Tax planning isn’t just a compliance exercise. For many businesses, especially in construction, manufacturing, transport and logistics, it can be part of a real growth strategy.

A powerful tool for South African small business tax planning in South Africa is the Section 12E allowances, under South Africa’s Income Tax Act, which function as accelerated wear-and-tear claims.

While standard Section 11(e) wear-and-tear rates typically force businesses to spread tax deductions over several years, Section 12E empowers qualifying Small Business Corporations (SBCs) to “fast-track” these claims by writing off the full cost of manufacturing assets in the first year – or by using the rapid 50/30/20 split for other equipment.

Why Wear-and-Tear Allowances Matter

If you run a business in South Africa, you know the pressure points: wages, suppliers, fuel, materials, rent and equipment maintenance don’t wait for your tax return to be finalised.

If your business meets the requirements to be treated as an SBC, you may be able to write off certain equipment sooner than you normally would under standard wear-and-tear rules.

By taking advantage of these allowances, you can reduce your immediate tax liability and inject vital cash flow back into your operations.

Section 12E allows qualifying small business corporations (SBCs) to write off the cost of business assets much faster than usual. Instead of spreading the tax deduction over several years, you get to claim a large portion – or even the full amount – right upfront.

“It increases the depreciation expense, which in turn reduces profit, which results in less SBC income tax payable,” says Nicolette Janssen, Chartered Business Accountant in Practice (CIBA) at Jantec Solutions.

By reducing your taxable profit, you keep more cash in the business to reinvest in growth, hiring or equipment.

Accelerated depreciation doesn’t remove what you owe. If your business satisfies the requirements, it brings forward the tax deduction – meaning you may pay less tax earlier by claiming a larger write-off up front.

For many business owners, this is where smart planning overlaps with the effective management of working capital. Instead of paying more now and reinvesting later, you can invest in equipment and receive the tax relief sooner.

What is Section 12E Accelerated Depreciation and Who is it Meant for?

Section 12E is an accelerated depreciation allowance for SBCs in South Africa that fall within the criteria. In plain terms, it allows an eligible business to claim a tax deduction on certain assets sooner, rather than spreading it out over several years.

This can help cash flow because the deduction may reduce taxable income earlier – but it doesn’t make your tax bill disappear.

Think of Section 12E as a “fast-track” upgrade. When a business qualifies as an SBC, Section 12E effectively overrides the slow, year-by-year schedule of Section 11(e) wear-and-tear claims.

“Simply put, manufacturing assets can be considered for a 100% write-down in the year of assessment in which the asset was brought into use, whereas non-manufacturing assets can be written down at 50% in the first year, 30% in the second year, and 20% in the third (50/30/20),” says Janssen.

Read on to see whether your business is eligible for Section 12E allowance – and which business purchases and record-keeping requirements matter most.

SBC Eligibility: The Key Requirements to Meet

Section 12E applies to SBCs, but not every small operation satisfies the requirements. In practice, eligibility usually comes down to a few core requirements:

- The taxable turnover must be under R20 million for the year of assessment.

- The shareholders must be natural persons (not businesses, trusts or other entities).

- Those shareholders generally must not hold shares in other entities (in other words, they should typically only have an equity interest in the SBC).

- If the business is a personal services business, it must employ at least three independent employees on payroll to be accepted as an SBC.

“The business must generate a turnover of less than R20 million. Shareholders must be natural persons and also be listed shareholders on the SBC. They also can’t be listed on any other entities. For a personal services business to become an SBC, they have to have three independent employees on their payroll,” says Janssen.

This is also where a ‘beneficial owner’ check becomes important, because shareholder structures and who holds shares can determine whether the business meets the SBC requirements.

Common Reasons a Business Does Not Meet the SBC Rules

Even if a business is small, it won’t always satisfy the requirements as an SBC and won’t be able to use Section 12E if it fails the SBC tests in the Income Tax Act. Common disqualifiers include:

- Turnover/gross income above R20 million for the year of assessment;

- Individuals who hold shares or an equity interest in other businesses during the tax year of assessment (subject to limited exceptions), which can disqualify the entity; and

- Personal services-type businesses that don’t meet the conditions that allow certain personal services to still be eligible (including the requirement around employing three or more full-time employees throughout the year of assessment).

Before you do your tax planning around accelerated depreciation, confirm you meet the SBC criteria. It’s one of the quickest ways a small business tax strategy can turn into a compliance problem if the tax return is reviewed.

