Growing a business in South Africa is no easy feat. Just ask any business owner wrestling with the never-ending stack of financial documents that they must have on hand.

The statement of changes in equity is one of the most important reports. It’s the one document that everyone wants to see, from banks to potential investors, because it tells the story of your company’s financial health over time.

Yet putting it together can be challenging due to:

- Confusion about equity movements and how to identify and include different types of equity

- The time-consuming preparation process, including going through financial data and preparing the document in the right format

- The risk of misrepresenting your company’s financial position to stakeholders due to small calculation mistakes

As a result, your business could miss out on pivotal business opportunities – just because you can’t properly demonstrate your equity movements.

Luckily, preparing a professional statement of changes in equity isn’t as difficult or as costly as you might think.

Looking for solutions to streamline your financial reporting? Open a Lula Business Bank Account to start managing multiple business accounts through a single login.

Keep reading for an in-depth guide and template that will show you how to create this essential piece of financial reporting for your business in no time.

What is the Statement of Changes in Equity? (And Why is it Important?)

The statement of changes in equity is a document that tracks how your company’s ownership value has shifted over a specific accounting period, typically a financial year.

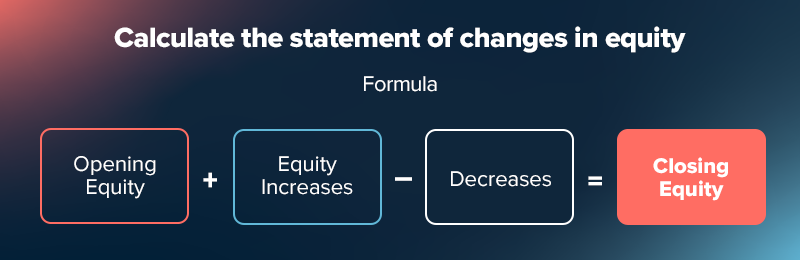

If you want to know how to calculate the statement of changes in equity, the formula is simple:

Opening equity + equity increases – decreases = closing equity

The formula breaks down exactly how your company’s share capital, retained earnings, and other equity components have changed over your financial year. It takes into account your total comprehensive income and outgoings to give you a year-end figure.

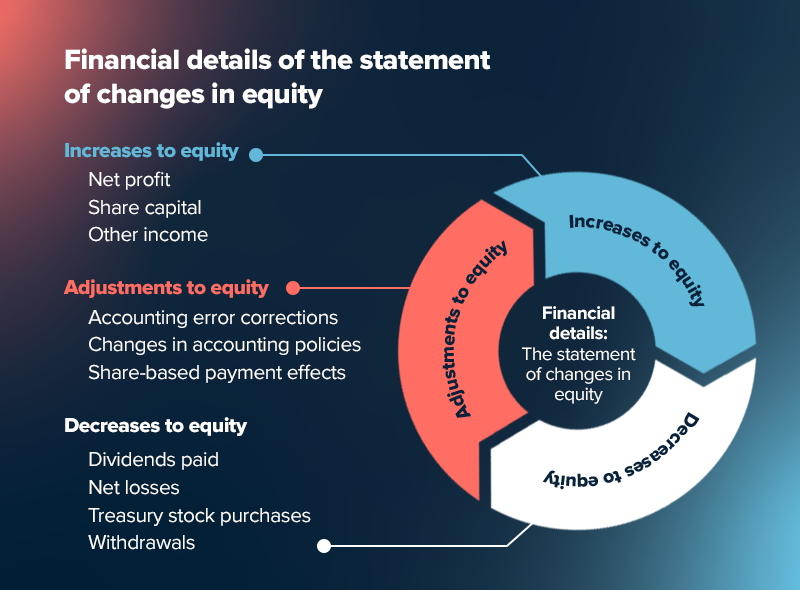

Specifically, the statement of changes in equity looks at the following financial details.

Increases to equity:

- Net income or net profit – The company’s retained earnings from operations that are kept in the business (in other words, in equity) rather than being paid out immediately

- Additional share capital – New investments coming into the business from new share issues to investors or existing shareholders

- Other comprehensive income – Value gains that don’t appear on your income statement, like unrealised gains on investments and asset revaluations

Decreases to equity:

- Dividends paid – Cash or stock distributions made to shareholders from the company’s earnings

- Net losses – Operating losses that reduce retained earnings and the company’s equity position

- Treasury stock purchases – Buying back your own company’s shares from the marketplace

- Owner withdrawals – Capital taken out of the business by owners (common in smaller companies)

Adjustments to equity:

- Prior period error corrections – Adjustments made to fix accounting mistakes from previous reporting periods

- Changes in accounting policies – Adjustments when companies change how they calculate accounting, like changing from one inventory method to another

- Share-based payment effects – The impact of giving employee stock options and similar equity-based rewards

Feeding all of these components of equity into the equity balance answers the question: “Where did our equity come from, and where did it go?” and thus gives you a clear view of the financial decision-making in the company.

Equity and Financial Reporting: Getting the Bigger Picture

The statement of changes in equity is one of the four fundamental financial statements that every established business must prepare alongside its income statement, balance sheet, and cash flow statement.

Every financial statement shows a different side of your business’s financial story. The income statement reveals whether the business is profitable, the balance sheet shows what you own versus what you owe, and the statement of cash flow puts you on the right track to effective cash flow management.

