing the right account depends on the size and stage of your business. Here’s a breakdown of the common tiers:

Basic or entry-level accounts

These are designed for sole proprietors, freelancers and new businesses with low transaction volumes. They typically have a low monthly fee and offer fundamental features to help you transact and manage your funds.

Growth or mid-tier accounts

Aimed at growing SMEs, these accounts offer more features, such as higher transaction limits, integration with accounting software, and the potential to earn interest on your balance.

Enterprise or premium accounts

Larger, established companies with high transaction volumes benefit from these accounts. They often come with dedicated support advanced cash management solutions.

The modern alternative

Digital-first banking solutions like Lula’s Free and Unlimited Business Bank Accounts are built for the modern SME. Lula’s all-in-one accounts combine powerful features with easier access to funding. Through a sophisticated banking app, you get complete control over your finances, with tools for delegating payments and managing multiple business accounts from a single profile.

What You’ll Need to Open a Business Bank Account (The Checklist)

Before you start, gathering your documents will help make the application process smoother and faster.

When opening a traditional bank account, you’ll generally need the following documents:

• Company registration documents: For registered companies, this means your founding documents from the Companies and Intellectual Property Commission (CIPC).*

• Proof of address: A recent utility bill or statement for the business’s operating address.

• Identification of directors: Certified copies of ID for all directors, members or partners.

• Proof of income (sometimes): Some banks may want to see evidence of business activity or financial projections.

*Only required for the Lula Unlimited Business Bank Account application.

How to Open Your Business Bank Account Online (The Step-by-Step Process)

You don’t need to visit a branch to get started. Follow these simple steps.

Step 1: Research and compare your options

Look at the features that matter most to you. Compare the monthly fee, transaction costs and digital tools on offer to find ways to save on business banking fees.

Step 2: Gather your documents

Get digital copies of everything on the checklist above. Having them in a single folder on your computer or phone will make the next step much easier.

Step 3: Complete the online application

Go to the provider’s website and start the application. You’ll fill in your business details and upload your documents. The best online platforms have a simple, intuitive workflow.

Step 4: Verification and activation

Some traditional banks will want to verify the information you submit. Once approved, you’ll receive instructions on how to activate your account. Your business debit card will be delivered, and you’ll get access to the online banking portal and banking app.

Common Pitfalls to Avoid When Choosing a Bank Account

As you compare options, keep an eye out for these common traps:

• Hidden fees: Don’t be drawn in by a “free” account without reading the fine print. The real cost often lies in high per-transaction charges, card machine rental fees, or costs for transferring funds. Look for a transparent, simple fee structure.

• Lack of scalability: The account that works for you today might not work for you in a year. Think ahead. Does the account support multiple users? Can it integrate with your accounting software? Choose a banking partner that can grow with your business.

• Poor digital security: In a digital-first world, security is paramount. Ensure your chosen provider offers robust security measures like two-factor authentication (2FA), real-time notifications, and customisable user permissions to protect your hard-earned money.

What to Look for in a Business Bank Account

When comparing business accounts, focus on these key areas:

• Fees: Look for a transparent fee structure without hidden costs. A low, flat monthly fee is often better than complex pay-as-you-transact models.

• Digital tools: A powerful and easy-to-use banking app is non-negotiable. It should allow you to manage your account, gain insights on the go, and streamline business payments with smart features like Payment Controls and Multicompany.

• Customer support: You should be able to get support easily without needing to queue in line at a bank. Look for providers who offer responsive digital support. While a traditional banker can be helpful, modern solutions often provide faster, more efficient support through their digital platforms.

• Integration: The ability to connect with accounting software like Xero or Sage can save you hours of admin time.

It’s easier than ever to switch if your current bank isn’t meeting your needs. Don’t settle for outdated services and high fees.

Set Your Business Up for Growth

Opening a dedicated business bank account is a foundational step in improving your business operations and setting your company up for growth. With digital solutions like Lula, the entire process is faster, simpler and more aligned with the needs of a modern small business.

You will also receive dedicated support from a Business Relationship Banker, who will guide you through every step of the process.

Open a business bank account online with Lula for a business-class banking experience.