What ‘Brought into Use’ Means

A common misunderstanding is thinking that buying equipment automatically triggers an allowance. Under Section 12E, what matters is the year of assessment and whether the item was actually brought into use – that is, “when the asset is used in manufacturing or a similar process in the company,” says Janssen.

Any documentation showing the exact date and time that the asset was brought into use can be used as proof.

So, when planning for the year’s assessment, keep the paperwork that supports real use, not just invoices. Depending on the situation, with regard to the equipment’s use in trade, that may include job cards, installation sign-offs, delivery notes and receipts.

Which Assets Commonly Qualify Under Section 12E?

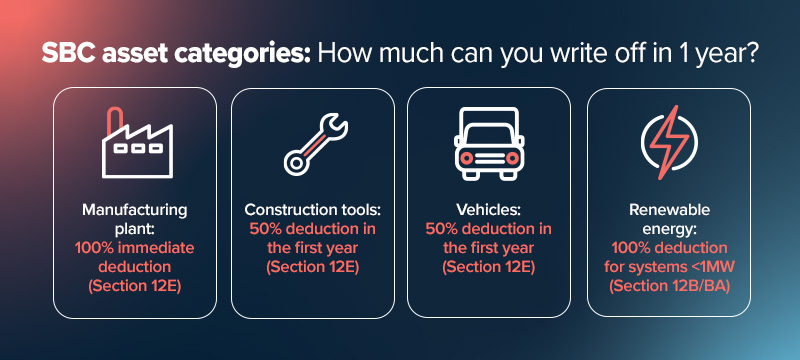

Section 12E can apply to business purchases such as machinery, plant, implements, utensils, articles, aircrafts or ships – as long as the item falls within the criteria for a wear-and-tear (depreciation) deduction and is used in the operation. Here is a breakdown of the incentives that apply for three asset categories:

1. Manufacturing assets

You can write off 100% of the cost in the very first year the asset is brought into use.

2. Non-manufacturing assets

You can use an accelerated 50/30/20 split (50% in year one, 30% in year two, 20% in year three) rather than waiting 5+ years.

3. Solar and wind assets

For assets brought into use to generate electricity, you can often deduct 125% of the cost in the first year with no cap on generation capacity. These assets fall under Section 12BA for renewable energy which offers the most aggressive “accelerated” incentive in South Africa.

According to the South African Revenue Service (SARS), Section 12BA allows a deduction of 125% of the cost of renewable energy assets that are brought into use for the first time on or after 1 March 2023 and before 1 March 2025.

This incentive applies to assets brought into use for the first time between 1 March 2023 and 28 February 2025.

Assets purchased now may no longer qualify for the 125% Section 12BA incentive. They would instead likely fall back to the standard Section 12B 100% write-off for systems <1MW.

“The renewable energy deduction does not form part of the Section 12E Act, but it is part of Section 12BA. It allows taxpayers to claim 125% of the cost incurred to acquire renewable energy assets,” says Janssen.

How Write-offs Apply to Assets

Manufacturing assets

If the asset is used directly in a manufacturing process, Section 12E generally allows a 100% write-off in the same year of assessment that the asset is brought into use, as long as it is used for manufacturing processes and meets the wear-and-tear requirements.

Manufacturing, for Section 12E purposes, is usually understood as an activity where raw materials are transformed into a finished product. Because ‘manufacturing’ is sometimes used loosely, it’s important that the claim reflects what your operation actually does and how the asset is used to generate income.

Non-manufacturing assets

If an asset falls within the criteria under Section 12E but is not used in manufacturing, the allowance is spread over three years rather than claimed all at once. The write-off works on a fixed schedule:

- Year 1 (year brought into use): 50%

- Year 2: 30%

- Year 3: 20%

In practice, the most common issues are not about the percentages but about how the asset is recorded and classified. Problems arise when the asset type is unclear, the values recorded do not match supporting documents, or the paperwork does not clearly show when the asset was brought into use.

SARS guidance is clear that timing matters because the allowance is claimed with reference to the year of assessment in which the asset is brought into use.

If the classification or reporting is weak, SARS may disallow or adjust the claim, which can change the final tax result when the return is reviewed.

If you aren’t an SBC but you are a manufacturer, you still get an accelerated 40/20/20/20 write-off:

Year 1: 40% deduction

Year 2: 20% deduction

Year 3: 10% deduction

Year 4: 5% deduction

General wear-and-tear claims

For businesses that aren’t SBCs, the standard SARS write-off periods apply. ‘Acceleration’ in this context means choosing the shortest legal lifespan permitted by SARS. Here are the typical periods:

• Small items: You can write off any asset costing less than R7,000 (excluding VAT if you are a VAT vendor) by 100% immediately in the year you bring it into use.

