Small and medium-sized enterprises (SMEs) are the lifeblood of innovation and employment in South Africa’s vibrant economy. Yet, understanding financial options and the different short-term loans in South Africa can be challenging for businesses, with cash flow management often cited as a major hurdle.

For many, inconsistent revenue streams can stifle growth opportunities before they even begin. This is where short-term loans in South Africa provide a vital lifeline, offering the speed and flexibility needed to seize opportunities and maintain momentum.

When it comes to funding, it’s important to understand your options. It’s also crucial to always work with a reputable, registered funding provider when considering business funding options.

We’ve put together this helpful guide to explain four different types of short-term loans that can help you manage your cash flow more effectively and drive your business forward.

What is a Short-Term Loan?

A short-term loan is a form of financing that businesses typically repay within one year, distinguishing it from a long-term loan used for major capital expenditures.

Unlike personal loans, which are for individuals, these funding solutions are designed specifically to provide quick access to money for commercial needs. They address immediate financial requirements, from managing operational expenses to capitalising on sudden growth opportunities.

They come in various forms, each structured to meet different business needs, making them a popular choice for SMEs looking for accessible and manageable funding solutions.

Key Characteristics of Short-Term Loans in South Africa

Short-term loans are powerful tools for business growth precisely because of their unique characteristics. They are typically faster to acquire than traditional bank loans, especially when you apply online through streamlined processes. This speed allows business owners to act decisively.

The funds are often flexible, meaning they can be used for a wide range of business purposes, from marketing campaigns to emergency repairs. This combination of speed and flexibility makes them catalysts for expansion, empowering SMEs to stay agile in a competitive market.

Types of Short-Term Loans in South Africa

When it comes to short-term loans online in South Africa, choosing the best solution is easier when you understand the different options available. Here are four common types:

1. Merchant cash advance (MCA)

A merchant cash advance isn’t technically a loan but an advance on your future sales. A funder provides you with a lump sum of cash in exchange for a percentage of your future debit and credit card sales.

How it works: The repayment, including a small percentage of each transaction, is deducted automatically. When sales peak, you repay faster; when they slow down, your repayment term is longer.

Best for: Businesses with high volumes of card transactions, like those in retail or hospitality. For example, a restaurant could use an MCA to renovate its dining area before the busy season, and repay the advance from the increased volume of customer transactions.

2. Lines of credit

A business line of credit provides access to a set amount of capital that you can draw from as needed. Its cost structure can be complex, sometimes including an initiation fee to set up the facility, a monthly service fee, and a variable interest rate on the funds you use.

How it works: It functions like a credit card for your business. You have a credit limit and can draw any amount up to that limit, repaying it over time.

Best for: Managing unpredictable expenses or ongoing projects. A construction company, for instance, can use a line of credit to pay for materials and labour between client invoice payments, ensuring projects stay on schedule.

3. Lula’s Fixed-Term Funding

A modern and flexible funding solution, Lula’s Fixed-Term Funding is designed specifically for the fast-paced needs of South African SMEs. It provides a lump sum of capital with a transparent, fixed fee, so the total repayment amount is clear from the start.

How it works: If your business has at least one year of trading history, you can apply online in minutes. After an affordability assessment, approved funds are disbursed directly into your business bank account. To streamline the process, it helps to have all your registration documents, like your COR 14.3 certificate, in order.

While alternative funders have criteria that make funding more accessible than that offered by traditional banks, a healthy business credit score also improves your chances of being approved for funding. With alternative lender Lula, if approved, you can receive a lump sum of up to R5 million and repay it over six to 12 months. The repayment terms are flexible and can be structured to align with your business’s revenue patterns.

Best for: Established cash-generating small and medium-sized businesses that need a straightforward small business short-term loan in South Africa for growth. An IT & Communications firm could use Lula’s Fixed-Term Funding to purchase new servers to handle a major client contract, to fuel immediate expansion without being locked into a rigid repayment schedule.

Ready to take the next step?

4. Microloans

Microloans are smaller short-term loans aimed at entrepreneurs or businesses that may not meet the criteria for traditional funding. The final loan amount is typically less than that of other short-term loan options.

