The biggest business mistakes don’t always arrive with fanfare.

For many South African small business owners, they creep in quietly, hiding behind business decisions that seem harmless at the time.

These might include overspending on marketing strategy, launching a new product without proper backing, or trusting that a client will always pay on time.

By the time the signs appear, it’s often too late: suppliers aren’t paid, growth stalls and sleepless nights take over.

This often starts with subtle missteps you might not even realise are hurting your business and builds up to the bigger miscalculations that can threaten survival.

Read on to discover nine of the biggest business mistakes that quietly sabotage cash flow. Along the way, you’ll find practical strategies – from smart tech to new funding solutions – to patch the cracks and keep your cash flowing, so your business can grow without unnecessary stress.

Why Getting Your Cash Flow Right is So Important

For small businesses and start-ups in South Africa, cash flow is the lifeline that keeps operations running smoothly.

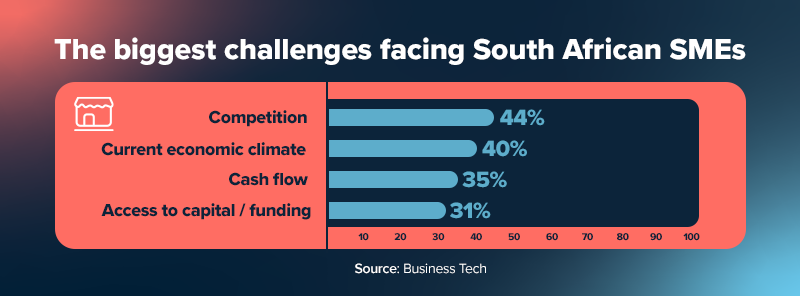

According to Business Tech, restricted cash flow is cited as one of the biggest challenges facing SMEs, with limited access to funding not far behind.

Without steady cash flow, even profitable businesses can struggle to pay suppliers, cover staff salaries or invest in growth opportunities.

Poor cash flow can also:

• stall expansion plans;

• damage relationships with clients and vendors; and

• create constant stress for business owners.

Getting cash flow right means understanding exactly what’s coming in and going out of your business and spotting bottlenecks before they become damaging.

Being aware of common cash flow mistakes will help you do that.

The Nine Biggest Business Mistakes That Kill Cash Flow

Cash flow errors affect all businesses at some point, even the likes of Amazon, Apple, Microsoft and Netflix when they started out.

The key is to recognise a big mistake in the making and stop it from being something that can derail your cash flow management and, ultimately, your business growth.

1. Confusing revenue with cash flow

One of the most common mistakes SMEs make is equating sales with cash in the bank. High sales numbers look good on paper, but they don’t always translate into liquidity.

Let’s take the example of a retailer who pushes out strong monthly sales, but most of those transactions are on credit. When suppliers come knocking, there’s no cash to pay them, despite the bumper revenue.

Why it matters

Overconfidence from sales figures often leads to overspending – and financial commitments the business can’t sustain.

Tip for small business owners

Treat sales, profit and cash as three separate measures. You can use cash flow statements to see what’s actually moving in and out of your account, not just what you’ve billed your customers.

2. Poor cash flow planning for irregular or seasonal income

South African businesses know the rhythm of feast and famine.

Agriculture, tourism and even retail swing heavily depending on the season. The same goes for government or corporate clients who often delay payments for months.

A common example is an e-commerce business that sees a bumper revenue month in December, overhires staff in January, then struggles through a lean February when payments are late.

Why it matters

Without a buffer, these cycles create unnecessary cash stress. This leads to borrowing at the wrong time or owners being forced to dip into their personal funds – 41% of South African SME owners have done this in the last year, according to a recent Xero report.

Tip for small business owners

Build a cash reserve that covers at least two months of expenses. Use rolling cash flow forecasting to anticipate dry spells and plan spending more strategically.

3. Ineffective debt collection and credit management

Cash tied up in unpaid invoices is cash you can’t use. Unfortunately, this is the reality for most South African SMEs, with 91% facing late payments. This issue isn’t just frustrating – it can threaten your business’s growth.

A services firm that waits months for payment from a large client, for example, may find it nearly impossible to cover payroll.

Employees who receive their wages late are much less likely to perform at their best or remain loyal to the business. This can quickly ripple into operational problems and reputational damage as customers notice the lower morale among the team.

Why it matters

Late invoices create a domino effect. If clients don’t pay, you can’t pay your team, suppliers or creditors.

Tip for small business owners

Set clear payment terms up front, use invoicing software to automate reminders, and follow up consistently – even using social media direct messages (i.e. LinkedIn), if it comes to it.

Don’t let the fear of “annoying” clients cost you your business: protecting cash flow protects your team, too.

4. Neglecting professional advice

DIY finance feels cost-effective, but it’s often expensive in the long run. Many South African SMEs avoid accountants or tax advisers, only to make compounding blunders in tax, compliance or forecasting.