The four essential financial statements compared

| Document | Income statement | Balance Sheet | Cash flow statement | Statement of changes in equity |

| Purpose | Shows profitability and financial performance | Displays financial position and solvency | Tracks cash movements in and out of the business | Documents movements in owner’s equity |

| Key data | Revenue, expenses, net income, earnings per share | Assets, liabilities, shareholders’ equity | Operating, investing and financing activities | Share capital changes, retained earnings, dividends paid and total equity |

| Time frame | Specific period (monthly, quarterly, or annual financial statement) | Specific point in time (snapshot) | Arbitrary accounting period | Arbitrary accounting period |

*Toggle over the table and scroll down to view all the information.

What is the Purpose of a Statement of Changes in Equity?

The document helps readers understand whether management decisions have improved shareholder value over time. The statement of changes in equity provides hard evidence of financial discipline and strategic decision-making to (potential) funders and stakeholders.

A strong statement is one of the most effective ways to get funding for a small business in South Africa from lenders and investors who view strong equity documents as evidence of professional financial management. It also provides the transparency that builds stakeholder confidence in your company’s growth trajectory.

How to Prepare a Statement of Changes in Equity in 7 Steps

Now that you understand the formula, let’s look at how to prepare a statement of changes in equity. Following these seven steps, you can build this essential document for your South African business:

| Step | Action | What you need | Result |

| 1 | Gather documents | Previous balance sheet, current income statement, shareholder records | All source materials are ready |

| 2 | Find opening balance | Last year’s total equity from the balance sheet | Starting point established |

| 3 | Add net income | Net profit from the current income statement | Equity increases recorded |

| 4 | Subtract dividends | Dividends paid and owner withdrawals | Equity decreases recorded |

| 5 | Include other changes | New share capital, treasury shares, adjustments | All equity movements captured |

| 6 | Calculate final balance | Apply formula: opening + income – dividends ± changes | Closing balance complete |

| 7 | Verify accuracy | Cross-check with the current balance sheet equity section | Statement validated |

Step 1: Gather your financial statements

Begin by compiling all relevant financial data, including your previous year’s balance sheet, statement of retained earnings, and any records of shareholder transactions. Gather proof of every equity movement during the relevant accounting period.

Step 2: Find your opening balance

Assuming you’ve done your account well, pull the total equity figure from last year’s balance sheet. This then becomes the opening balance for the current accounting period.

Preparing this statement for the first time? Simply start the reporting period and equity amount from when your business began operations.

Step 3: Add your business profits

Take the net income figure straight from your current income statement. This represents the profit your business earned during the year that belongs to shareholders and increases their ownership stake.

Step 4: Subtract money paid out

Deduct any dividends paid to shareholders or owner withdrawals during the year. These transactions reduce equity because cash left the business and went directly to the owners.

Step 5: Include all capital changes

Add fresh share capital from new investor contributions or subtract treasury shares from buybacks. Don’t forget adjustments for prior period errors or accounting policy changes.

Step 6: Calculate your closing balance

Use the formula: Opening equity + net income – dividends ± other changes = closing equity. This final number should match the equity section on your current balance sheet.

Step 7: Cross-check your calculations

As a failsafe, check whether all figures tie back to other financial documents, like your balance sheet and income statement. If the numbers don’t add up, review each step for errors. Some businesses make the mistake of including working capital calculations among the financial figures, for example.

Calculating a statement of changes in equity isn’t that hard if you’ve done your accounting well. In that case, you can depend on your financial statements to compile your company’s equity movements throughout the year.

Statement of Changes in Equity Format and Template

The format for a statement of changes in equity follows a standard structure that South African businesses must use for financial reporting compliance.

Your document needs five essential columns: opening balance, comprehensive income, owner transactions, other changes, and closing balance.

Most companies use a horizontal statement of changes in equity format that lists equity components vertically (share capital, retained earnings, reserves) while showing movements across columns. This layout makes it easy for stakeholders to track how each equity component changed during your reporting period.

We’ve created a professional statement of changes in equity template specifically for South African SMEs to make the expected layout extremely clear. It includes preformatted sections, built-in formulas, and clear instructions for each line item.

You’ll also find a completed statement of changes in equity example showing how a fictional business would fill out its statement.

Both the blank template and worked example follow the IFRS standards required for South African businesses. The template automatically calculates your closing balance once you input your opening balance, net income, dividends paid, and other equity movements. You can download this free Statement of Changes in Equity template and start preparing today.

Presenting (and understanding) a statement of changes in equity puts you ahead of many small South African businesses looking for funding.

With our step-by-step guide and free template, you’ll be ready to impress investors, lenders and franchise partners, and increase the chances of your business getting approved for funding or investment.

Fast-Tracked Access: How Lula Simplifies Funding

Preparing a statement of changes in equity might demonstrate that you’re financially robust, but the process of reconciling financial trails is often tedious and time-consuming.

Yet not every funding provider requires such elaborate documents. Lula’s streamlined online application process is one example. We use smart technology to assess your real-time business performance from just three simple requirements:

- Three months’ transaction data (if you opt for read-only access to bank statements they will be shared automatically).

- A minimum of R500,000 in annual turnover

- At least one year of trading

“What we liked about Lula is that the process for application was extremely simple. Within a couple of hours, we were approved,” said Theresa Ward, co-founder of Manyene Holdings, a fire and security company in Cape Town.

This simplified approach means you can access up to R5 million in business funding within 24 hours of approval – with no complex paperwork needed.