How it works: These loans provide smaller amounts of capital, often with more lenient qualification requirements. They are crucial for supporting entrepreneurs at the grassroots level.

Best for: New businesses or those with a limited credit history. A small-scale manufacturing business could use a microloan to purchase essential raw materials to fulfil its first large order.

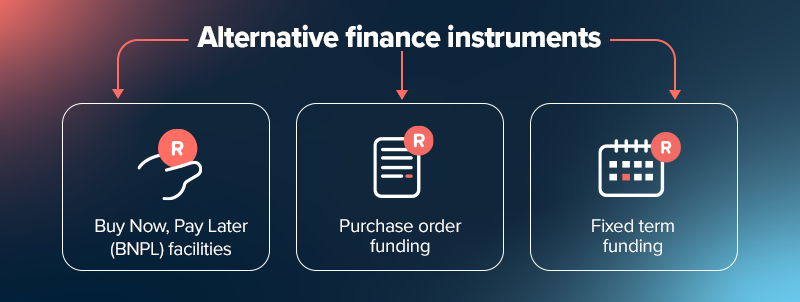

Alternatives to Short-Term Loans

Beyond traditional loan structures, innovative funding solutions offer even more flexibility for SMEs. Here are a few alternatives:

- Buy now, pay later (BNPL) facilities: B2B BNPL services, like Lulapay, a BNPL facility, allow businesses to purchase inventory or supplies and pay for them over time. This is perfect for managing stock levels without tying up working capital. A transport & logistics company, for example, could use a BNPL facility to immediately buy parts for an urgent vehicle repair, keeping their fleet operational.

- Purchase order funding: Another popular option is purchase order funding, which helps businesses pay their suppliers to fulfil a large customer order, bridging the gap between receiving an order and getting paid.

- Fixed term funding: Fixed term funding, is a type of term loan where you receive a single, once-off lump sum of money that can be repaid over a predetermined, fixed period of time with set amounts.

Benefits of Securing Short-Term Loans

The right kind of funding can transform a business. Here are some of the key benefits of short-term loans:

- Collateral-free loan options: Many modern short-term loans, including Lula’s Fixed-Term Funding, are unsecured. This means you don’t have to risk personal or business assets to qualify for funding.

- Easy to secure: With streamlined online applications and advanced data analytics, alternative lenders can approve and disburse funds much faster than traditional banks, sometimes within as little as 24 hours.

- Flexible usage of funds: The capital can generally be used for any legitimate business purpose, giving you the freedom to allocate it where it’s needed most, be it marketing, inventory or operational costs.

- Quick repayment: The short repayment term (typically 12 months or less) means you can clear the debt quickly and focus on your business’s long-term profitability without being burdened by years of debt.

When to Consider a Short-Term Loan

A small business short-term loan is an ideal solution in several key growth scenarios:

- Bridging cash flow gaps: Cover payroll, rent and other operational costs during a slow sales period.

- Purchasing inventory: Stock up on products ahead of a busy season or take advantage of a bulk discount from a supplier.

- Managing unexpected expenses: Fund a sudden large order or invest in an equipment upgrade to improve efficiency. For major asset purchases, specialised equipment finance might also be a suitable option.

- Seizing growth opportunities: Invest in a new marketing campaign, hire additional staff or take on a larger project than you could typically afford.

Your Partner in Growth

Understanding the different short-term loans in South Africa empowers you to make the best financial decisions for your business. From merchant cash advances to modern solutions like Lula’s Fixed-Term Funding, there is a funding option designed to meet your specific needs.

At Lula, our business-class banking and funding solutions are tailored to meet the unique needs of small business owners. We also provide access to a suite of tools designed to streamline financial management, improve cash flow and enable growth and expansion. When opening an Unlimited Lula Business Bank Account you will also receive dedicated support from a Business Relationship Banker to help you.

Fast-Track Your Business Growth

Don’t let a temporary cash flow crunch hold your business back. You can access up to R5,000,000 in business funding within as little as 24 hours. The online application process is fully digital and you can fill in your business details in minutes to see if you qualify.

If you want an estimate of what your repayment term would be, you can do a quick calculation with our business funding calculator.