What is purchase order funding, and is it the right choice for your business?

With growing pressure on supply chains and rising operational costs, many South African SMEs are turning to short-term funding to stay competitive. Understanding options like purchase order financing – and their limitations – can help you make smarter, more sustainable financial decisions.

But what exactly is purchase order financing, and is it the best fit for your business’s needs?

We’ve put together a helpful guide explaining what purchase order funding is and when it makes sense to use it. We also look at the drawbacks of purchase order funding, and how Lula offers a flexible, transparent alternative for growing SMEs.

What is Purchase Order Funding?

Purchase order (PO) funding is a type of short-term financing that helps businesses pay suppliers to fulfil large customer orders.

Instead of missing out on a big deal because of limited working capital, a business can approach a lender who pays the supplier directly.

Once the order is fulfilled and the customer pays the invoice, the business repays the lender.

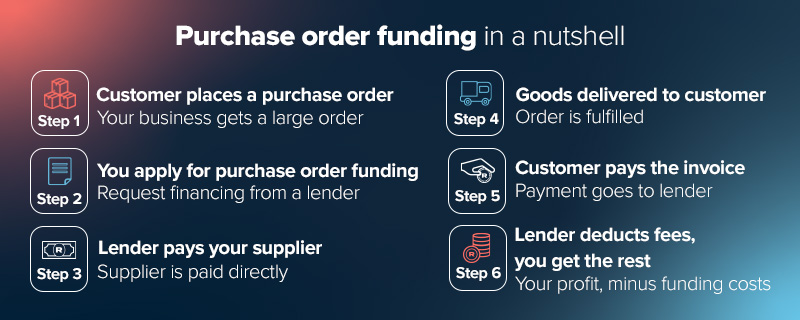

How does purchase order funding work? Here’s a breakdown:

- Your business receives a purchase order from a customer.

- You apply for purchase order funding.

- A lender evaluates your purchase order and agrees to pay your supplier.

- Your supplier delivers the goods directly to your customer.

- Your customer pays the invoice.

- The lender deducts their fees and passes on the remaining amount to your business.

What is Purchase Order Finance Used For?

Typical businesses or industries that use purchase order funding include:

- SMEs dealing with large or unexpected orders.

- Businesses that work with international suppliers who need upfront payment.

- Wholesalers or distributors that resell goods to retailers.

- Seasonal businesses preparing for peak trading periods (eg holiday stock).

- New businesses receiving their first major retail or wholesale order.

- Businesses that need to fulfil tenders or government contracts where delivery must happen before payment.

PO funding can also support SMEs involved in tender work or seasonal retail, where large stock orders are needed in advance, but payment is only made once goods are delivered. This ensures they don’t miss out on lucrative opportunities due to cash flow gaps.

Note: PO funding is typically suited for product-based businesses rather than service-based businesses. It’s most effective when there is a clear, guaranteed end-customer payment.

Drawbacks of Purchase Order Funding

While PO funding can be useful for some SMEs, it also comes with a few drawbacks that are important to consider before accepting terms:

1. Limited scope

Purchase order funding is not a one-size-fits-all solution. It’s generally only available for:

- Product-based businesses

- Orders that meet certain volume or value thresholds

- Specific supplier relationships

If your business needs funding for working capital, marketing or operations, PO funding may not help.

It also doesn’t support businesses that are still in the ideation or prototyping phase – PO funders typically require a confirmed and legitimate customer purchase order before considering an application.

2. High costs

Between processing fees, interest rates and administrative charges, the cost of PO financing can be steep. Over time, these expenses can eat into your profit margins.

Depending on the provider and the complexity of the purchase order, total costs can range from 3% to 8% per month, which adds up quickly if the sales cycle is long.

This makes PO funding significantly more expensive than some other SME funding solutions.

3. Strained cash flow

Even though purchase order finance helps fulfil orders, repayment terms can be long and rigid, especially if your customer takes time to pay their invoice. This can create a cash flow crunch, affecting day-to-day operations.

Businesses might end up juggling multiple short-term loans to keep operations afloat, which increases financial strain and administrative overhead.

In some cases, this can delay salary payments, stock replenishment or marketing campaigns.

4. Risk of dependency

Relying heavily on purchase order funding can lead to a cycle of debt and a lack of financial flexibility. Diversifying your funding sources can better support long-term growth.

PO funders often hold considerable control over the transaction, and repeated reliance may limit your ability to negotiate better supplier or customer terms.

It can also give off the impression that your business lacks financial stability.

The Value of Considering Alternative Financing Options

If you’re looking for more versatile, transparent, and flexible SME funding solutions in South Africa, Lula offers alternatives that make it easier to run and grow your business without the constraints of PO funding.

Cash Flow Facility

Our Cash Flow Facility works like a revolving credit facility that gives businesses flexible access to funds when they need them. Use it for anything from purchasing stock and covering day-to-day expenses, to investing in that game-changing piece of equipment.

Unlike with PO funding, you don’t need a confirmed purchase order in order to apply for this facility. It can be used proactively to take advantage of new opportunities, manage seasonal cash flow dips, or invest in business improvements.

Fixed-Term Funding

With our Fixed-Term Funding, you get a one time lump sum with fees that don’t change and transparent terms. This funding solution is ideal for short- to medium-term needs.

It’s suitable for businesses in South Africa that need fast access to funding without jumping through hoops. Whether you’re bridging a temporary shortfall or expanding into a new market, our Fixed-Term Funding puts you in control.

[Replace Asset]

Why Lula’s alternatives work better for many SMEs

- Flexibility: Use funds for various business needs, not just supplier payments.

- Predictable costs: Know exactly what you’ll repay with no hidden fees. Try our Business Funding Calculator to get a clear picture.

- Faster access: Apply online in minutes and receive funds within as little as 24 hours.

- Scalability: Our funding options grow with your business needs.

Explore all our funding solutions – flexible, transparent alternatives.

Lula’s SME Funding Solutions: A Better Alternative to Purchase Order Funding

So, what is purchase order funding? It’s a tool designed to help SMEs experiencing a cash flow dip fulfil large customer orders by covering upfront supplier costs.

But while it may seem like a quick fix, the drawbacks – from high costs to rigid repayment structures – often outweigh the benefits.

That’s where we come in.

Our flexible, transparent SME funding solutions offer faster, broader, and more adaptable alternatives to PO funding.

Whether you need to boost cash flow, grow your team, or take on new orders, Lula has a solution tailored to your business.

Apply now or learn more about our business funding options.