• Laptops and software: Over three years (33.3% per year)

• Cellphones: Over two years (50% per year)

• Delivery vehicles: Over four years (25% per year)

• Passenger vehicles: Over five years (20% per year)

• Office equipment and security systems: Over 5 years (20% per year)

• Furniture and fittings: Written off over 6 years. (16.6% per year)

Recoupment and capital gains tax

Accelerated depreciation is not ‘claim and forget’. If you sell the equipment later, there can be consequences.

“When a business claims Section 12E and sells business items, the treatment depends on whether it was previously removed as a capital asset. If the item was deducted as a capital asset, the amount previously allowed as a deduction must be included in the taxpayer’s gross income. This is known as recoupment,” says Janssen.

So yes, capital gains tax can apply, and it becomes relevant when disposal proceeds exceed cost.

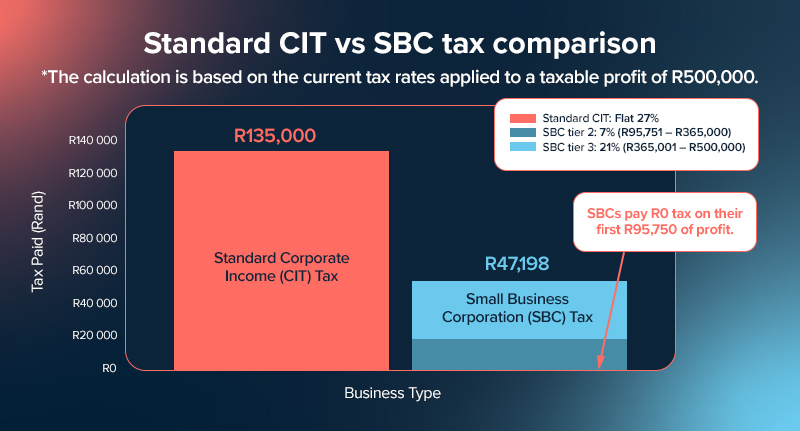

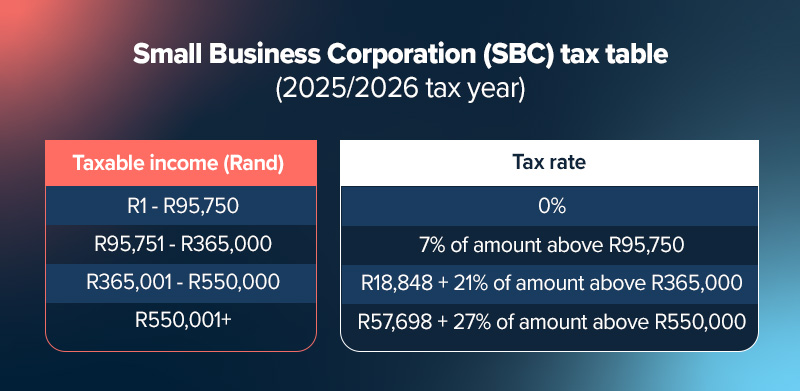

The current small business tax tables (2025-2026)

Small business tax tables show the rate of tax you would pay at each taxable income level in rands. You can use it as a predictive roadmap by identifying exactly where your profit falls within the brackets and strategically time your business expenses and take full advantage of wear-and-tear allowances if you do qualify.

For the current year of assessment, the SBC bands and rates are as follows:

- Taxable income (R) R0 – R95,750: Nil (0% – no tax is payable in this band)

- Taxable income (R) R95,751 – R365,000: 7% of the amount above R95,750

- Taxable income (R) R365,001 – R550,000: R18,848 + 21% of the amount above R365,000

- Taxable income (R) R550,001 and above: R57,698 + 27% of the amount above R550,000

As your taxable income increases, your rate of tax increases.

How to use a small business tax calculator

A small business tax calculator can help you estimate how your taxable income might change based on depreciation and projected results.

A practical approach is to compare:

- taxable income before the equipment purchase;

- taxable income after allowable depreciation;

- estimated tax to pay under the relevant tax tables; and

- the full cost of the equipment (including any funding cost).

Provisional Tax: Paying in Advance During the Tax Year

If you’re a provisional taxpayer, you make payments during the tax year based on estimates, not final figures. Many businesses only realise they’re expected to pay in advance when SARS issues a notice. It helps to confirm early on whether you’re liable and what your payment cycle looks like.