A business that misses tax deadlines, for example, pays penalties that eat into already thin cash reserves.

“Keep in mind that tax laws are complex, and what works well for one person may not suit another,” says Stefan Kritzinger, Head of Compliance and Support at Govchain, speaking to Forbes Africa.

Why it matters

Professional guidance can highlight risks you may not see and help prevent avoidable cash leaks.

Tip for small business owners

Partner with an accountant or adviser, even on a part-time basis. The upfront cost often saves money and stress down the line.

5. Not separating personal and business finances

Mixing personal and business money makes it nearly impossible to see how your business is really performing. It also complicates tax submissions and can block access to funding.

A common example here is when a café or restaurant owner dips into the till for household expenses, leaving less for stock purchases. Apart from this cash flow hold-up, it can also affect their ability to apply for funding, with their messy books raising red flags among lenders.

Why it matters

Unclear reporting blurs finances, making it harder to understand profit, cash flow and eligibility for funding.

Tip for small business owners

Open a dedicated business account. The best ones provide dedicated customer support, digital banking features, and easier access to business funding.

This will help you keep personal spending separate and pay yourself a salary rather than dipping into business funds.

6. Over/understocking or bad inventory management

Inventory is a cash trap when not managed properly. Too much stock ties up money that could be used elsewhere, and too little leads to missed sales.

A retailer that over-orders for a new season, for example, will leave shelves full of unsold goods and little cash to cover rent or salaries.

Why it matters

Stock management is one of the biggest levers in retail and distribution cash flow. Getting it wrong can stall a business fast.

Tip for small business owners

Use digital inventory tools to align stock with real demand. Rely on data, not guesswork, to place orders so that you free up cash and prevent unnecessary waste.

7. “Driving blind” without tech, data and financial metrics

Ever tried driving with your eyes closed? If not, great – we do not recommend it.

Trying to run a business without financial visibility is a little like this, albeit less physically dangerous. Too many SMEs still rely on paper records or spreadsheets, but this can open up blind spots that lead to cash flow crashes.

With a simple paper record, an owner might discover a shortfall only when a supplier payment bounces. By then, it’s too late to react.

Why it matters

Without metrics, you can’t see trends in profitability, customer behaviour or cash burn. This creates a cycle of constant firefighting.

Tip for small business owners

Adopt affordable financial tools for accounting, invoicing and KPI tracking. Lula’s SME funding and banking platform, for example, gives real-time visibility and quick access to funding when gaps appear, so you don’t get caught off guard.

8. Underpricing or lacking a pricing strategy

Setting prices too low to attract potential customers feels safe, but it slowly starves your business of the cash it needs to survive.

A cleaning company that undercuts competitors to win contracts, for example, may find margins so thin they can’t cover rising fuel and wage costs.

Why it matters

No matter the business idea, underpricing creates a race to the bottom. Without profit, cash flow dries up, no matter how many clients you serve.

Tip for small business owners

Review pricing regularly as part of your business strategy. Consider your costs, the value you provide and market conditions. Don’t be afraid to raise prices if your service justifies it.

9. Expanding too quickly without adequate funding

Growth is exciting, but expansion without proper financial planning is a cash flow killer. Many businesses mistake short-term success for long-term sustainability.

A franchisee may open multiple outlets within a year, but then realise cash flow can’t support the overheads.

This is a common issue across the continent. According to the LSEG, 40% of African SMEs cite a lack of funding as the primary factor constraining their growth.

“Traditional lenders have historically underserved the SME market,” says Trevor Gosling, co-founder and CEO of Lula. “This has unfairly hindered the growth of companies that make up the backbone of South Africa’s economy.”

Why it matters

Rapid scaling stretches working capital thin, leading to closures even when demand is strong. Even business owners with the strongest entrepreneurship skills find this challenging.

Tip for small business owners

Before expanding, map realistic cash requirements and secure the right funding. The best lenders are those that are more like growth partners than banks and provide flexible funding tailored to your business plan.

With Lula, for example, you can check eligibility in minutes and grow without risking the stability of your existing business.

Stop the Drip: Keep Your Cash Growing With Lula

Most South African SMEs don’t become business failures because of weak ideas or a poor business model. They stumble because of small, avoidable business mistakes that slowly choke cash flow.

The danger is that these errors often look like harmless drips – until they snowball into something serious.

The good news? They’re fixable. With a few simple shifts, like separating personal and business finances, leaning on new technologies, or getting the right professional advice, both established and new business owners can keep their footing and stay prepared for growth.

And when that growth calls for extra support, platforms like Lula are built to help.

Lula gives you fast, flexible access to small business funding, so you can bridge cash flow gaps, scale with confidence and keep your focus on building a bigger market share and lasting success.