Because the provisional tax system is progressive, the tax rate depends on where your taxable income falls in the tax tables, and taking advantage of Section 12E accelerated depreciation can shift that outcome by reducing taxable income earlier.

SARS wants you to pay based on estimated taxable income, even before you file your return for income tax.

To avoid surprises, review the tax tables to confirm the tax rate and the rate of tax that applies, and update your estimate if your taxable income/turnover changes.

Because a sole proprietor is taxed in their own name, personal income tax estimates also determine what you pay.

“For a person or a company, the provisional tax rate is calculated on the estimated income.

The general days are 31 August for the first provisional payment and 28 February for the second provisional payment, unless the company’s year-end date differs from the norm,” says Janssen.

If you miss a deadline, under-estimate, or pay too little, SARS may impose penalties and interest, depending on the circumstances. A practical way to manage this is to use the previous year as a baseline and update your provisional tax estimate as trading results change.

Some systems can automatically generate internal summaries to support forecasting, but the responsibility still sits with the taxpayer to pay for provisional tax.

Turnover Tax and Taxable Turnover (Micro-Business Option)

Some operations with lower annual turnover look at turnover tax as an alternative route.

To keep it clear:

- Taxable turnover is turnover-based.

- Taxable turnover is not the same as taxable income.

- In a tight period, a business can still have taxable turnover even when finances are under pressure.

That difference matters for small businesses, which is why comparing each approach carefully can affect what you pay across the tax year.

Holistic Tax Planning: Business Expenses, Records and the Tax Return

Depreciation is only one lever. Another way to improve your small business tax in South Africa is by tightening how you track business expenses and maintain records. Here are some valuable small business tax tips you can apply while preparing for the tax season.

Even if you meet the Section 12E rules, you still need clean inputs when filing your tax return. That includes properly tracking income, categorising expenses and keeping invoices and receipts.

SARS expects the tax return to reflect real activity supported by documentation in South Africa.

Common deductible categories for business expenses can include:

- salary and wages (salary costs);

- rent for premises;

- operating materials and consumables;

- professional fees; and

- utilities linked to trade.

Keeping expenses organised helps you claim what you can legitimately claim, while still staying compliant and avoiding last-minute gaps when you prepare your tax return.

Home Office Deductions: Strict Requirements and What to Keep

Home office claims may be valid, but the requirements are strict.

Home office deductions are only available if the room is regularly and exclusively used for your trade and is specifically equipped for that purpose.

“If your remuneration consists only of a salary and similar remuneration, your duties must be mainly performed in this part of the home. More than 50% of your duties must be performed in your home office.

“If more than 50% of your remuneration consists of commission or other variable payments, then more than 50% of your duties must be performed somewhere other than an office provided by your employer,” says Janssen.

For salaried employees (not commission earners), the law is even stricter than implied. SARS has recently taken a very hard line, often disallowing home office claims if the employer provides an office space elsewhere, even if the employee chooses to work from home.

In addition to this, all relevant documentation on the allowance home office claim must be submitted with proof in the form of a photo of the home office area used for business.

Small Business Tax Impact on Working Capital

Many small business tax decisions are really working-capital decisions because tax affects how much money stays in the business each month.

When you claim the accelerated depreciation allowance correctly (for example, under Section 12E), you are not ‘saving’ money out of thin air – you are moving a deduction forward. Small business funding can give you access to capital to purchase equipment.

This reduces the income tax pressure on your cash flow and frees up working capital for you to invest elsewhere. By taking advantage of incentives, tracking expenses correctly and planning ahead, you can reduce your taxable income.

To protect your cash flow while ensuring you have the working capital to cover expenses, day-to-day operational costs, and to purchase equipment with ease and grow. An alternative funding solution like our Lula Cash Flow Facility can help you.

The key is to treat tax relief as part of a broader working capital plan – accurate records, compliant claims and enough money on hand to keep operations moving even when provisional tax or other payments land.

Section 12E can be a valuable tool for small businesses in South Africa, especially where the business invests in productive equipment and keeps strong records, bearing in mind that it only benefits the company if the requirements are met and there is supporting documentation.

If you want to take advantage of accelerated depreciation and keep working capital healthier, treat it as part of a broader plan: clean records, clear reporting, well-supported claims, and proactive planning around your year of assessment and key deadlines, including whether you need to pay provisional tax.

Ready to maximise your small business tax savings and take advantage of accelerated depreciation? Learn more about equipment finance and how you can make use of funding to take advantage of tax benefits.